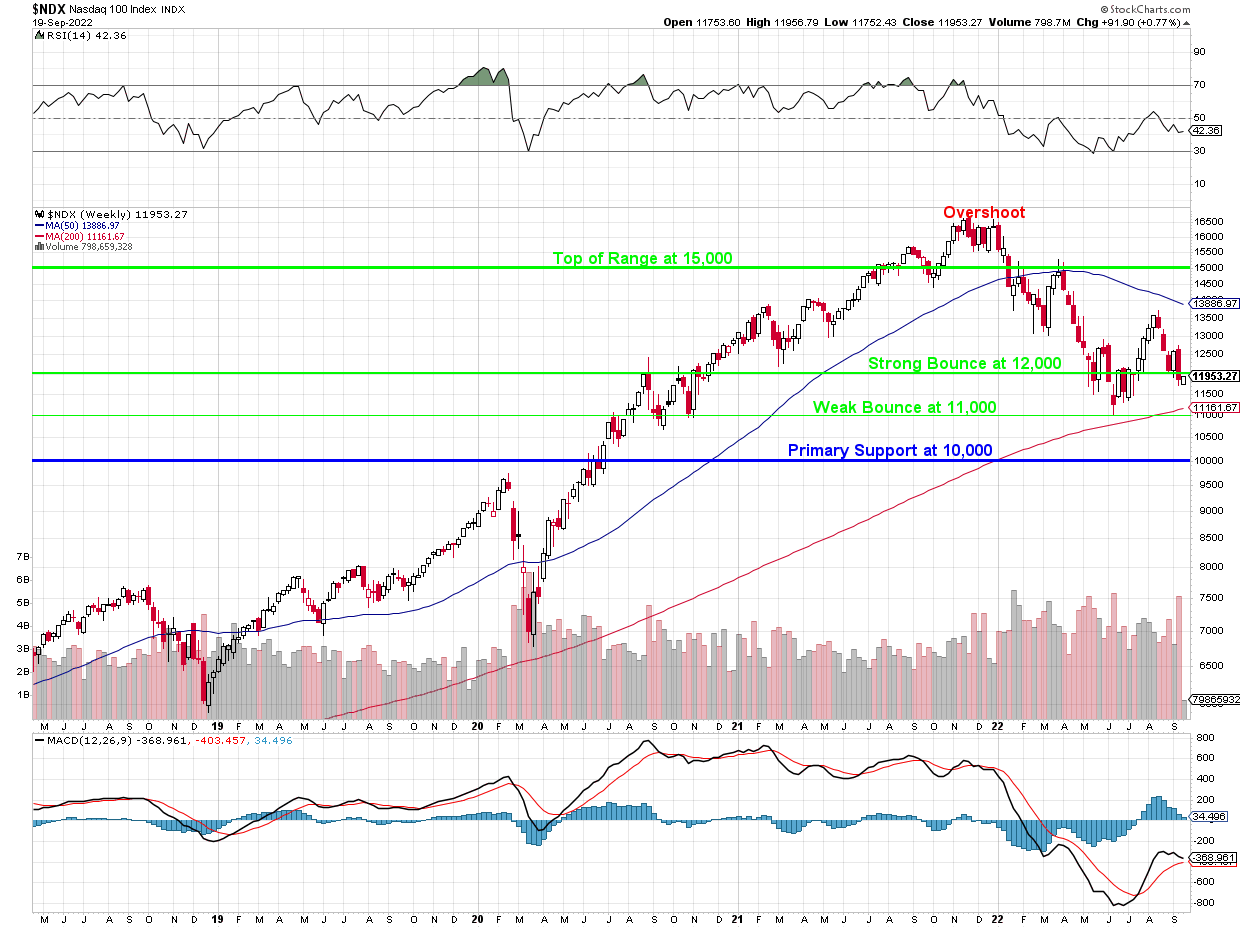

We’re still in our range.

Granted, it’s a very big range but that’s what happens when you make very big gains in a very short amount of time – we never built up the support necessary to hold that ridiculous run-up. Good thing too as stocks were downright unattractive at 15,000+ but, at 12,000 – we find plenty of good values on the Nasdaq.

For all the hand-wringing last week – we are still on track to be between 12,500 and 13,000 into earnings next month – which is where we expected to be sine last quarter. As I keep saying, what we had in the first half of the year was a CORRECTION and that is not the same as a crash or a sell-off as both of those things imply something went wrong and will be fixed.

In this case, what went wrong was our entire 2021 move from 12,000 to 16,000, a 33% gain in the index fueled by 2 years of Fed and Government stimulus to the tune of $11Tn. THAT was the unnatural thing. Take away the extra money and now we see how these stocks do on their own in the real world.

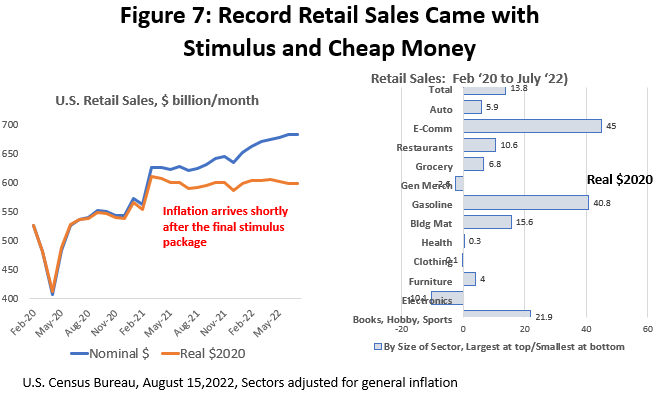

Notice the analysts don’t talk about this – because it’s complicated and doesn’t make a good sound-byte. Giving the economy $11Tn over 2 years is 25% of our annual GDP and, like a blood transfusion – if it’s what we need, it’s what we need. But did we NEED to pretend everything was fine when it wasn’t? Also, what’s the cost of all that blood? As you can see from the chart below (and every time you take out your wallet) inflation is part of that cost:

So Retail sales are up 16.66% but the actual AMOUNT of physical goods purchased has gone down – we are just getting less stuff for more money. Apparently, we’re not willing to give up the stuff at any price. As you can see Gasoline is a very big driver of inflation and that’s come back down quite a bit. Keep in mind paying $100 a tank to drive back and forth to work for a week does not make you more productive than paying $50 did – it’s nothing more than a money sink to the Consumers (as are all fuel costs to Industry as well).

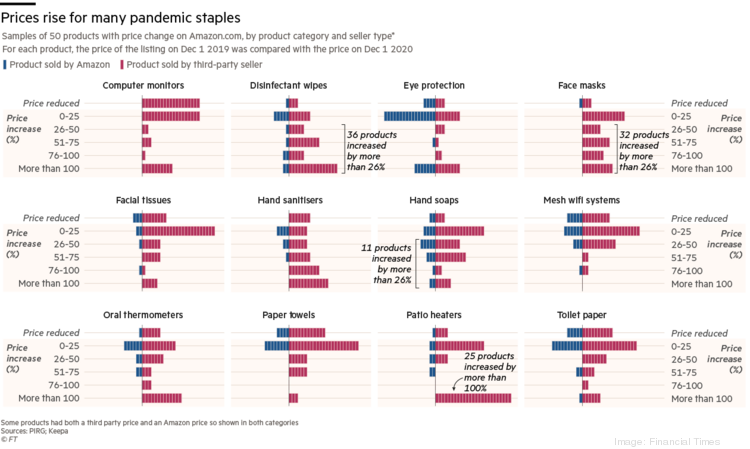

The other huge bump in spending comes from our friends at the Nasdaq, with E-Commerce having jumped 45% in two years. E-Commerce is the master of nickel and diming you to death and you hardly notice all the fee increases until you realize you’re now paying $200 a month to watch TV (and we used to think no one would pay $10/month for cable) and another $200 to have Internet (which we can’t live without) and we used to pay $3.99/month for a phone line but they gave you a Princess Phone and our Dads used to complain about that cost! And don’t even get me started on Amazon:

And you have to pay them $139 a month now so they can rape you on the goods (and shipping is often not free now – and it’s slower). When Prime started, it was $79 in 2005 and it went to $99 (up 25%) in 2014 and $119 (up 20%) in 2018 and this year it’s $139 (16.8%) – so they are staying with $20 raises but it went from 9 years to 5 years to 4 years as they accelerate the rate of the raises. I bet you didn’t even notice they charged you $20 more to renew, right?

There’s your death by 1,000 cuts – $20 here, $20 there and you can’t quite put your finger on it but suddenly there’s a lot more bills than there used to be. That’s their business model – AMZN, NFLX, the entire Internet used to be very cheap (they even lost money providing the services) and they got themselves to be an indispensable part of your life – and then they put the screws to you. You know who else has that business model? Drug dealers…

Anyway, so the point is it’s good to invest in drug dealers – they have addicted customers and huge mark-ups and the Nasdaq drug dealers have, so far, been able to escape prosecution for most of their crimes (the EU is beginning to crack down on privacy violations and monopolistic practices but they still get to topple Governments, so the EU Government will probably change before Big Tech policies do).

Lots of things are back on sale and, once we see how much damage the Fed does tomorrow (we’re still thinking this is it but not brave enough to go all in), we can start looking for things to buy again, like Generac (GNRC) which is back at $200, where we liked it last time.

$200 is $12.5Bn and GNRC drops $800M to the bottom line so about 13x earnings but take $1Bn in debt and add 3% is $30M off that as the Fed raises rates. Still fine. Growth is great, they were doing $250M in profits 2019 on $2.2Bn in sales and now they are doing $750M this year on $5.2Bn in sales and 10% growth next year should drop a lot more to the bottom line as the fixed costs are taken care of at this point.

We will add GNRC back into our Long-Term Portfolio with the following spread:

-

- Sell 5 GNRC 2025 $150 puts for $30 ($15,000)

- Buy 10 GNRC 2025 $150 calls for $90 ($90,000)

- Sell 10 GNRC 2025 $250 calls for $52.50 ($52,500)

That’s net $22,500 on the $100,000 spread so we have $77,500 (344%) upside potential if GNRC can manage to claw back over $250 in the next couple of years. Doesn’t seem like much to ask, does it?

It’s a relatively small position for the LTP if assigned – $75,000 worth of stock or $97,500 if we also lose the entire $22,500 and that would be $195 per share – roughly the current price. That’s our worst-case scenario and our best case is making $77,500 using very little cash and margin.

In reality, the Jan $210 puts are $30 so if we can roll $50 lower in strike by adding 2 years – it’s only 6 years until our obligation goes to zero. As long as they don’t suddenly go bankrupt, we should be fine.

Which reminds me of RH, which is being priced like it’s going BK – we’ll do that one in Member chat – see you there!