Whaaa, if the market doesn’t go up every day I don’t know what to do – Whaaaa…

Whaaa, if the market doesn’t go up every day I don’t know what to do – Whaaaa…

I have to go to a wedding this weekend and I am pre-warning people NOT to come up to me and complain about the market like I’m Casey Jones driving the train. Markets go up and down and September was down month (as it often is) but, so far, October is off to a good start and now we’ll see what earnings can do for us.

Big, bad OPEC huffed and they puffed but their October 5th meeting has been a bust and oil had run from $78 to $93 in anticipation of OPEC’s great power move and that pushed inflation numbers, which caused fear in the market but Oil is back to $85 already and it needs a catalysts or we’ll be seeing $80 before it’s time to Trick or Treat.

Big, bad OPEC huffed and they puffed but their October 5th meeting has been a bust and oil had run from $78 to $93 in anticipation of OPEC’s great power move and that pushed inflation numbers, which caused fear in the market but Oil is back to $85 already and it needs a catalysts or we’ll be seeing $80 before it’s time to Trick or Treat.

One thing that might help keep oil up is the very scary Dollar rally seems to be easing as pretty much every other country on Earth is engaging in counter-measures to strengthen their own currencies and counter-act the Dollar-driven inflation that is being piled on top of their own internal inflation.

One thing that might help keep oil up is the very scary Dollar rally seems to be easing as pretty much every other country on Earth is engaging in counter-measures to strengthen their own currencies and counter-act the Dollar-driven inflation that is being piled on top of their own internal inflation.

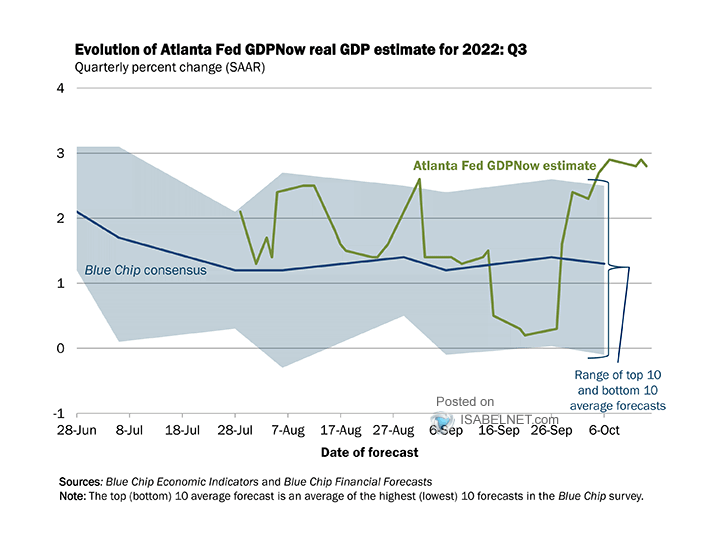

Commodities (like Oil) trade in Dollars so, when the Dollar is expensive – it’s a double hit on non-Dollar economies. So the Dollar this and oil that but the reason we’re generally bullish in our Portfolio (though about 70% CASH!!!) is that the BLS, in their recent release of Q3 GDP data, said Corporate Profits hit a record high last quarter and we are certainly not priced for record profits, are we?

Sure there might be a Recession and this weekend I heard the Leading Economorons try to top each other with their predictions of when and how bad and the consensus seems to be next year (very brave with 75 days left in this one) there is a 125% chance of a VERY BAD Recession.

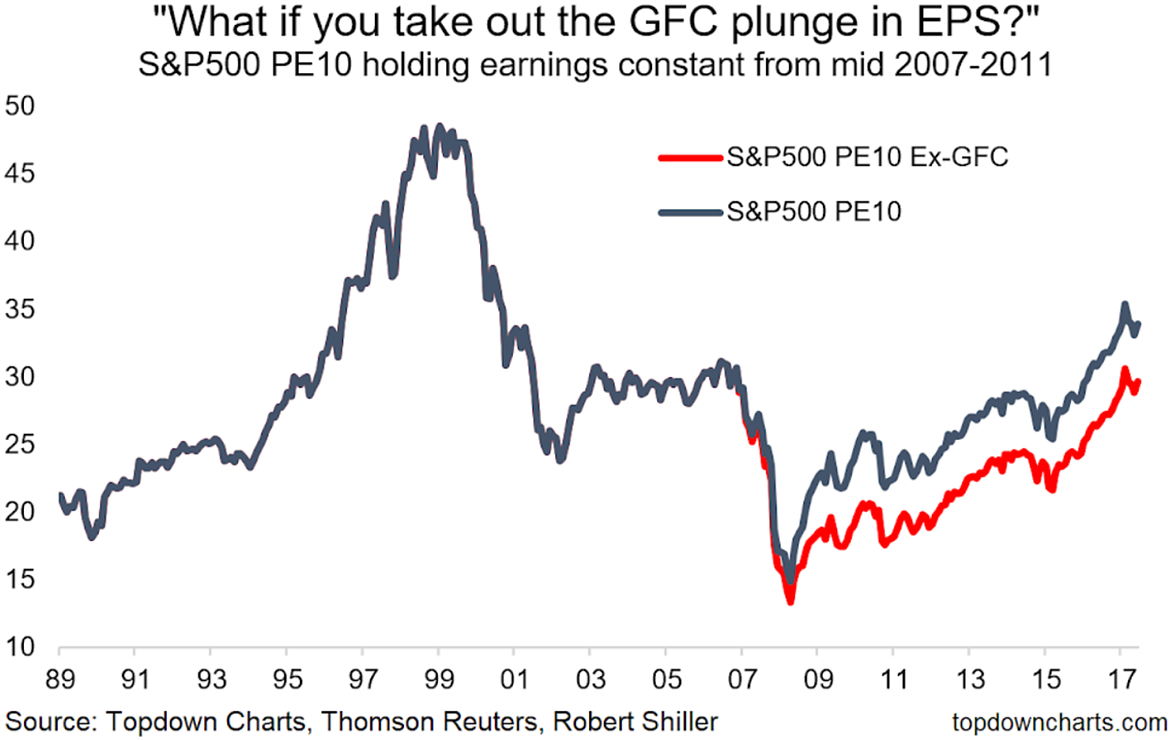

Now, here’s the thing. We haven’t had a real Recession since 2009 (Covid should have been a Recession but we papered over it with stimulus) but that was caused by the Subprime Mortgage Crisis, when the profits we had seen in the market turned out to be FAKE and banks had to reverse valuations on their mortgage and property portfolios because the entire rally of the prior decade has been based on complete BS. That’s not what’s happening here.

Now, here’s the thing. We haven’t had a real Recession since 2009 (Covid should have been a Recession but we papered over it with stimulus) but that was caused by the Subprime Mortgage Crisis, when the profits we had seen in the market turned out to be FAKE and banks had to reverse valuations on their mortgage and property portfolios because the entire rally of the prior decade has been based on complete BS. That’s not what’s happening here.

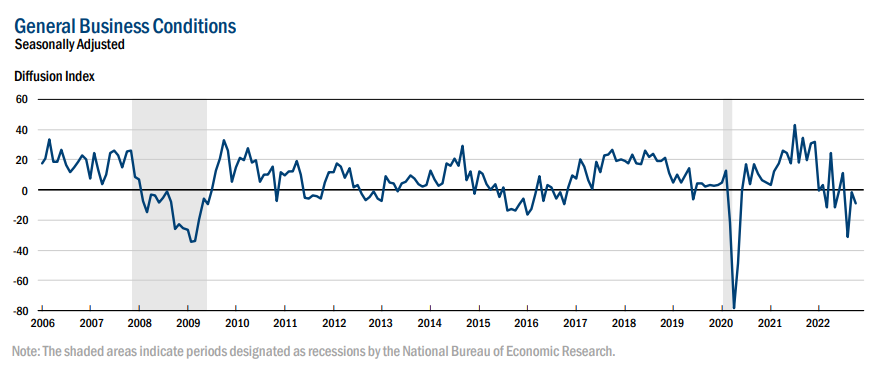

“The unofficial beginning and ending dates of recessions in the United States have been defined by the National Bureau of Economic Research (NBER), an American private nonprofit research organization. The NBER defines a recession as “a significant decline in economic activity spread across the economy, lasting more than two quarters which is 6 months, normally visible in real gross domestic product (GDP), real income, employment, industrial production, and wholesale-retail sales”.[3][a]

So it looks like we are 0 for 5 on the things that are officially used to identify a Recession yet look at all the stocks we’ve been adding to our portfolios in the past month at 10 times earnings! That’s why the past two month have seen the most bullish additions to the PSW Member Portfolios since April and May of 2020 – the last time we had such a nice buying opportunity.

And I am not telling you to buy the entire S&P 500 – we set our criteria last month for our Watch List and we looked for Blue Chip companies with Low Debt, Low P/E, High Revenues/Employee ratios (where higher wages should be less of a factor), Low Dependence on Commodities, Pricing Power (to pass along inflated costs) and, of course, Strong Management operating in Strong Sectors.

With 4% rates, money is moving back into Bonds but when your stocks are making 10% returns to the bottom line – the only thing stopping people from buying them is FEAR – fear of the unknown, fear of what lies ahead. That’s why we tray to be guided by FACTS, not fears…

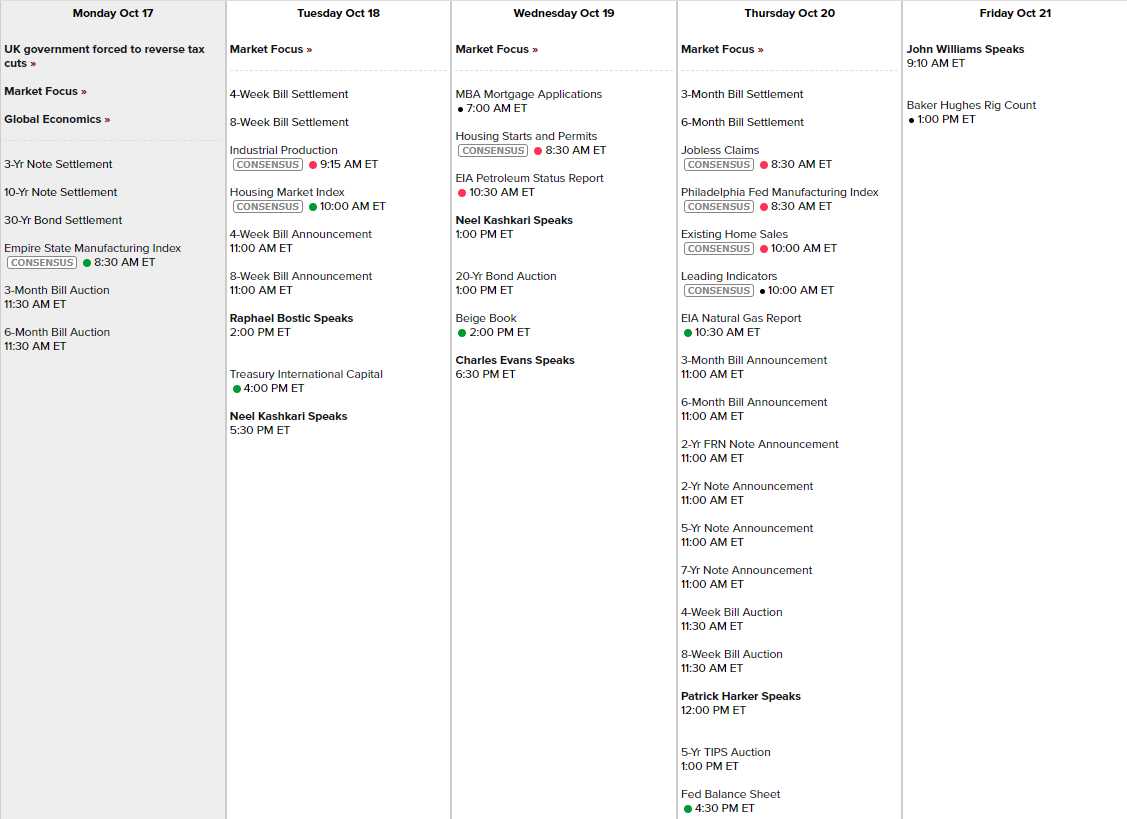

We’ll get the FACTS from hundreds of companies this week including some nice big ones. On the Data front, we have 6 Fed Speakers this week along with the Empire State Manufacturing Index at 8:30, Industrial Production tomorrow along with Housing Data, the Beige Book and a 20-year Bond Auction on Wednesday, Philly Fed and Leading Economic Indicators on Thursday with a TIPS Auction:

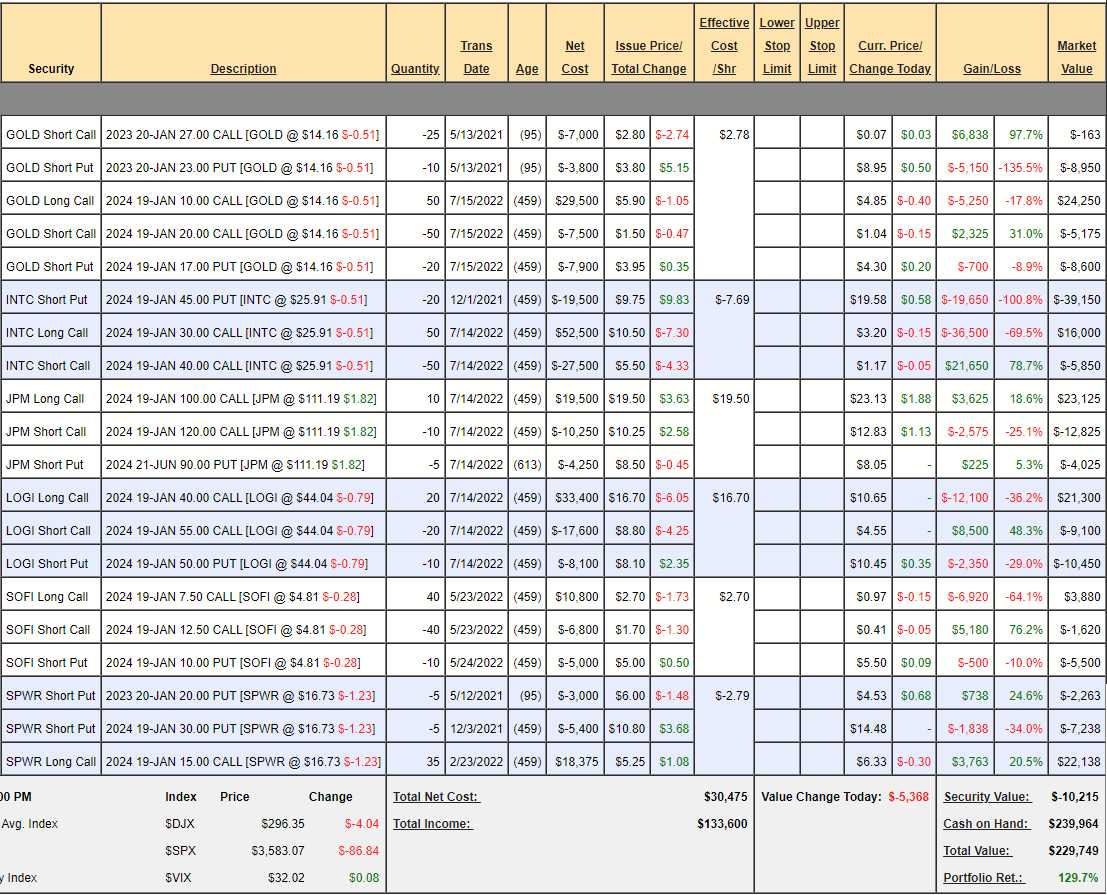

Speaking of Portfolios: The last time we did a review of our Money Talk Portfolio was back on August 24th. We only trade this portfolio when I’m on the show and, since we couldn’t adjust between shows and we expected a correction (which is NOT a pullback but a move back to the CORRECT market levels) we cut half our positions and went back to mainly CASH!!! over all.

Nonetheless, the remaining positions are still down from $269,804 to $229,749 (14.8% – the same as the S&P) but that means we can now improve them as well as add new positions in stocks that are much cheaper now than they were two months ago. It’s not a crisis, it’s an opportunity – as the Chinese like to say…

Nonetheless, the remaining positions are still down from $269,804 to $229,749 (14.8% – the same as the S&P) but that means we can now improve them as well as add new positions in stocks that are much cheaper now than they were two months ago. It’s not a crisis, it’s an opportunity – as the Chinese like to say…

-

- GOLD – The Jan $27 calls will expire worthless and we love GOLD as an inflation hedge. Gold (/GC) is down so GOLD is down but we’ll use the opportunity to move to a 2025 spread. Overall we’re down $1,937 on the $50,000 spread that’s $20,000 in the money and we paid net $3,300 for it. If we roll our $17,550 in puts to 25 of the 2025 $20 puts at $7 ($17,500), that will clean those up at no cost and then the 2025 $10s are $5.25 so that roll would cost very little ($2,000) and buy us another year for Gold to get it’s groove on.

-

- INTC – Our faith in them is getting very expensive. This is where all of our losses came from but also we’ll roll out to 2025 and wait patiently. The 2025 $25 ($6.30)/35 ($3.20) bull call spread is $3.10 so we can trade 100 ($31,000) of those for the 2024 $30s ($16,000) for net $15,000 and that would increase our net from $5,500 on a $50,000 spread to $20,500 on a $100,000 spread that’s $10,000 in the money. I like that idea!

-

- JPM – Just had good earnings and halfway to goal already – not worried. You can still catch this as it’s a $20,000 spread that’s $11,000 in the money for net $6,275 with $13,725 (218% upside potential over the next 15 months). This is EXACTLY the kind of situation we’ve been jumping at with our Member Portfolios!

-

- LOGI – I’m surprised how poorly they are doing. We’ll probably add more if earnings don’t disappoint.

-

- SOFI – Also great for a new trade but we’ll be adjusting to 2025 $5s (now $2.20) and wait PATIENTLY for the market to come around on them. Notice that, because we sold short calls to cover, we only took a small loss on a big dip so now we can salvage $3,880 from the 2024 $7.50 calls (more than we paid for the spread) and move that money to lower strikes in 2025.

-

- SPWR – Our Stock of the Decade is plunging but we’re still not losing money as we had a great entry. We’ll roll out to 2025 very happy to get a nice deal.

So very happy with our MTP positions – there’s a lot of potential here.

8:30 Update: Empire State Manufacturing came in at -9.1, which is pretty bad but -7 was expected. 23% of the respondents indicated conditions had improved while 32% said they had gotten worse. Shipments killed the index with a 23% drop and some of that is seasonal – all firms are still hiring and hours are increasing so demand for labor is still strong.

Keep in mind a slowdown in Manufacturing is what the Fed wants – so not bad for the market overall. Slower manufacturing also depresses the Dollar, which is also good for stocks, which are priced in Dollars. So we should be off to a good start today but it’s Industrial Production that matters tomorrow morning (9:15) and, of course, earnings.

It will be an interesting week.