I will be on Money Talk at 7pm, this evening.

I will be on Money Talk at 7pm, this evening.

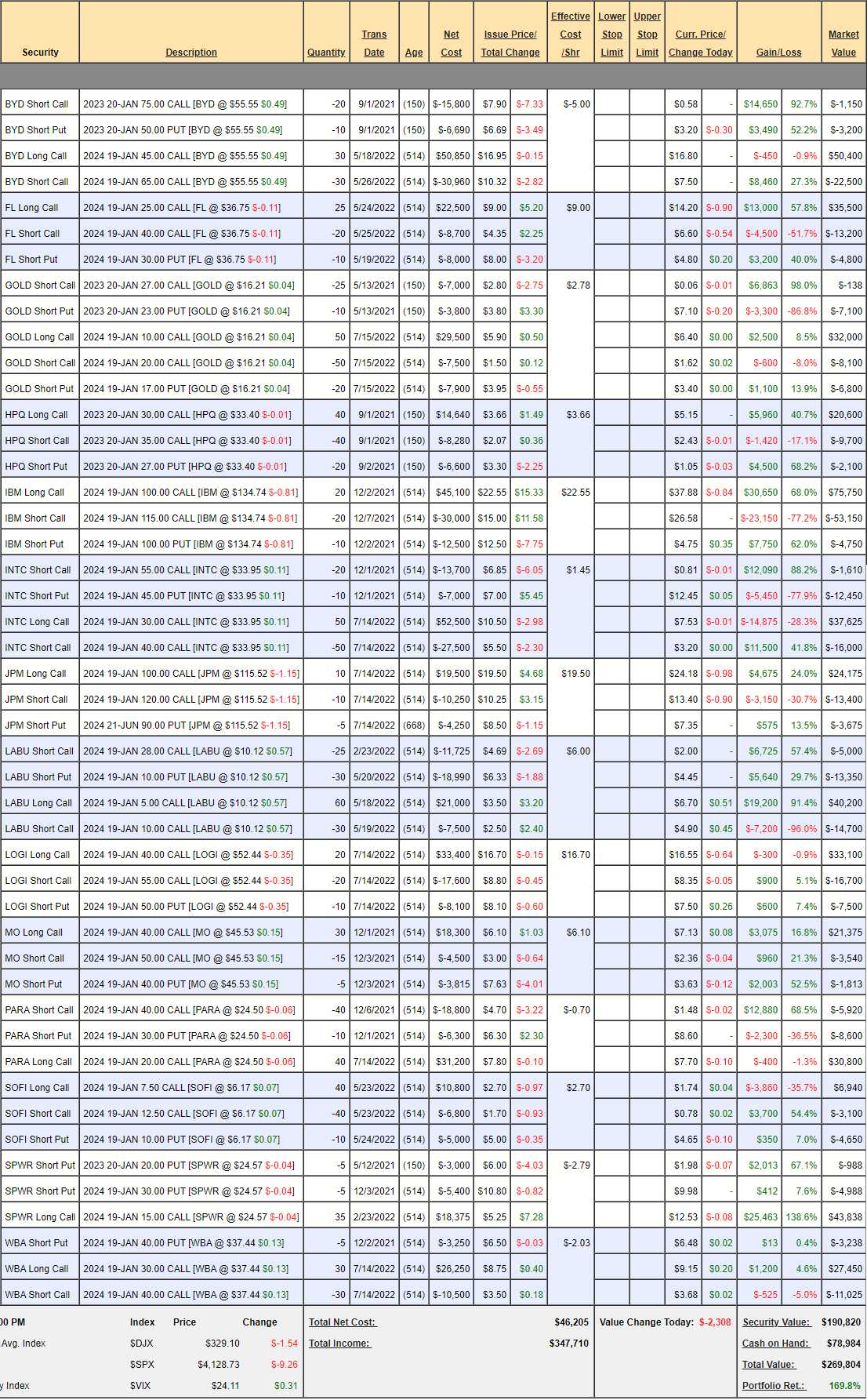

We just did the show on July 13th and, usually, we’re on once per quarter but, because we only make adjustments to the portfolio on the day of the show and because last Tuesday, I wanted to cash out (at $307,376) but I couldn’t – I called BNN and asked if they could give me a spot this week to officially cash out the portfolio.

Unfortunately, thanks to this little pullback (which we predicted last week), we’re down to $269,804 (up 169.8%) but that’s still up $75,473 (39%) in 6 weeks and, although we’re only halfway to our $500,000 goal, that goal doesn’t mature until Jan, 2024 and I’m too worried about the short-term in a portfolio we can’t adjust on the fly to let all those profits ride.

So we are going to cash out half our positions but I’ll be putting them in a new Money Talk Portfolio that starts with a fresh $100,000 so new followers can start from scratch.

-

- BYD – Nice profit, cashing in.

- FL – Nice profit, retail concerns are mounting, cashing in.

- GOLD – GOLD (and gold) is a great inflation hedge and this is a well-balanced trade at net $9,862 and if GOLD is over $20 in Jan, 2024, this will be a $50,000 spread so the upside potential is $40,138 (406%). Even now, at $16.21, this spread is $30,050 in the money. See why we don’t want to close it?

-

- HPQ – Again, we’re concerned about the consumer so cashing in.

- IBM – Although it’s our Trade of the Year, it’s already up $15,250 (586%) from our $2,600 cash outlay so we’re cashing in.

- INTC – Not only a keeper but we’ll get more aggressive, buying back the 2024 $55 calls at 0.80 ($400) and selling 10 more of the 2024 $45 puts for $12.50 ($12,500) as that’s only net $32.50 and we’d LOVE to own INTC at that price. At the moment, it’s a $50,000 spread at net $7,565 so there’s $42,435 (560%) upside potential.

-

- JPM – This is a new trade for us and we’re keeping it. Currently net $7,100 on the $20,000 spread that is 100% in the money so the upside potential, if we hold $120, is $12,900 (181%).

-

- LABU – Biotech ETF has made good money and we’ll cash it in.

- LOGI – Another new one for us that we will keep. This is a $30,000 spread at net $8,900 so we have $21,100 (237%) upside potential at $55.

-

- MO – Cashing in.

- PARA – It pains me to cash them in. I really like these guys but they’re not getting traction in a tricky market.

- SOFI – This one is a keeper. I think the market is very much underestimating their potential. It’s a $20,000 spread at a net $810 credit so the upside potential is $20,810 (2,569%).

-

- SPWR – This is our Stock of the Decade and the decade is young, so we’re sticking with it. Even at $30, this is a $52,500 spread and the current net is $37,862 so the upside potential at $30 is “just” $14,638 (61%) – but we can certainly do better than that – just selling the 2024 $35 calls (now $4.50) can bring in another $15,750 (107%).

-

- WBA – Sadly, did not make the cut.

So our 6 remaining positions have $152,021 (152% of the fresh $100,000) in upside potential over the next 17 months. That’s out of $230,000 that remained before we made the cuts but now we have plenty of CASH!!! to make new trades with as opportunities present themselves.