October was crazy!

October was crazy!

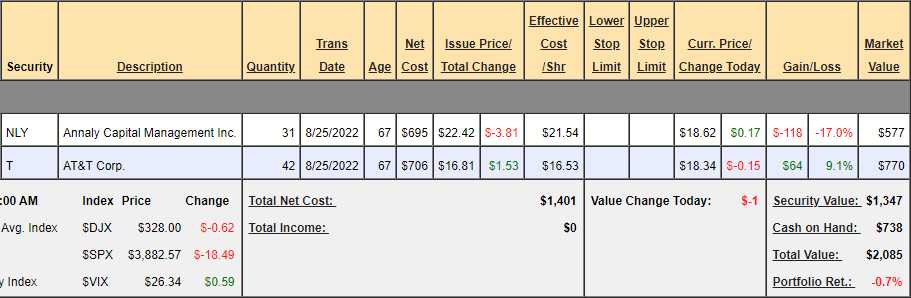

We began this portfolio on August 25th, starting out with 13 shares of Annaly Capital (NLY) and 20 shares of AT&T (T) and that was a bad time to start investing but we followed through with our accumulation game on September 28th, adding a bit more than double to each position (since the stocks got cheaper).

THAT turned out to be a good time to buy and we’ve gotten a nice pop since then but nothing to get cocky about as the Fed still seems determined to keep raising rates and cause a Recession. Of course, since this is only month 3 of 360 – we are not even 1% invested yet so it suits us just fine to have even 10% of our portfolio (30 months – 3 years!) filled with very cheap entries. Let the market make it’s gains AFTER we accumulate some good positions!

NLY screwed up our plans a little, as they did a 1:4 reverse split, which means it will take us a lot longer to accumulate 100 shares that we can start selling options against. They did, however, pay out an 0.88 dividend on Sept 29th, and that was good for $27.28 – which is 1.9% of our entire portfolio paid out in our 2nd month already.

T paid us 0.278/share ($11.676) on October 6th and that’s another 0.8% collected. We’re still down, but only 0.7% and, with another $700 added this month – here’s how the portfolio stands:

Notice how ugly the charts were when we doubled down last month. We are Value Investors – we don’t let other people tell us what a stock is worth – especially people who follow TA! If our stocks go on sale – we buy more – unless something FUNDAMENALLY changes about them.

We have, so far, put in $700 3 times for $2,100 total and the positions are hanging at $2,085 – down $15 overall and we have $738 ready to deploy, thanks to our dividends. Last month, we discussed selling a put in NLY’s cousin, Chimera Investment Corp (CIM) before they bounce away from us.

At the moment , CIM is at $6.82 and we feel the REIT space is very undervalued so we’re going to follow through with our plan to sell 2 CIM 2025 $5 put for $1.70 ($340). By selling puts instead of buying the stock, we will be getting paid $170 per 100-share contract in exchange for promising to buy 100 shares of CIM for $5 between now and Jan 17th of 2025.

We can be assigned this stock at any time, though it would make no sense for the seller to force us to buy it for $5 if it is over $5. Selling two contracts means we are obligated to buy 200 shares for $1,000 – but we collected $340, so our net would be $660 – comfortably within our cash range.

-

- Sell 2 CIM 2025 $5 puts for $1.70 ($340)

If we are assigned, we’ll have 200 shares of CIM at net $3.30 and THEN we can sell short calls. At the moment, we can sell the 2025 $7 calls for $1.20 and, even if the stock falls to $5, we are likely to be able to sell the $5 calls for $1 and that would lower our basis to $2.30 with a call away at $5. That would be great but, more likely, the stock stays over $5 and the short calls expire worthless and we keep our $360 against our $640 risk of ownership for a 56.25% profit in two years – that would be nice too!

What a fantastic way to put money INTO our portfolio while promising to buy a stock for less than half of what it trades for today. You can learn how to use these tools to improve all of your stock purchases as we trade our way to $1M – in just 357 more steps!

Have a happy Halloween,

-

- Phil