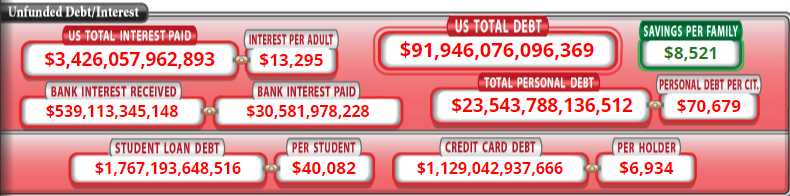

We are an economy with $32Tn of debt and a $24Tn GDP.

We are an economy with $32Tn of debt and a $24Tn GDP.

We NEED inflation because we’re not growing the economy organically. Birth rates are nearly negative (20% of young adults do not plan to have any children) and immigration was just 245,000 people last year – not even enough to fill half the new jobs we created in July. That’s not how you grow an economy.

Neither Governments, Businesses or people that are 150% of their valuation in debt are considered financially healthy. Our $24Tn GDP is not income, and it’s not revenue – the Internal Revenue Service only collects about $2.5Tn a year of Income Tax and Payroll Tax is another $1.5Tn and and our Corporate Masters pay $391Bn (yes, not even 10%) so the REVENUE is $4.4Tn and we have $32Tn in debt so it would take over 7 years to pay that Debt off – if we were using 100% of our Revenue to pay off Debt.

But we’re not, are we? We are, in fact, running a $1.5Tn annual deficit with our $6Tn Federal Budget and that’s with just $441Bn in interest (1.3%). As the Fed Funds rate moves to 3.5-4% next year, that number will triple over time to $1.2Tn per year of debt service. Where will that additional $800Bn come from? We can cut 15% of the budget or we could borrow another $800Bn a year so that, at the end of the decade, we’ll be $50Tn in debt (assuming nothing breaks along the way).

Oh and Oops:

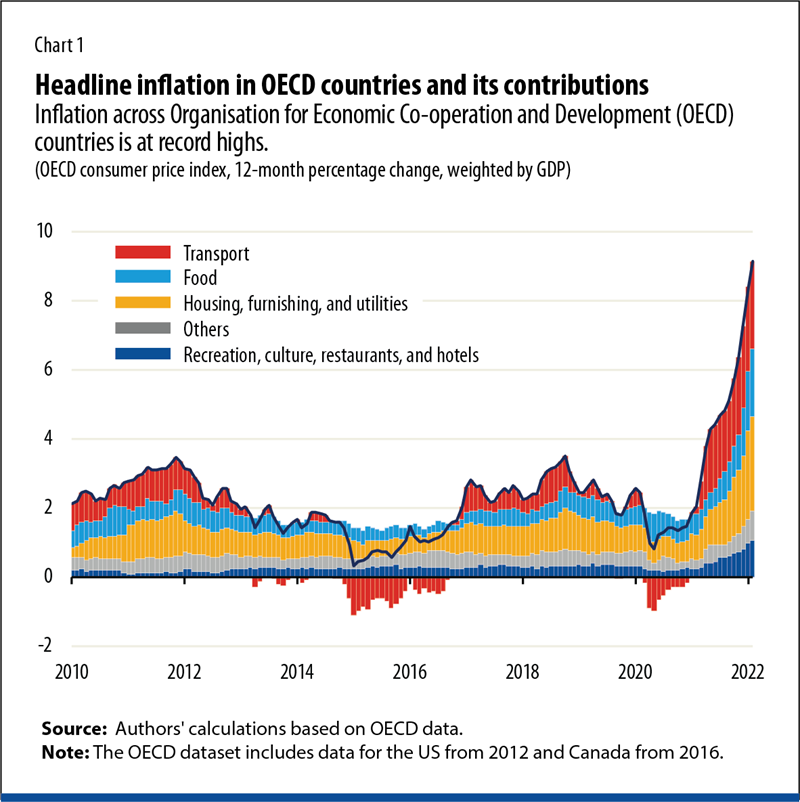

OR we could allow INFLATION to be our friend and rise faster than the 6.66% rate our debt is expanding. Even “just” 8% annual inflation will bring our GDP to $44Tn in 2030 and we’re projecting $50Tn in debt and LOOK – we’re down to 113% of our GDP. So, as much as the Fed says they want to fight inflation – they really don’t – it’s the only way we’re going to move forward without defaulting on our debts eventually. But that’s a painful way to go for the people, isn’t it?

Of course, Inflation is just a way of taxing people without raising taxes. It’s nowhere near as efficient as just raising taxes would have been – since that takes money out of circulation AND raises Government Revenues. But Americans don’t like taxes – especially on the Ultra Rich – so we all pay a 10% Inflation Tax to cover their end.

We need to cut 15% of the Budget just to stop making more debt and, as I said, we’ll need $800Bn a year in addition to that very soon, that’s another 3% that needs to be cut. Meanwhile, we need to spend AT LEAST $1Tn a year fighting climate change or the debt won’t matter much in 20 years and we have $4Tn in Infrastructure Repairs that are long overdue. You can see why the Government goes “F-it” and just keeps running a deficit – what’s the point of trying at this stage of the game?

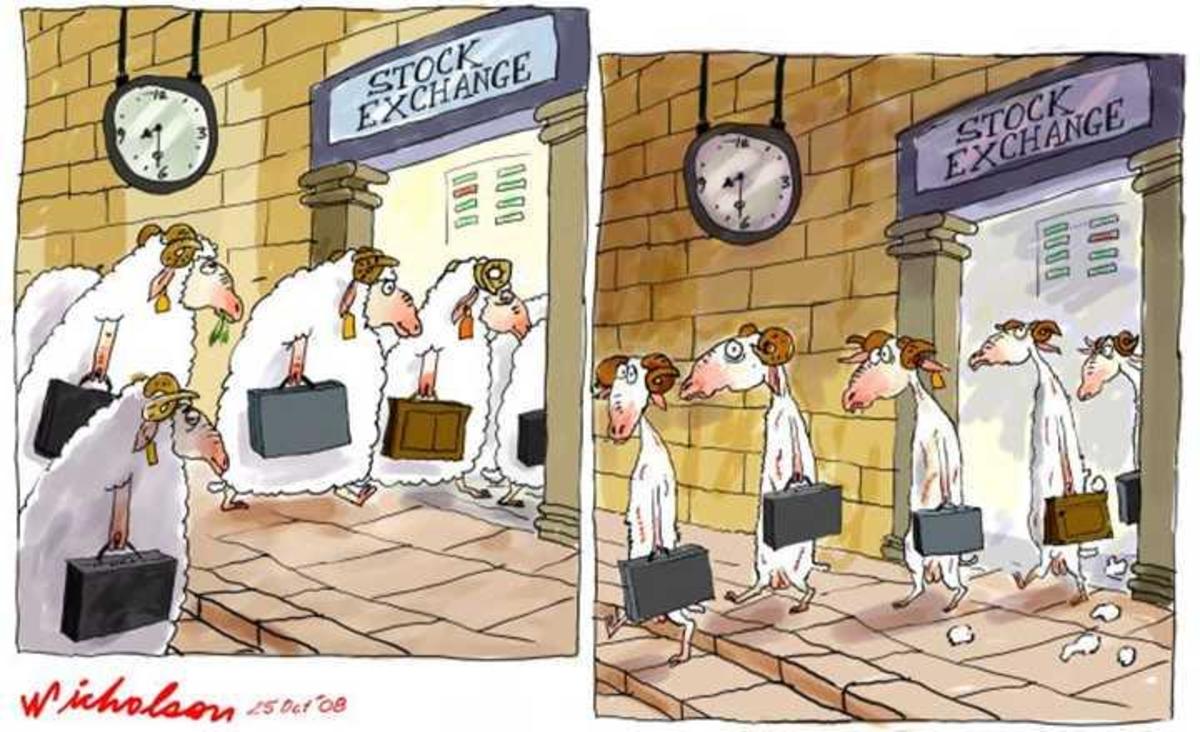

8:30 Update: The markets are flying higher – and I’m talking 4,200 on the S&P 500 – because CPI came in at “just” 8.5% vs 8.7% expected. See – I told you you can get people used to anything. We CAN grow the economy 8% a year and still have a happy market. Just get people used to 9%-10% spikes and 8% seems like a calm day at the beach.

8:30 Update: The markets are flying higher – and I’m talking 4,200 on the S&P 500 – because CPI came in at “just” 8.5% vs 8.7% expected. See – I told you you can get people used to anything. We CAN grow the economy 8% a year and still have a happy market. Just get people used to 9%-10% spikes and 8% seems like a calm day at the beach.

The Dollar has pretty much committed suicide over this data, dropping back to 105 from 106.5 yesterday so of course the indexes are booming – they are priced in Dollars. Gold is up, Silver is up, Oil is up (which boosts inflation) but who cares – it’s a party!

The Dollar has pretty much committed suicide over this data, dropping back to 105 from 106.5 yesterday so of course the indexes are booming – they are priced in Dollars. Gold is up, Silver is up, Oil is up (which boosts inflation) but who cares – it’s a party!

I am very happy that we put out Top Trade Alerts for 3 new positions yesterday – especially JXN, who are popping 5% off this morning’s earnings results. We played them both as a Stock Trade for the excellent Dividends as well as a much more aggressive options spread in our Earnings Portfolio.

In the Earnings Portfolio, let’s:

-

- Sell 10 JXN 2024 $25 puts for $6 ($6,000)

- Buy 20 JXN 2024 $30 calls for $6 ($12,000)

- Sell 20 JXN 2024 $40 calls for $2.65 ($5,300)

That’s net $700 on the $20,000 spread and our worst case would be owning 1,000 shares at net $25.70 – about 10% off the current price. This is one of those that we hope will go lower so we can get more aggressive but, if not, we’ll have to be satisfied with the upside potential of $19,300 (2,757%) at $40.

The fills turned out to be just $5.30 on the short puts ($5,300) but the $30 calls were just $4.85 ($9,700) and the short $40 calls were $2.40 ($4,800) so the net was a $400 credit – better than we expected. The options hadn’t traded since the 3rd and the prices had changed more than I thought but it’s getting your net that matters – same spread otherwise.

The point of this “Earnings Trade” is that you don’t have to mess around with short-term options to make great money in the short-term. This is a very sensible, well-protected spread (profitable on anything over $25) yet I bet we are up over $1,000 by the end of the day with $0 cash outlay.

That’s how trading should be – FUN! We were almost hoping this one would go the other way, so we could buy a lot more but we were worried they would get away from us on earnings as people begin to notice how undervalued they are. In Q2, they made $2.52 per $30 share – that’s pretty good!

They also pay a $2.20 dividend, that’s 8%!

See – FUN!