This is bad:

This is bad:

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations.” – FDX CEO, Raj Subramaniam

FDX is down 20% and their profit warning is dragging down other shippers (UPS is down 7%) and, fortunately, FDX is not a Dow component but blaming the Global Economy for their problems is spooking the whole market. China is shut down again, Europe is a mess, Currency issues are plaguing the company but, in REALITY, revenues are still $23.2Bn vs $23.52Bn originally expected so blaming the Global Economy for guiding earnings down 33% on a 1.3% revenue miss is disingenuous to say the least.

The company is predicting an even worse Q2 (fiscal) with a 50% reduction in earnings forecast ($2.75 from $5.46) on perhaps 5% less Revenues ($23.75Bn) so again – the Global Economy is doing their part with a very slight miss – this is an internal FedEx issue – not the end of the World – they are just blaming the World for whatever is ailing them.

The company is fighting back with cost cuts including a reduction in flight frequencies, volume-related reductions in labor hours, consolidation of sort operations, cancellation of planned network capacity and other projects, deferral of hiring, and closure of over 90 FedEx Office locations. It also plans to shutter five corporate office facilities but all those laid-off employees will be very happy to know that the company is also buying back $2.5Bn worth of their own stock in the next 6 months (now that they’ve put it on sale).

Is FDX a good buy down here? Well, they are still making about $15 per $165 share and, as I noted, the revenues are still there. $165 is $45Bn in market cap and they bottomed out at $100 in 2020 when the World was actually CLOSED (and they made $1.3Bn that year) and last year they made $5Bn so – if things normalize, $45Bn is a joke for the company – no wonder they are buying 5% of their stock back.

In our Long-Term Portfolio (LTP), the FDX 2025 $120 puts should be close to $20 this morning – certainly I don’t mind taking that risk on 5 of them and getting paid $10,000 in exchange for our promise to buy 500 shares of FDX for net $100 so we’ll do that and we’ll also pick up 10 of the 2025 $140 ($60)/180 ($45) bull call spreads at net $15 ($15,000) and that will put us in the $40,000 spread for net $5,000 with $35,000 (700% upside potential) if FDX can get back to $20 less than they were yesterday in two years.

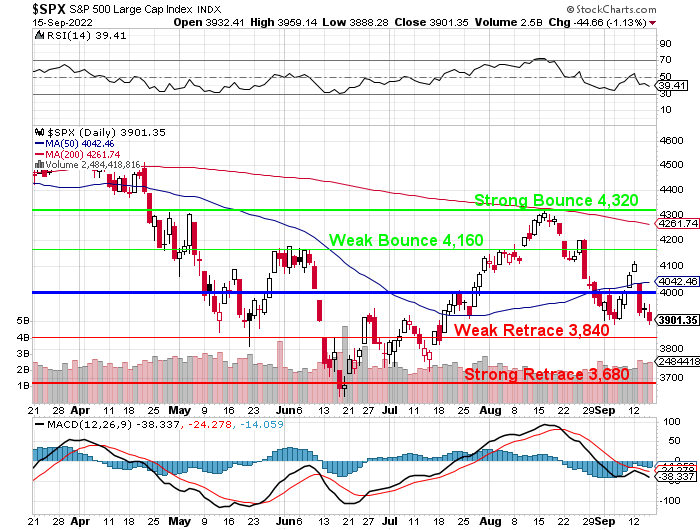

We haven’t had FDX in the portfolio for a long time but this seems like a nice opportunity to take a stab at them. We’ll be reviewing the rest of the LTP later today in our Live Member Chat Room. It should be a great day to spend money improving our positions because I don’t see why FDX having 1.3% less revenue should make IMAX any cheaper and we’ll get a very nice view of panic lines for the indexes as we continue to sell off ahead of the Fed (next Wednesday):

As long as 3,840 holds (post Fed) then we’re still improving over where we were in June. At 4,320 we cashed out half our positions because the market was way ahead of where it should be – now it’s where it should be – there’s really nothing to worry about, not even FDX.

And no, we’re not going to bounce back to the highs we never should have been at – not until the Fundamentals catch up and that could take years. THIS is the range we belong in so stop being shocked when we’re in it. We’ve reviewed 6 of our 7 portfolios this week and, for the most part – we’re happy with our targets and haven’t found the need to adjust – despite the very bad week the market has had.

The LTP is sitting on $1.2M in cash, 63% of the portfolio, so we’re looking for ways to deploy it as our Short-Term Portfolio (STP) has about $5M in downside protection. I’m a lot more concerned about missing out on buying opportunities than I am about getting burned by a big move lower.

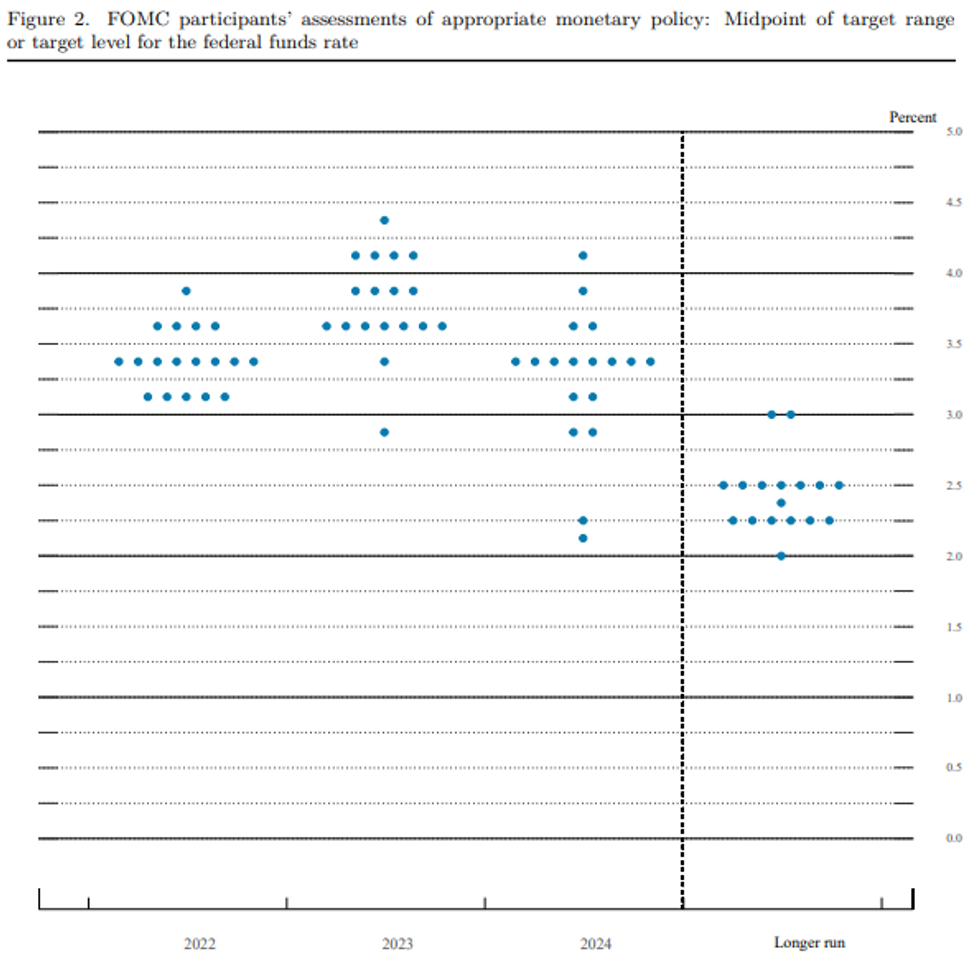

To some extent, that’s up to Powell and the Fed next week but I smell peace in Ukraine soon (before Putin is totally embarrassed) as Xi Jinping just met with Putin and it did not go well for the Russian leader. Thanks to a last-minute save on the Rail strike, the supply chains continue to improve and, as to the Fed – 0.75% or 1% – who cares? What matters is when they stop and anything under 6% is a gift and the plan still seems to be 4% and this meeting will put us at 3% or 3.25% – either way there are more hikes ahead – so learn to live with them.

Again, 4-6% interest rates are NORMAL, not a punishment! Powell hasn’t gone insane – 0.25% WAS insane! Get a grip people. The free money train ride is over and now Americans and our Corporate Masters have to figure out how to work and exploit workers in the real World – until they can come up with another crisis to throw money at, of course…

Have a great weekend,

– Phil