Down and down we go!

Down and down we go!

The S&P 500 is down 20% since April and the Dollar is up 10% since April. Is that a coincidence? Not only does a rising Dollar push down the price of stocks and commodities but it also lowers the revenues collected from devalued overseas currencies and that impacts earnings. That is even worse for companies who pay their workers and expenses in expensive Dollars – it’s a double hit to the bottom line.

Silver (/SI) has dropped down to $18.50 this morning and we are thrilled to take a long here (with tight stops below that line) and Oil (/CL) can be played long at the $95 line, looking for a re-test of $100 and a $5,000 per contract gain (tight stops below). I also like the Russell (/RTY) long at 1,700 – a good support line.

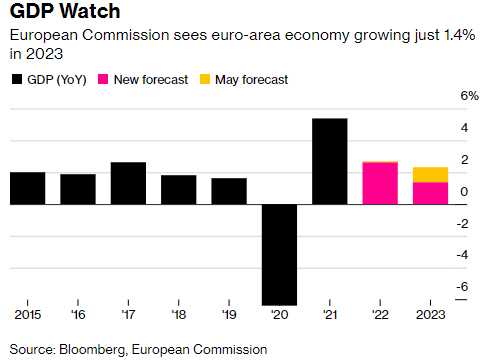

This morning’s dip (and Dollar spike) is caused by Europe cutting their 2023 GDP forecast from 2.3% to 1.4% – indicating a long, lingering Recession. Well, not a recession as 1.4% is growth – just not a lot of it. This year, in fact, is still at 2% so thing are nowhere near as bad as they were in 2020 – despite the war raging on their boarders.

This morning’s dip (and Dollar spike) is caused by Europe cutting their 2023 GDP forecast from 2.3% to 1.4% – indicating a long, lingering Recession. Well, not a recession as 1.4% is growth – just not a lot of it. This year, in fact, is still at 2% so thing are nowhere near as bad as they were in 2020 – despite the war raging on their boarders.

Still, when I was being interviewed on Bloomberg last night, Kim closed by saying how optimistic I was, which was very funny as I was the pessimistic one most of last year but she’s right – 99% of the guests on Bloomberg, CNBC, etc are telling investors that the World is going to end – and I’m seeing bargains.

I don’t think I’m crazy but I may be early and we don’t mind being early because we are well-hedged. If the market drops 50% from here, like they did in 2008/9, then our hedges will provide us with enough cash to buy 2 or 3 times the amount of shares we have now – and then we wait for a recover (or the actual end of the World). That’s our backup plan!

For the moment, however, we are sticking to our plan to get a bit more aggressive at what we HOPE is merely a re-test of the June lows – and not a prelude to a break below them. Keep a close eye on EuroStoxx at 3,400 – below that is a new low for them and Germany’s DAX has already broken below their June lows – it will be bad if the close there today.

For the moment, however, we are sticking to our plan to get a bit more aggressive at what we HOPE is merely a re-test of the June lows – and not a prelude to a break below them. Keep a close eye on EuroStoxx at 3,400 – below that is a new low for them and Germany’s DAX has already broken below their June lows – it will be bad if the close there today.

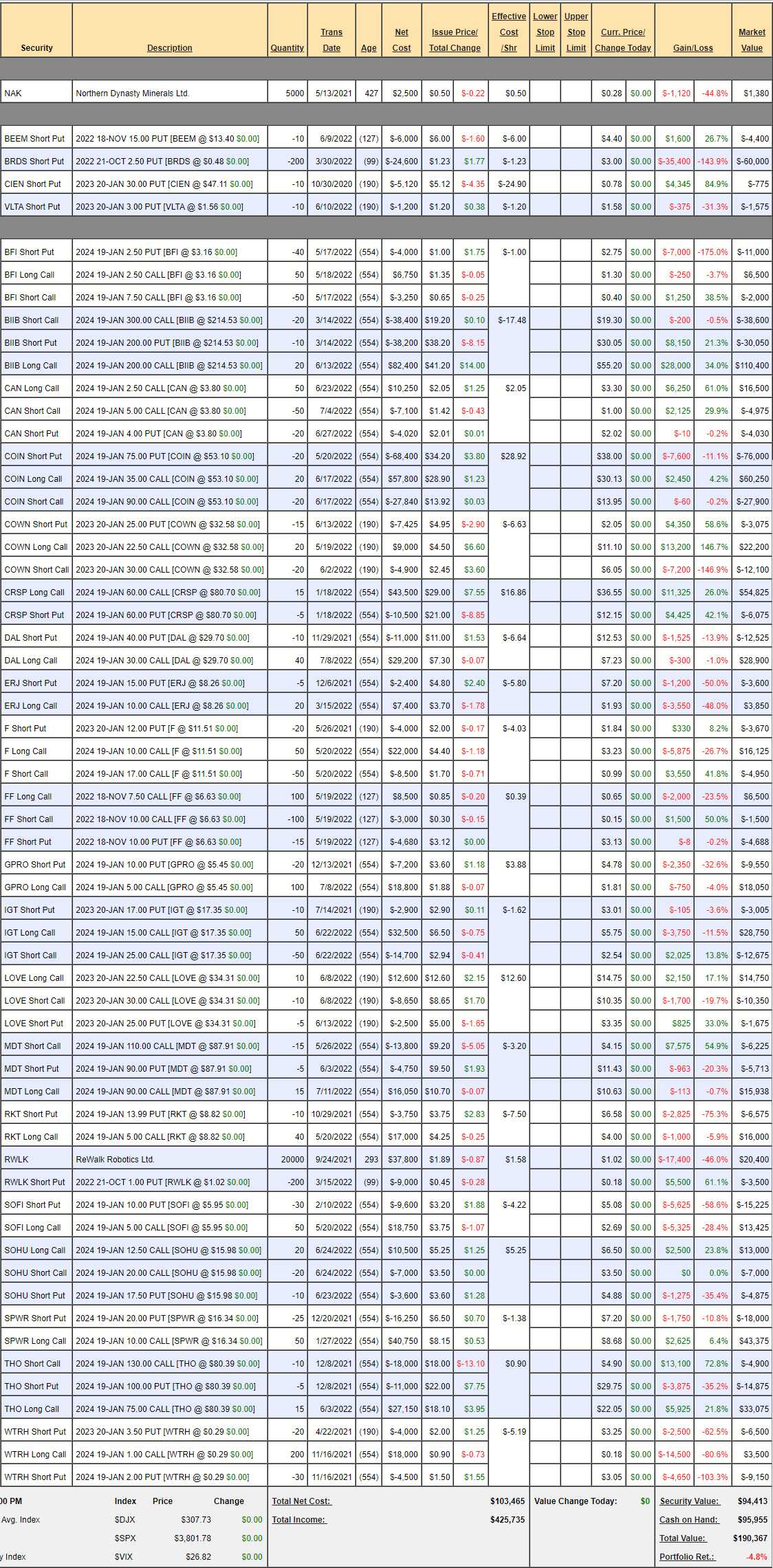

Future is Looking Bleak Portfolio Review: It used to be called the “Future is Now” Portfolio but things have sure changed since we started it! $190,367 is up $6,620 from our last review but, overall, the portfolio is still down 4.8% from our 12/12/19 start – our worst performer by a mile. An optimist might say you are getting in on the ground floor!

-

- NAK – The Supreme Court just de-fanged the EPA and I think that’s a huge positive for NAK so it would be silly not to spend $2,800 to buy 1,000 more shares – just in case we get lucky.

-

- Short Puts – BRDS collapsed and they have until the end of July to get the price back over $1 or face NYSE de-listing, so a reverse-spit is very likely to happen. Not much we can do for now but sit back and see how it goes. At 0.48, this is a $134M stock with $328M in revenues (up from $200M last year) and a $98M loss (down 50% from last year) but only $35M in the bank so dilution is likely as well. We are waiting for longer-term puts to come out. The other short puts are fine.

-

- BFI – Patience on this one.

- BIIB – Holding up very well. Fantastic for us as we got more aggressive in the last review – just in time to catch a nice move up.

-

- CAN – On track.

- COIN – Still getting no love but if BitCoin comes back – they are one of the survivors of the Crypto Carnage.

-

- COWN – Over our target already. This is why buying undevalued stocks is so tricky – we try to get in before this happens – but not too much before…

-

- CRSP – I’m really glad we got more aggressive on these.

-

- DAL – We just got more aggressive on them last week.

-

- ERJ – We bought back the short calls and now we wait.

- F – One of my favorite cheap stocks.

- FF – I love these guys, don’t understand why the market does not. Well, they did lose money last Q (5/29 results) but they still closed 2021 with a $26.3M profit and you can buy the whole company for $290M at $6.60. Rising Nat Gas costs killed them in Q1 and those are coming down and we don’t play these quarter to quarter.

-

- GRPO – We just got more aggressive on them.

- IGT – New trade, cheaper now.

-

- LOVE – Over our target already. It’s a $7,500 spread we paid net $1,450 for. This is why we put out Top Trade Alerts! We took a much bigger position in the Earnings Portfolio.

-

- MDT – Another one we just moved to a better spot.

- RKT – I think this is a great entry for them.

-

- RWLK – This is why we bought the stock – it’s a long, slow process for this technology to be adapted.

- SOFI – Still in start-up mode.

- SOHU – On track.

- SPWR – Our stock of the Decade but it’s only 2022. This is our 2nd set though, we took early winners off the table on last year’s spike.

-

- THO – I think we have to spend $4,900 to buy back the short 2024 $130s as they are up 72% already and I think once their supply chain clears up, these guys will rocket back.

-

- WTRH – When the 2025s come out we will roll the puts but, otherwise, we wait.

Only two adjustments and very little money spent – I’m happy.

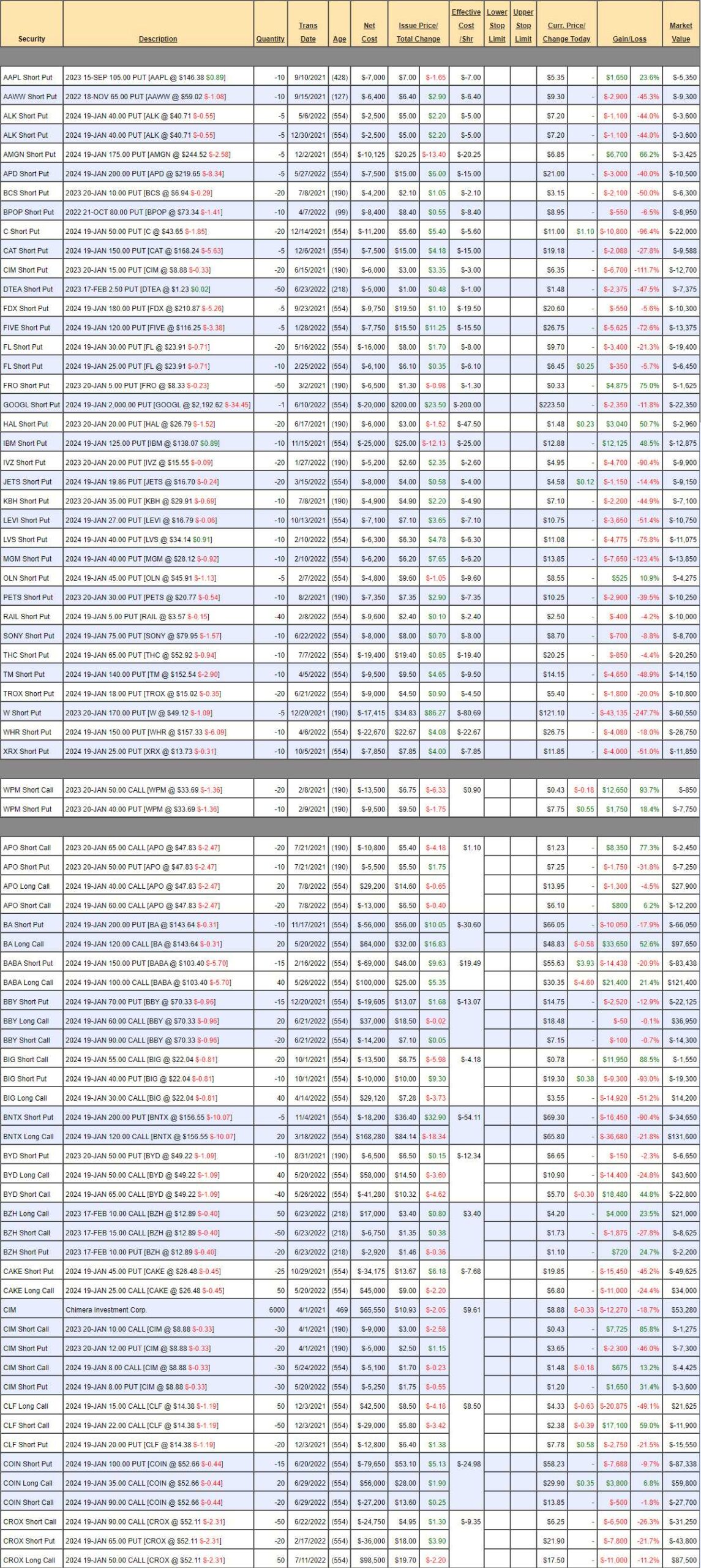

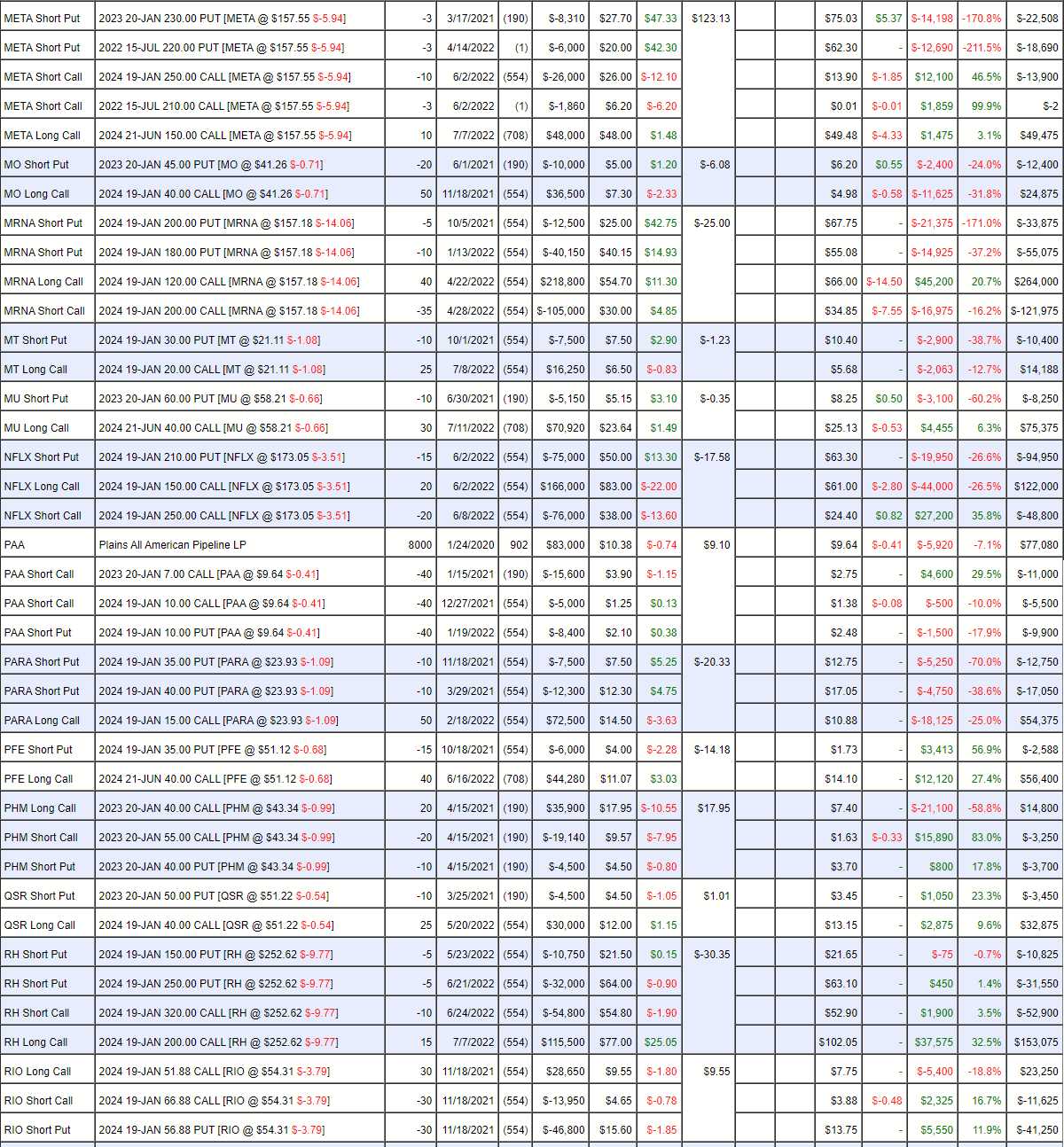

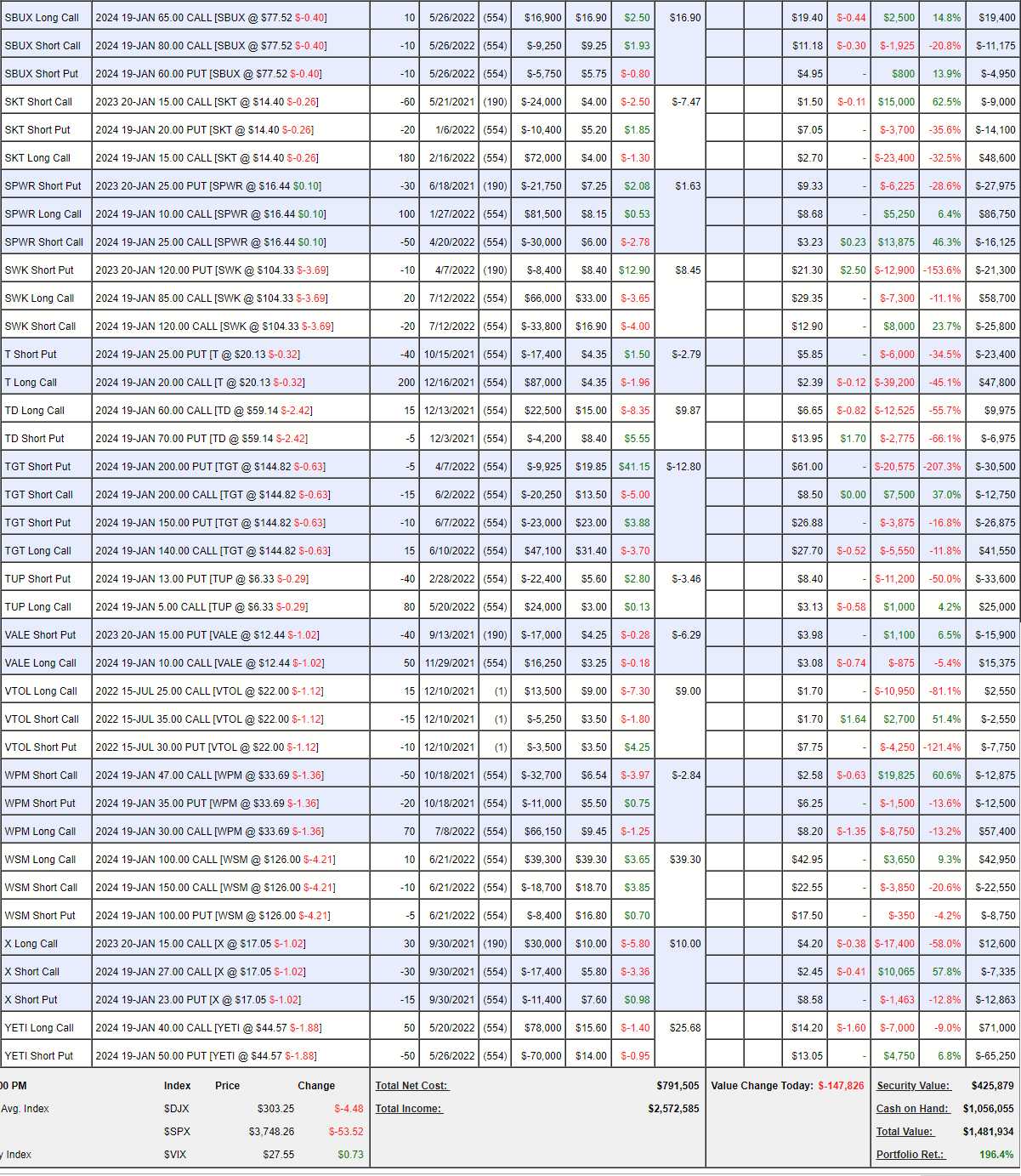

Long-Term Portfolio (LTP) Review: We made a lot of adjustments last Thursday and we’re down about $100,000 since then at $1,481,934 and we used $220,000 of our cash on the adjustments but we still have $1,056,055 left – so we COULD do more – but I want to be cautious.

-

- Short Puts – This is where it gets dangerous as we can’t REALLY afford to own all these but we do have another $1.2M in the STP so the loss is not a big deal vs the gains over there. We’re not going to worry about them until the 2025s come out and then we will decide who to roll and who to buy back. It would cost $440,000 to buy them all back with a net loss of $110,000 – not terrible – therefore we can afford to wait.

- WPM – These are going to annoy me so let’s close them out. Just the two at the top and we’ll stick with the lower play.

- APO – I don’t want to risk the short Jan $65 calls so let’s buy them back.

-

- BA – We got more aggressive.

- BABA – Very aggressive and today is not a good day for them.

- BBY – Love this as a new play.

- BIG – Another favorite at a big loss at the moment.

-

- BNTX – Hopefully earnings will get them going again.

- BYD – Still laying around.

- BZH – On track.

- CAKE – I can’t believe people don’t like them. We’re already aggressive but great as a new play (maybe with lower puts).

-

- CIM – My favorite REIT is way too cheap at $8.85. Let’s buy back the short Jan $100 calls for 0.43.

- CLF – Let’s buy back the short 2024 $22 calls for $2.38 as they are up 60% and I think $15 should hold (even though it isn’t).

COIN – We’ll see how earnings go.

CROX – Here’s a great example of how you can’t take your portfolio balance for granted. It’s ridiculous that we’re losing money on our long 2024 $50 calls AND our short 2024 $90 calls – it’s a function of the VIX and really tells us we should be selling more short $90s but it’s a big enough position as it stands.

-

- DAL – Airlines still out of favor. Good for a new entry.

- DELL – Also good for a new entry.

- DIS – I’m excited about earnings.

-

- DOW – Down and down they go! If the market wasn’t so shaky, I’d double down on the longs. Let’s buy back the short $65 calls with a 56% profit.

- EBAY – Are people not using EBay anymore?

- GILD – On track and it should be – it’s a cash machine.

- GLW – At the bottom of our range.

-

- GOLD – Very tempted to DD on those $15 calls.

- HBI – Another stock in silly territory.

- HPQ – On track!

- IBM – Stock of the Year doing its thing. NOW you can see why I like them so much – even a terrible market can’t bring them down.

-

- INTC – We knew this would be a rough year for them but it’s an opportunity to buy.

- JD – At the top of our range already. Of course, it was a very conservative range…

-

- JPM – Despite “disappointing” earnings today, I’m very happy to be in these for the long haul. Let’s take advantage of the dip and roll our 25 2024 $120 calls at $10.25 to 25 more of the June 2024 $110 calls at $15.73. $5.48 buys us 6 additional months to gain and $10 in position.

-

- KHC – Nice, boring stock.

- LABU – Got a nice pop since we got more aggressive.

- LEVI – Great for a new trade.

- LMT – Our Stock of the Century. Pullback isn’t helping us as we’re still over our target.

LOGI – Love these guys, stupidly cheap.

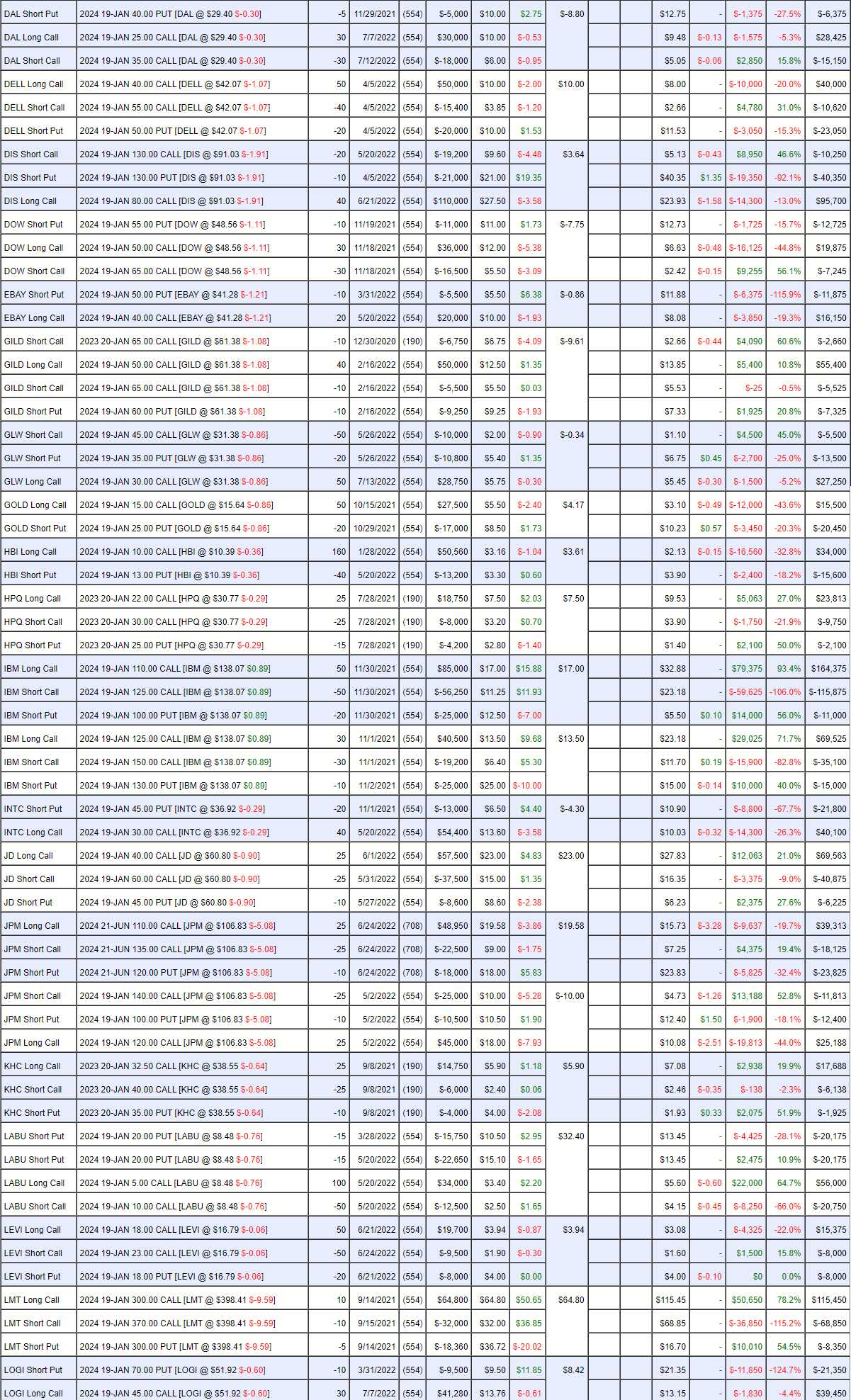

-

- META – The July short $210 calls will go worthless but the 3 short July $220 puts at $62.30 ($18,690) will have to be rolled to 5 short Sept $200 puts at $44 ($20,200) and we may as well do the same with the 5 short Jan $230 puts so we’ll end up with 10 short Sept $200 puts and hopefully they move back over that line by then.

-

- MO – We’ll see what they have to say for earnings.

- MRNA – Coming back a little, finally.

-

- MT – Another one I love.

- MU – Way too cheap.

- NFLX – I think their ad model will work so we’ll have to wait and see.

- PAA – Right on target.

- PARA – I can’t get over this one. $24 is $16.2Bn and they make $1.7Bn even in a spending cycle. When they are done spending in 2 years, more like $3Bn to the bottom line.

-

- PFE – Another money machine.

- PHM – Gotta give them time.

- QSR – Holding up nicely and we got more aggressive.

-

- RH – Pretty new and doing well already as we picked a good time to roll.

- RIO – I still think there will be more infrastructure and less recession.

-

- SBUX – On track

- SKT – Got cheap again. Let’s buy back the short $15 calls for $9,000 and give them a chance to recover.

-

- SPWR – You know I love them.

- SWK – Waiting for 2025’s to roll the puts.

- T – Nice and bullish.

- TD – So stupidly cheap we have to double down on the calls. If they go lower, we then roll those calls down and, if they go lower, we DD again and then roll. Early innings…

-

- TGT – Wow, I forget how many Blue Chip stocks are on sale. Can’t double down on them all – unfortunately…

- TUP – Give them time.

- VALE – I think $12 should hold.

-

- VTOL – Another one I’d add to if the whole market wasn’t so iffy.

- WPM – This is what’s left after killing the ones on top.

- WSM – On track and good for a new trade.

- X – Should have quit when we were ahead. Now we have to wait for them to cycle back. Let’s buy back the short $27 calls.

-

- YETI – Disappointing but nothing to worry about – yet.

Just 10 adjustments is good for the LTP and we still have tons of CASH!!! to deploy. At a certain point though, if we get a pop we take in a lot of cash re-covering our open long calls. For now – we’ll be reacting to earnings as they come across the desk.