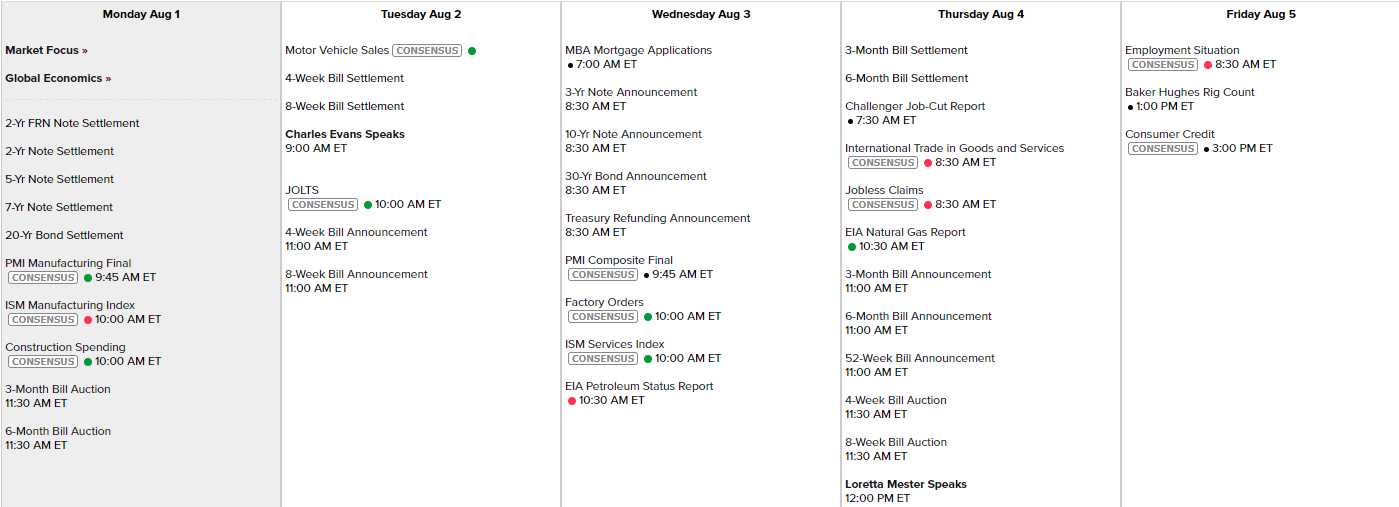

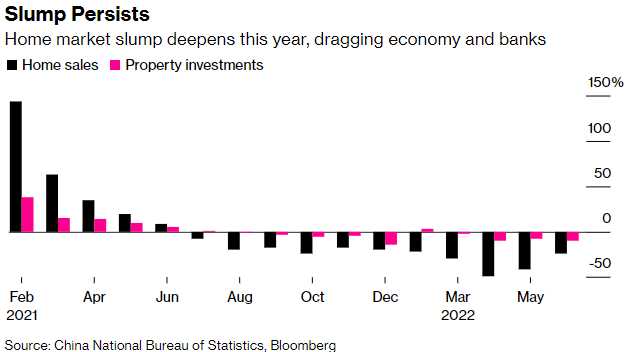

China’s PMI fell clearly into contraction in July, from 50.2 (barely expanding) in June to 49 in July and, without Construction, it would have been much worse and Construction is about to blow up too. Data from China’s top 100 property developers showed the housing market continued to slump last month as well.

A recent flareup in the southern manufacturing hub of Shenzhen impacted factory operations there, raising concerns about disruptions to global supply chains.

“The slowdown was led by production and new orders, signaling disruptions to supply and unstable domestic demand recovery,” said Liu Peiqian, chief China economist at NatWest Group Plc. “Covid-related policies continue to dampen the momentum of recovery and more easing policies are needed to stabilize the domestic demand in coming months.”

Consider how many millions of people are losing jobs looking at China’s Employment Index:

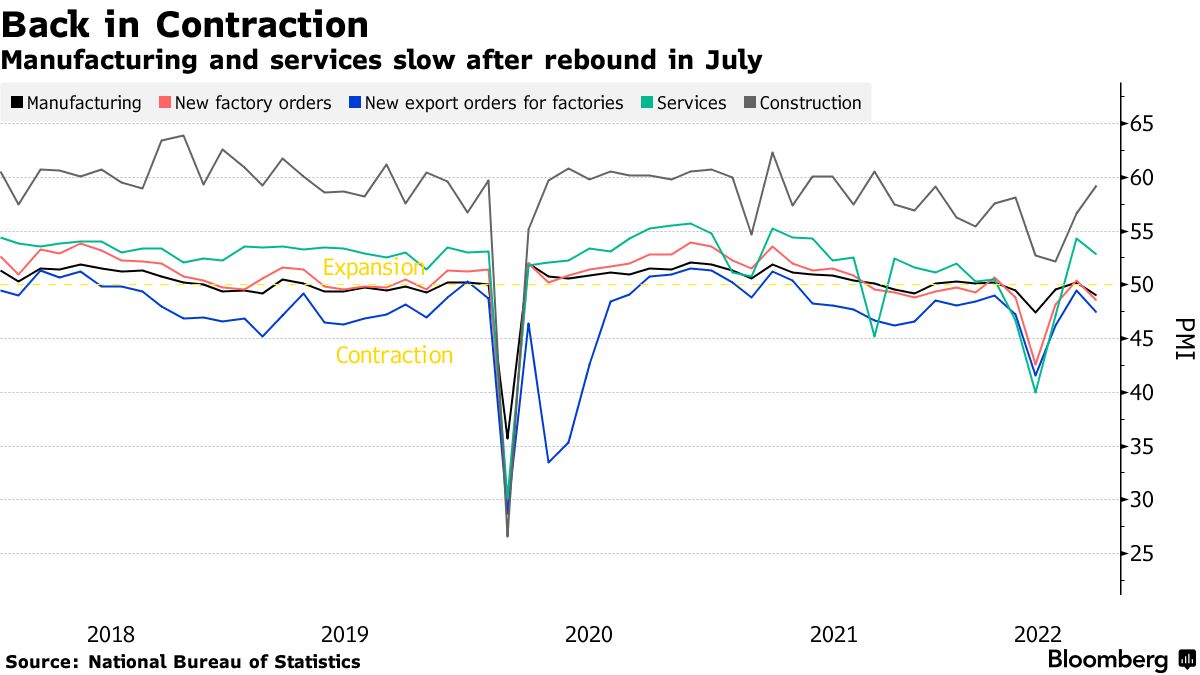

The Caixin manufacturing PMI, based on a survey of mainly smaller and privately-owned businesses, also showed a weakening in sentiment. The index dropped to 50.4 last month from June’s 51.7, missing the median estimate of 51.5 but staying above the 50 dividing line, Caixin and S&P Global said in a statement Monday.

Less people working means less people spending and both of those mean less demand for Yuan which then lowers its value and that then exacerbates Inflation which is how Governments get their hands tied as stimulus leads to more inflation but so will doing nothing. This is why inflation is so hard to fight. On the bright side, less Chinese activity has pulled oil back down to $97.27 this morning and Nat Gas is down to $7.80 so Yay!, I guess…

China’s GDP growth is now tracking 4%, which is miles below the 5.5% target the Government conceded to last quarter and that means we have to call even the 4% growth number into question as Chinese data tends to be exaggerated to hit targets. The housing market continues to weigh on China’s outlook. Sales at China’s top 100 developers fell 39.7% from a year earlier.

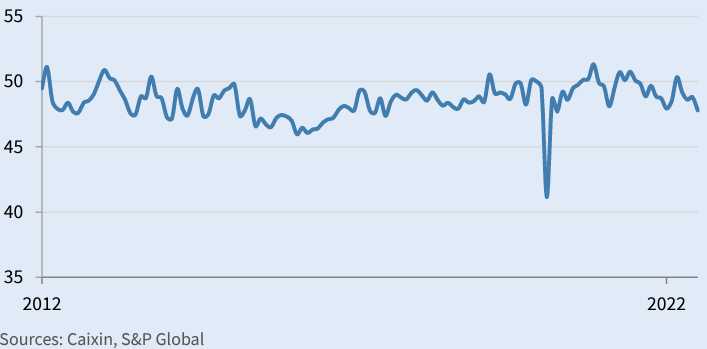

China’s banks face mortgage losses of $350 billion in a worst-case scenario as confidence plunges in the nation’s property market and authorities struggle to contain deepening turmoil. A spiraling crisis of stalled projects has dented the confidence of hundreds of thousands of homebuyers, triggering a mortgage boycott across more than 90 cities and warnings of broader systemic risks.

Much as the US did in 2006/7, Chinese lenders pushed Consumers into homes they could not afford to make up for flattening Commercial Loan Growth. Now, $2.9Tn Yuan of loans went bad in Q1, 7.6% of all mortgages. Bailouts won’t be simple either with China’s debt to GDP at 260% – up from 150% in 2009 so, over the past 13 years, 11.5% of China’s annual 7% growth has been funded by debt.

Much as the US did in 2006/7, Chinese lenders pushed Consumers into homes they could not afford to make up for flattening Commercial Loan Growth. Now, $2.9Tn Yuan of loans went bad in Q1, 7.6% of all mortgages. Bailouts won’t be simple either with China’s debt to GDP at 260% – up from 150% in 2009 so, over the past 13 years, 11.5% of China’s annual 7% growth has been funded by debt.

Not that the US is better – just to point out how F’d we all are at this point.

Property investments, which drive demand for goods and services that account for about 20% of China’s Gross Domestic Product, plunged 9.4% in June:

This then leads to poor bank earnings, which puts stress on China’s entire market so we’ll be keeping a close eye on those results this month as they begin to come in.

We’ll also have plenty of other earnings reports to watch as well:

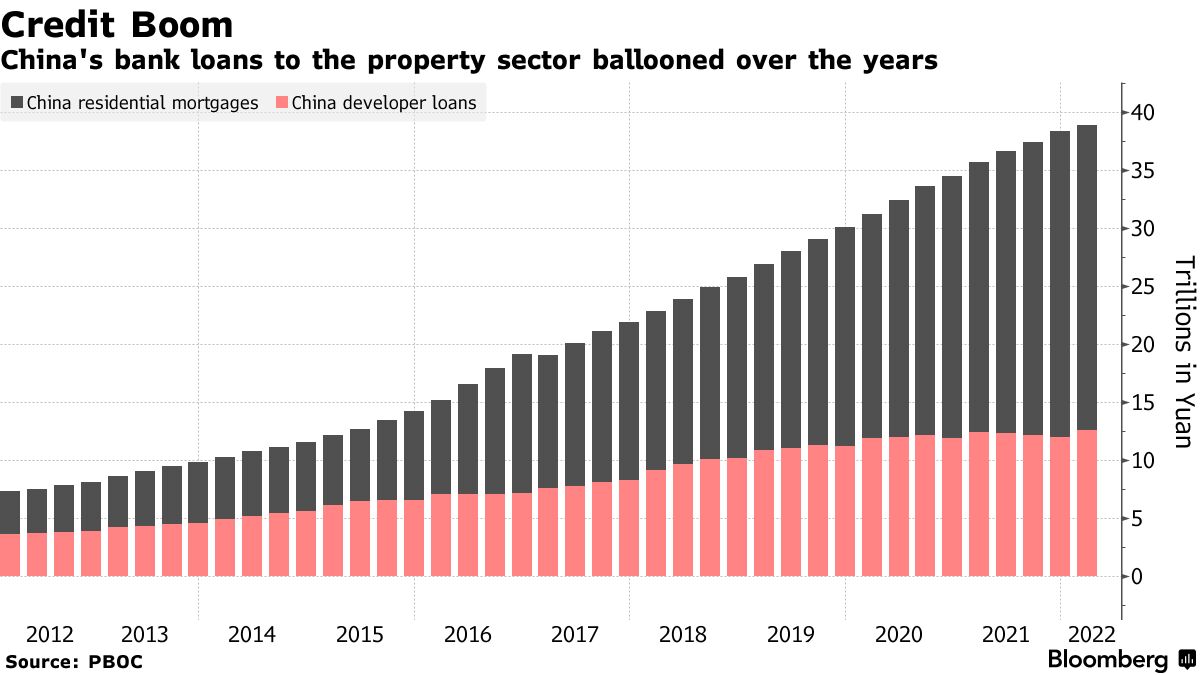

Data-wise, we have our own ISM and PMI Manufacturing Reports along with Construction Spending – which is busy for a Monday. Just a few Fed speakers this week, Motor Vehicle Sales and Job Openings tomorrow, PMI Composite and ISM Services along with Factory Orders on Wednesday, and Consumer Credit on Friday – nothing really more important than the earnings reports on the data front.