So close and yet so far:

We had a good couple of weeks on the Nasdaq but Big Tech was a big let-down last night with an almost 20% miss by GOOGL, negative guidance by FFIV and MAT, a 25% miss by SKX and negative guidance by TXN and even MSFT wasn’t particularly compelling. This morning BA has a big miss.

BA is not so bad, actually, they are taking a hit on military contracts that they bid before inflation and will be completed at a loss in the Future. Free Cash Flow was actually great ($2.9Bn), so it’s a good time to add BA if you don’t have it on this drop.

Other companies have reasons for disappointing but that won’t make investors feel better in the short term. GOOGL, for example, added 36,000 employees since last year, 12,765 in Q3 so there’s all expense and no chance for them to be productive yet. Also, currency exchanges killed GOOGL (5% of total Revenues were hit) with so much Revenue coming from overseas – expect the same from META this evening – so no break for the Nasdaq today.

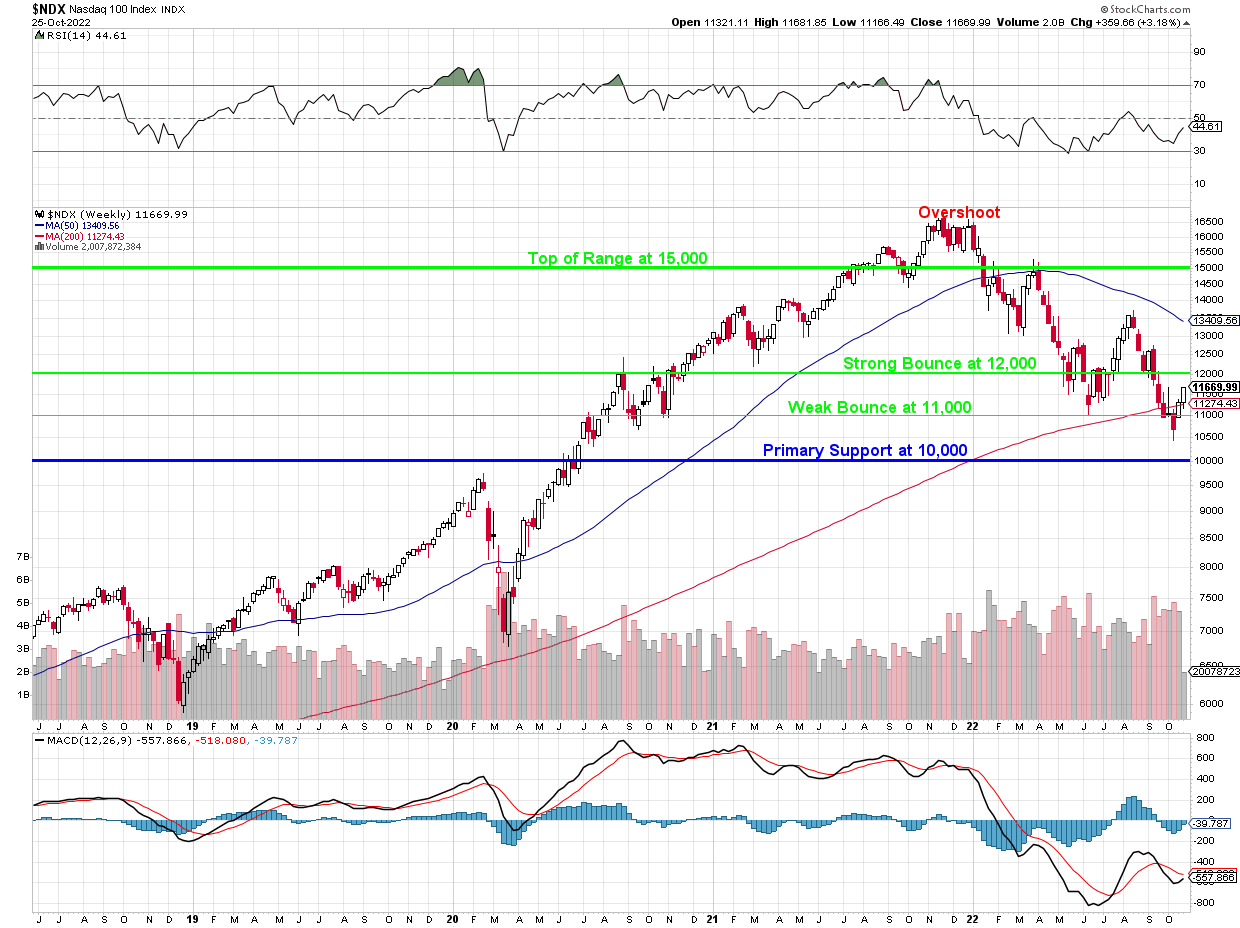

As you can see from the chart above, it would be nice to hold the 200-week moving average on the Nasdaq 100 at 11,274. If we can do that on bad news – we may be in good shape into the end of the year but, if not, it will be hard to hold 11,000 – let alone get to 12,000. So it’s going to be a critical week for the Nasdaq and the S&P 500 is right back at our 3,840 line this morning – also a critical indicator.

As you can see from the chart above, it would be nice to hold the 200-week moving average on the Nasdaq 100 at 11,274. If we can do that on bad news – we may be in good shape into the end of the year but, if not, it will be hard to hold 11,000 – let alone get to 12,000. So it’s going to be a critical week for the Nasdaq and the S&P 500 is right back at our 3,840 line this morning – also a critical indicator.

We’ve been getting a free ride from a Dollar decline in the past week but that party is over as we are almost certain to weak bounce off 110 and, from 114, that would be 0.80 to 110.80 and a strong bounce would be 111.60, which would be very hard for the broad market to swim against.

We’ve been getting a free ride from a Dollar decline in the past week but that party is over as we are almost certain to weak bounce off 110 and, from 114, that would be 0.80 to 110.80 and a strong bounce would be 111.60, which would be very hard for the broad market to swim against.

Without any new hawkish statements from the Fed this week – traders are able to pretend the news we are seeing is enough to bring about at least a pause in the Fed’s relentless hiking cycle. This is based on no evidence at all but other Central Bankers are taking advantage of the Fed’s quiet period ahead of next week’s meeting to talk up their own currencies. Why? Because talk is cheap – their budgets can afford that…

Speaking of talking, our top Banksters are over in Saudi Arabia kissing rings and glowing globes and luminaries like David Solomon of Goldman Sachs (who just took over England) and JP Morgan’s Jaimie Dimon were super-negative in their outlooks for 2023.

“There’s no question that 2023 looks a little dicey,” Franck Petitgas, head of international operations at Morgan Stanley, said at the conference. “It’s pretty safe to say that the US is probably going to have some sort of landing that’s not super soft.”

Rents are up 25% in the past two years, miles ahead of inflation and miles ahead of increased costs. Many landlords raised rates because they could as housing became unaffordable but now they’ve made rents unaffordable too and landlords are suffering the same fate as home sellers.

Is the Fed willing to keep raising rates and force a potential housing collapse just to avoid inflation? The cure may be worse than the disease but we’ll have to wait until next week to see what they have to say.

Meanwhile, we’ll see what holds on the pullback.