Welfare Queens

What’s the most successful venture capital firm in history? Kleiner Perkins and Sequoia Capital backed many Internet-era success stories. Andreessen Horowitz? No, one organization towers above. This firm was there before the first transistor was printed, and it will be there after we receive brain implants. One investor funded the computer, the internet, speech recognition, last-mile distribution, mapping the human genome, the core technologies of fracking, and the first horizontal shale drill, and today it’s driving down the cost of solar and wind power below that of coal. Even better news: If you’re a U.S. taxpayer, you’re a limited partner.

The Firm

Founded in 1776 by General Partners Washington, Jefferson, and Madison, and headquartered today in a Beaux Arts corporate campus in the District of Columbia, the U.S. government is the world’s premier funder of technological and commercial innovation. The Inflation Reduction Act (“IRA”) is being hailed/hated as a climate bill, but it’s really just the most recent investment by Eagle Capital. Opponents of the legislation claim it’s a poor investment. Eagle Cap’s track record suggests otherwise, and we can expect big returns.

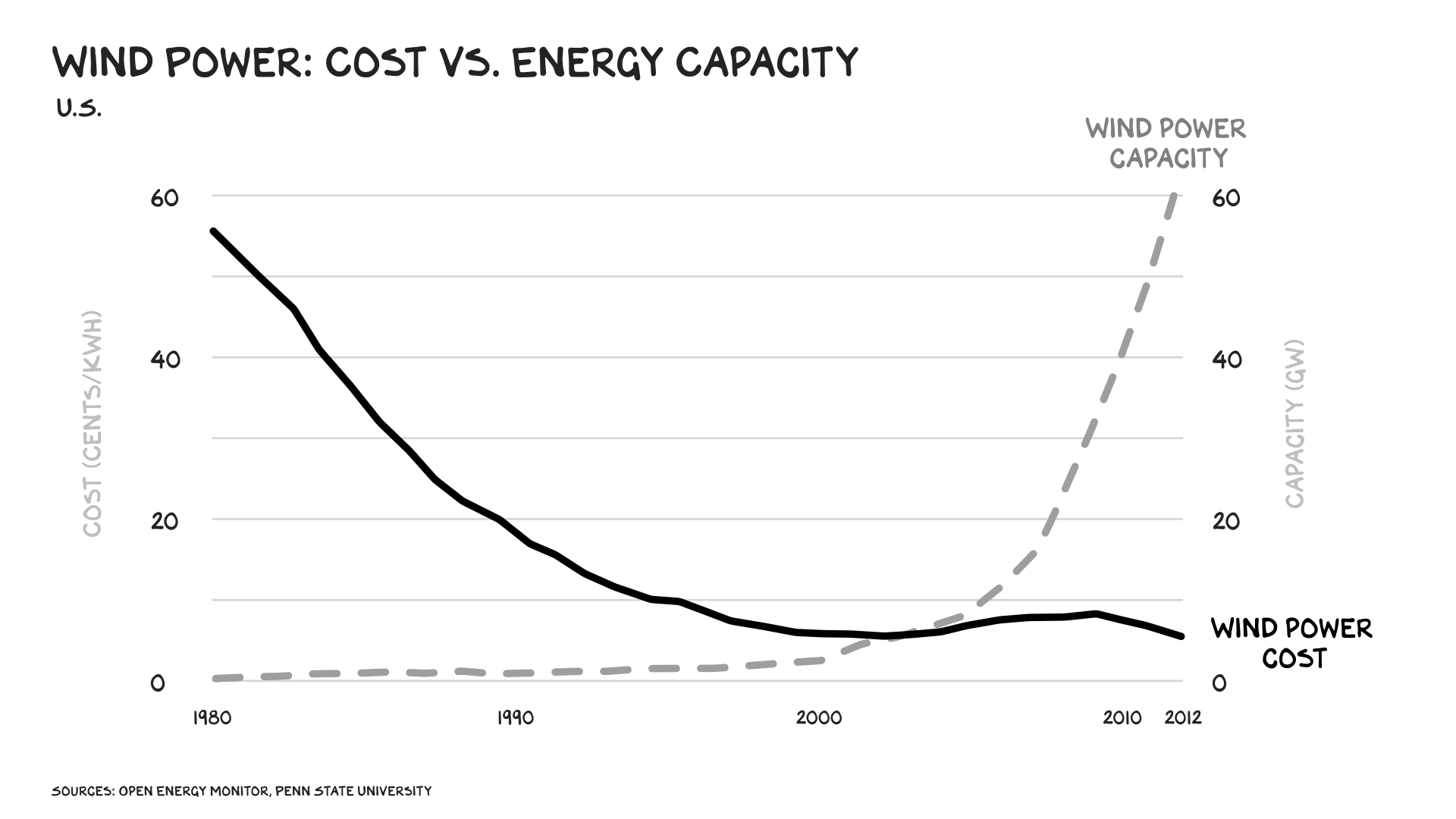

The IRA (awful name) will direct $369 billion to a variety of clean-energy initiatives, largely through tax credits. The largest investments are for solar, wind, and nuclear power generation, where Eagle builds on a track record of success. The government has invested over $3 billion in wind power R&D since 1976, and it’s been offering tax credits for wind and solar since the 1990s. Just since 2010, the cost of solar has dropped 85%, and the price to harness wind energy has been halved. Public funding, through R&D and tax credits, has been instrumental to that progress. Ninety percent of U.S. coal-fired power is now more expensive to operate than replacement wind or solar sources. And that’s not for lack of investment in coal. Conservative accounting puts government subsidies for coal at $20 billion per year, and the IRA includes investments in carbon-capture technology intended to support coal energy for several years.

Eagle Cap’s $528 million loss on solar cell manufacturer Solyndra, which declared bankruptcy in 2011, was a notable miss. But failure is inherent to venture investing. One analysis found the best-performing VC firms have more money-losing investments than the average funds. The key difference is the magnitude of their successes and aggregate portfolio returns. Solyndra was a miss, but the $30 billion Department of Energy loan program that funded it turned a profit. There are many notable wins; one business that took a $465 million loan from the same program in its early days: Tesla. You likely didn’t know that, as its CEO spends more time shitposting America than crediting it.

Going Deep

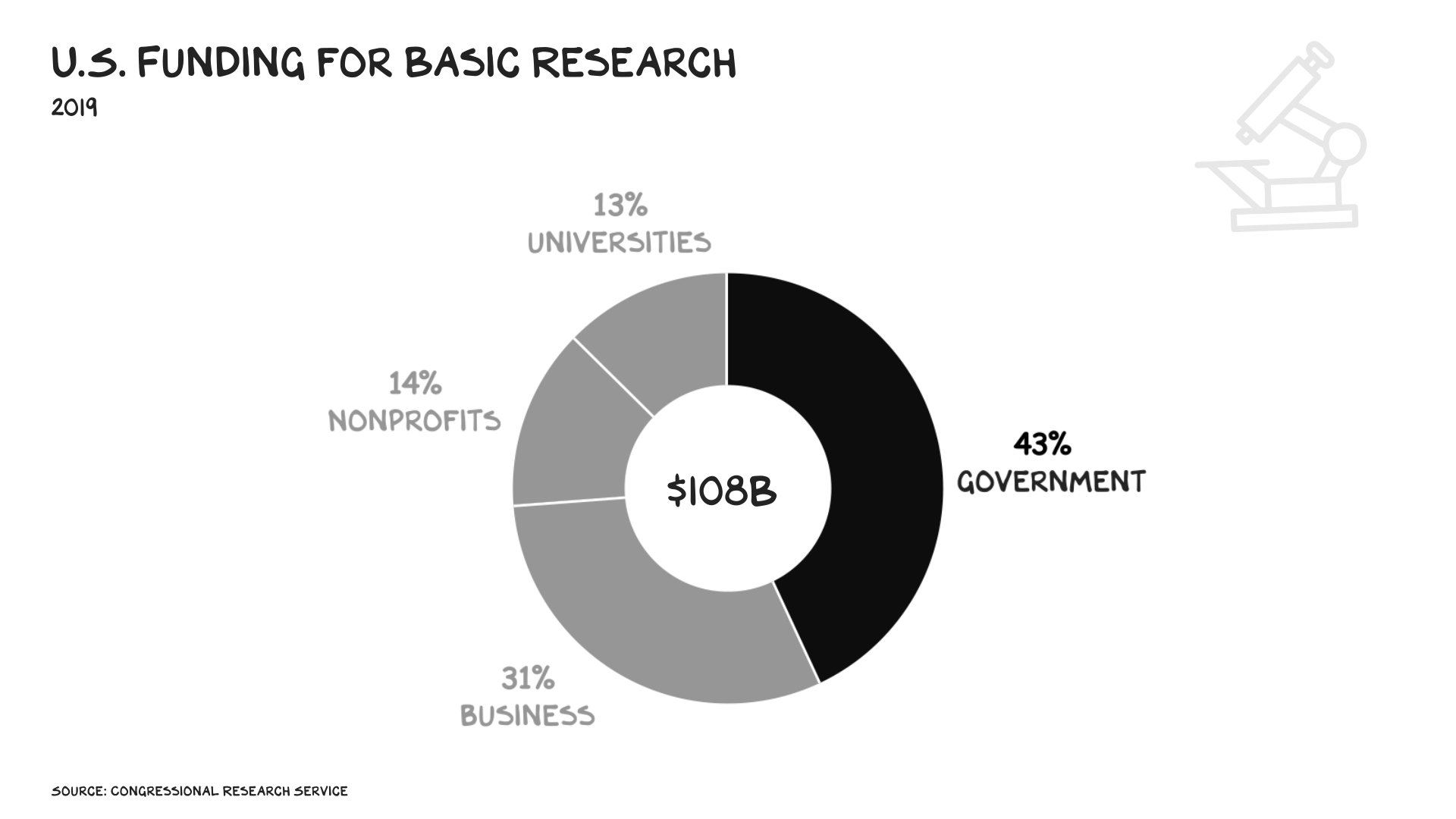

Early-stage, future-leaning research is riskier and requires large amounts of patient capital. Private industry struggles to justify long-term, mammoth investments in deep science. The most enduring societies have one thing in common: Their governments play the long game. In the 1960s in the U.S., this meant computer and networking technology. At its peak, federal R&D spending approached 2% of GDP. The most cutting-edge work was done by the Defense Advanced Research Projects Agency (“DARPA”), which developed or funded the development of almost every building block technology of our tech infrastructure, from the Internet and the mouse to graphical user interfaces and GPS. More recently, DARPA has been a major funder of AI projects, notably speech recognition — both Dragon and Siri spun out of DARPA. Speech illuminates the difference between government and private R&D: In the 1950s, private Bell Labs (aka the phone company) did pioneering work on speech recognition — but only on phone digits zero through nine.

The government also invests upstream by supporting public education and universities. Stanford established leadership in engineering thanks to a unique three-way partnership between the university, industry, and government contracts, centered around the Stanford Research Institute, where many DARPA innovations have been created. Marc Andreessen coded Mosaic, the first consumer-friendly graphical web browser — it was the precursor to Netscape Navigator — while attending the (publicly funded) University of Illinois and working at the federally funded National Center for Supercomputing Applications. Again, did you know that? Why would you? According to an MIT study, technology developed at universities and then licensed to industry between 1996 and 2010 created $388 billion in GDP and 3 million jobs.

Double-click on any major tech product or company, and you’ll find government-funded tech. Apple, Intel, and Qualcomm were all beneficiaries of a loan program similar to the one that funded Solyndra and Tesla. Google’s core algorithm was developed with a National Science Foundation grant. Economist Mariana Mazzucato, in her book The Entrepreneurial State, calculates that U.S. government agencies have provided roughly a quarter of total funding for early-stage tech companies, and that in the pharmaceutical industry (a sector requiring immense experimentation and a willingness to fail), 75% of new molecular entities have been discovered by publicly funded labs or government agencies.

Fifty years from now, the field most likely to spawn more value than digital computing is genetics, and similar to digital computing, genetics is an Eagle Cap portfolio industry. The Human Genome Project cost U.S. taxpayers $3.8 billion, was completed under budget and two years ahead of schedule, and has generated $966 billion in economic activity and $59 billion in federal tax revenue. It’s estimated the federal government’s $3.3 billion in annual spending on genetics projects generates $265 billion in economic activity annually. This number doesn’t account for the improved health outcomes and quality of life flowing from genetic breakthroughs — which have an estimated value of $1 trillion per year and growing. One of Eagle Cap’s recent wins in this space: the Moderna Covid vaccine, the result of a $25M DARPA grant to the company for developing RNA vaccine technology.

Eagle’s Biggest Critics

The biggest critics of the government are, oddly, some of its biggest beneficiaries. Tech billionaires are often the first to shitpost America, even as they continue to harvest wealth from the investments taxpayers make via the U.S. government.

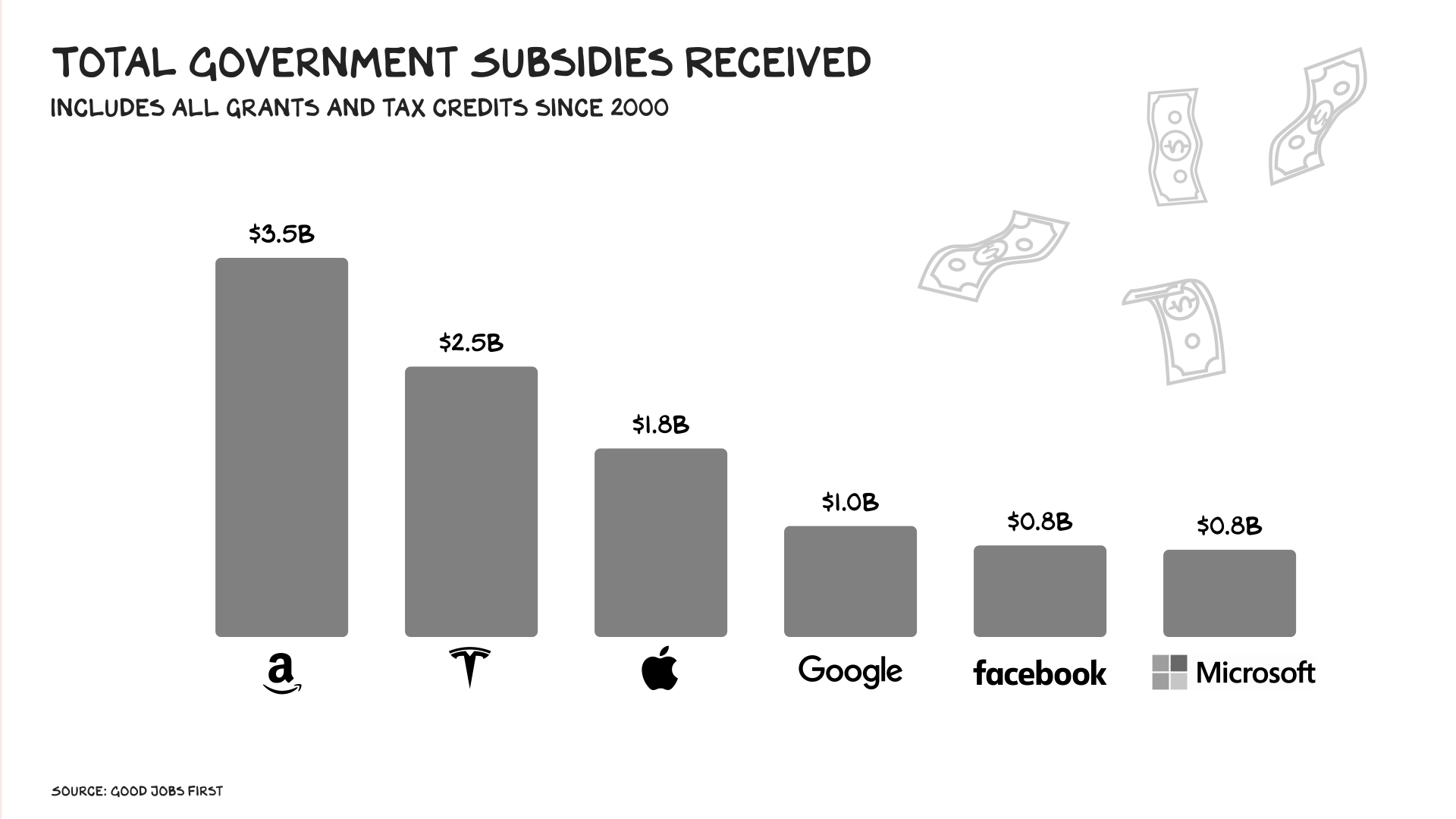

In fact, the biggest bitch(er) may be the biggest (financial) beneficiary. Elon Musk says we should “get rid of all” government subsidies, that “the government is the biggest corporation with a monopoly on violence,” and last week mocked Washington for hiring more employees at the IRS. Let’s be clear: Elon didn’t build an EV company in South Africa or start a rocket company in Canada. He built Tesla and SpaceX in the United States. And both continue to be heavily dependent on U.S. government support.

There would be no SpaceX without NASA, its largest customer. Tesla built its Fremont factory with a $465 million DoE loan in 2010, and its first 200,000 cars benefited from tax credit subsidies of up to $7,500. For years the company was able to report profits thanks to the “sale” of emissions credits to other carmakers. All told, the company has accepted an estimated $2.5 billion in government support.

Marc Andreessen says he’s “pro-gridlock,” because “when the government does things, it usually doesn’t end well.” Except for providing the state-sponsored platform for his career — the University of Illinois and NCSA. Now @pmarca is making news because he’s concerned about our nation’s “housing crisis.” We aren’t building enough houses, he wrote recently, and that’s “a driving force behind inequality and anxiety.” Except when the housing is near … his house.

Another outspoken billionaire, Peter Thiel, says the U.S. government is “socialist” and believes we have “much worse outcomes than the Soviet Union in the 1950s.” (His solution is to take up seasteading — i.e., building floating autonomous ocean communities that aren’t subject to regulations or taxes.) But Thiel’s current venture, Palantir, is a government contractor that provides data analytics to the CIA, DoD, and other government agencies — and these contracts make up almost 60% of its revenue. Note: Palantir has lost money every year of its existence. That feels like a Soviet outcome.

Mother of All Welfare Queens

In his 1980 presidential run, Ronald Reagan advocated tearing up our social safety net on the manufactured claim that it offered nothing more than handouts for lazy people. He popularized the notion of the “welfare queen,” someone living large on the government dime, having more children to generate more welfare income. It was a classist, racist stunt. And it worked. Twenty-two states passed laws banning increased welfare payments to mothers who had additional children, and we’ve been slashing and burning the government ever since. Reagan’s welfare queen was a caricature, a country club cocktail fantasy of the ungrateful beneficiary of hard-earned tax money. The new welfare queens are tech billionaires. The only difference is, they’re real.

VCs claim they partner with entrepreneurs (many do), bring unique insight (most don’t), and care about the founder (read: money). What’s clear is that the economic model of 20% carried interest — investors and VCs get 80% and 20% of the gains on capital, respectively — has been flipped on its head re: public investment, where investors (taxpayers) often get less than the VCs and entrepreneurs they back. Ironically, a Democrat held up the legislation until the most obscene tax break in our tax code was restored. I hope someday somebody loves me the way Senator Sinema loves VC and private equity.

Lemonade Stand

We’re on vacation and my kids made $27 from their lemonade stand yesterday. They then spent $29 on Nerds and Airheads candy, and were 100% confident they should have unfettered access to their returns (before/during/after dinner) … as they earned it. The gap in the math was that Dad spent $38 on supplies (table, sign, market, pitcher, cups, lemonade mix, etc.). Take this times a trillion, and you’re starting to get warm re: the relationship between taxpayers, Sand Hill Road, and the innovators they back.

Citizenship

A wonderful thing about our country is that the people who are most patriotic are the ones who’ve made the greatest investment: veterans. Less heartening are the individuals who’ve registered the greatest benefit, are the least grateful, and are often the most critical: VCs who relocate to Miami and, before buying sunblock, disparage (constantly) the state they built their wealth in. Also, mega-welfare queens who cash EV subsidy checks and sell carbon credits as they mock the elected leaders who passed those laws. BTW, nobody believes you moved to Florida or Texas for better governance — you wanted the chance to recognize a capital gain at a lower tax rate than the middle-class taxpayers who funded your infrastructure. Fuck off.

The first trillionaire will likely be an entrepreneur who builds a layer of innovation on top of the bold investment American citizens are making to address climate change. Let’s hope they display more grace and citizenship and our elected leaders demonstrate more backbone representing investors, the lower 99.99%.

Life is so rich,

![]()

P.S. My Brand Strategy Sprint is coming up on September 19. If you haven’t taken it, I’ve heard it’s pretty good. Enrollment closes September 13 – sign up now.