Stocks Bottom First

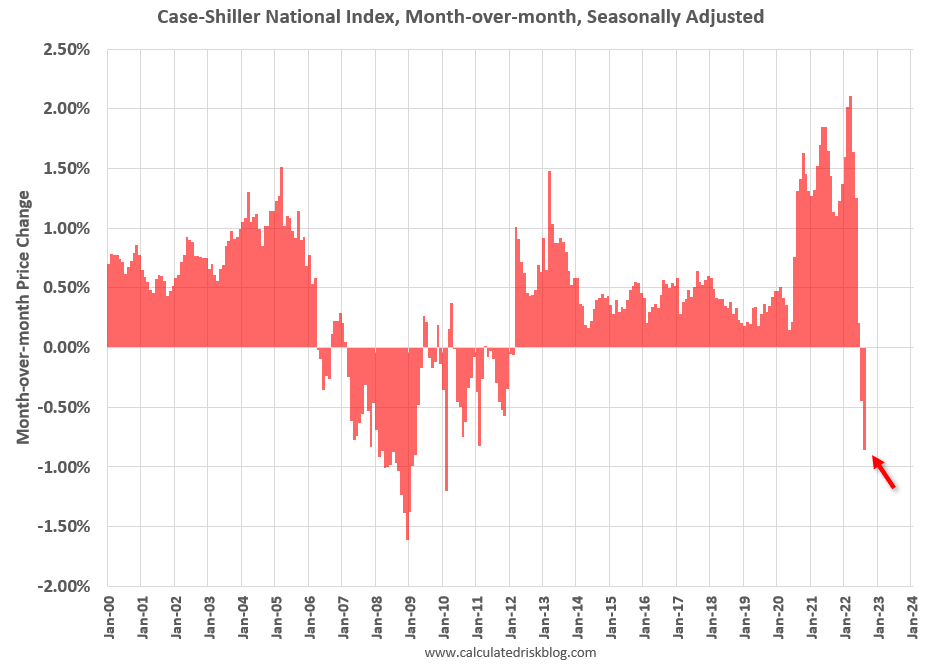

Today we learned that home prices had their largest drop since 2009. This is just a small preview of what I believe we’ll see in the coming months as the market adjusts to 7% mortgages.

In fact, a lot of the economic data will likely worsen. We just heard from the Chief Business Economist at S&P Global opine on the most recent Global Flash US Services PMI report. He said:

“The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply.”

I don’t want to sound alarmist, but brace yourselves for some lousy headlines as interest rate increases work their way through our economy. Actually, you’re probably already calloused to the non-stop negativity. Michael Cembalest said:

“I read around 1,500 pages of research each week and the most consistent message now is a litany of gloom on earnings, valuations, wage and price inflation, Central Bank policy normalization, housing, trade, energy, the surge in the US$, China COVID policy, etc”

When you see things like “A litany of gloom” you can be sure that the market is aware of the situation we’re in and has adjusted risk assets accordingly. Nobody knows where we go next, but the stock market has already priced in some carnage, removing 25% from the S&P 500, 35% from the Nasdaq-100, 50% from Facebook, Nvidia, and Disney, and 80% from Shopify and Coinbase and the like.

Overweighting today’s news, for better and for worse, gets investors in trouble because today is already priced in. Stanley Druckenmiller recently relayed this message to an audience, saying: “Do not invest in the present. The present is not what moves stock prices.”

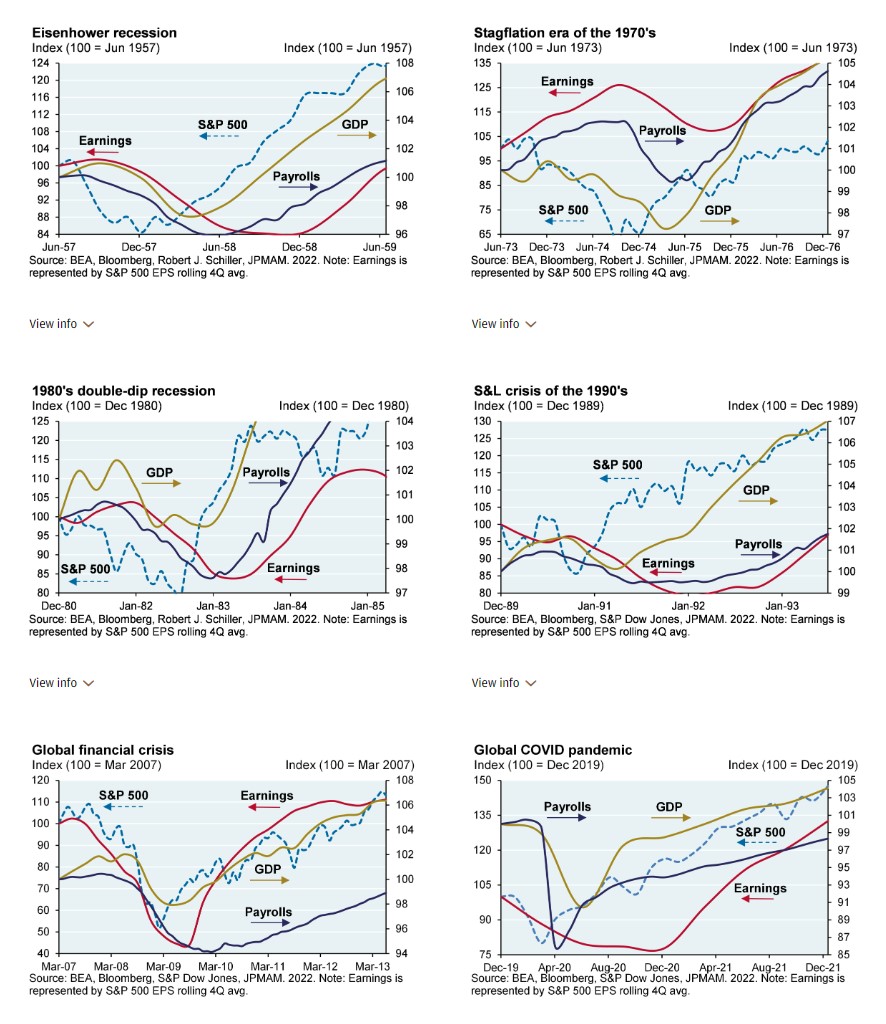

Michael Cembalest has a great visual representation of what Druckenmiller is talking about. The stock market is forward-looking and has an uncanny ability to bottom while the data continues to sour. It stops going down while GDP, employment, and earnings deteriorate.

This is how you’ll see seemingly incongruous headlines like “Dow Jones gains 900 points while unemployment hits a 24-month high.” The market has better long-term vision than we do, which is one of the trickiest parts of a bear market. Everything in your gut will tell you to sell. It will tell you that things are going to get worse. And it’s probably right. Things will get worse! But the market will have already looked past it.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?