It’s a miracle!

It’s a miracle!

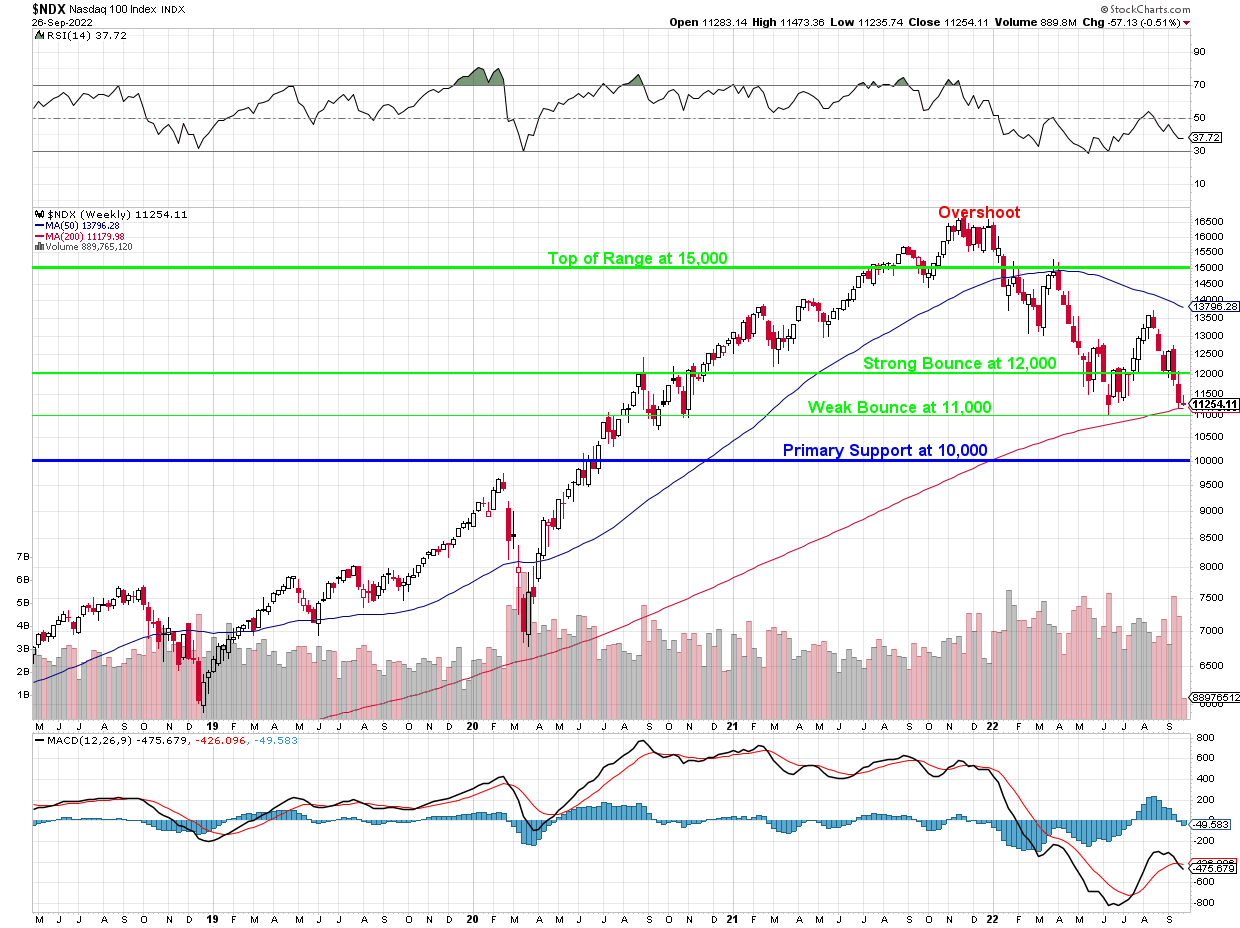

No it’s not, it’s the exact spot we said would be the bottom since we started shorting the market in fall of last year. As I noted back on Dec 22nd in “Will We Hold It Wednesday – Russell 2,200 Edition (again)“:

After shooting up to it (2,200) last Winter on a stimulus-fueled 50% run, the Russell kind of lost interest in going anywhere this year and, once again, it’s looking to prove itself on one side or the other of the 2,200 line. Perhaps that’s because despite the Russell having a forward (dreamland) p/e ratio of 30 at 2,200 – it has a trailing (reality) p/e ratio of 642 times earnings.

That’s right, even after ingesting $3Tn (15% of our GDP) of stimulus in the past 12 months, even with ultra-low interest rates from the Fed and all those SBA loans and even with all that free money given to their customers – things are still not going so great for the small-caps. By comparison, the Nasdaq is trading at 35 times trailing earnings (still ridiculous) and the S&P is at 29 times trailing earnings with forward estimates at 30 and 22 respectively – though I can’t see the S&P possibly improving that much in 12 months.

As VALUE investors, we don’t need a chart to tell us when a stock, or an index, is overbought – the MATH tells us. The chart merely illustrates the math – any physicist will tell you the same thing. It’s like when you say “bird“, you think of 100 things about a bird and a picture of a bird is only one of those things – that’s why TA people have such a shallow view of the markets – it’s very limited…

As VALUE investors, we don’t need a chart to tell us when a stock, or an index, is overbought – the MATH tells us. The chart merely illustrates the math – any physicist will tell you the same thing. It’s like when you say “bird“, you think of 100 things about a bird and a picture of a bird is only one of those things – that’s why TA people have such a shallow view of the markets – it’s very limited…

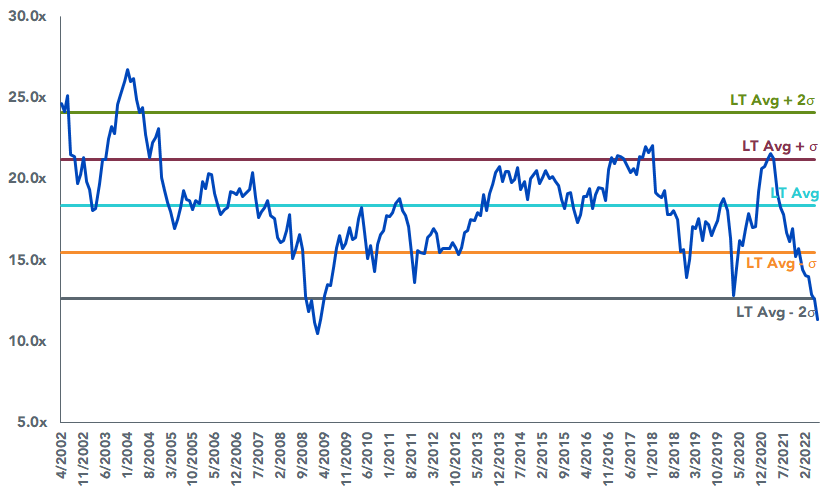

Now MATH is telling us that the indexes are oversold. That does not mean they can’t get more oversold – just that it’s a lot less likely than returning to a norm. Do you know what the trailing (reality) p/e of the Russell is today? 52! And that’s despite a withdrawal of stimulus, rising input costs, rising labor costs, inflation, etc. That’s a pretty darned good turnaround from 642 – don’t you think?

The Russell is always high p/e as they are, in theory, growing companies (maybe not in a Recession!) but the S&P, more importantly, is now trading at 18x earnings vs 31x earnings a year ago with 16x being the historical norm. But again, they have all the same headwinds the RUT stocks do – as well as a super-strong Dollar wrecking their converted foreign earnings – which are 60% of their revenues.

The Russell is always high p/e as they are, in theory, growing companies (maybe not in a Recession!) but the S&P, more importantly, is now trading at 18x earnings vs 31x earnings a year ago with 16x being the historical norm. But again, they have all the same headwinds the RUT stocks do – as well as a super-strong Dollar wrecking their converted foreign earnings – which are 60% of their revenues.

Charts don’t take those things into account but we do so we’re seeing a lot of things worth buying down here and we don’t mind patiently waiting for the Financial Sheeple to see it too. As you can see from the chart above, the Russell stocks are now being valued as they were when the World shut down for Covid and when the World Economy collapsed in 2008 – are things really that bad today?

Of course not! This is silly. In 2008 banks were collapsing, home prices were collapsing, entire countries were going bankrupt. In 2020, we literally shut down the World for 3 months and the Russell wasn’t as low as it is today!

Nor do the wind, the sun or the rain

We can be like they are

Baby, take my hand (don’t fear the reaper)

We’ll be able to fly (don’t fear the reaper)

Baby, I’m your man” – Blue Oyster Cult

Don’t let fear and superstition (TA) stop you from buying perfectly good stocks at ridiculously low prices. Last Thursday, for example, we discussed adding a long spread to our existing Alphabet (GOOGL) short puts and I said to our Members:

We have 20 short 2024 $100 puts we sold for $10, now $14. The 2025 $75 puts are $7 so we can always roll our losses there so I’m not worried. I think the big issue for them is all the privacy suits and the effect they will have on their business model going forward. $1.3Tn at $100 isn’t too bad as they are making $68Bn so call it 19x earnings and they are growing 20% top and bottom and were $30Bn in 2018 and it’s only 2022 and more than double.

They will get dragged down with the economy though as they already have 4.3Bn active users and that’s vs 3Bn for META, who “only” make $28Bn but they are down to $382Bn so 13x but MSTF trades at 22x with 3Bn users (which is less than I thought). AAPL is about 2Bn and AMZN already drops off to 300M (less than I thought).

So, if you want eyeballs, it’s GOOGL or UGH! Zuckerberg so GOOGL is the better choice for many reasons. It’s a little hard to grow when you already have half the World (ask KO) – especially when that is REALLY beginning to concern global governments. Still, GOOGL warned us of the “Law of Large Numbers” in 2007 and they’ve grown 10x since then.

I’m sure you’ve noticed already that when you look up a restaurant or a destination, GOOGL jumps in with airfares and reservations – that’s a nice developing revenue stream. They have to be subtle because they are so dominating but I can see it creeping in.

So yes, for the LTP, let’s add to our GOOGL short puts the following:

-

- Buy 20 2025 $90 calls for $30 ($60,000)

- Sell 20 2025 $120 calls for $17 ($34,000)

We collected $20,000 for the short puts so we’re in for net $6,000 on the $60,000 spread with $54,000 (900%) upside potential at $120. You can see I’m still a bit tentative, assume we’ll spend $10 ($20,000) to roll down to the $70s if we go lower and then we’ll be in a $100,000 spread for $26,000.

So we’re already planning for what to do if it goes lower but, if it doesn’t, we’ll make a boatload of money if the stock just manages to get back to $120 in the next two years. If GOOGL is not worth $120, then every single person who bought the stock for the last 12 months has been wrong. While that’s possible, it’s not likely and we’re doing our own valuation of 19x with 20% growth so down to about 16x next year and 13x in 2025 if they stay at this price ($100)? Not likely, is it?

And, as I said, even if we are disappointed, we simply spend $20,000 to roll to the $70 calls and I’ll certainly be THRILLLED to own GOOGL until 2027 at that price. You can still make that play today, by the way – the short puts sold for $16.50 yesterday, which is $33,000 for $20 and that coupled with the $90/120 spread (same price) at $26,000, would give you a $7,000 CREDIT on the $60,000 spread – you’re welcome!

You are also welcome for yesterday’s call to go long on Natural Gas (/NG) at $6.70 – it’s back over $7 this morning for a $4,600 per contract gain in 24 hours. Silver (/SI) also popped from $18.50 to $18.75 and that pays $50 per penny so $2,500 per contract gained there and Oil (/CL) hit $80 from $77 for $3,000 per contract and this morning again we had $77 last night and now back to $78 for another $1,000 per contract but GOLD (/GC) is still $1,650 and I like that long too.

Trading is fun!