![]() It’s not even 1%.

It’s not even 1%.

That’s right, when the Dow drops 300 points these days, it’s not even 1% of 33,500 so don’t get all worked up about it. Our brains tend to get fixed on what was considered bad when we started trading and for me that was about 100 points and that was in the 80s, when the Dow was about 2,000 so 5% is where our 5% Rule™ came from. 5% of 33,500 is 1,675 points – now THAT is something we should be concerned about!

The Dow is a stupid, price-weighted index – so we don’t give it a lot of consideration but it is the index most of the World and, sadly, most traders look at to gauge the health of the US Stock Market – so we’re stuck with it anyway.

So we topped out at 34,200 and 95% of that is 32,490 and we’re 1,000 points over that today – so it’s hard to be too concerned at the moment… A 5% or more sell-off WAS our concern last Tuesday, when we began doing our Portfolio Reviews and I said:

“Now, here’s the problem. We did such a good job that the portfolio is already up to $307,376 (up 207.4%) – up $113,045 (58%) in a month! As we only planned on making 154% over the next 18 months – this is wildly ahead of schedule. It’s not that we don’t still love our positions, it’s just that now we have $307,376 we could cash out (well, we can’t, I’m not on the show) and the upside is now “only” $186,538 (60%) over the next 17 months – and we can do that with low-risk dividend stocks so the Reward is no longer worth the Risk – especially since the very silly $113,045 gain could just as easily reverse itself if the market turns back down.

“So, if were up to me today, I would cash out and start from scratch and that’s the decision you should be making with every single position you have when there’s a rally because look how drastically our risk/reward ratios can change. We went from having 154% upside potential to just 60% yet the risk is the same – so it’s very simply no longer worth it – no matter how much we love our positions.”

That was the VERY TOP of the market and we stayed at that top for a full day before beginning to fall out but not before, fortunately, we cashed out a considerable amount of positions and set the hedges in our Short-Term Portfolio more aggressively to the bear side.

There’s no magic trick here, the chart we really care about is the S&P 500 chart and the thing we really care about are VALUATIONS and MACRO CONDITIONS – THAT is how you “predict” when a market is likely to turn. In this particular case – we nailed it.

The correction in the volatile Dow has “only” been a 3.2% correction (at 4,180) this morning in the much more meaningful S&P 500. The Weak Bounce Line at 4,160 is a 3.7% pullback from the Strong Bounce Line at 4,320 and, based on S&P earnings and the Macros haven’t changed since last week other than China cutting rates, which we talked about on Friday but became official this morning.

That’s popped the Dollar all the way to 108.50, which is up 2.5% from 105.50 last Monday so really, all the S&P had done is correct for the Dollar – not a big deal. If it’s no big deal, why did we get out? Well we still have over 20 short puts and 30 longs in our Long-Term Portfolio – so all we did was take our winners off the table along with positions we have lost faith in. Just because we THINK the S&P will not majorly correct does not mean we shouldn’t prepare for it – just in case.

That’s popped the Dollar all the way to 108.50, which is up 2.5% from 105.50 last Monday so really, all the S&P had done is correct for the Dollar – not a big deal. If it’s no big deal, why did we get out? Well we still have over 20 short puts and 30 longs in our Long-Term Portfolio – so all we did was take our winners off the table along with positions we have lost faith in. Just because we THINK the S&P will not majorly correct does not mean we shouldn’t prepare for it – just in case.

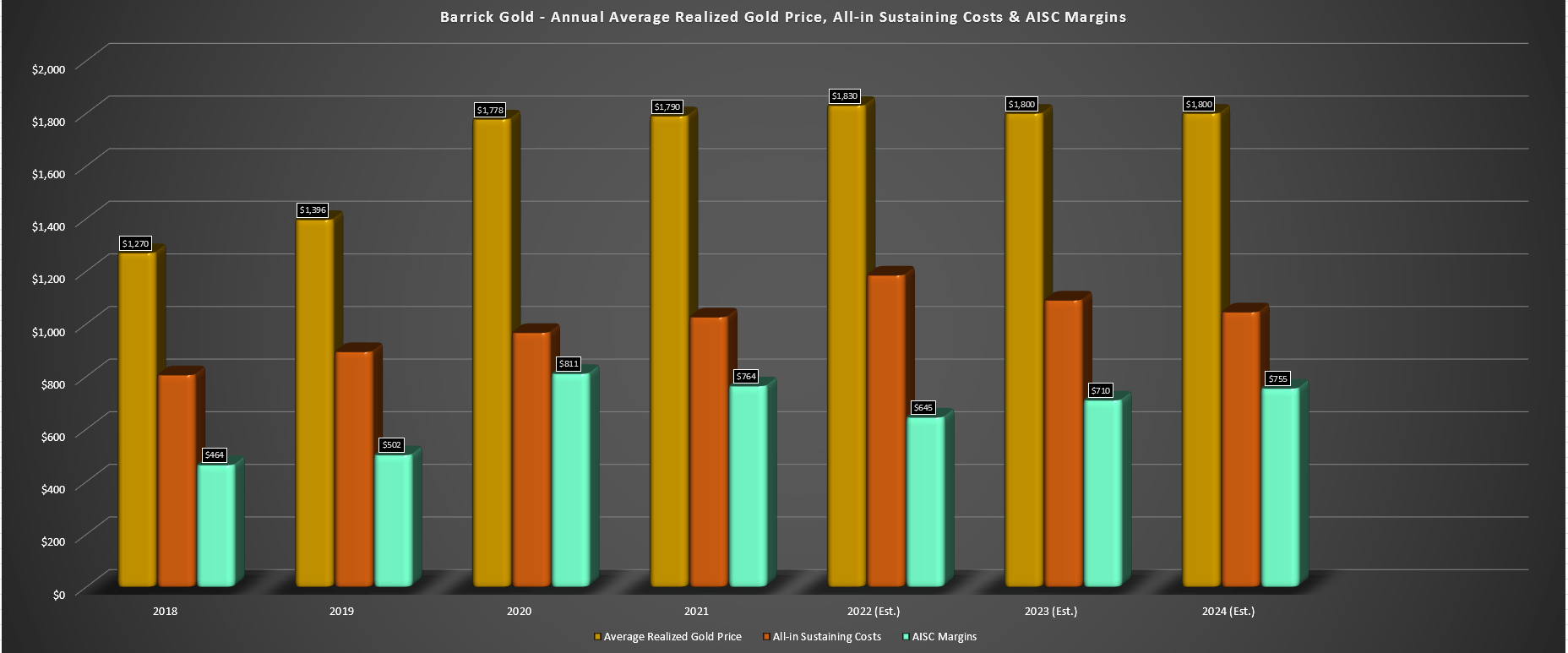

The CASH!!! we now have leaves us free to bargain-hunt – if we feel things are stabilizing – but that’s not going to be clear for another week or two. One of the stocks we are keeping is Barrick Gold (GOLD), who are back down to $28.5Bn at $16 – even though they are net debt-free with $636M in the bank and dropping close to $2Bn to the bottom line so less than 15x earnings for the World’s largest gold miner is SILLY – especially when you consider what a great inflation hedge GOLD is.

Notice any correlations? See – trading isn’t hard – you just have to pay attention… Now HERE comes the magic trick – this is Gold priced in Euros since last August (2 years, actually):

Since last August, Gold is up from below 15 to 17.56 (17%) while for us it has seemed flat due to our very strong Dollar. That’s why, to the rest of the World, Gold is still a very hot investment – even while US traders are getting turned off to it. Not to be unpatriotic but Barrick Gold doesn’t care WHO they are selling their gold to – as long as there are buyers, they are happy.

Barrick’s cost of production is $1,200 all-in (including the cost of acquiring the Gold) and $700 AISC (All In Sustaining Costs) for their 70M ounces of proven reserves. Since they have already acquired the Gold – their acquisition costs are not your problem and new investors should care about that AISC and, at $700/ounce. Even if Gold were $1,200 (now $1,750) – they would make $35Bn pulling it out of the ground at a rate of roughly 4M ounces ($2Bn profit) per year for 17 years. THAT is what you are buying when you invest in GOLD.

Not only that but Barrick also mines Copper (it’s there with the Gold) and Copper production was up 25% to 120M pounds last quarter at about $3.40 per pound so that’s a bonus $408M in Revenues (at about 50% gross profit) – nothing to sneeze at.

Another positive note is Barrick has conservatively estimated their costs for Q3 and Q4 with oil at $110/barrel – to avoid any nasty surprises. This should lead to some positive surprised if oil remains under $100 ($90 this morning).

GOLD was our Stock of the Year in 2021, so I’m a little biased. We took our profits and ran when they were much higher but we like them now for all the same reasons we liked them last time they were at $15/share. In fact, in our Long-Term Portfolio, we have 50 of the 2024 $15 calls we bought for $5.50 back on October of last year (averaged on a recent double down) and, in our recent review – I told our Members I would rather double down than cover them at the moment.

In our Money Talk Portfolio (and I’ll be on the show Wednesday to adjust), it’s one of the 5 stocks we’re keeping, as I noted in Wednesday’s review, and we have the 2024 $10/20 bull call spread there with short Jan calls – so we’re in perfect shape there. In our Butterfly Portfolio, we bought back the short calls – getting more aggressive there as well and, in our Earnings Portfolio, we also got much more aggressive last week.

As a new trade (and I guess you can tell how much I like them at this point), I would go with:

-

- Sell 10 GOLD 2024 $17 puts at $3.50 ($3,500)

- Buy 25 GOLD 2024 $15 calls at $3.20 ($8,000)

- Sell 25 GOLD 2024 $22 calls at $1.20 ($3,000)

That’s net $1,500 for the $17,500 spread and it is aggressive with the sale of the $17 puts, which obligate you to own 1,000 shares for $17 if GOLD goes lower plus, assuming you lose all $1,500 on the spread, another $1.50 per share so the risk is owning 1,000 shares for $18.50, $2.50 over the current price. The upside potential is $16,000 (1,066%) – so I think it’s worth the risk.

If you want to be more conservative, you can sell 10 of the 2024 $15 puts at $2.40 ($2,400) and buy just 15 of the spreads for $3,000 and the net on that spread would be just $600 out of pocket on the $10,500 spread so the upside potential is $9,900 (1,650%) and the worst case would be owning 1,000 shares for net $15.60 – also not a bad trade but I have too much faith to leave $6,000 potential Dollars on the table.

So there’s PLENTY of things we can do with our CASH!!! that are better than waiting 18 months to squeeze the last 30-50% out of an already winning trade – that’s why we took so much off the table – there’s just no reason to be inflexible in an uncertain market in this land of market opportunity we find ourselves in.

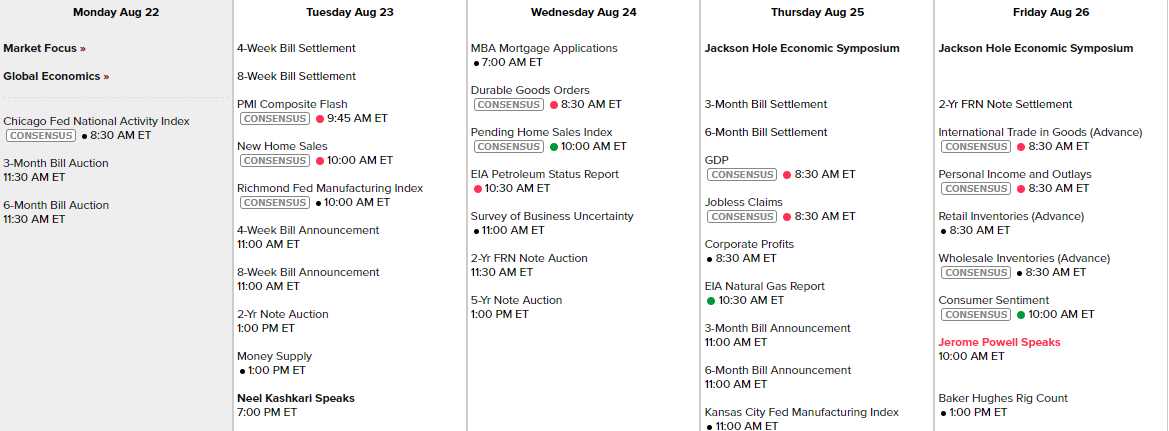

This is not a big Data week but Jackson Hole is Thursday and that leads to many market-moving statements. Powell is speaking at 10am on Friday – so be ready for that. Today we’re leading off with a positive Chicago Fed National Activity Index – first time in 2 months above the line so – Yay!

Tomorrow we have PMI, New Home Sales and the Richmond Fed and Neel Kashkari is the only Fed speaker this week. Wednesday is Durable Goods, Pending Home Sales and Business Uncertainty but don’t ignore the 5-year note auction (don’t worry – everyone wants Dollars). Thursday is GDP and the 7-year auction and Friday it’s Personal Income and Outlays along with Inventory Reports and, Powell speaking.

And, of course, the small(er) cap Earningspalooza continues:

So nothing particularly concerning that should be breaking the 5% lines this week. Natural Gas (/NG) is testing $10 and that could drive inflation higher (especially electric costs) and that keeps pressure on the Fed to keep up the pace of the tightening and that will be the topic of speculation into Jackson Hole on Thursday. T

That’s what we’ll be keeping our eye on – aside from further developments in China as they attempt to right that ship before it falls off the edge of the Earth.

Be careful out there!