WY – 25M acres of timber but they also have the mineral rights for Rare Earths, which is interesting but I think they’ll have a hard time turning that way as their logo is a Tree and strip mining doesn’t go hand in hand with tree-hugging. Still, they are a great value as is with $10Bn in sales and $2.3Bn in profits against a $22Bn market cap but they have guided for HALF of that next year (profit, not sales), which is why the multiple is so low. $3.3Bn in debt is half of historical but still going to cost them $165M (10%) of the remaining profits so call it $1Bn next year though I bet their down guidance took the interest into account. Here’s the story of their jump in profits:

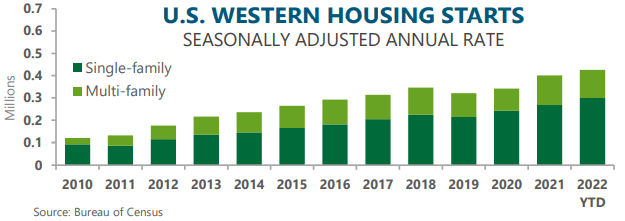

We still have a housing shortage so I’m sure they’ll have bonus earnings in the future as well. For the LTP, let’s just take a small starting position:

We still have a housing shortage so I’m sure they’ll have bonus earnings in the future as well. For the LTP, let’s just take a small starting position:

-

- Sell 10 WY 2025 $30 puts for $6.50 ($6,500)

- Buy 25 WY 2025 $25 calls for $7 ($17,500)

- Sell 25 WY 2025 $35 calls for $3 ($7,500)

That’s net $3,500 on the $25,000 spread that’s $10,000 in the money to start. Upside potential is $21,500 (614%) and that’s not bad for an entry position.

https://charts2.finviz.com/chart.ashx?t=wy%20&ty=c&ta=1&p=d&s=l

You hear a lot of negatives in the housing sector but homes are still being built at a good clip and that won’t change as we have less homes per person than we did 10 years ago and homes need wood.