I will be on Money Talk at 7pm, this evening.

I will be on Money Talk at 7pm, this evening.

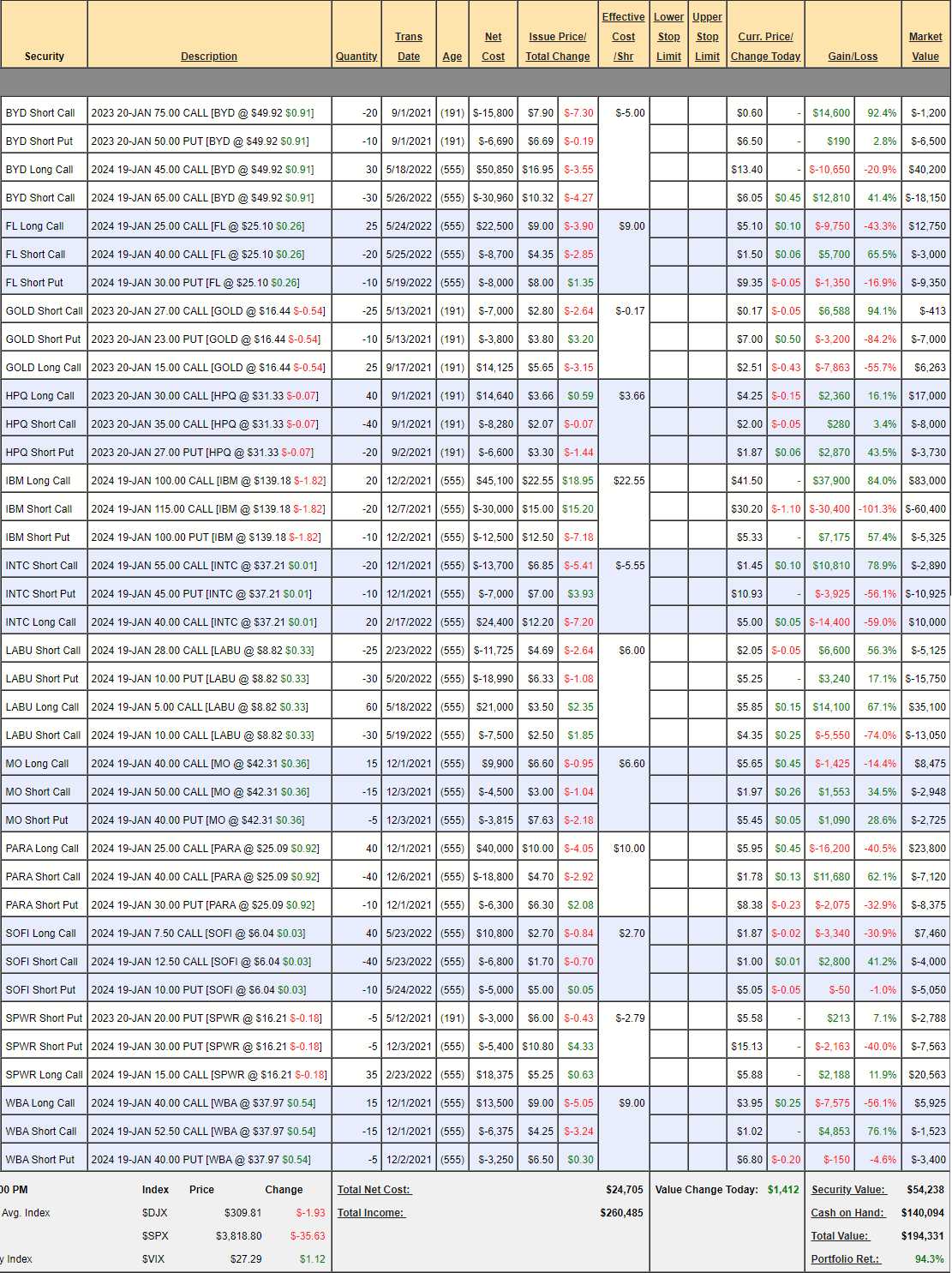

We keep a Money Talk Portfolio and the challenge is we only make our picks live, on the show and no adjustments can be made in-between so we have to pick companies that are going to be rock-solid from quarter-to-quarter – as there is no room for daily adjustments. Fortunately, despite the sell-off, the Money Talk Portfolio is still at $194,331, up 94.3% from our 11/13/19 start with $100,000. Roughly 30% per year is right on track with our conservative goals.

Last time I was on the show was May 18th, when I said “This is a correction, not a pullback.”

Since then we have, as expected, drifted along in the same range but, this morning, the Consumer Price Index popped a whopping 1.3% for June, pushing the year up to 9.1% vs 8.8% expected. Even worse, Core CPI, which the Fed watches closely, hit 0.7% vs 0.5% expected by leading Economorons. Actually, being off by 40% is as close as those guys ever get.

I think CPI is a lagging indicator, first PPI prices go up and then those prices are passed on to the consumer so we’ll keep a close eye on PPI when it comes around. It’s a bit silly for the market to react so strongly – as if the Fed’s minor move (so far) was going to fix inflation within 60 days. Everyone wants an immediate fix – and the economy is not giving it to them.

I think CPI is a lagging indicator, first PPI prices go up and then those prices are passed on to the consumer so we’ll keep a close eye on PPI when it comes around. It’s a bit silly for the market to react so strongly – as if the Fed’s minor move (so far) was going to fix inflation within 60 days. Everyone wants an immediate fix – and the economy is not giving it to them.

The problem is we REALLY don’t want to be wrong in our Money Talk Portfolio as we’ll have to wait another quarter to fix things if we are, so we are going to mostly make positioning adjustments for now and then we will have to consider some very strong contenders for new trade ideas going into the second half of the year:

-

- BYD – Despite the pullback we are still way ahead at net $14,350 on this $40,000 spread so we have $25,650 (178%) of upside potential if we can get back to $65 by Jan 2024.

-

- FL – This is new and we started out aggressive with 5 uncovered calls. So far, we’re down about $5,000 but only at the bottom of our expected range so we’ll wait and see how they behave on earnings. It’s a $37,500 spread at net $400 so there’s $37,100 (92,750%) upside potential at $40 – so it will be really cool if this works out.

-

- GOLD – Remember when Gold was supposed to be an inflation hedge? Isn’t this inflation? We’re not going to let this opportunity pass us by so let’s roll our 25 Jan $15 calls at $2.51 ($6,263) to 50 of the 2024 $10 ($6.70)/20 ($1.80) bull call spreads at $4.90 ($24,500) and we will sell 20 of the 2024 $17 puts for $3.50 ($7,000). So we’re spending net $11,237 to move to a more realistic $50,000 spread and our original net entry was $3,325 so NOW we have a proper investment. Upside potential against our $14,562 now spent is $35,438 (243%). If GOLD goes lower, we’ll have to buy back the short Jan calls but I expect they will bounce into the fall.

-

- HPQ – Still on track despite the 20% pullback as we were way over our target at the highs. It’s a $20,000 spread currently at net $6,270 so another $13,730 (218%) left to gain.

-

- IBM – Our Trade of the Year is giving us no trouble and is already at net $17,275 from our net $2,600 credit entry so we’re up $19,875 (764%) already but it’s a $30,000 spread and we’re very confident we’ll be collecting the last $10,125 (50.9%).

-

- INTC – We knew they were going to struggle but this is ridiculous. We’re down about $7,000 but our net entry was only $3,700 as we expected to be adding more in a second round so here we are. I have no problem with the put target ($45) so let’s just roll our 20 2024 $40 calls at $5 ($10,000) to 50 of the 2024 $30 ($10)/40 ($5) bull call spreads at net $5 ($25,000). So now we’ve spent net $18,700 for the $50,000 spread that’s $35,000 in the money with $31,300 (167%) upside potential at $40 ($45 with the short puts).

-

- LABU – This is an ultra ETF for Biotech and so far, so good on those. Our net $17,215 credit is now a positive net $1,175 for a gain of $18,390 (106%) but it’s a $30,000 spread at $10 with more to gain above that but conservatively $11,610 (67%) upside potential at $10.

-

- MO – Boy did they have a rough couple of months but that’s an opportunity to me so we’re going to double down on our 15 2024 $40 calls at $5.65 ($8,475) to make it 30 for net $8,475 and that makes it a $30,000 potential spread at $50 with room to make more above that target and our total cash outlay is $10,060 so our upside potential is $19,940 (198%).

-

- PARA – Another stock I can’t believe is so cheap! In this case it makes sense to spend $2.05 ($8,200) to roll the 40 2024 $25 calls at $5.95 to 40 of the 2024 $20 calls at $8 as we’re spending $8,200 to buy $20,000 more in position. This will also put us in a better position to sell short calls later. That puts our net outlay up to $23,100 but the good news is we get $40,000 back at $30 now – and simply making that goal will give us $16,900 (73%) with another $40,000 potential if we make it back to $40.

-

- SOFI – Another new one and not doing well out the gate. Even better as a new entry with a $1,590 net credit on the $20,000 spread so $21,590 (1,357%) upside potential and we will adjust it if they go lower but I doubt it.

-

- SPWR – Our Stock of the Decade has has a bad 2nd and 3rd year and we already got more aggressive on this spread by buying back the short calls so our net is now $9,975, which means we need to be over $18 to see a profit (we’ll roll the puts) but let’s say $25 is realistic and that would put us at $35,000 for a potential gain of $25,025 (250%). That last huge spike was Biden getting elected and expectations for massive solar funding. The huge dip since was the lack of that funding from Congress – but it will come eventually as solar is now economically viable without stimulus.

-

- WBA – Another disappointing stock I love. Finally time to spend money as we began timidly at net $3,875 in case we missed something – and we did not. Now we can roll our 15 2024 $40 calls at $3.95 ($5,925) to 30 of the 2024 $30 ($9.20)/40 ($3.95) bull call spreads at net $5.25 ($15,750) and we may as well buy back the short 2024 $52.50 calls at $1 ($1,500) to keep things tidy. That net $11,325 of additional spending so net $15,200 on the $30,000 spread gives us $14,800 (97%) upside potential at $40.

So we’ve spent $57,937 of our $140,094 in cash and that is pretty much in-line with the spend we made in our other Member Portfolios. We’ve been pretty aggressive calling a bottom and our cash reserves are down to about 1/2 but I have to go with my gut here and imagine things will steady out by October – the next time I’ll be on the show.

If not, another round of adjustments but we already have $263,208 (135%) upside potential over the next 18 months in the positions we have.

So, as new trade ideas for the portfolio, I could not pass up the following:

JP Morgan (JPM) has $150Bn of unencumbered CASH!!! and how can you not love that? They are valued at $331Bn at $112 yet they drop $33Bn to the bottom line so the p/e is just 10 times earnings – love it! They report tomorrow so let’s buy them now as:

-

- Sell 5 JPM 2024 $90 puts for $7.75 ($3,875)

- Buy 10 JPM 2024 $100 calls at $22.50 ($22,500)

- Sell 10 JPM 2024 $120 calls at $12.50 ($12,500)

That’s net $6,125 on the $20,000 spread so we have $13,875 (226%) upside potential at just $120. Our worst case is losing that money and having to buy 500 shares at $90 and that would be net $102.25/share – still about 10% less than the current price as our worst case.

Logitech (LOGI) is a company you don’t think much about but they are likely on your desk. $52.39 is $8.9Bn in market cap and they have $1.3Bn in cash net of debt, so a very solid company that drops a very consistent $800M to the bottom line for a p/e of about 11 so this is another one we shouldn’t pass up:

-

- Sell 10 LOGI 2024 $50 puts at $8 ($8,000)

- Buy 20 LOGI 2024 $40 calls for $16.50 ($33,000)

- Sell 20 LOGI 2024 $55 calls for $8.75 ($17,500)

Here we are spending net $7,500 on the $30,000 spread so we have $22,500 (300%) upside potential if LOGI can simply hold onto $55 (about where it is now) for 18 months. We may get more aggressive after earnings – but this is a very good place to start.

That’s another $36,375 of upside potential we’ve added using just $13,625 of our cash. We still have plenty left to make adjustments with but, hopefully, we won’t need them as markets stabilize over the summer.

By the way, these were the candidates we’ve been considering for additions to this portfolio and where we’ve recently discussed them in our Live Member Chat Room:

- LEVI is almost certain: https://www.philstockworld.com/2022/06/21/two-percent-tuesday-weak-bounces-accomplished-now-what/#comment-8125624

- CROX is good too: https://www.philstockworld.com/2022/06/21/two-percent-tuesday-weak-bounces-accomplished-now-what/#comment-8125627

- WSM is worth mentioning but too expensive: https://www.philstockworld.com/2022/06/21/two-percent-tuesday-weak-bounces-accomplished-now-what/#comment-8125628

- RH has the same price issue: https://www.philstockworld.com/2022/06/21/two-percent-tuesday-weak-bounces-accomplished-now-what/#comment-8125629

- BBY is a good one “Winter is coming!“: https://www.philstockworld.com/2022/06/21/two-percent-tuesday-weak-bounces-accomplished-now-what/#comment-8125678

- TROX is was loving in the same comment as BBY.

- NFLX too expensive but worth a mention.

- F is a strong contender: Two Percent Tuesday – Weak Bounces Accomplished – Now What?

- SONY is another good one: Which Way Wednesday – Powell has some Splainin’ to Do to Congress

- BIG is also interesting: https://www.philstockworld.com/2022/06/30/faltering-thursday-powell-says-fed-must-accept-higher-recession-risk-to-combat-inflation/#comment-8126520

- MT may be a winner! https://www.philstockworld.com/2022/06/30/faltering-thursday-powell-says-fed-must-accept-higher-recession-risk-to-combat-inflation/#comment-8126531

- LOGI still stupidly cheap (same link).

- DIS should rate a mention: https://www.philstockworld.com/2022/07/07/federally-forgiven-thursday-light-at-the-end-of-the-tunnel/#comment-8126814

- We talked about IMAX in that comment too.

- THC we just added to the Earnings Portfolio: https://www.philstockworld.com/2022/07/07/federally-forgiven-thursday-light-at-the-end-of-the-tunnel/#comment-8126820

- And, of course, JPM.