What a crazy time to be in the market!

What a crazy time to be in the market!

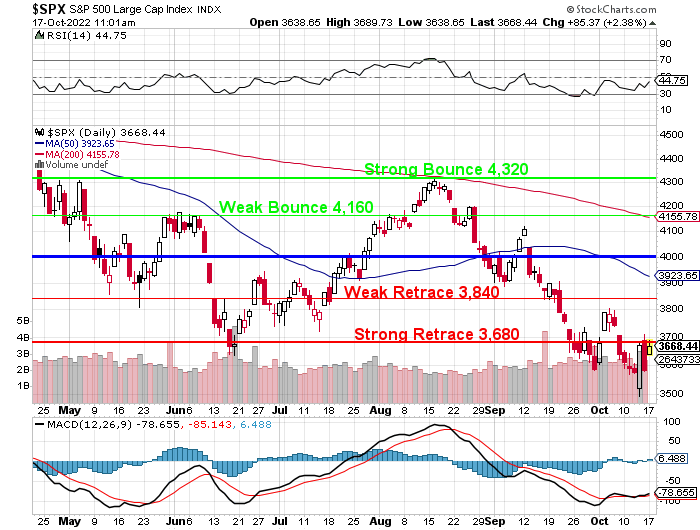

We’re struggling to get over the Strong Retrace line at 3,680 and that is NOT where we expected to be a month ago, when we were still above the Weak Retrace line at 3,840 and we THOUGHT consolidating for another run at 4,000.

I don’t mind being between 3,680 and 4,000 – that’s all we really deserve at the moment but below 3,680 is panic and panic makes me nervous because you never know which way the herd will stampede of they get spooked. We did expect trouble overall back in August, however, so we’ve got lots of CASH!!! and we’ve been spending it adding a LOT of new positions in the past 30 days. We’re still waiting for Earnings Season to confirm it but I think the selling is at least one bracket overdone.

Nonetheless, we are long-term Value Investors and not Day Traders so it’s all part of the process but, if the facts do change, then our opinions might as well.

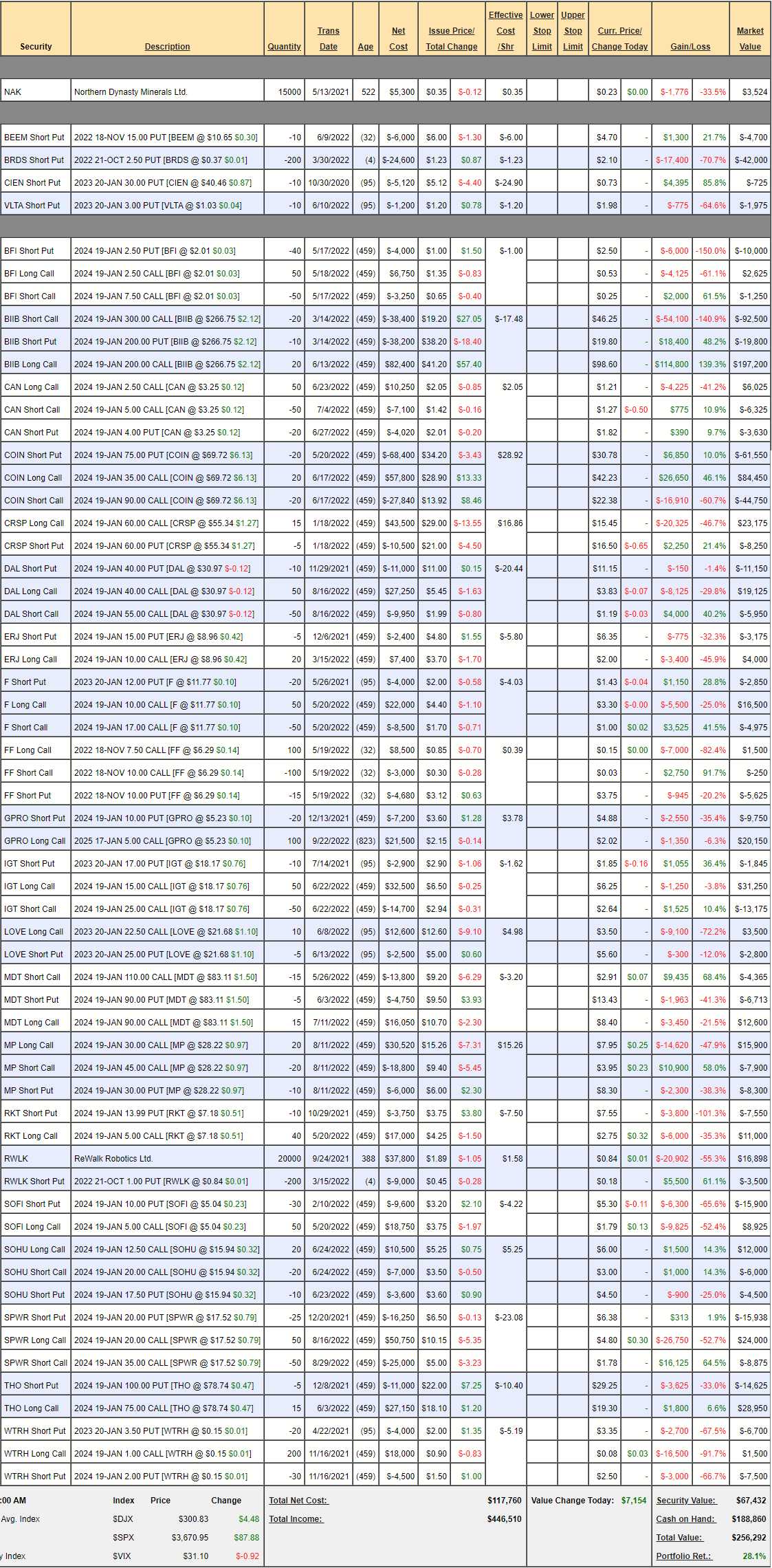

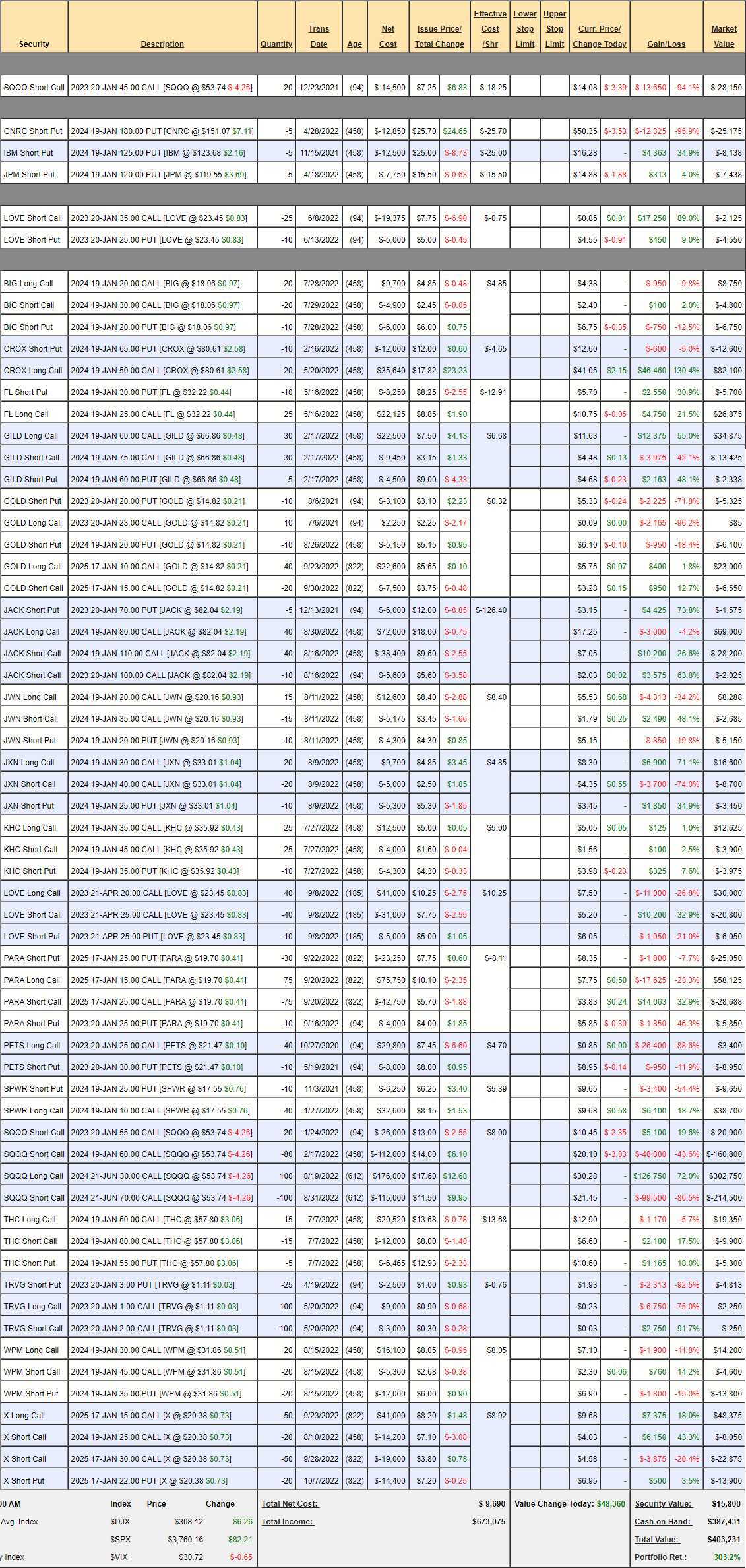

Future is Back on Hold Portfolio Review: The volatility in this portfolio is painful. We are down to $256,292 from $290,441 in our 9/13 review. It’s not terrible – we’re just falling with the market but what if the market keeps falling? Let’s take a close look at how much faith we have in this future:

-

- NAK – Penny stock but sitting on huge Gold, Copper, Moly and other Rare Earths – maybe largest in the World that isn’t being mined. The fish are all dying anyway and US has strategic needs so it’s possible they will overcome even Biden’s EPA at some point.

- BEEM – We will roll them along.

- BRDS – The April $2.50 puts are $2.25 so we collect more money and buy more time on the roll.

- CIEN – Way over target.

- VLTA – We can roll these to 10 2025 $3 puts at $2.50 for better than even.

- BFI – Waiting on earnings in early November. Hurricane hit their business mildly but still took a bite out of the quarter.

-

- BIIB – On track with over 100% ($100,000) left to gain.

- CAN – BitCoin mining got hit hard but they’ve been holding on so far.

-

- COIN – Finally coming back a bit. Same problem as BitCoin flounders.

- CRSP – Very disappointing. Earnings early November and we’ll see how they’re doing but we already got aggressive.

-

- DAL – Just silly how low they got. We will invest another $10,875 to roll the 50 2024 $40 calls at $3.83 ($19,125) to 50 2025 $25 ($12)/40 ($6) bull call spreads at $6 ($30,000). That brings our net cost from $6,300 to $16,875 on the $75,000 spread but now we’re $30,000 in the money. Nothing wrong with that…

- We can also roll half (25) of the short 2024 $55 calls at $1.19 ($2,975) to 15 short March $35 calls at $2.50 ($3,750) as that will burn off the premium faster and we can always roll them back if we have to.

-

- ERJ – Another crazy-undervalued stock.

- F – OK, so there are lots of crazy-undervalued stocks, apparently.

-

- FF – As /NG comes down, their profits should climb. Let’s roll our 15 Nov $10 puts at $3.75 to 30 of the May $7.50 puts at $1.70 as I would love to own 3,000 shares for $5. There’s no point in cashing the Nov $7.50 calls as we MIGHT have an upside revision but we’ll go ahead and buy 100 of the May $7.50 calls for 0.60 ($6,000) and we’ll offset that a bit when we can sell more short calls (the $10s are currently 0.15).

- GPRO – I’m good with where we are.

- IGT – Happy with this spread.

-

- LOVE – Dec 2023s came out so let’s roll our 10 Jan $22.50 calls at $3.50 ($3,500) to 20 of the Dec 2023 20 ($8.90)/30 ($5.60) bull call spreads at net $3.30 ($6,600) and we’ll sell 10 of the Dec 2023 $17.50 puts for $4.35 ($4,350) to pay for it.

-

- MDT – Let’s buy back the short 2024 $110 calls for $2.90 with a $9,500 profit and see how earnings go.

- MP – Rare Earths in the USA. Disappointing so far but greatly in need. Let’s roll the 20 2024 $30 calls at $7.95 ($15,900) to 40 of the 2025 $25 ($12.60)/40 ($8) bull call spreads at $4.60 ($18,400).

-

- RKT – Giving them a pass for now as rates are so crazy.

- RWLK – I just love the technology.

- SOFI – I’m happy where we are for now.

- SOHU – On track.

-

- SPWR – Have to take advantage of this and buy back the short 2024 $35 calls for $8,875 and we’ll roll the 50 2024 $20 calls at $4.80 ($24,000) to 50 2025 $15 ($8)/30 ($4.20) bull call spreads at $4 ($20,000) so we’re spending net $4,875 to roll $5 deeper in the money on 50 contracts ($25,000 deeper). It’s almost like a magic trick. We started with net $9,500 and it would have been fantastic if we just made $75,000 with no problem but now our strike is $25% lower and we have 12 more months to hit our target with $13,500 invested.

- THO – Big one to see how earnings are going.

-

- WTRH – This one seems dead, unfortunately. We’re going to end up owning 5,000 shares so no reason to mess around with more options.

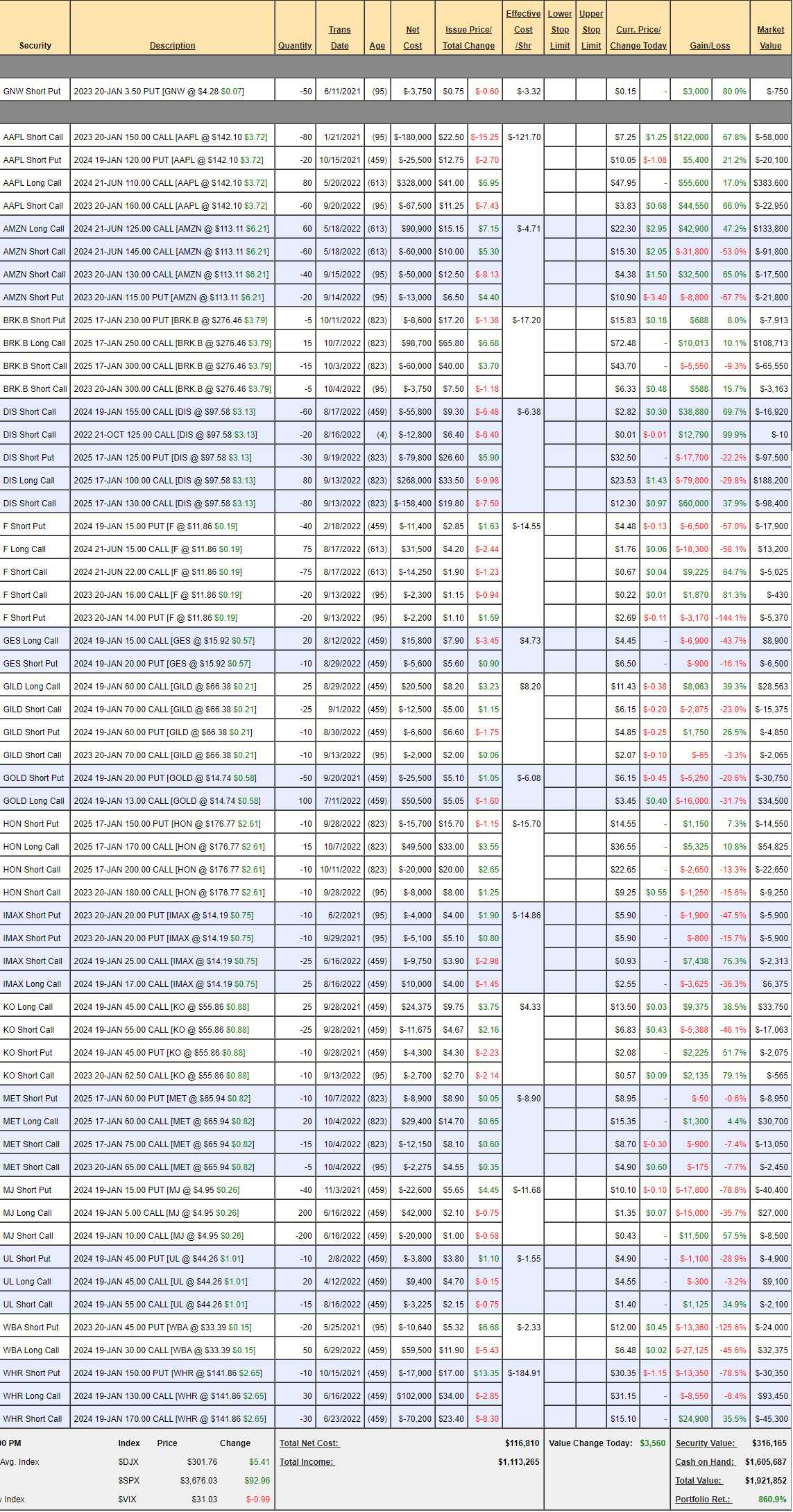

Butterfly Portfolio Review: $1,921,852 is UP $54,435 since our 9/13 review and our oldest portfolio is up 860.9% since Jan 2nd, 2018. At this point, it’s fairly bullet-proof as we follow our discipline of selling as much premium as possible against what are now, long paid-for positions.

We only have 2 uncovered plays but the real winning move was getting downright bearish on AAPL and AMZN at about the perfect time. HOWEVER, we do not like to take risks in the Butterfly Portfolio – that doesn’t mean we don’t when the odds are strongly in our favor – but we don’t like it – even when it works.

-

- GNW – Up 80% already but we can wait until Jan.

- AAPL – The danger to making a great call like this is you start thinking you’re smarter than the market and you get cocky. I do think AAPL will do well on earnings (next week) so I’m no longer in the mood to have 80 short Jan $150 calls on top of the $160 calls (we cashed out the other longs in August). Let’s buy back the 80 short Jan $150 calls (with a $44,550 profit) and that leaves us with 20 extra June 2024 $110 calls and then we’ll see how earnings go. If they go too well, we’ll roll the short calls and, if not – we’ll sell more short calls. Hard to lose.

-

- AMZN – This kind of makes up for all the times they usually burn me. Here we have 40 extra Jan $130 calls, now $4.38 and it’s not worth risking on earnings so let’s buy those back (with a $32,500 profit) and see what they report.

-

- BRK.B – We added 3 new plays this month. First time in ages we did that. The danger of owning Berkshire is Buffett will die or retire one day and there may be chaos so this position is one we’re happy to DD on if it drops 40% in panic. To me, Berkshire is a proxy for the S&P 500 but generally better quality than most of the index – as selected by Buffett. This one is already on track after just two weeks.

-

- DIS – They are starting to really piss people off with the constant price increases but the dumb-asses keep packing the park, so why not? I’m sure they are squeezing the park-goers to make up for shortfalls at ABC, Disney+, ESPN, Cruises, etc. Fortunately we saw it coming and were very short but now we need to reign it in and the Oct $125s will expire worthless and the 2024 $155s are certainly out of reach but let’s buy them back with a $33,880 profit and clear the deck to sell something more expensive – hopefully on a pop.

-

- F – Not worried about the puts as I don’t mind being assigned but, for the sake of neatness and to take advantage of the high VIX and the low stock – let’s roll our 60 puts at $23,270 to 50 of the 2025 $15 puts at $5 ($25,000) to consolidate. The short Jan $16 calls should end up worthless and then we’ll see how things look before making other changes.

-

- GES – I’d like to give them a chance to move back to at least $20 before covering.

-

- GILD – Right on track so far. It’s a fairly new position as well.

-

- GOLD – Very aggressive and now good so far but I don’t see how Gold ($1,658) stays this low with all the turmoil.

- HON – Another new one that’s on track.

- IMAX – We love stocks that are volatile WITHIN a channel – that’s gold for this portfolio! We’re waiting for the next trip up to sell more calls and we’ll see how the puts finish before rolling.

- KO – Well, I wish we would have sold more short calls but I wasn’t sure. Since PEP did well, why assume KO did not? Earnings are next week but let’s not wait and buy back the 25 short 2024 $55 calls for $17,063 as this pullback has been a blessing. If we’re wrong, we sell the 2024 $45 calls to some other sucker and roll our long calls to 2025.

-

- MET – Brand new.

- MJ – We need national legalization for this to pay off.

- UL – It’s not much money so let’s buy back the short calls for $2,100 and see if they beat on earnings.

-

- WBA – I love them but they don’t love me. The 2025 $30s are $7.45 so sure, we should spend $1 to roll to those. While we are in the neighborhood, let’s sell 10 of the 2025 $35 puts for $7 ($7,000) to pay for the roll.

-

- WHR – What kind of maniac buys a Durable Goods company in a global recession? We’re actually still a little ahead but I’m not brave enough to buy back the short calls.

As always, loving our Butterfly positions!

Dividend Portfolio Review: $422,532 is down $6,937 since our 9/13 review and that’s fine given the pullback in the market. This is a very conservative portfolio we started in October 25, 2019 so, on our 3rd anniversary – up 111.3% is right on track for our 30% annual goals.

-

- Short Puts – Not worried. Short puts are essentially the next stage of our interest after a stock goes on our Watch List. When they get attractive enough, we offer to buy them at an additional discount.

- BXMT – This I why I thought we had added BLK the other day – it was BlackStone we recently added. Still good for a new trade.

- FF – They are working better here than in the Future is Now portfolio.

- FL – On track.

- JXN – On track.

- KHC – On track.

- LYB – Good time to buy back the short Jan calls for $3 – just in case they pop on earnings. We already made $7,250 (82.9%) and we’re better off leaving the slot open for our next sale.

-

- PRU – On track.

- SKT – We were too conservative with our short calls but nothing wrong with making what we intended.

- SPG – Also new and an amazing spread. Still just net $31,124 and we get called away at $47,500 for a $16,376 (52.6%) gain if they hold $95 and, while we wait, they pay a $7 ($3,500) dividend, which is another 11.2% per year against our net. We should probably buy more before it gets away…

-

- DOW – We sold more puts to take advantage of the dip.

- ET – Ahead of our goal already.

- FRO – We hit the mark where we’re supposed to stop out of the Jan short calls so let’s take them off the table.

-

- JXN – We’re waiting for a nice move up to sell calls.

- MO – Right on target.

- NLY – Way too cheap to cover down here. Don’t see any reason not to buy 1,000 more shares at $16.96 ($16,960).

-

- PETS – On track.

- T – Earnings (20th) should get them back over $16. Here’s a very valuable options trick. We have $50,000 worth of short puts on T and the 2025 $20 puts are $5.40 but we only need to roll the losses ($16,000) so we’ll cash out the short puts and sell 30 of those for $16,200 and be happy to break even. Instead, we’ll go for a profit by selling 5 more SPG 2025 $90 puts for $17.73 ($8,865). You don’t have to roll your puts to the same stock – something else you REALLY want to buy will do just as well.

-

- TWO – Too cheap not to buy 4,000 more for $3.15 ($12,600).

- VTRS – The 20 short Jan $12.50 puts at $3.10 ($6,200) can be rolled to 10 short 2025 $15 puts at $6.80 ($6,800).

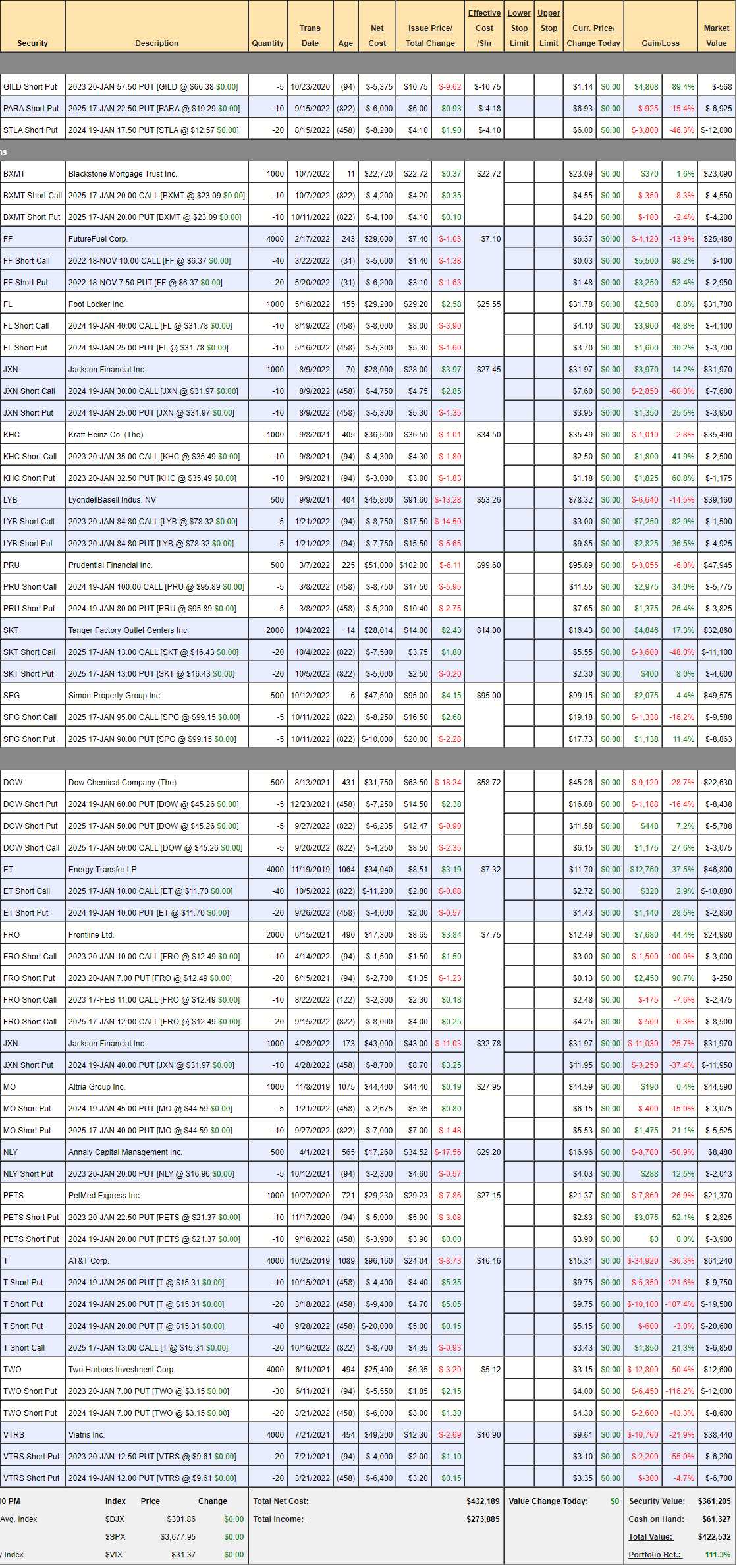

Earnings Portfolio Review: $403,231 is down $27,305 from our last review and that’s because we weren’t hedge enough for this dip. The Earnings Portfolio is self-hedging and we had carried too many short calls against our longs and this dip burned us.

-

- SQQQ – If SQQQ doesn’t calm down, we’ll have to roll them.

- GNRC – Our net entry is $154.30 and we’re at $146.04 so nothing to worry about but let’s go ahead and sell 5 of the 2025 $130 puts at $32 ($16,000) as a pre-roll and we’ll put a stop on the short 2024 $180 puts at $55 (now $50) and, if that triggers, we’ll probably double down on the new puts.

-

- IBM – I WISH we got in for net $100.

- JPM – Another very good opportunity to raise cash in margin portfolios.

- LOVE – We cashed out the longs with good timing and now cheap again so let’s buy 15 of the Dec 2023 $20 calls for $9 ($13,500) and sell 10 of the Dec 2023 $30 calls for $5 ($5,000) for net $8,500 and our intent is to sell 10 Jan $30 calls, now $1.60 for hopefully $3 ($3,000) or better. If we can collect $3,000 two more times – we paid for the roll.

-

- BIG – Down a bit, not worth adjusting.

- CROX – We’ll take the money and run on the long $50s ($82,100) and we’ll buy 25 of the 2025 $70 ($36)/100 ($25) bull call spreads at $11 ($27,500) and also sell 10 of the Jan $80 calls for $11.50 ($11,500) so our net on the new $75,000 spread is $16,000 after we’ve taken net $66,100 off the table. If CROX goes lower, we’re happy to roll down our long calls and if it goes too high – we’ll be happy to buy more $75,000 spreads for $27,500 to cover it (and we’ll roll the short calls to a higher strike. This is, essentially a brand new trade that’s excellent (include the puts).

-

- FL – Another one we were being brave about. Lower stakes so we’ll let it ride.

- GILD – Right on track.

- GOLD – Let’s roll our 20 short $20 puts (both years) at about $11,500 to 20 of the short 2025 $17 puts at $4.50 ($9,000). Also let’s buy back the short 2025 $15 calls for $6,300 – it’s worth taking a chance.

JACK – Been doing well since one of the drive-through people opened fire on a customer – I guess people like the element of danger with their meals… The Jan puts and calls will expire worthless (and what a silly price they are now) so let’s sell 10 of the 2025 $70 puts for $8 ($8,000).

- JWN – Way too cheap and some analyst was just making nice noises about them. Let’s buy back the short 2024 $35 calls for $1.79 ($2,864) and roll the 2025 $20 calls ($8,288) to 25 2025 $15 calls at $9 ($22,500) and sell 20 of the 2025 $30 calls for $4.10 ($8,200) and, when it comes back over $25, we can start selling short calls to make up the difference. The Jan $20s are $2.70 so selling 8 quarterlies of 10 units would bring in $21,600 and the net of the new rolls is $8,876 and we had $3,125 invested so now it’s net $12,001 on the $37,500 spread and possibly $21,600 of additional short call selling makes this a fantastic new trade idea!

This is a great example of how we scale in and adjust. We made a very small commitment spending net $3,125 on a $22,500 spread in August and the stock dropped but we still like it so now we commit another $8,876 but now it’s a $15/30 $37,500 spread that’s $7,500 in the money with a lot of room for growth as we’re only 60% covered.

That’s what scaling in is all about – the flexibility. If JWN had gone up instead of down – it would have been boring but we’d have made $19,375 with no adjustments as a consolation prize. Now we stand to make $25,000 on the spread and maybe another $20,000 selling short-term calls instead.

-

- JXN – Wow, this portfolio is full of great picks! This one is on track.

- KHC – Virtually no progress since July but no reason to adjust.

- LOVE – Oh nooooooooooooooooo!!! I forgot we had two of these. Let’s roll our 40 April $20 calls ($30,000) to 30 more (45 total) of the Dec 2023 $20 calls for $9 ($27,000) and sell 20 more (30 total) of the Dec 2023 $30 calls for $5 ($10,000) for net $17,000. That takes $13,000 off the table and we’ve got the short calls well-covered.

- PARA – I can’t believe $20 didn’t hold. Well, it sort of did in a rough market. We’re 50% in the money on a $75,000 spread at net $2,925 credit. I kind of want to double down…

-

- PETS – We are just crossing our fingers on earnings.

- SPWR – The 2025 $10s are just $10.20 so that’s 0.52 to roll the 2024 $10s, so that’s a no-brainer to buy a year. Also may as well sell 10 of the 2025 $20 puts for $7.75 ($7,750) to overpay for the roll.

-

- SQQQ – So above we have 20 short Jan $45s we’ll probably have to roll. Here we have 80 short 2024 $60 calls which are far more expensive than the short $45s so there’s a roll if we need it. The 2024 $60 calls are $20.10 and the June 2024 $70s are $21.45 and the June 2024 $80s are $20.80, etc. These are very tight and easy to roll – that’s why I’m not worried. SQQQ is only $56 now – there’s just a lot of premium in all the short puts but I’m not worried enough to spend $10,000 rolling them higher – not yet.

- We can also add 100 2025 $60 ($27)/90 ($23.50) bull call spreads for net $3.50 ($35,000) if we get worried so $45,000 would put us in massively better shape and we have $387,431 in CASH!!! so not worried.

See, it LOOKS scary and volatile but, in reality:

Fundamentally, I don’t see SQQQ over $70 and there’s also the element of decay that destroys the value of all 3x ultras over time – especially ones that churn as much as SQQQ. We use that very much to our advantage with our hedges. It’s very hard to imagine SQQQ won’t be lower than $60 in 2024.

-

- THC – See, this one is going well and I wish it wasn’t so we could add to it…

- TRVG – We’re trapped in this one as the April options only go down to $2.50 so let’s hope for good earnings.

-

- WPM – Not off to a good start but I’m fine with it.

- X – They idled 2 blast furnaces last month so I’m not looking forward to earnings projections. The don’t do that unless they see little chance of improvement. Let’s sell 15 April $22 calls for $2.85 ($4,275) to help pay for a roll if we need it and, if we don’t, we have a $50,000 spread that’s currently net $2,850 covering the gains.

- So my plan is, if they go higher, we have 20 short 2024 $25 calls and now 15 short April $22 calls and we can roll both of those higher and I don’t mind buying more longs if things are better than expected. If they drop back to $15, then the Aprils go worthless and we buy back the short 2025 $30s and roll the 2025 $15s lower and wait patiently for the Recession to end.

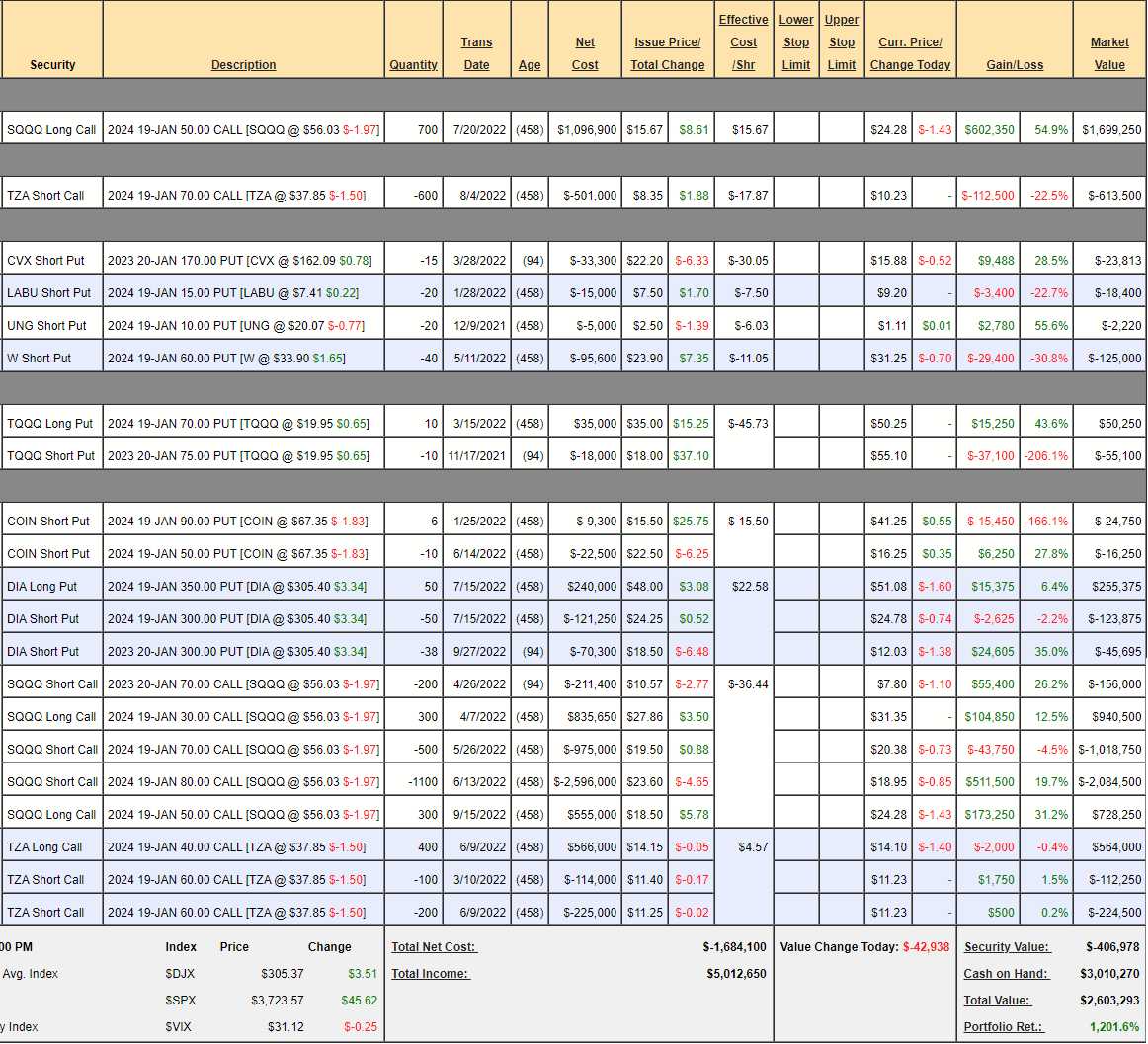

Short-Term Portfolio (STP) Review: $2,603,293 is up 1,201.6% since our 10/28/20 start with $200,000 – not bad for 2 years’ work! We have been very lucky to hit the nail on the hear with the market turns – though this recent one has not gone exactly to plan. Still, it’s doing the job it’s supposed to do and the STP/LTP paired portfolios are still over $4M, though they’ve traded places with the STP now bigger than the LTP.

The trick is to take APPROPRIATE short-term risks in the STP and keep dropping cash to the bottom line wile the LTP plods along and hopefully, in a couple of years, we hit our targets and make a killing on both ends.

At the moment, I’d love to get very bullish but we need more earnings data before making a more bullish call.

-

- SQQQ – The bulk of our protection is these 2024 $50 calls and they are up $602,350. Looking below (things just get detached sometimes) We have 300 2024 $30 calls and $300 2024 $50 calls as well so 1,300 longs and 1,800 shorts but the longs are so much deeper – we’re fine and, as noted in the Earnings Portfolio, we can always roll.

- I don’t see how we can pass up this chance to take the 300 2024 $30s off the table for close to $1M ($940,500). That leaves us with 800 extra short calls but, also as noted above, the 2025 $60 ($27)/90 ($23.50) bull call spreads are only net $3.50 so 500 of those would be $175,000 of our $940,500 and we’ll sleep better with another $1M of coverage against all those short calls. So we’ve taken $765,500 off the table and I THINK I’m good with this balance but we’ll quickly add more covers if 11,000 fails to hold.

-

- TZA – 600 loose short 2024 $70s and below we have only 400 long 2024 $40s and another 300 short 2024 $60 calls. On the whole, we’re lucky we got this pullback. We have $3M CASH!!! in the portfolio (more now) BECAUSE we cashed in those longs. It’s a cheap roll to put the $60s to the $70s but I’m in no hurry for that and $70 is a long way away.

- As I’m thinking about this, I remember why we got like this – the TZAs were underperforming the SQQQs and they are less liquid so I was not keen on adding more but let’s not let the 300 short 2024 $60s go over $13 – call that a stop on those at $390,000 and they are currently $336,750 so not much of a risk but also, hopefully, keeps us from wasting $336,750 buying them back out of fear.

-

- Short Puts – Just a way to generate money if the market goes up. Still, we can roll the loss on 40 W 2024 $60 puts ($29,400) to 30 of the W 2025 $40 puts at $19 ($76,000) and we’ll see how that plays out. These are leftovers from a very successful short on W but I think they are oversold so I haven’t wanted to buy the short puts back.

-

- TQQQ – This is a decay play that did not go well. We have lots of time to roll the short $75s so we’ll see how it plays out.

- COIN – I think COIN is way underpriced so we’ll wait and see.

-

- DIA – Getting close on the short $300 puts but we can always roll them if we have to. Notice we’re back to where we were in July when we sold them but time alone has cost them 35% of their value.

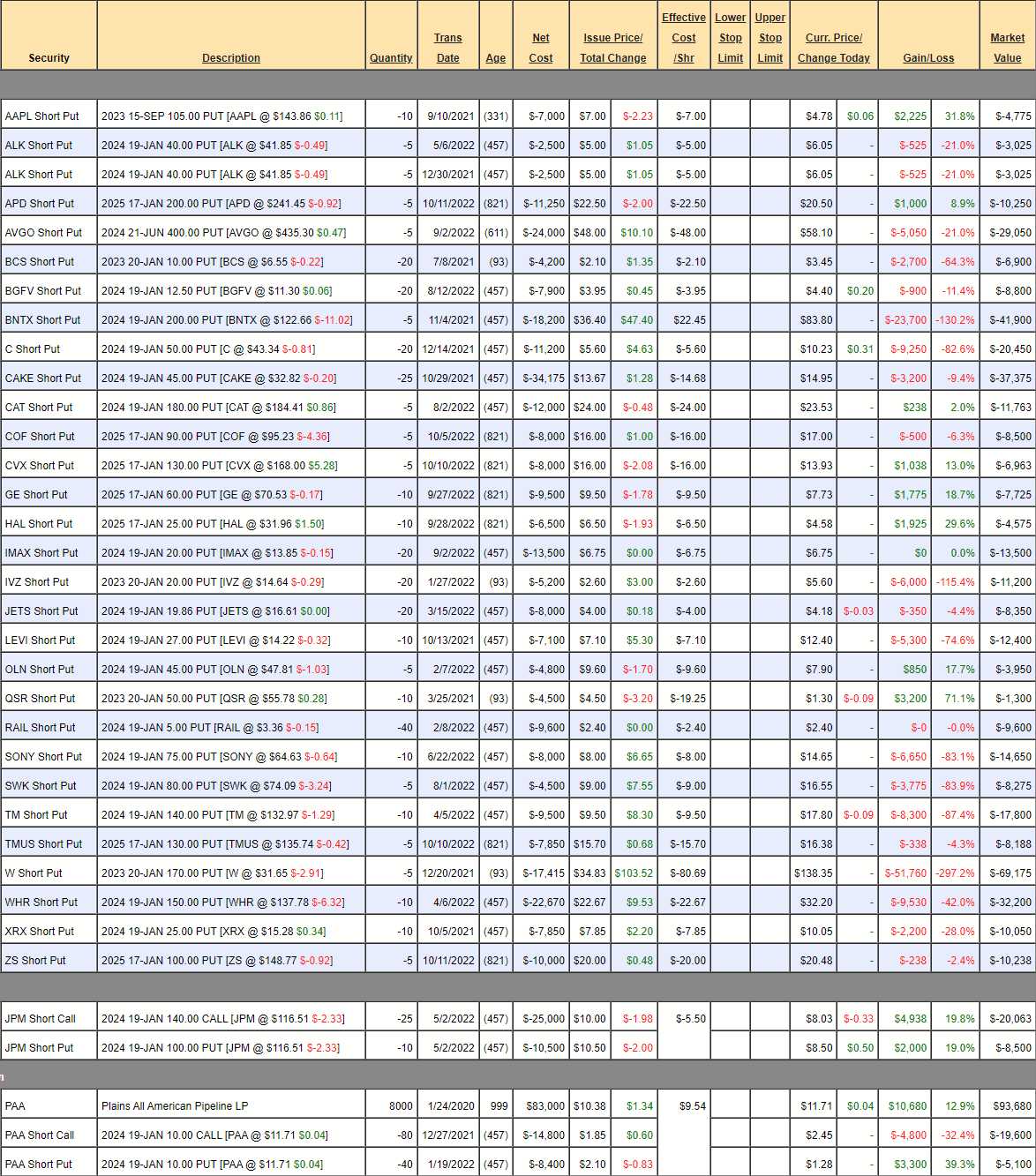

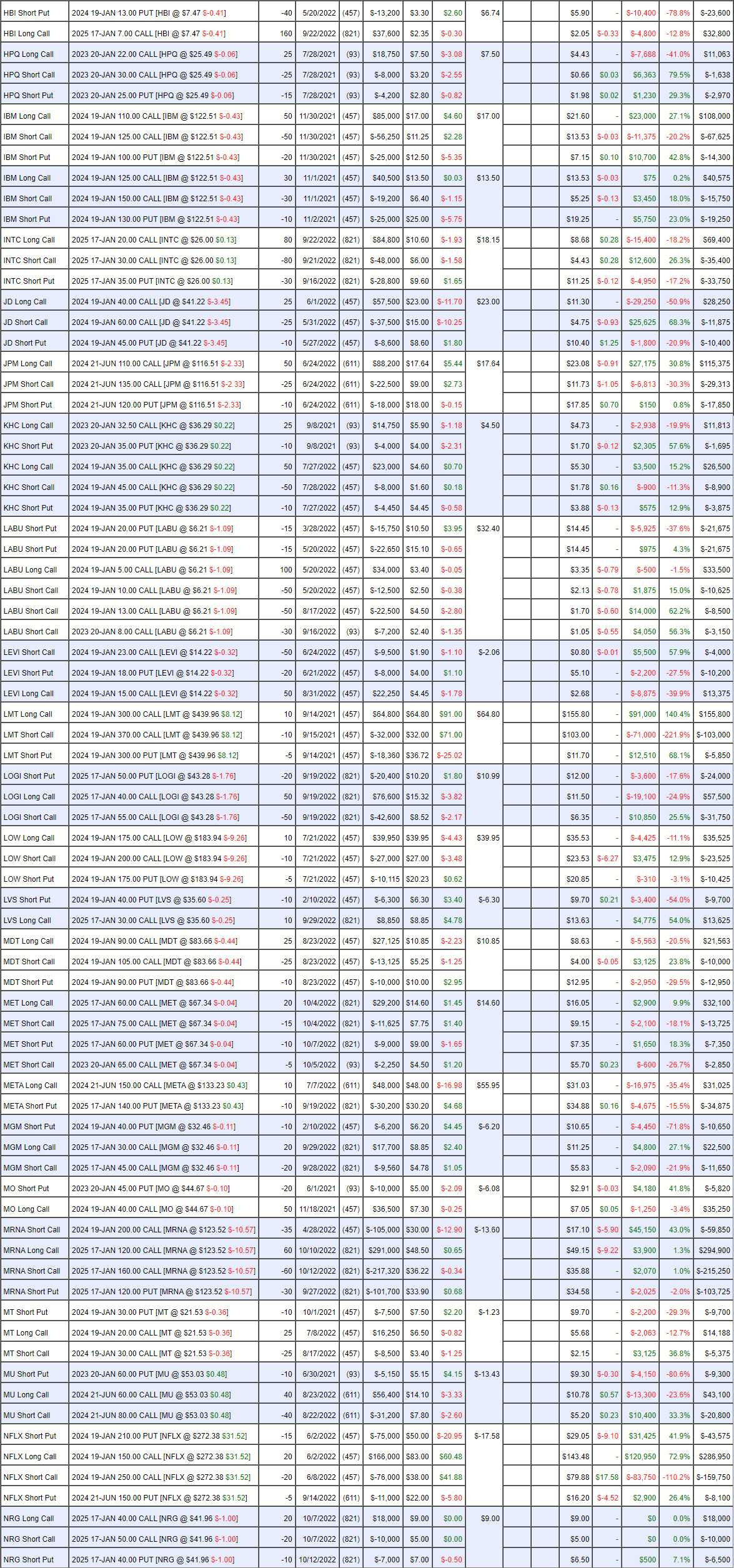

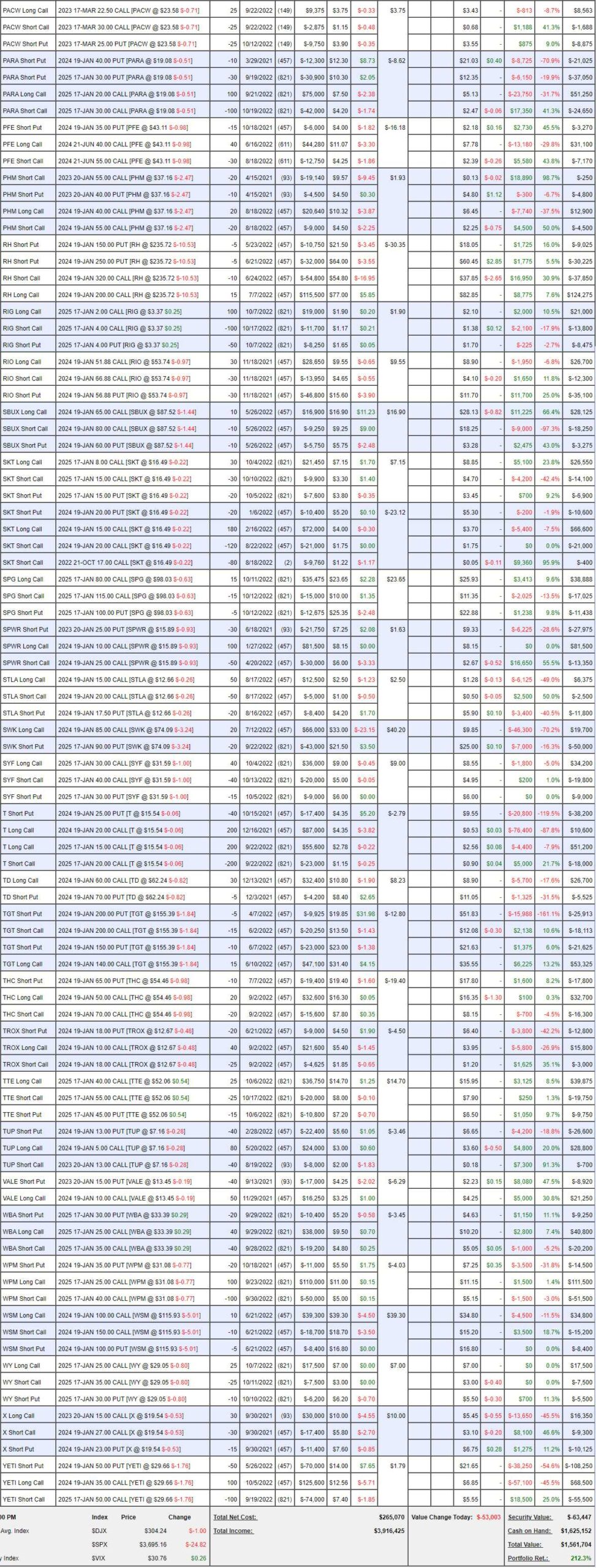

Long-Term Portfolio (LTP) Review: $1,561,704 is down $320,419 since our last review but, fortunately, made up for by hedges in our Short-Term Portfolio (STP) so our balance for the pair is still about $4M overall, up from $700,000 initially – so not much to complain about.

The LTP itself began with $500,000 on 10/01/2019 and we’ve gone through a couple of major purges but, in the past two months, we’ve added long trades from our Watch List on APD, BA, BIG, COF, CROX, CVX, DELL, DOW, EBAY, EXPE, FDX, HBI, GOLD, GOOGL, INTC, LMT, LOGI, MET, META, MRNA, NFLX, NRG, PACW, PARA, RIG, SKT, SPG, SYF, TMUS, TTE, VALE, YETI, WY and ZS.

That’s 34 new positions as the market HOPEFULLY bottomed BUT, as I said in the Webinar yesterday, we need to spend a lot of money on more hedges if we’re wrong about this being the bottom and I’m not sure I want to maintain such a large number of positions if 11,000 can’t hold on the Nasdaq and 3,680 on the S&P.

Of course, it’s hard to let go – especially as these positions are the survivors of several purges already. For now, we’ll see how earnings go but if that’s not the catalyst to take us back to 4,000 – I don’t see another one waiting in the wings and, if that’s the case – why sit through a major downturn loaded with positions? I’d rather have the CASH!!! to buy at the bottom.

Short Puts – The first stage moving off our Watch List is usually the sale of a short put. Selling the AAPL $105 put, for example says “Sure AAPL is cheap now but I’ll just collect $7,000 for promising to buy 1,000 shares at $105.” You get PAID $7 per share in exchange for that promise so, if you do get assigned, your net is $98. If we discipline ourselves to only buy stocks for a discount – we have a huge advantage in all of our positions.

-

- BCS (we’re just doing the changes) – Let’s roll the 20 short Jan $10 puts ($6,900) to 15 2025 $10 puts at $5 ($7,500). We pick up more money and get two years to turn around.

- BNTX – This is why we start small. The loss is only $23,700 and our allocation blocks are $200,000 so we’re fine – just off to a poor start. We can roll the 5 2024 $200 puts at $41,900 to 10 of the 2025 $130 puts at $41 ($41,000) and, if we have to roll to 20 2026 $80 puts at $41,000 next year – the total commitment of 2,000 shares at $80 would be $160,000 less the same $18,200 we collected is about $71/share and of course I would LOVE to own BNTX at $71 per share – so sticking with this put is a no-brainer.

- C – We sold the $50 puts for $5.60 so our net is $44.40 and the stock at at $43.34 but the put shows an 82.6% loss. Option traders need to learn to ignore the silly premiums and focus on the actual value of the contract if executed. The main reason we’re adjusting these is simply to take advantage of the dip and the high premiums we can sell with the VIX around 30. Let’s roll our 20 2024 $50 puts at $20,450 to 40 of the 2025 $40 puts at $6.25 ($25,000). We don’t have to DD but I REALLY want to own 4,000 shares of C at $40 ($160,000) less the $11,200 we collected originally and the $4,550 we’re collecting on this roll is net $144,250 ($36/share) which is 20% below the current price and we could sell 2025 $40 calls now for $10, which would drop our net to $26 so there’s no reason not to pursue this – unless the market is really collapsing.

-

- IVZ – Underperforming but I still like them. The 20 Jan $20 puts at $11,200 can be rolled to 30 of the 2025 $15 puts at $3.50 ($10,500).

- LEVI – We’ll roll the 10 2024 $27 puts at $12,400 to 20 of the 2025 $20 puts at $7 ($14,000).

- SONY – 10 2024 $75 puts at $14,650 can be rolled to 15 2025 $60 puts at $9 ($13,500).

- SWK – 5 2024 $80 puts at $8,275 can be rolled to 10 2025 $60 puts at $10 ($10,000).

- TM – 10 2024 $140 puts at $17,800 can be rolled to 15 of the 2025 $125 puts at $11.50 ($17,250) and, if those turn red – it will be time to add a bull call spread!

-

- W – Leftover from a bear position but eating up all the profits! 5 Jan $170 puts at $69,175 can be rolled to 20 SPG 2025 $90 puts at $17.50 ($35,000) and 15 ISRG 2025 $160 puts at $20 ($30,000). You don’t have to roll to the same stock – we just want to make back the money! SPG is a great value and ISRG is one I think is way too cheap as well.

-

- WHR – 10 2024 $150 puts at $32,000 can be rolled to 15 2025 $120 puts at $22 ($33,000).

- XRX – 10 2024 $25 puts at $10,050 can be rolled to 20 2025 $20 puts at $7 ($14,000).

- JPM – Why do we not have long calls? Something screwed up but let’s fix that and buy 40 of the 2025 $100 ($30.75)/125 ($18.50) bull call spreads at $12.25 ($49,000). That puts the net of the spread at $13,500 with $86,500 upside potential at $125. See how easy that is?

-

- PAA – They pay a nice $1,700 dividend each quarter too!

-

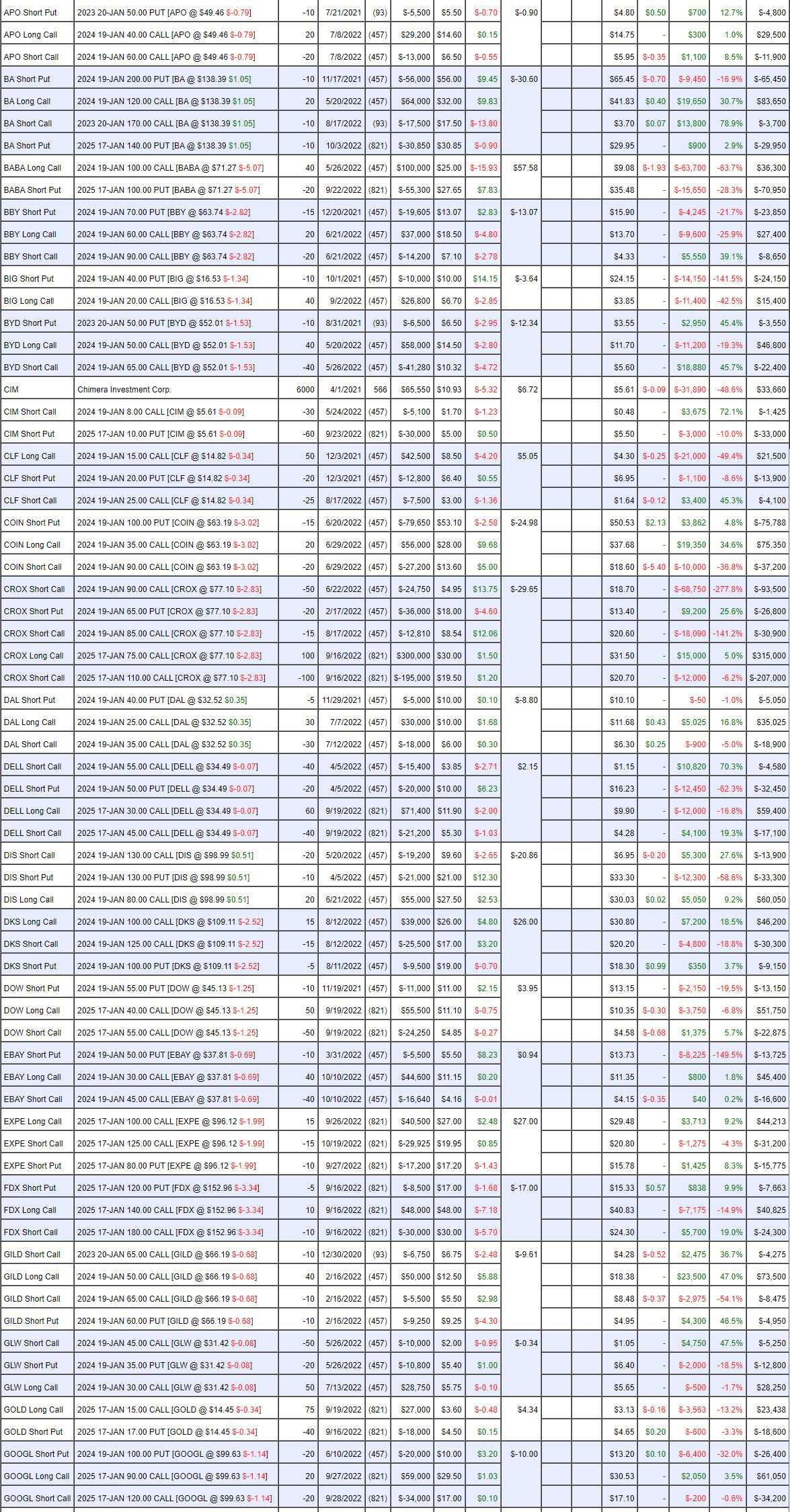

- APO – Asset management should be a good place to be.

- BA – The Jan $170s will expire worthless and I’m not inclined to cover down here.

-

- BABA – Our relationship with China is getting worse so we may cut them if earnings are not great.

- BBY – Way too cheap coming into Christmas.

- BIG – Disappointing so far, waiting on earnings.

- BYD – Small casinos. As long as Covid stays away I think Spots Betting will much improve their bottom line.

-

- CIM – They just paid us $1,380 and I forgot to add it. Love these guys and we just added more puts rather than just doubling down.

- CLF – Let’s roll the 50 2024 $15 calls at $4.30 ($21,500) to 100 of the 2025 $10 ($7.85)/17 ($5) bull call spreads at $2.85 ($28,500). So we’re spending net $7,000 to be in the $70,000 spread that’s $48,000 in the money. The original position was net $22,200 so now net $29,200 with $40,800 (139%) upside potential.

-

- COIN – I see a lot of potential in this one.

- CROX – We had a nice run so we cashed in our original longs and replaced them with a spread. If we have to, we’ll buy more longs and roll but let’s see earnings first.

- DAL – Pretty new and on track.

- DELL – Lots of talk about low PC sales. We’ll see what they say on earnings. I think they are more adaptable than other PC makers – we’ll see…

- DIS – They have cruise ships that are still hurting them but I like them long-term. Let’s roll the 10 2024 $130 puts at $33,300 to 20 of the 2025 $100 puts at $17 ($34,000).

- DKS – On track

- DOW – High Nat Gas prices hurt their bottom line but it will pass.

- EBAY – Crazy low now. Let’s roll the 10 2024 $50 puts at $13,725 to 15 2025 $40 puts at $8.20 ($12,300).

-

- EXPE – Brand new.

- FDX – Also new.

- GILD – On track.

- GLW – Should start picking up.

- GOLD – We are aggressive as we should be down here.

- GOOGL – We just added the bull call spread and another case of ignoring the loss on the short puts as we’re at $100 and those are 100% premium but showing us a loss of $6,400 when we’re likely to have a profit of $20,000 when they expire in a year.

-

- HBI – Boy are we bullish on them! They kept going lower and we kept adding more. Earnings first week of November so we’ll see. May as well roll the 40 2024 $13 puts at $23,600 to 60 of the 2025 $10 puts at $3.70 ($22,200). We’re rolling the $10,000 loss as we have so many longs, we don’t need the puts to make money if this thing turns up.

- HPQ – Same net as we came in. No sense in leaving the Jan $22 calls in case they go lower so we’ll roll those ($11,063) to 60 of the 2025 $20 ($9)/$27 ($5.60) bull call spreads at $3.40 ($20,400) and we can always roll the short calls along if they don’t expire worthless but let’s also sell 20 2025 $25 puts for $5 ($10,000) while we still can and now we’ve spend net $0 on our new $42,000 spread that’s almost entirely in the money.

-

- IBM 1 – Already near goal. This is our original Trade of the Year spread, now up from net $3,750 to net $26,075 (595%) but it’s a $75,000 spread so still great for a new trade – even if you missed the first 600% gain!

- IBM 2 – More aggressive spread but also working. Nice pop today.

-

- INTC – On the dark side… INTC was in the running for Trade of the Year but we didn’t go with them (thank goodness) because they are still in a heavy spending cycle through next year. Long-term though, this is a STUPIDLY LOW price for the stock. We already repositioned so watching and waiting now.

- JD – Disappointing but what isn’t lately? May as well take advantage and buy back the short 2024 $60 calls for $11,875 (up $25,625) and if they weren’t Chinese I’d be pressing the longs but let’s see how it plays out for a while.

- JPM – On track, of course. Betting against JPM is like betting against Mike Tyson. I forgot we had this when I made the adjustments above but they are great adjustments and I don’t mind being extra bullish down here.

-

- KHC – This position got complicated. Oh, I remember, we thought they were too low in July and we added the new spread but didn’t roll because we thought the Jan calls still had a chance to come back – and they did. If $35 fails we should kill the Jan $32.50s but, otherwise, we can give them some room to run.

-

- LABU – Speaking of complicated! Biotech ETF is going nowhere. We’re making money selling short calls, that’s for sure so let’s see how earnings look in this sector before adjusting.

- LEVI – Love them! Let’s buy back the 50 2024 $23s as they are already up 58%. They cut guidance due to strong Dollar and supply chain issues – that’s no reason not to own them for 20 years, is it?

- LMT – Our Stock of the Century is heading for an early cash out at net $50K on the $70K spread that’s deep in the money. No need to do anything right now.

- LOGI – I really like them down here, great bargain.

-

- LOW – Getting downgraded over housing declines. We’re about even from July entry and I still like them long-term.

- LVS – BTE Revenues and loss not so bad with Macau barely functioning so holding these guys but a small entry.

- MDT – Love them and WAY too cheap down here. Spread is good though – no reason to change.

- MET – New one. Didn’t like the note from ALL today, they are down 11% so let’s sell 5 of the March $70 calls for $4 ($2,000) to add some coverage. It’s just inflation pains but it can still impact earnings for a few quarters so may as well protect ourselves a bit.

- META – I hate these guys. I can’t believe we’re bullish. Even worse, I can’t believe we need to roll the 10 2024 $150 calls at $31,025 to 30 2025 $120 ($51)/160 ($36) bull call spreads at $15 ($45,000), but that’s the proper move to make. Now we have $120,000 spread that’s $48,000 in the money – so well worth the extra $14,000.

-

- MGM – More casinos. I think casinos do well in a Recession. The spread is brand new, added to the old puts, which I’m not worried about.

- MO – Another good sin stock. Waiting for legal cannabis to kick-start them.

- MRNA – One of my favorite underperformers. I think we should be happy to make a fairly quick (6 months) $45,150 and buy back the short 2024 $200 calls as we already have the covered spread so why take a chance on earnings (11/3) when I think they’re underpriced?

-

- MT – It’s a tight spread so we’ll just see how it plays out. I love those guys but X shutting down production makes me nervous.

- MU – All the chip guys are suffering but we still need chips. Let’s roll the 10 short Jan $60 puts ($9,300) to 20 short 2025 $40 puts at $6 ($12,000) and the rest we can watch and wait.

- NFLX – Very nice pop on earnings. I think we played this too conservatively but it was a net $15,000 entry and, when it went lower, we sold $11,000 more in puts so net net $4,000 on the $200,000 spread. This is what I mean about it being annoying when our initial entry works out before we have a chance to DD. Still, will be a nice gain and still only net $75,525 (up 1,788%) with another $124,475 (164%) to go if they can hold $250 into next Jan. Aren’t options fun?

-

- NRG – Brand new.

-

- PACW – Earnings were disappointing but baked in. I think we made the right entry.

- PARA – Another huge holding for us in several portfolios. Nobody else seems to love them but I say they get bought by June if they are still at $20, which I doubt. We’re already committed so nothing to adjust other than rolling the 10 short 2024 $40 puts at $21.03 to 20 more short 2025 $12.35. Our buy-out target is $30 so $40 puts won’t help us.

- PFE – I can’t believe they sold off like that – people are crazy. Let’s buy back the 30 short June 2024 $55 calls for $7,170 (up $5,580 from Aug) to give them room to bounce before selling something else.

-

- PHM – Homebuilders! As I said in the webinar – I think the fear is way overdone. Nice that we’re picking up $19,140 on the short Jan $55s (the original short calls before we cashed the longs in and rolled to a longer spread) – that’s making the trade. Just because you like a stock doesn’t mean you shouldn’t bet against it in hard times. Those will go worthless and we’ll see what they have to say next week.

-

- RH – Wow, so many great stocks in this portfolio. All these purges have left us with the 1927 Yankees. These guys are barely out of the gate and already profitable.

- RIG – Brand new. Persistent over $80 oil leads to more offshore drilling. Simple math.

- RIO – Opening up Venezuela oil drilling again will be good for them.

- SBUX – Another unstoppable force of nature. We’re watching their notes on labor costs very closely though.

-

- SKT 1 – We added another but why not – they are FANTASTIC! This is the brand new one.

- SKT 2 – Those October short calls will go worthless almost right on the money with a $9,760 profit and THAT is why we have the 60 open longs so we will be selling more but earnings are in two weeks so let’s give them a chance to test $18.

There’s another example of liking the stock but, in August, we got a nice pop so we decided to sell the Oct $17s as they seemed expensive at $1.22 and I didn’t see the justification for $18 to break while the Fed was bound to be tightening. Now that we’re halfway done with the rate raises and they’ve had time to adjust – it’s possible we’ll get positive guidance into the holiday quarter.

-

- SPG – Two malls in a row! This is currently my leading contender for Stock of Year next year because the option spreads are so good (but more Covid could derail it). Well see if it sticks into Thanksgiving – this is a brand new trade.

- SPWR – Our Stock of the Decade and how the HELL are people letting this go unbought? There were a series of idiotic analyst notes on them that completely miss the reality of what’s going on (solar becoming the dominant energy source). Earnings are 11/8 so we’ll see what they have to say but we’re aggressive enough with this spread.

-

- STLA – Stubbornly low but I like them long-term. The short 20 calls are already up 50% so let’s buy them back and hopefully they get back to $15+ where we can sell some more.

- SWK – We already bought back the short calls so now let’s roll the 20 2024 $85 calls at $19,700 to 40 of the 2025 $65 ($21.25)/$90 ($12) bull call spreads at $9 ($36,000) and we’ll sell 10 of the 2025 $80 puts for $20 ($20,000) to overpay for the roll. Earnings are next week and, as a new trade – that’s net $16,000 on the $100,000 spread.

-

- SYF – Brand new.

- T – When is the last time we had a good day? We left the 2024 $20 calls in hopes they do get a big pop but it will take more than this to get them in the money.

-

- TD – Love this bank. Give them time.

- TGT – Let’s roll the 5 short 2024 $200 puts at $25,913 to 10 short 2025 $150 puts at $28.25 ($28,250). Problem solved! Yes, it’s that simple. We COLLECT $2,000+ and we roll down 25% in strike. As long as TGT doesn’t go BK, we do it again in 2026 (75% of $150 is $112.50 for 20 and then 2027 would be $84.37 for 40. So, if we don’t RELLY want to own 4,000 share of TGT for $84.37(ish) – then we should take our loss now. Our current commitment is to own 500 shares at net $180 so $90,000 and $320,000 would be a stretch but it’s a $1.5M portfolio with $3M in buying power (not counting the STP cash) and it’s almost unthinkable that TGT will go down and down another 50% over 3 consecutive years without giving us a break – so we do the roll.

-

- THC – Pretty new hospital play.

- TROX – I can’t believe they are not getting respect but we’ll wait for earnings next week to see if we’re being too aggressive or not.

- TTE – Another company I LOVE! Brand new trade.

- TUP – We’ll see how this goes. They are being hurt by less people going to the office with lunches but kids are back in school – so that’s good.

-

- VALE – We’re aggressive on them.

- WBA – We repositioned. Hopefully things turn up.

- WPM – Another one I love, still good for a new trade.

- WSM – Like RH, rich people don’t care whether their convection toaster is $199 or $249.

-

- WY – Brand new.

- X – I think they are doing the right thing being cautious and our spread is pretty conservative so let’s do the correct thing and buy back the 30 short 2024 $27 calls as they are up 46% already and we’ll see if they can get back to $25.

- YETI – We talked about them in the Webinar. We can wait until next Q to see if these lows stick. Their CFO quit so turmoil at the moment and we’ll see how earnings look.

Wow, so nothing I really wanted to cut so I guess I’m more bullish than I thought but still we have to keep an eye on the data and earnings to see if we really can expect these to perform.