So much for Friday’s sell-off.

Of course, an hour from now, we could be saying “So much for Monday’s rally” as this market is all over the place – driven by the latest rumor, earnings report or data point. We have all of those coming in this week – plus a Fed Decision on Wednesday (2pm), followed by a press conference with Jerry Powell – who has not been very helpful with his press conferences recently.

On the rest of the data front, we have the Chicago Fed and the Dallas Fed this morning and those reports have been running cold. Home Data, the Richmond Fed and Consumer Confidence is tomorrow – not likely to be winners either although, with Consumer Confidence, notice it’s the EXPECATIONS that are in the toilet while the actual present situation is not so bad.

This is the idiocy of Economic Data – a lot of it is based on opinion – not facts. So we’re going to hear how awful Consumer Confidence is but keep in mind it’s entirely because the survey cares more about what people THINK is going to happen than what is actually happening – and 40% of those people watch Fox as their primary news source.

Of course, as I have noted recently, it’s not just Fox – I said I found some good stocks to buy with price-earnings ratios that were below 10 with no debt last time I was on Bloomberg and the host called me an “optimist“. That’s how far down the gloom trail the mainstream media has gone lately…

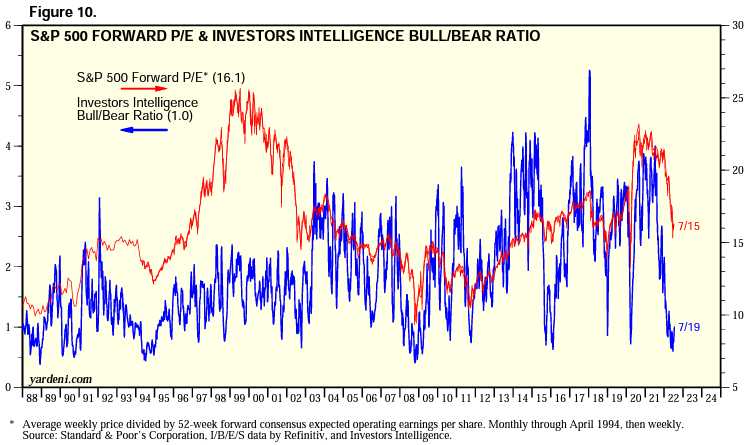

Yardeni has a lot of charts on this but this one is simple – the sentiment (opinion) for the S&P 500 is miles apart from the actual earnings (fact) so far. This is not like 1999, when tech companies were getting 1,000 x valuations and it’s not like 2007, when the earnings being reported turned out to be fake, Fake, FAKE!!! All we have here are market multiples that got ahead of themselves based on extrapolations of stimulus-driven revenues that are now drying up at the same time as artificially-depressed interest rates are evaporating.

Will companies make less money going forward? Yes, but inflation will make them look bigger than they are and that will inflate the price of your stock – regardless of the merit. People forget that we buy stocks to get a return on our capital but that return doesn’t mean higher share prices – it means EARNINGS – which translate into higher share prices over time. As investors, it is our job to identify companies where the earnings are not being properly priced into the security.

Now, where were we? Oh yes, the Chicago Fed came in unchanged at -0.19 – slight contraction. Wednesday we get Durable Goods, which are likely to be sad as home sales slowed down. We also get Investor Confidence and the Fed – which is all that really matters that day. Thursday is the 3rd GDP Revision to Q1 and it was -1.6% last time we looked but there’s a chance for an upward revision based on data we’ve seen recently.

Then it’s the KC Fed and Friday it’s the Chicago PMI along with Personal Income, Consumer Sentiment and Farm Prices so lots and lots of data to chew on this week, along with mucho earnings:

As you can see from this list, we’ll have a very firm handle on the Nasdaq by the end of the week and all we’re looking for from a technical standpoint is for the Nasdaq to stay over 12,000 and the S&P to hold 4,000 and the rest is very likely to sort itself out.

I’m still “optimistic” relative to the vast majority of my peers and we’ll be taking a look at those Top 10 Stock Picks from my July 13th appearance on Money Talk in our Live Member Chat Room this week as we look to spread a little cash around while things are still so cheap.