Will Biden be completely crippled on Tuesday?

Will Biden be completely crippled on Tuesday?

It’s interesting how America might change, even as the UN’s Climate Conference just began this weekend. 10 years ago, after Obama signed the Paris Climate accord, Trump “unsigned” it and the whole thing fell apart. Since then, we’ve had the 8 warmest years ever recorded – each one worse than the last. The rate of sea level rise has now doubled since 1993 with, of course, last year being yet another record.

Can we afford another 8 years of inaction? No. The global average temperature in 2022 was 1.15 degrees higher than the 1900 (pre-industrial) baseline so we’re rising (faster now) over 0.01 degrees per year and 1.5 degrees is considered the planetary point of no return – the consequences of which are generally unthinkable and, at this pace – we’ll pass it in 2050.

The climate crisis is already costing us Trillions of Dollars and, this weekend, Buffett’s Berkshire Hathaway (Geico) reported a $2.7Bn hit from Hurricane Ian alone. Unfortunately, most Billionaires own the companies causing the pollution and have no interest in sacrificing some of their profits for the common good – so the GOP has endless supplies of money to stop the Government from doing something to save the planet.

The climate crisis is already costing us Trillions of Dollars and, this weekend, Buffett’s Berkshire Hathaway (Geico) reported a $2.7Bn hit from Hurricane Ian alone. Unfortunately, most Billionaires own the companies causing the pollution and have no interest in sacrificing some of their profits for the common good – so the GOP has endless supplies of money to stop the Government from doing something to save the planet.

Anyway, don’t want to get depressing on a Monday – fate of the World at stake in tomorrow’s election – so let’s talk about the stock market!

Actually, let’s get back to Buffett and Berkshire (BRK.B) who made $7.76Bn in Q3 despite the Insurance losses and despite losing $10.4Bn in the stock market. Buffett owns $126.5Bn worth of AAPL and $31.2Bn worth of BAC, $20.5Bn AXP, $22.4Bn KO and $24.4Bn worth of CVX. Many others of course – those are just the $20s and up…

Buffett also owns $5Bn more of his own company this year through buybacks and $300 seems to be the magic number where he starts buying back the stock and that’s a $650Bn Market Cap against $31Bn in annual earnings so about 20x – despite the market losses.

That means the rest of the company: Heinz, Dairy Queen, NetJets, See’s Candies, Real Estate, Precision Castparts, Clayton Homes, Shaw Industries, Benjamin Moore, Acme, Fruit of the Loom, Duracell, Scott’s, Helzberg Diamonds, Oriental Trading… Are doing pretty well to offset $13Bn in losses, right?

As I keep saying, well-run companies know how to navigate inflation and often come out ahead in the game and these is not a better collection of well-run companies than the ones Buffett has acquired over the years. If we assume they are buying back $6Bn this year then that’s 5% of their stock off the market and that means 5% more profit per share next year for the shares that are left but the $31Bn is a raw number – and it’s very strong.

The company also has $109Bn in CASH!!! and we love cash and that’s 15% of the market cap right there. So I do like a play on BRK.B down here. For our Earnings Portfolio, we can sell 5 of the BRK.B 2025 $250 puts for $18 ($9,000) to keep an eye on them. If the stock takes off – we’ll never own them but we’ll keep the $9,000 – that’s OK with us!

Congratulations to all who followed last week’s idea to buy Natural Gas (/NG) futures at $5.67 as, this morning, it has popped to $7.13 for a $14,600 per contract gain in a week – you’re welcome! For the non-Futures players, our trade idea was to play the ETF (UNG) as such:

Congratulations to all who followed last week’s idea to buy Natural Gas (/NG) futures at $5.67 as, this morning, it has popped to $7.13 for a $14,600 per contract gain in a week – you’re welcome! For the non-Futures players, our trade idea was to play the ETF (UNG) as such:

That’s another one we can put in the STP:

-

- Buy 25 UNG Jan $15 calls for $5 ($12,500)

- Sell 25 UNG Jan $20 calls for $3 ($7,500)

That’s net $5,000 on the $12,500 spread with $7,500 (150%) upside potential at $20.

We’re already over $20 and on the way to the full gain and, as of Friday’s close, we were already at $6.90 ($17,250) on the $15s and $4.25 ($10,625) on the $20s and that is already net $6,625 so we’re up 32.5% in our first week out of 10 – well ahead of schedule. You’re welcome!

Why do the spread and not just buy the calls? Well, we might have been wrong and the spread would have given us time to roll our short calls before they dropped below the net $5,000 we paid for the spread and we could then salvage them with a longer-term play or flip downright negative if conditions had changed (like Putin declaring it was all a big misunderstanding and giving the land back). Anything can happen – we just play the odds…

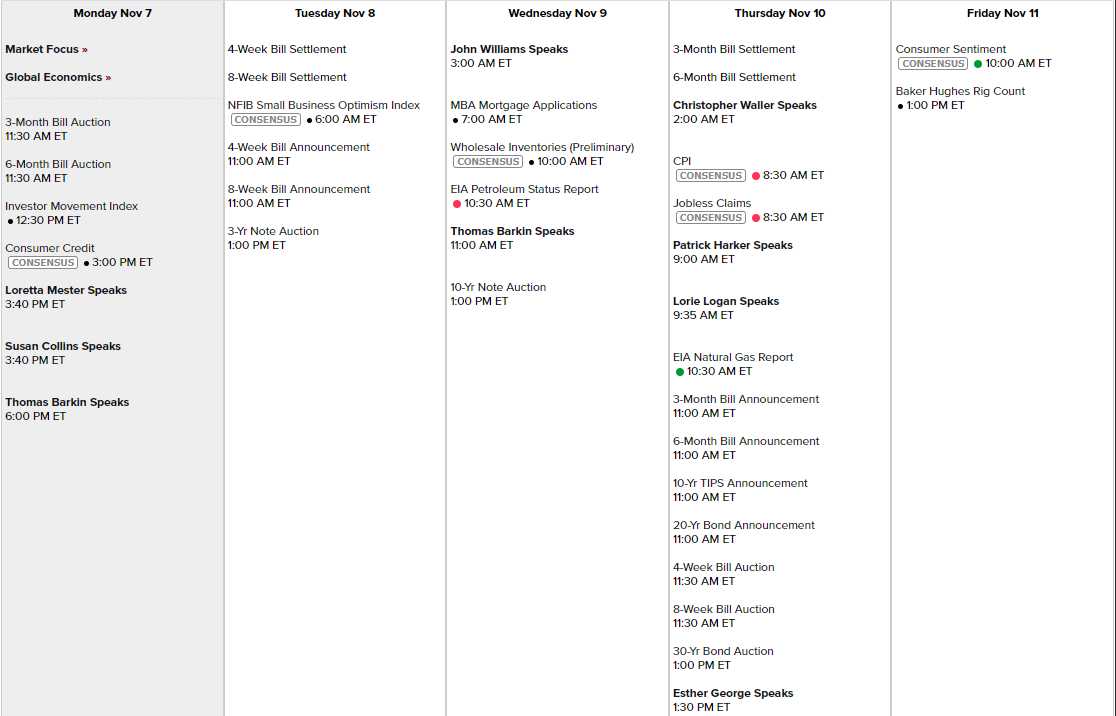

We have 9 Fed Speakers this week and 3 of them this afternoon, ahead of the elections. The market would like to see the GOP re-take the House as that guarantees Gridlock, which is their favorite form of government. I wouldn’t mind but, as I said, doing nothing is a poor option these days and we only have 13,505 days left until we’re past 1.5 degrees and then it’s pretty much game over for life as we know it on planet Earth.

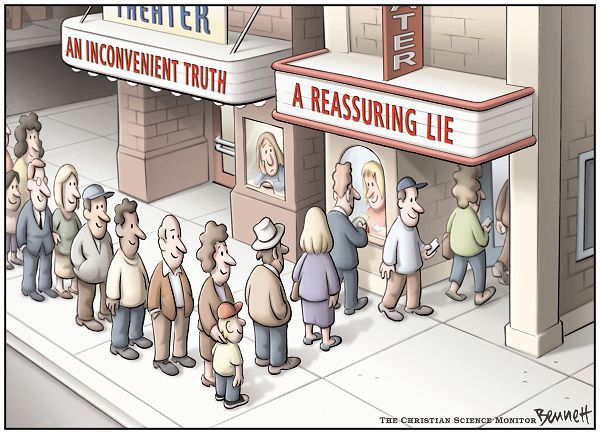

It has been 5,840 days since Al Gore’s “Inconvenient Truth” was released (2006) and he had bee whining about the Environment since the 80s. Since then he said “F it” and became a $300 Millionaire. I get it as he’s 74 so by 2050 he’ll be 102 in 2050. I’ll be 88 so I might care a little but I’m sure I’ll move somewhere that’s still nice (maybe Alaska).

I do feel bad for my kids, who will be 48 and 50 in 2050 and their kids are just screwed over completely. Still, why worry about the 2022 election – it only dooms future generations, right?

We have Consumer Credit this afternoon and we’ll see how bad that’s getting, Small Business Optimism tomorrow, the 10-Year Note Auction on Wednesday could be bad if no one wants them. CPI is a big deal for the Fed on Thursday and they have 2 speakers scheduled to spin that one, so I bet it’s bad. Friday we finish with Consumer Sentiment – election polls show that’s also trending badly.

Lots and lots of interesting Earnings Reports to keep us interested while we wait (about a month) for the election results to be litigated:

As you can see, Health Care and Technology have taken a beating so far this earnings season while Energy and Financials have been the stars.

Plenty of companies still to report and plenty of bets left to be made!