Another day, another downturn for Big Tech.

Another day, another downturn for Big Tech.

Mark Zuckerberg has bet his company and his fortune on the Metaverse and, so far, it’s sinking the ship but yes, building a new Universe is an expensive project but Facebook (the old company name) already has 3.71 BILLION people logging into this Universe – so they need a new place to visit to keep things fresh. 3.71Bn is the Monthly count and that’s up 4% over last year despite the release from lockdowns and Daily People are also up 4% at 2.93Bn.

As we expected, the problem with having half the planet as a source of revenues is that half the planet is pretty poor and has weak currency. While Ad Impressions were up 17%, the Price Per Ad dropped 18%.

Overall Revenues were down about $4% to $27.7Bn but META is spending it all, with anticipated expenses this year of about $99Bn. At this point, building the Metaverse is costing META as much as a major acquisition would have – although without all the nice revenues that usually go with such a thing!

We have META in our Long-Term Portfolio and we’re going to stick with them because, if Zuckerberg is right, they will be miles ahead of everyone else in owning the Metaverse and, if he’s wrong, they can always go back to making money off of 4Bn eyeballs in the regular Universe.

Also in the regular Universe – US Q3 GDP was 2.6% (annual) vs. 2.1% expected and neither of those numbers are anything like a Recession. That is miles up from a 0.6% contraction in Q2 and, even better, the GDP Deflator was only 4.1% vs 5.3% expected, so the Fed is having an effect in slowing inflation.

Also in the regular Universe – US Q3 GDP was 2.6% (annual) vs. 2.1% expected and neither of those numbers are anything like a Recession. That is miles up from a 0.6% contraction in Q2 and, even better, the GDP Deflator was only 4.1% vs 5.3% expected, so the Fed is having an effect in slowing inflation.

That has the markets in a good mood this morning. Durable Goods was up 0.4% but ex-Transportation it’s down 0.5% and that’s also good as the Fed wants things to slow down and we’re starting to see the effects. It’s not likely to take next week’s hike off the table but it does mean the end is somewhere and these hikes won’t last forever (I say 6% in June is the end).

Tomorrow we get Personal Income and Spending and both of those should still be going up but PCE Prices will be the wild-card along with the Employment Cost Index (all at 8:30) and then we get Consumer Sentiment at 10 and it’s hard to imagine how that could get any lower than last month’s 59.8 (though it was even lower the month before).

The ECB raised their rates by 0.75 this morning and the BOE was up 0.5% yesterday and that’s been keeping the Dollar down around 110 but, as I predicted yesterday, we’re bouncing there though the low was 109.535 so the bounce is shy of the marks so far.

The ECB raised their rates by 0.75 this morning and the BOE was up 0.5% yesterday and that’s been keeping the Dollar down around 110 but, as I predicted yesterday, we’re bouncing there though the low was 109.535 so the bounce is shy of the marks so far.

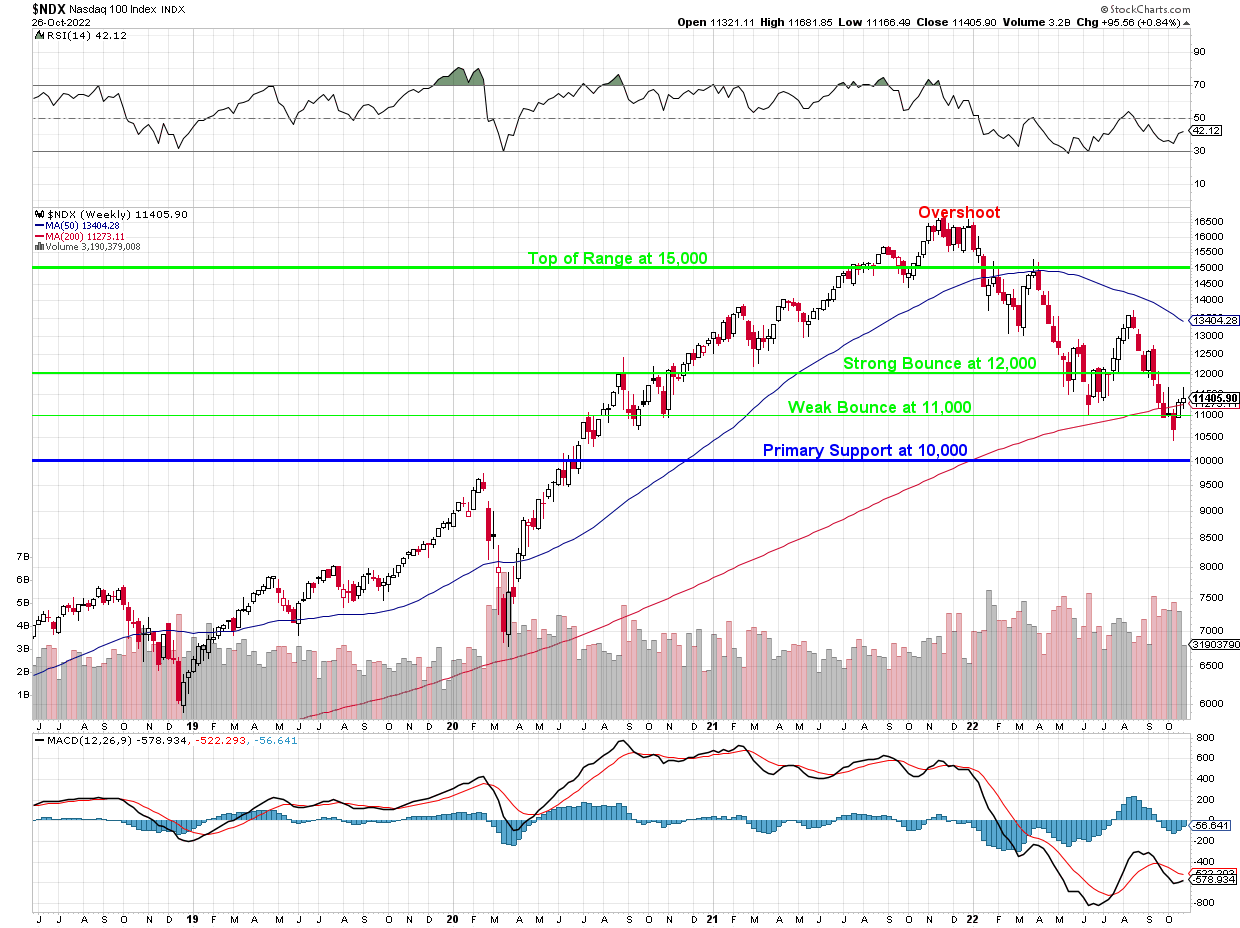

MCD figured out how to make money in an inflationary environment – as will almost everyone – eventually. None of this matters until we get AAPL earnings this evening – THEN we’ll see how much bounce the Nasdaq has left in it. Yesterday we held that 200-week moving average (barely) but that’s a nice, bullish sign considering all the reasons we had to fail it: