AT&T Earnings Top Views On Strong Wireless, Fiber Broadband Subscriber Growth

AT&T Earnings Top Views On Strong Wireless, Fiber Broadband Subscriber Growth

THAT is the kind of headline you want to hear after 3 months of lower and lower prices (we just kept buying more). There was a great Stephen Colber clip about AT&T and how it is now bigger than when it was broken up but AT&T is so big they have purged it from the Internet. Unlike Trump, they simply snuff out their enemies quietly.

In our Long-Term Portfolio, we have the 2025 $15/20 bull call spread which we bought for net $1.63 and it’s still $2.60/0.90 so net $1.70 but it pays $5 at $20, which would be a gain of $3.30 (194%) on just the spread but we also offset that cost with short $20 puts we sold for $4.35 so, if T does make it back over $20 – this will be an incredible profit.

At this point, we have T in most of our Member Portfolios and, if it is still below $17 in a month – it is contention to be our Trade of the Year for 2023 as that distinction is for the option spread I am most confident will make a 300% return on cash and I think T is worth way more than $20.

So T is a $110Bn company at $15.50 so $20 is about 30% more or $30Bn and THAT is how we determine the S&P 500 is undervalued. The S&P 500’s Total Market Cap is $30Tn so if T is $30Bn undervalued, that’s one tenth of a percent too low for SPX. GOOGL (which we also have), is at $1.3Tn and 20% undervalued so $260Bn which would add 0.86% to the S&P, etc.

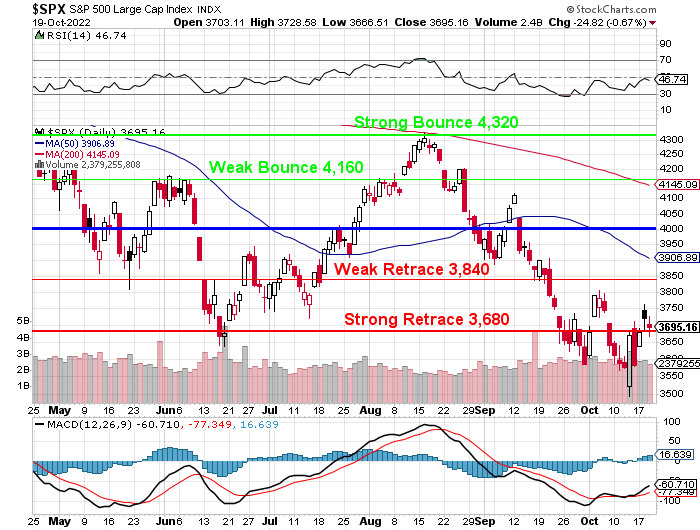

This is how we come up with our fair value estimates for the indexes, we look at the components and determine if they are under or over-valued and then we just do the math – no chart is required but it does illustrate the point(s). If the earnings or outlook changes (and not what they say, but what we see), then the math will change but, so far, the lines we drew over a year ago to predict where we’d be at the end of 2022 are still in play.

The only macro we hadn’t factored in was the war in Ukraine. We expected the inflation and the Fed raising rates, continuing Covid and the supply chain issues but the war and the fuel inflation was more than we counted on and that’s why we’re a bit under our target of 4,000 – but not enough to adjust so far – we may have the same lines in 2023 with potential Recession being the major wild-card ahead. That was also expected but the Fed is accelerating the time-line more than we thought they would.

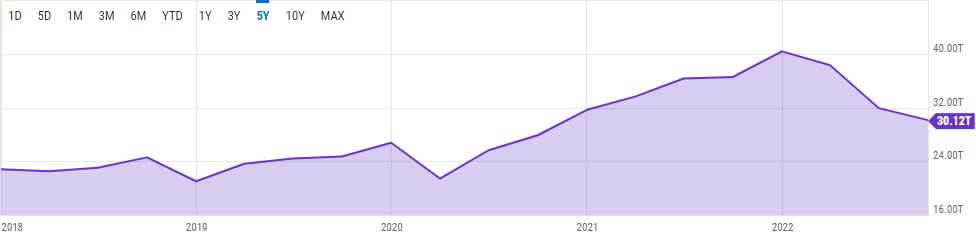

By the way, S&P 500 valuation topped out at $40.36Tn last December so we’re down about 25% from there but in Dec of 2018, we were at $24.5Tn so $40Tn was up 60% in 4 years – we KNEW that was ridiculous – that’s why our “timing” was so good – we didn’t fall for the BS at the time.

And that’s why this is a CORRECTION and not a pullback. A pullback would indicate we are going back to $40Tn after a minor setback but a correction is saying that NOW, we are at the CORRECT price/value for the S&P 500. There was a mania driving stocks that included Government Stimulus and Low Interest Rates that are a thing of the past – now companies have to make money the old-fashioned way – by providing the lowest quality goods and services at the highest prices the market can bear!

Meanwhile, earnings WERE going well with 76% beats but last night was NOT GOOD with misses by AA, KMI, LVS, PACW, TSLA, WDFC and others. 11 out of 24 reporting companies missed last night and, this morning, ABB, AUB, BANC, DOW, ERIC, EWBC, FITB, HRI, KEY, SASR and WSO (11 again) our of 40 – which isn’t terrible but now we’re down from 76% to about 68% beats – no longer that good.

My comment to our Members on ERIC yesterday was: “Are the still in business?” and they got hit pretty hard – so maybe not much longer. Still, PM did well and NUE is a surprising beat. ALK is our other favorite airline along with DAL, so no surprise there. BX no surprise in a beat. DOW we have and disappointing but we expected it (high Nat Gas prices) and it’s already priced in. FCX hanging on so well we should buy some, DGX is unstoppable and UNP keeps chugging along.

So it’s a stock-picker’s market and that is our favorite kind as we are value investors and we love to find those hidden gems!

Have a great weekend,

-

- Phil