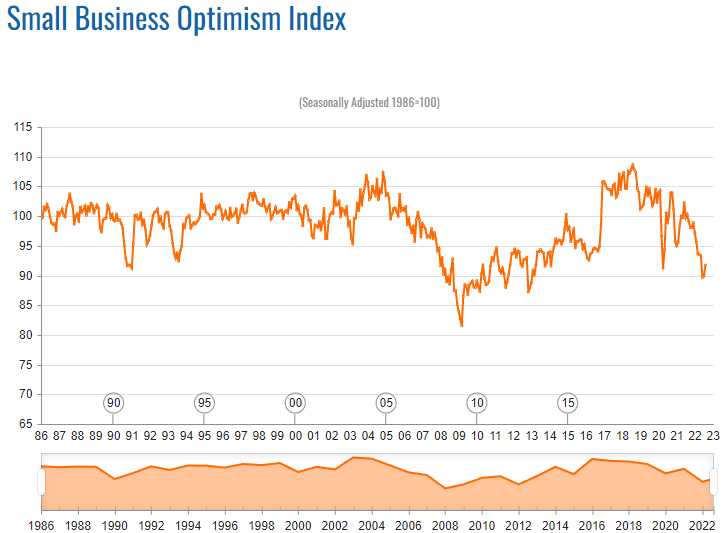

Small Business Optimism is improving.

Small Business Optimism is improving.

Back to 91.8% in August from 89.68% in June and nowhere near 81.5% in March of 2009 when – surprise! – the World didn’t end and that turned out too be the best time ever to invest in the market.

Small businesses are owned by people and you know these people – they are your friends in some cases. They read the same papers you do and watch the same news and went to the same schools — and have the SAME opinions. They are swayed just as we all are by the news that we hear and the “experts” we listen to. As General Marcus liked to point out – none of these things create facts – the facts are there to be discovered if we do the work, but not if we stop looking for them and accept other people’s opinions as our facts.

49% of the small businesses surveyed plan to increase employment, 52% plan to increase capital outlays, 48% currently have job openings, only 32% feel they still need to raise prices, 36% are buying new equipment. 32% say they are still suffering from Supply Chain Issues with only 11% saying it has not impacted their business. Only 4% of businesses surveyed said they had trouble obtaining capital.

There are NOT Recessionary numbers folks! We are being TOLD things are bad but there have not been too many FACTS backing that OPINION up, have there been? What then is the agenda of the Banksters who sponsor the Billionaire-owned media to convince you things are worse than they are? Why to get you to sell your stocks at low prices, of course!

If you are afraid then you are more likely to sell so they tell you stories of doom and gloom and tell you to ignore the very common-sense logic that there are 10.5M job openings in the US. There are only 15.4M jobs in Canada – TOTAL! and we have 10.5M open jobs. The GDP of Canada is $1.6Tn so we have about $1Tn worth of open jobs – 5% of our own GDP – just waiting to be filled.

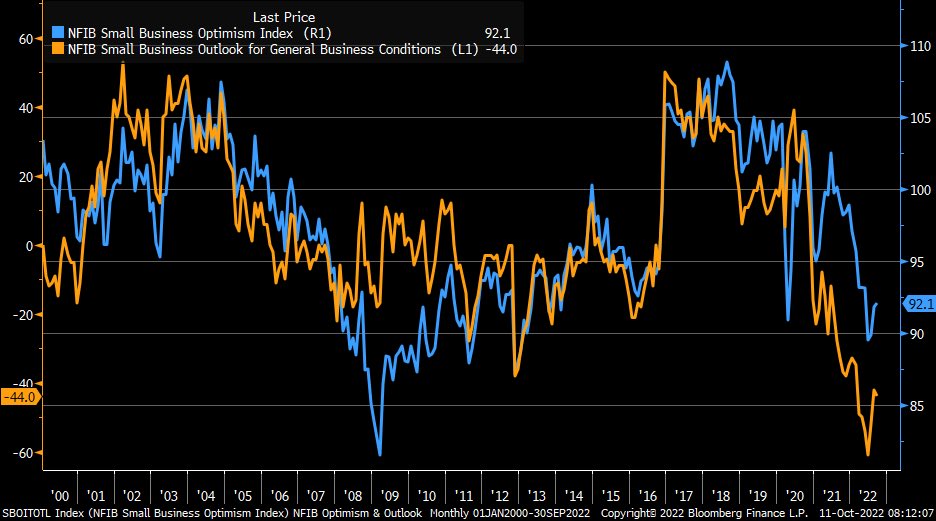

We had a discussion about this on Friday, so I’m not going to have that again but please do keep in mind that the FACTS do not support the Opinions. As you can see from this chart – the OUTLOOK has never been as negative as it has been recently – even when the actual conditions were 10% lower.

Why is that? It’s the evolution of Social Media and the de-emphasis of the facts. When is the last time you have held a newspaper in your hands? How many times have you read on-line articles, even ones from supposedly top-notch outlets and KNOWN they were dead-wrong or poorly reported? It’s not just about Social Media taking over as our primary news source – it’s about the old news sources losing money they used to spend to have top-notch resources of their own.

So we patch together shaky conclusions based on ill-formed opinions fed to us by sponsored content-providers who all have their own agenda, paid to make us believe whatever their Corporate Masters want us to believe. It’s very easy for the truth to be lost in the shuffle in this brave new world we find ourselves trapped in.

So we patch together shaky conclusions based on ill-formed opinions fed to us by sponsored content-providers who all have their own agenda, paid to make us believe whatever their Corporate Masters want us to believe. It’s very easy for the truth to be lost in the shuffle in this brave new world we find ourselves trapped in.

2008 was only 14 years ago yet no one seems to have learned their lesson. AAPL was trading at a spit-adjusted $7 per share at the time – because it was treated like any other Tech Stock and not like Apple Computer. In March of 2009, as the market was crashing – I went on TV and made 13 picks that made 469% just 6 months later (way more now) like BAC at $3.14, GE at $7, DIS at $16, AMZN at $62.50, TGT at $25 and HOV at 0.65.

There was nothing brilliant about those picks other than having the conviction to ignore the panic that was raging all around us and look for perfectly good Blue Chip stocks that were being priced like they were going bankrupt when clearly they weren’t.

That’s what we’ve been doing for the past two weeks as we’ve gone over dozens of stocks in our Live Member Chat Room and that’s what we’ll be doing for the next month as earnings reports (FACTS) begin to come in for the 3rd quarter.

FACTS or not – there’s no stopping people from panicking over opinions but we can make our own picks when there’s no rational way to see a stock we like can go much lower – or at least STAY much lower for a prolonged period of time.

Weyerhaeuser (WY) was a recent pick of ours, trading at a very silly 9 times earnings for a company that sells lumber. That’s because lumber prices have been erratic but it was all just bonus money to WY and it doesn’t stop them from making the same money in the future they have been making for the past 122 years (and even more on future Carbon Credit trading).

Weyerhaeuser (WY) was a recent pick of ours, trading at a very silly 9 times earnings for a company that sells lumber. That’s because lumber prices have been erratic but it was all just bonus money to WY and it doesn’t stop them from making the same money in the future they have been making for the past 122 years (and even more on future Carbon Credit trading).

Those are the kind of companies our Members look for.