4,064.

4,064.

That was our Weak Bounce target for the S&P 500 in yesterday’s Morning Report and that is EXACTLY where we got rejected just before 2PM and it’s where we’re back to this morning – after being over it since the EU open.

4,128 is the Strong Bounce line and we HOPE we can get there. Home Prices will be up about 20% from last year and that should make homeowners happy (and home buyers miserable) but there are more owners than buyers at any given time so it’s a net positive for Consumer Confidence – coming at 10 am. 98 is expected, up from 95.7 in July.

Best Buy (BBY, not to be confused with BBBY) is one of the longs we kept in our Long-Term Portfolio (LTP) and our 20 2024 $60/90 bull call spreads with 15 short 2024 $70 puts was net $15,512 on the $60,000 spread when we did our review on the 17th and this morning they are popping back over $75 on not so terrible earnings – so we should be in good shape.

Best Buy is second only to Amazon in Consumer Electronics Sales but it’s a distant second with AMZN at 60% and BBY at 15%. As a store retailer, BBY has about 1/3 of the market, so they are a pretty good indicator for Discretionary Retail. Overall, sales are down 12.7% from last year. That’s not too terrible for a store that’s mostly WANT, not NEED kind of items.

In other Macros:

China’s growth has been downgraded yet again, this time to 3.5% for 2022 and 5.2% for 2023 and 5% in 2024. The downgrades suggest economists aren’t convinced Beijing’s recent stimulus measures – which more recently include 1 trillion yuan in funds largely for infrastructure projects, and central bank rate cuts – can help counter the slowdown.

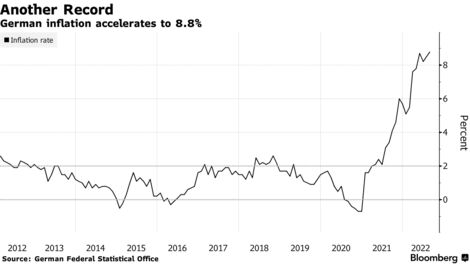

Germany’s inflation hit a new EU record at 8.8% – just a week before the ECB meets to discuss raising rates. Food and Energy costs led the advance despite their impact was being artificially offset by temporary government aid, including a fuel rebate and ultra-cheap public transport. We would be seeing a 10% tag on inflation if not for the Government jumping in with emergency measures.

Germany’s inflation hit a new EU record at 8.8% – just a week before the ECB meets to discuss raising rates. Food and Energy costs led the advance despite their impact was being artificially offset by temporary government aid, including a fuel rebate and ultra-cheap public transport. We would be seeing a 10% tag on inflation if not for the Government jumping in with emergency measures.

And speaking of the EU. I don’t think people realize how bad things are over there with Utility Bills jumping 500% (5x) for many people. If your electric bill went from $200 to $1,000, what would happen to the rest of your spending for the month? A study by the University of York predicts that over half of all UK households will be trapped in fuel poverty by January 2023 – which is now just 120 days away.

And speaking of the EU. I don’t think people realize how bad things are over there with Utility Bills jumping 500% (5x) for many people. If your electric bill went from $200 to $1,000, what would happen to the rest of your spending for the month? A study by the University of York predicts that over half of all UK households will be trapped in fuel poverty by January 2023 – which is now just 120 days away.

And speaking of China (again), Country Garden – another massive Real Estate Developer – has reported first-half profits of $89M, which might seem nice but last year it was $2.2Bn, so down 96%. More than 30 Chinese Real Estate companies, including China Evergrande Group and Sunac China, have already defaulted on their International Debt. Many privately run developers this month issued profit warnings ahead of their earnings.

China Huarong Asset Management Co., reported a $2.7 billion net loss for the first half, hurt in part by the real-estate downturn. The company, which is partly owned by China’s Ministry of Finance, described the country’s economic conditions as “extremely complex and difficult.” Huarong’s international finance arm separately predicted that in the second half, China will face manifold challenges including pressure on investment, consumer spending and export trade.

As we all have become painfully aware – when China catches a cold – the rest of the World gets it as well…