Momentum Monday…What Will Apple Do and What Are The Best Venture Capitalists Excited About

Courtesy of Howard Lindzon

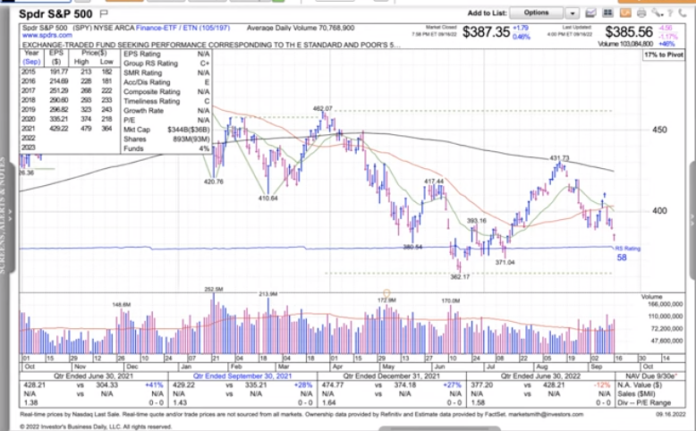

As a reminder, Marketsmith (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from Marketsmith.

Good afternoon from Munich.

I am out of the Alps and back in the real world where the $VIX is 28.

I am headed to Tel Aviv in a few hours to meet with investors and founders for a few days. I am looking forward to the energy.

As always, Ivanhoff and I did our weekly Momentum Monday video and you can watch it here. I have embedded it below in my blog:

I riffed on Fedex, Apple and my conversations with the best investors of last couple of booms moving into climate chance and alt energy (nuclear energy). Do not expect the majority of past leaders to lead us in the next bull market and boom.

Here are Ivanhoff’s thoughts:

The main indexes have made three consecutive lower highs and lower lows since mid-August. The number of distribution days is growing. It seems they are headed for a test of their summer lows. Some mega-cap stocks like META, GOOGL, and NVDA already made new year-to-date lows and those are the ones that are the most sensitive to the economic cycle.

The year-over-year Inflation keeps coming above 8%, which probably won’t change in the next few months. This would give the Fed all the excuses they need to keep raising interest rates. As the Fed keeps fixating on inflation, the market is starting to worry about a potential recession in 2023 due to Fed’s action. New credit creation is shrinking quickly as interest rates are rising. Companies that are economic bellwethers keep lowering their earnings guidance by a shocking size. The most recent examples are FedEx (FDX) and Nucor Corporation (NUE).

While the indexes and most stocks are in a clear downtrend, there are some groups that are showing notable relative strength. Anything related to alternative energy is holding relatively well – EVs (TSLA, RIVN), solar (ENPH, FSLR, SPWR, NOVA, etc.), lithium (LTHM, ALB, etc.), others (BE, PLUG, STEM, etc.). Ironically, the only group that is holding well is the one that is expecting hefty government subsidies.

Charlie’s 10 charts were helpful and worth a skim.

I have been a broken record, but with major US indexes still well below their 200 day moving averages …why waste too much energy on the markets.

Go for a bike ride or something…I did.

Have a great week.

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. For full disclosures, click here.