How about a good, old-fashioned earnings play?

Nordstrom (JWN) is not a stock I generally like but it's on sale at $23.80 and earnings are on the 23rd. Retailer to the Top 1%, who are unaffected (or benefitting) from inflation is a good place to be and they are a very steady $16Bn in sales with $500M to the bottom line but you can buy the whole company for $3.7Bn. Debt is $2.4Bn but that's normal in Retail, they have about $5.4Bn in fixed assets (real estate and inventory) so no worries there. Applying a 3% boost to interest takes $75M off the earnings though - still less than 10x.

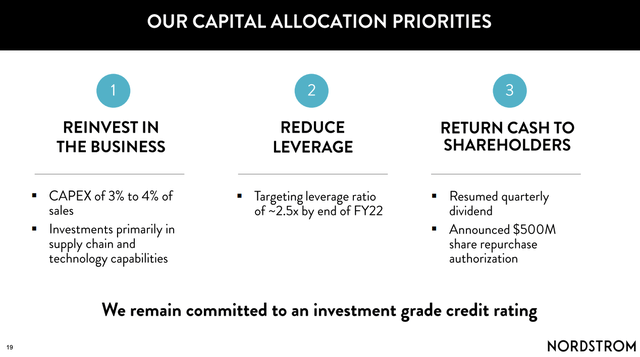

They have 94 regular stores and 240 Rack (discount) stores in the US and maybe 20 more in Canada. They are buying back $500M of their own stock

As usual, just because it's an earnings play doesn't mean we need to take a big risk. For the Earnings Portfolio, let's:

-

- Sell 10 JWN 2024 $20 puts for $4.25 ($4,250)

- Buy 15 JWN 2024 $20 calls for $8.40 ($12,600)

- Sell 15 JWN 2024 $35 calls for $3.40 ($5,100)

That's net $3,250 on the $22,500 spread so we have $19,250 (592%) upside potential and $35 may be a stretch but the $30s are $4.70 so I thought it was worth the risk ($1,950) for $7,500 more upside potential. We risk being assigned 1,000 shares at $20 + $3.25 in losses and that's the current price but the short puts are rollable and JWN pays a nice dividend so we don't mind if we end up owning them at $23 and then selling 2026 puts and calls for $11 to knock it down to net $12, do we?

As I often say - when your fallback strategy sounds like something you want to do anyway - it's a good trade!

![54822143-1658718210578701[1] Nordstrom Earnings Presentation](https://www.philstockworld.com/wp-content/uploads/2022/08/54822143-16587182105787011.png)