Momentum Monday…A Break From Relentless Selling or Just Selling Rotation? and Let’s Talk About Bonds…

Courtesy of Howard Lindzon

As a reminder, Marketsmith (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from Marketsmith.

Good morning everyone.

Last week there was a little bit of relief for tech stocks and banks. Defense stocks are benefitting from the drumbeat of war and actual spending.

Here is this weeks Momentum Monday where Ivanhoff and I tour the markets looking for momentum. I have embedded the viseo on the blog here below:

While some tech bounced, the selling and rollovers continues in rails and truckers. The recession textbook is in play, but the strength in energy defies the playbook for now.

I share a couple new ideas starting at minute 13…

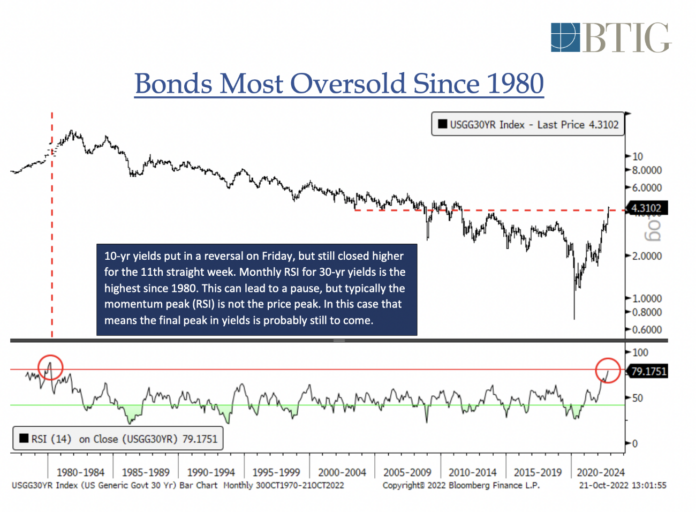

It is BONDS that are the big crash story of 2022 (even though China markets crash is a big one).

Here are two charts that capture the Bond misery:

I added some bonds via $AGG for the first time in my life (but I have been heavy cash and am an old fart).

Here are Ivanhoff’s thoughts and he lists the defense stocks that are strongest right now:

The S&P 500 (SPY) finally had a strong weekly close for the first time since early September. SPY has room to run to 380 where it will probably encounter some minor resistance and pullback to 375. Then, if it clears 380 from the second attempt, it can run to about 390.

Last week was chop, chop, chop, and then a strong close on Friday. It might be related to monthly options expirations. It might be connected to the Bank of Japan intervening to boost the Yen which led to a decline in the US Dollar. For the better part of this year, stocks have negatively correlated to the US Dollar. Another viable reason is the overall sentiment. People are getting very pessimistic – “recession” was one of the main trending topics on Twitter Friday morning. The markets love to play a contrarian game and react in the opposite way when something becomes too mainstream. There has been so much chop lately that almost no one believes this rally. It was the same in the summer. It is normal to behave that way. The human mind tends to extrapolate the most recent price action into the future. If it has been choppy, we expect it to remain choppy. If it has been rising, we expect it to continue to rise. The market rarely conforms to widely perceived expectations for too long. This is why the big money in markets is made not when you are right about something that everyone is right about (the consensus opinion) but when you are right about something very few are.

When it comes to individual stock setups, one sector clearly stands out. It is not biotech. There are still some Ok setups there but the sector showed how vulnerable it is to interest rate increases last week. XBI dropped 5% in one day last Wednesday and its relative strength line has been flat-lining since August – this is now how leaders behave. The sector that has been shining as of late is oil & gas. Currently, about 80% of all stocks in an uptrend are oil & gas. Many have been perking up in expectations of strong earnings. Others like SLB continued to go up after reporting earnings. I don’t know how sustainable this move in energy names is in the face of rising interest rates, but this is where many of the constructive setups currently reside. Defense stocks also had a very strong week and show notable signs of accumulation – LMT, NOC, BAH, ASLE, CW, HII, etc.

Big tech reports earnings next week and will significantly impact the indexes and the overall sentiment. What matters is has the worst has already been discounted and is Big tech still doing fine at some level. Most of the big tech companies have already slashed their guidance so expectations are low. They will probably beat earnings estimates (as usual) but the market will pay attention to margins, sales estimates, and future earnings guidance. If the market wants to rally in the short-term, it will find a reason to rally.

Have a great week.

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. For full disclosures, click here.