112.

That’s the highest the Dollar has been since 2002 and it’s up 24% since last June – barely over a year ago. As I said on Monday, it’s all about the Dollar very simply because the market is priced in Dollars, commodities are priced in Dollars, earnings are priced in Dollars and, unfortunately for some companies (as we discussed in Wednesday’s Webinar), many companies have to pay their employees in Dollars so – if they collect their money in a weaker currency – that conversion becomes expensive as well.

The S&P 500, for its part, was at 4,300 last June and now we’re at 3,726, which is only down 13.3% but, from our 4,800 peak, we are down 22.4% – a bit less than the Dollar is up. As you can see from the two charts, the Dollar has a short-term effect on the market but not so much a long-term effect. The last time we had such a big move in the Dollar was 2014/15, when the Dollar rose 25% in a year and the S&P 500 didn’t even fall – it just stopped going up until the Dollar stopped – then it continued it’s journey higher.

Oil peaked at $114 and this morning we’re at $80.50, that’s down 29% (and that’s a good long to bet with tight stops under $80 on /CL – as is Natural Gas (/NG) off the $7 line with tight stops below). Gold peaked at $2,000 and is now $1,650 – that’s down 17.5% but Silver (/SI) has taken a deeper hit from $28.50 to $19 this morning (also a good long) and that’s down exactly 1/3 (33.33%), which is a great place to look for a bounce.

Silver suffers from being an industrial metal and everyone is screaming RECESSION!, even though the US still has 11M job openings that are unfilled, which indicates the average Corporation would like to have 7% more workers than it currently has, which means our GDP COULD be about 7% higher if we could actually find 11M workers but we can’t – so the economy stalls and wages rise as companies compete for workers but they wouldn’t be competing for workers if they didn’t REALLY need them and you don’t hire workers unless you think they will lead to more profits, do you?

This is the sad thing about market analysts, most of them seem to have forgotten Econ 101:

- First (2017), we kicked out the immigrants, which made America great again but deprived us of a few million farm workers and, even worse, 300,000 top-notch scientists and programmers that were desperately needed for our S&P 500 companies to be competitive.

- Second (2018), the remaining workers demanded more money. The minimum wage was last set in 2009, when workers felt lucky to have a job and were being exploited. At the time it was $7.25 per hour and movie tickets were $6.

Sadly, there are still 21 states that still have a $7.25 minimum wage (the GOP has shut down every effort to officially raise it) but the Blue States are mostly on their way to $15 with California beginning to push to $22/hour, long-term. New Hampshire, it should be noted, has continued the tradition of their state motto, which is “Live Free or Die” – because those are the choices given to that state’s low-level workers.

- Third (2017) we began a trade war with China and other countries with Tariffs on goods that raised prices on imports.

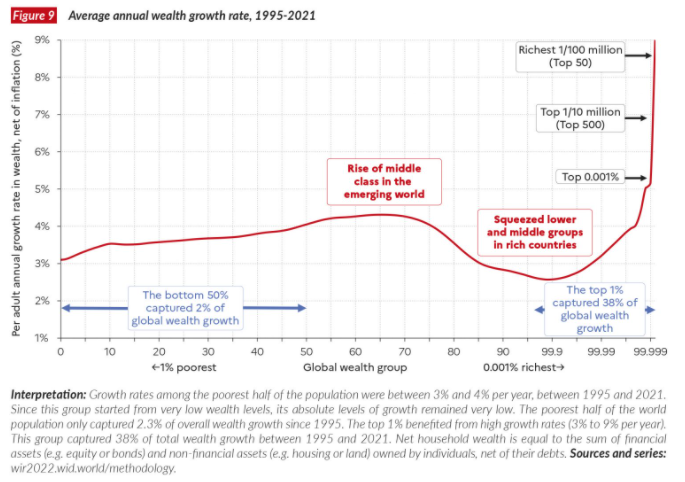

- Fourth (2017) Trump lowered the tax rate on Corporations from 35% to 21%, which increased the Federal Deficit and put more money into circulation. The tax cuts also helped wealthy investors keep more of their money, to the tune of $5,500,000,000,000 over 10 years. Billionaires got SO MUCH richer – not so much the rest of us…

- Fifth (2009-2021) the Fed kept pumping money into the economy and kept interest rates artificially low.

- Sixth (2018) was STIMULUS – $11Tn worth of it between Government handouts and Fed balance sheet expansion. Trump was handing out cash to his voters before Covid but Covid kicked it up about 100 notches and Trillions and Trillions of Dollars were spent – but only a few Billion actually fighting the disease. Go figure…

Covid led to a slower global economy that was papered over with stimulus so the same money was chasing less goods and services – so prices began to rise because there was now more money than the economy could accommodate at the old prices.

Covid also led to supply chain bottlenecks that take a long time to unwind. There are, for example, 3 ships that can hold 1M Barbie Dolls and they take a month to go from China to the US and usually one is being loaded and one is in California (a month to cross) and one is on the way back to China. Mattel makes 1M Barbie dolls per month and all is well until Covid when the ships suddenly stop running and, before the factory shuts down too, 3M Barbie Dolls are sitting at the doc.

Now we have a container shortage as well. Once the ships start running again the factory starts running again and keeps putting out 1M Barbie Dolls per month but people were buying Barbies on-line and the stores have empty shelves when they used to have a month’s supply and, even if you can put 20% more Barbies on each ship – it will still take you 15 trips (months) to work off your excess Barbies and get the supply chain back to equilibrium.

Meanwhile Barbie has to compete with people who need any extra shipping space for auto parts and pacemakers so they all bid against each other for shipping space and then UPS and FDX and the rails get overwhelmed and we’re rolling every truck in the World 24/7 trying to catch up, which sends fuel prices through the roof and places a premium on drivers (not to mention pilots) and we’re back in the wage pressure cycle.

Gosh – who could have seen this coming? Only people who took Econ 101, I guess…

The bottom line is these are all natural consequences of economic factors that have been years in the making so let’s not be all shocked that we have inflation and let’s not live in some fantasy World that the Fed will snap their fingers and it will go away. This is a process, we will have to unwind – but it is also not the end of the World while the market is acting like it is.

Have a great weekend,

– Phil

Learning to print, all of it’s hot

10-20-30 million ready to be spent

We’re stackin’ ’em against the wall

Those gangster presidents

But honey, prices have shot through the sky” – B52s