What a month it has been.

What a month it has been.

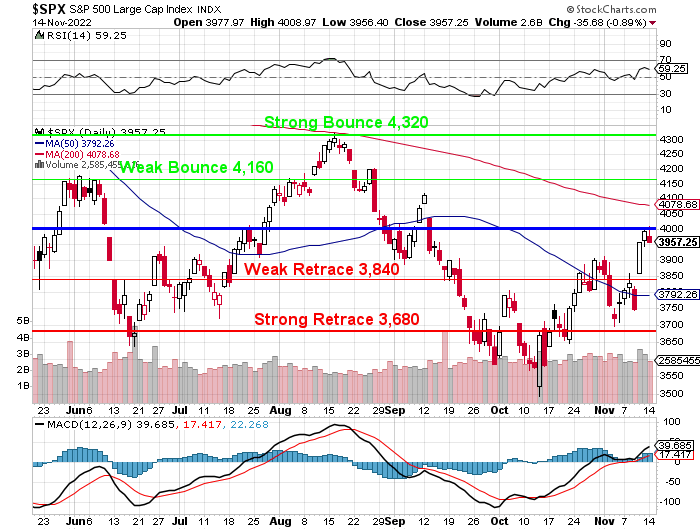

In our October reviews, on the 17th, the S&P was struggling to hold our Strong Retrace Line at 3,680 on the S&P 500 and things were looking glum but I said at the time:

“I don’t mind being between 3,680 and 4,000 – that’s all we really deserve at the moment but below 3,680 is panic and panic makes me nervous because you never know which way the herd will stampede of they get spooked. We did expect trouble overall back in August, however, so we’ve got lots of CASH!!! and we’ve been spending it adding a LOT of new positions in the past 30 days. We’re still waiting for Earnings Season to confirm it but I think the selling is at least one bracket overdone.”

Since then we’ve blasted back to our mid-point at 4,000 and this is where we predicted the S&P would finish 2022 and, as you can see, the 200-day moving average is still declining and, catalyst-wise, I don’t see any reason we should be breaking higher unless the War ends or the Fed decides to pause – neither of which are likely until Q2 – so SHOULD we keep our money in the market when we KNOW this is the top of the range?

Well, we can never KNOW for sure but, valuation-wise, we’re fairly sure of where things should be and that’s why we were buying 4 weeks ago and that’s why we are selling now. If you are not going to sell when you make profits – when will you be selling?

So, with that in mind, we’ll take a close look at every position and we’re going to need very strong reasons NOT to cash them out here. If we’re going to stick with something, we should be ready, willing AND able to put more money into the position if the market drops 20%, which is pretty much what it did from our September to October reviews.

There are many positions we did put more money into but, if we’re not going to take that money off the table when it makes a big, quick profit – what on Earth was the point of adding the money in the first place?

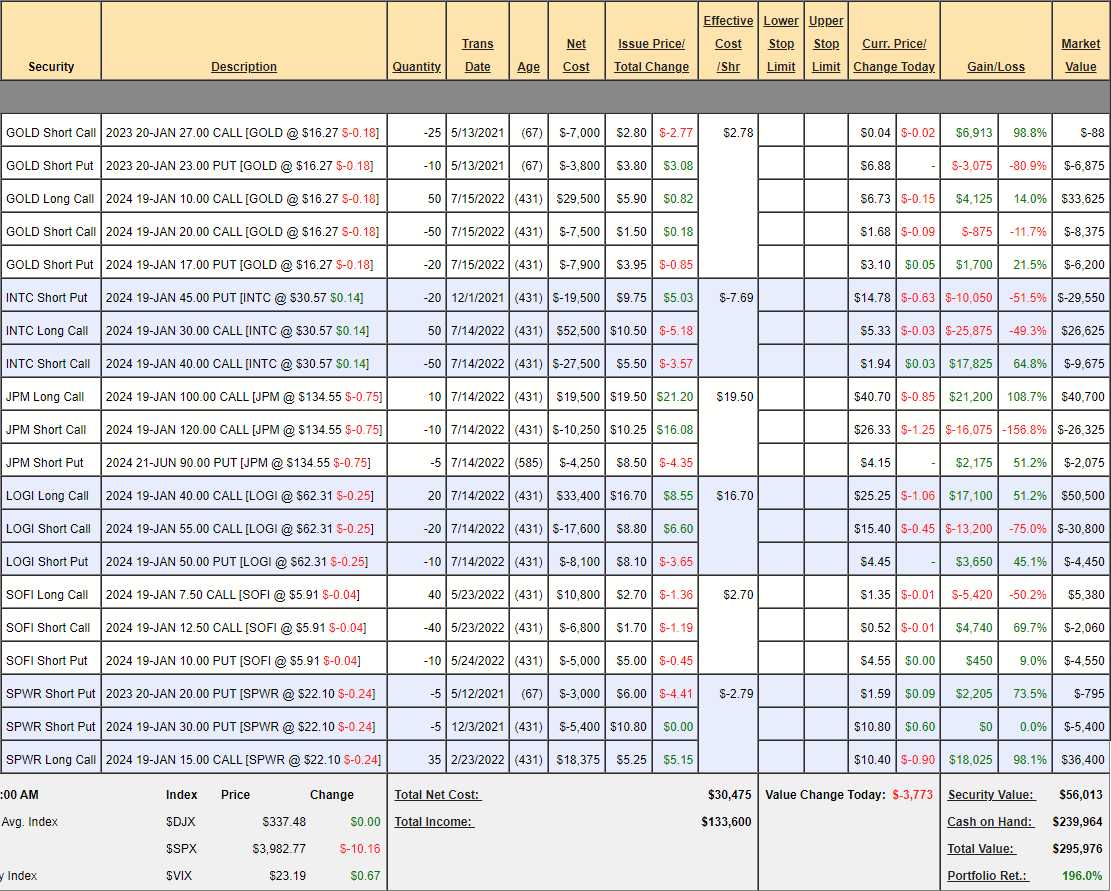

Money Talk Portfolio Review: The Money Talk Portfolio is one we keep for Bloomberg’s Money Talk and we only update it live when I’m on the show (about once per quarter) but I don’t know when I’ll be on – so I have to plan a quarter ahead for what to do with my hands tied for the next 3 months. The last time we made adjustments was way back on Aug 24th, when we were at $269,804 and cashed out about half the portfolio (as we expected a downturn). At the time we had $78,984 in cash and now the portfolio is at $295,964 (up 196%) with $239,964 in CASH!!!

The portfolio was down to $229,749 (up 129%) on Oct 17th and there was nothing we could do about it but watch and hope our positions would hold up – but they did bounce back nicely. Back in October, we ran the numbers and we had $152,021 of upside potential at $229,749 so we already gained $66,000 of it in just a month. We have to look very carefully at each position before deciding if it’s worth the risk going forward – as it will take 1-2 years to make the rest of the money ($86,000) – IF all goes well….

-

- GOLD – We love them and think they are way under valued.

- INTC – Stock of the Year 2024 (not sure about 2023) if they stay this low. Same problem they had last year, when they were in the running – no immediate catalyst and still tons of spending building new foundries makes for ugly quarters but, going forward – a stock you do not want to miss.

- JPM – Who can bet against JPM?

- LOGI – Finally vindicated on this one.

- SOFI – Still waiting for vindication (still good for a new trade).

- SPWR – Stock of the Decade and it’s only 2023.

No wonder they are still in the portfolio – all awesome but should we be riding out a recession with them? We have the cash to DD each of them if they drop 40% and that’s what we need in this ultra-low-touch portfolio (only when I’m on the show, quarterly). Still, if we have to use our CASH!!! to fix our existing positions, then we’re not able to buy new and exciting positions (like SPG) – which would have been our Stock of the Year for 2023 if it hadn’t popped 40% since we spotted it already.

Before I next do the show – we’ll take a very close look at each position and whether we have faith to leave them open for another 3 months but – if I were on today – I’d sell some calls against SPWR – just in case it pulls back. LOGI as well.

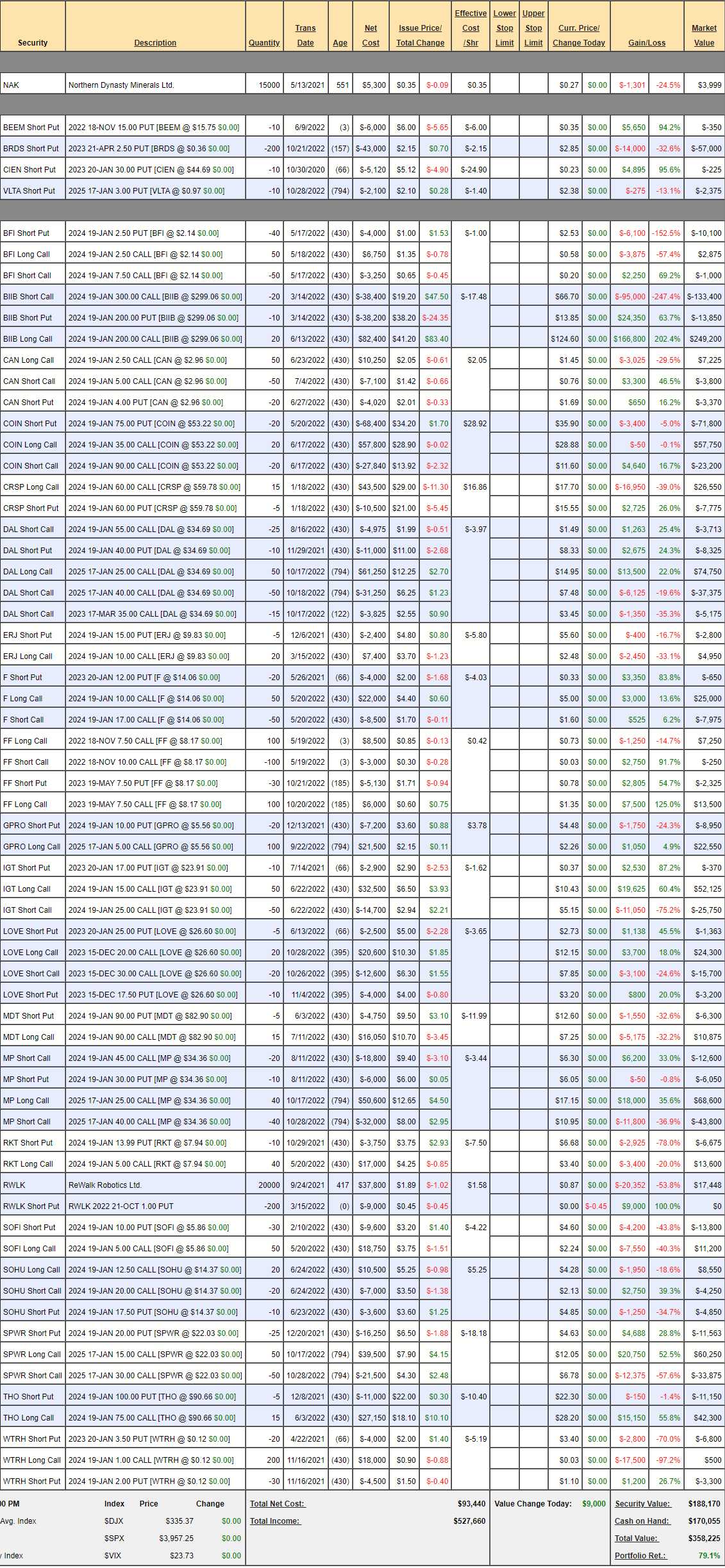

Future is Back (to the) Portfolio: This is our most speculative portfolio and it trades like it. As I said last month, the volatility is painful but it was a good pain this month as we blasted back from $256,292 to $358,225 – up $101,933 (39.7%) in 30 days. Again, that’s BECAUSE we made several aggressive adjustments and now we, in the very least, want to get a lot more defensive with these great gains (the portfolio is up 79.1% overall).

-

- NAK – Up from 0.23! Very speculative but pressure mounts every day for more Copper and Moly.

- BEEM – Holy cow, those were $4.70 last month! Expiring near worthless.

-

- BRDS – We just rolled those and they got worse. We sold the $2.50 puts for $2.15 so we’re in for 0.35 and they stock is actually at 0.30 so down 0.05 x 200 is $1,000 but the puts are currently $2.85, as if the stock were 0.15. So it’s really just a BS number that will resolve itself as time goes on.

- CIEN – Will expire worthless. Too far over target to waste money buying back.

- VLTA – We just rolled these. Ad-supported EV charging but it’s not going well. They are essentially a struggling start-up. They are spending $250M to get $64M in revenues so far but that’s double last year and enough money that, if they stopped installing screens – they’d make it back in 5 years – not terrible. But they keep installing so it’s a long, hard road and they will need more money so dilution, etc. That means, if we’re not prepared to DD and DD and DD – we should get out now. Our commitment is for 1,000 shares at net 0.90 and the stock is at 0.74 – that’s a lot of words to say we may as well play it out.

-

- BFI – My favorite burger chain! We’ve been waiting on earnings but they already popped. There are no lower calls or longer calls to roll to. Last month the 2024 $2.50s were 0.53 and now they are 0.58, so we didn’t miss anything but we will if they do well. Still, we should just be happy if it works out and we get $25,000 back on our net credit investment.

-

- BIIB – EXPLOSIVE growth in the past two months. Already at our 2024 target at net $101,950 out of a potential $200,000 and it was a net $5,600 spread so we’re already up $95,000 but still on track to double that in a year. We can sell 5 (1/4) March $300 calls for $35 and that’s $17,500 we can collect 5 times = $87,500 so there’s no need to close the spread when we have a path to collect most of the $95,000 starting now.

In other words, BIIB has hit our value target so, at this point, we sell a 1/4 cover that will begin taking our $95,000 off the table. Anything up from here means we have $200,000 covering the loss we take on the short calls while flat or slightly down gives us a huge bonus to what we ultimately collect. That is my reason for not cashing this one out.

-

- CAN – Nice recovery off bad BitCoin news (they sell chips for mining equipment) means we were right that they are not a one-trick pony and likely way undervalued at $500M ($3.15) with $1Bn in profit so far this year.

- COIN – FTX fallout hit them hard but they are a totally different kind of company. Another one I’d rather double down on than kill.

-

- CRSP – We got aggressive and bought back the short calls and things are improving. Too early to sell short calls.

- DAL – Holding up well and we are playing this for income. We have the $75,000 2025 spread and those are 1/2 covered with 2024 $55 calls and 30% covered with the short March $35 calls so net $20,162 and we stand to make $5,175 in March and $3,813 by the end of 2023 is 40% not counting the net $55,000 if we get the spread right so – keeper!

-

- ERJ – Plugging along and I still like them because of the EVTOL business.

- F – Blasting up but only about $17,000 out of a potential $35,000 in 14 months so worth keeping. March $15s are only $1.25 so 15 of those is $1,875 and that’s OK money but not worth the risk of F busting over $15 so let’s wait and see how it goes.

- FF – Just reported 0.36 vs 0.21 last Q3 and look what happened. I hate to say I told you so – no, actually I love it! Last month, I said “There’s no point in cashing the Nov $7.50 calls as we MIGHT have an upside revision but we’ll go ahead and buy 100 of the May $7.50 calls for 0.60 ($6,000) and we’ll offset that a bit when we can sell more short calls (the $10s are currently 0.15).” Now we can take the Nov calls off the table and the short Nov calls will expire worthless and Nov $10s are only 0.50 so not worth selling but we’ll probably cash out if $8 doesn’t hold.

-

- GPRO – They just beat so all is well here. Give them time to rise.

- IGT – Already at our target and net $26,005 on the $50,000 spread so pretty much a double to go and we’re very confident.

-

- LOVE – Finally coming off the floor and on track.

- MDT – Some fund is dissing them but those guys are idiots. We’re aggressive and it’s a small position (so far).

- MP – We sold short calls for income and it’s working great AND the longer position is on track to $60,000 at net $6,150 so far so it’s a nice 10-bagger in the making – if you are into that sort of thing.

-

- RKT – This is a tough one as it’s not their fault the mortgage market collapsed. They lost 0.08/share for the Q but revenues were 20% higher than expected ($1.3Bn) but they have $10.5Bn in debt and NO chance of making money this year or next. We can sell 40 2025 (yes, 2025) $12 calls for $1.75 ($7,000) to cover and that’s more than we’d collect taking it off the table so let’s do that and we’ll see how things go. If all goes well, we’ll eventually cash in the 2024 $5 calls and cover the short calls with a 2026 or 2027 spread.

-

- RWLK – I just love the technology. We actually own 40,000 shares as the short puts expired and we ended up with 2,000 more shares at net 0.55 but the stock is at 0.90 – so that worked out well.

- SOFI – Another one I strongly believe in but the environment soured and we’re taking a hit. They just beat and raised guidance but people still don’t believe in them. We’re going to have to Buffett this one and just keep buying more until people realize we’re right! Let’s roll our 50 2024 $5 calls at $2.36 ($11,800) to 100 of the 2025 $4 ($3.40)/$10 ($1.54) bull call spreads at $1.86 ($18,600) and now we’re in a $60,000 spread at net $15,950 less whatever we made when we bought back the original short calls.

- SOHU – Revenues were down and they are in China so let’s cut this one.

-

- SPWR – We bought back the short calls last month, thank goodness! The spread is on track at net $14,812 out of $75,000 and it’s $40,000 in the money so they are literally just GIVING you money as a new trade. It’s not a fad – it’s SOLAR ENERGY!!!

-

- THO – Another “I told you so” stock! NOW we can cover by selling 10 of the 2025 $100 calls for $22.50 ($22,500), which is much more than we paid for the spread and we can sell 5 (no possibility of getting hurt) March $90 calls for $10.50 ($5,250) so that’s $27,750 off the table and we’ll eventually roll the long calls to 2025 (the 2025 $75s are $32 – so just $4) to match.

- WTRH – This one is dead and we’re just seeing if the corpse comes back to life (doubtful).

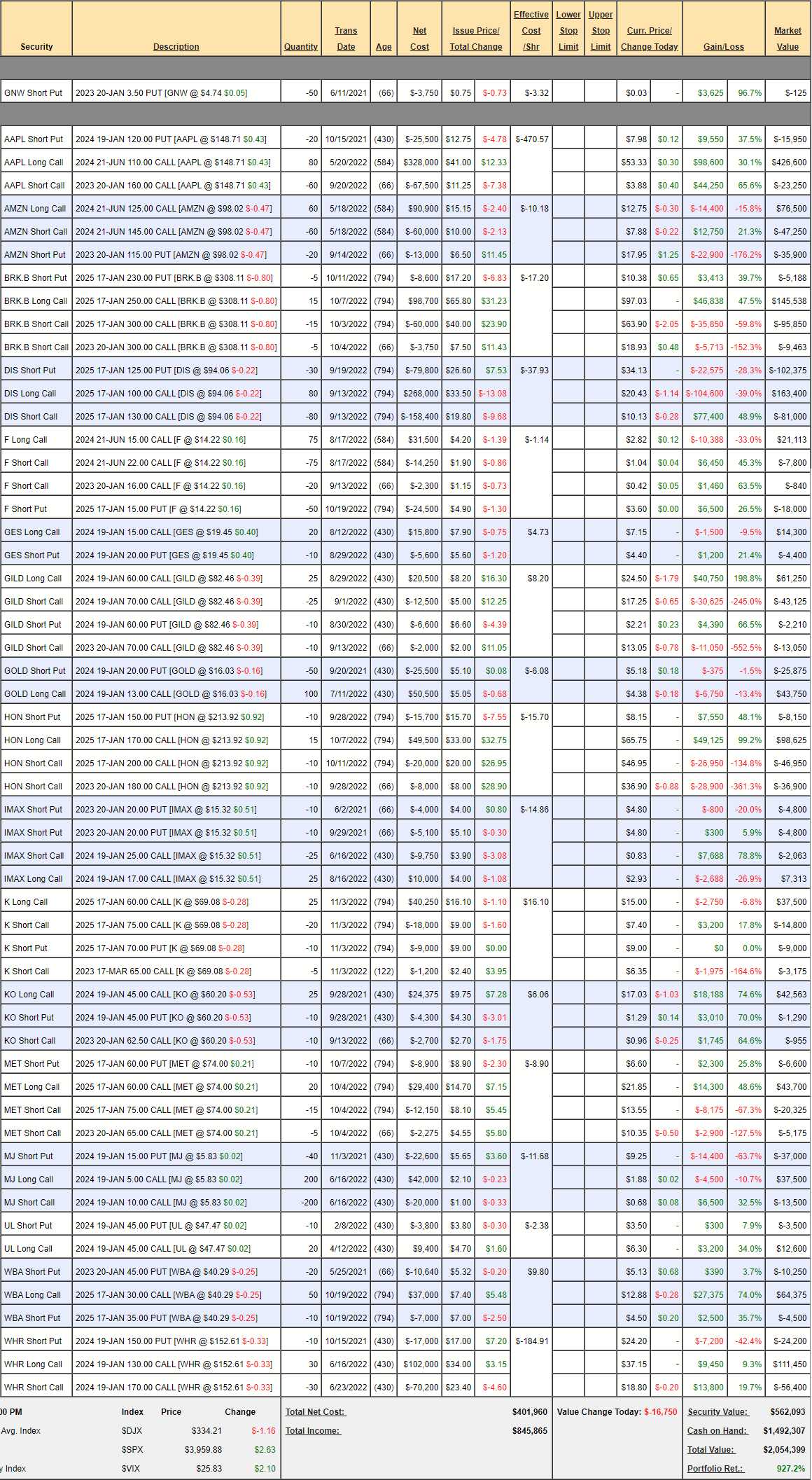

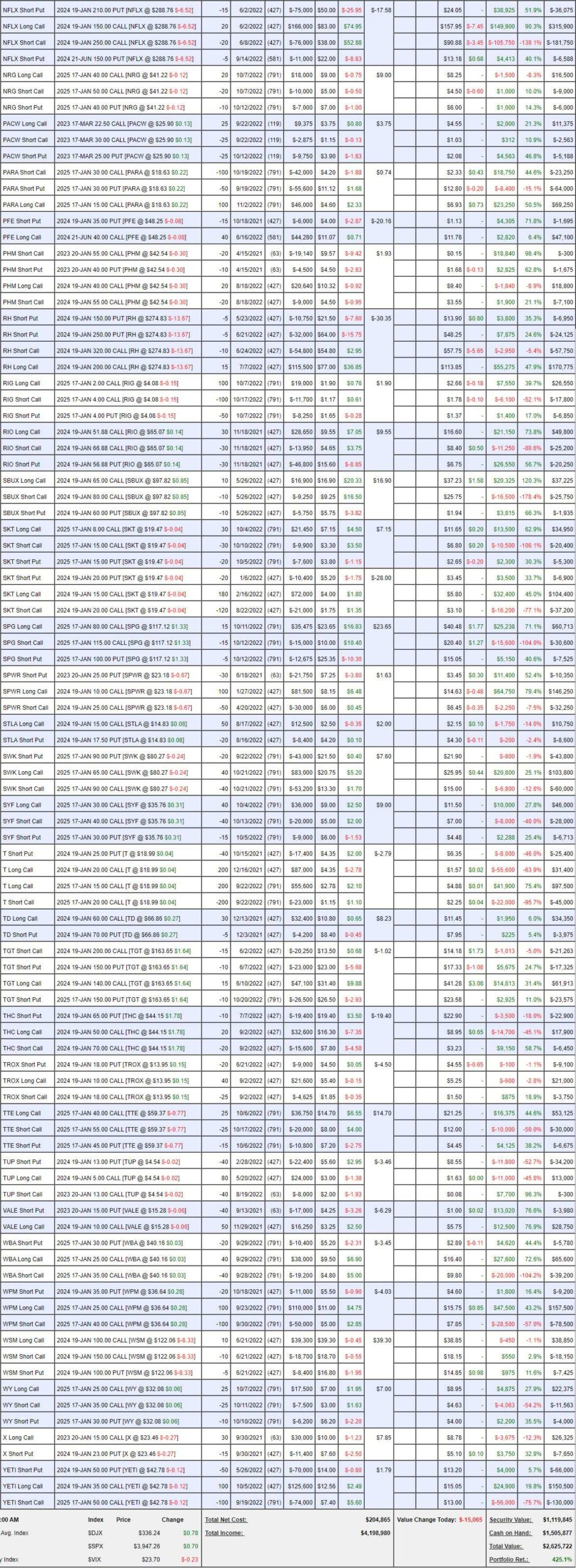

Butterfly Portfolio Review: We hit the $2M mark at $2,054,399 and that’s up $132,574 (6.8%) since our Oct 17th review. That puts our oldest (Jan 2nd, 2018) portfolio up 927.2% overall and it’s our steadiest portfolio, which most closely follows our core “Be the House – NOT the Gambler” strategy of constantly selling premium to generate income.

We’re 75% CASH!!! and, unlike our other portfolios, we don’t have goals for our positions. We take long spreads on value stocks that we think are range-bound and then we sell puts or calls against them as they travel in that range. As such, these positions are always good for new trades – since all we really care about is how much CASH!!! we can generate each quarter.

These positions are pretty much self-hedging and, of course, having 75% cash is also self-hedging.

-

- GNW – Just waiting for these to expire.

- AAPL – Last month, AAPL was at $142 and we bought back our short Jan calls ahead of earnings – in case they popped. They’ve been up and down since but nowhere overall. We are, in fact, only 60/80 covered but earnings were great and I want to give AAPL a chance to run before selling more calls. As it stands, it’s net $389,400 on a potential $400,000 spread but that’s at $160 and the short calls expire in Jan and we’ll make $23,250 there and THEN we can sell 60 2025 $180 calls, now $22 ($132,000) and 20 of the March $160s, now $8 and that will be $16,000 and if we roll our $110s ($426,600) to the 2025 $140s, now $40 ($320,000) – that’s another $106,600 off the table so $254,600 off the table and we’d still be in a $320,000 spread and ready to generate 2 more years of revenues – seems like a plan!

-

- AMZN – We thought they’d do better but it’s fine and we’ve made a ton of money selling calls this year. The short Jan puts will come down to the wire and we’ll just see how those go as we have $35,900 to gain if AMZN can pick up to $115, which is about where we’d start selling calls again anyway.

- BRK.B – Brand new and it’s so rare we add new Butterfly plays too. So let’s see, we have the 15 2025 $250/300 bull call spreads at $38,700 on the $75,000 spread less the $8,600 we collected for the short puts is $30,100 we laid out and we sold 5 of the Jan $300 calls for $3,750, which is 12.45% back in about 100 days (at the time). We had 825 days to sell so we’re on track to have a free $75,000 spread if all goes well (it never does). Notice we have a conservative $250/300 spread because, like the S&P – I don’t see BRK doing much next year – but that’s what makes it a perfect stock to sell short calls against!

-

- DIS – Ouch on this one. And we bought back the short calls. Now they are too low to sell short calls against, so we’ll just have to wait.

- F – We did sell the Jan $16 calls but not too many and they are still out of the money so nothing to do here but wait. Because of the aggressive put sale, the position is a net $9,550 credit on the $52,500 spread and we sold $2,300 worth of calls over 90 days and we have 8 sales like that to go.

- GES – We bought back the short calls and we’re still waiting for earnings but they’ve been blasting higher. This is my cotton cost theory (it got cheaper) and we’ll see how it pans out. Last month I said “I’d like to give them a chance to move back to at least $20 before covering” – so perhaps being greedy here as we should be thrilled with $19.58 but it’s a small position so I’m willing to risk it.

-

- GILD – Holy crap! Our short calls are in the money but here’s why we only sell a percentage. While the stock is up we want to take advantage and sell more short calls and the Feb $80 calls are $6.50 so let’s sell 10 of those ($6,500) as a pre-roll and, if the Jan $70 calls, now $13.05, hit $15, we’ll roll those to 10 more of the short $80s and, at that point, we’ll probably have to add more longs. We’re a bit better than break-even on this one – despite the spike.

-

- GOLD – Had a good two weeks but miles to go still. Let’s say it gets back to $20. We’d have $70,000 on our 100 $13 calls. The calls are now $43,750 so we’re better off rolling them to 200 of the 2025 $13 ($5)/20 ($2.55) bull call spreads at net $2.45 ($49,000) as those pay $140,000 at $20 and then we can start selling short calls like 40 of the March $17 calls for $1.10 ($4,400) – but not yet. 5 sales like that gets us $22,000 – which is more than we paid for the spread (we already bought back the short calls with a profit).

-

- HON – Another one that blasted off on us. Fortunately, we had a gap in our long spread but still damaging so watch this: We’ll roll the 10 short Jan $180 calls, now $36.90 ($36,900) to 20 of the June $220 calls at $16 ($32,000) and we’ll sell 10 of the June $200 puts for $10 ($10,000) for a bit of balance and we’ll roll our 15 2025 $170 calls at $66.75 ($98,625) to 30 of the 2025 $190 calls at $53 ($159,000) and we’ll roll the 10 short 2025 $200 calls at $36.90 ($36,900) to 20 of the 2025 $250 calls at $23.50 ($47,000).

When all is said and done, we’ve now got 30 2025 $190 calls and 20 short $250 calls and 20 short June $220 calls with 10 short June $200 puts and 10 short 2025 $150 puts and we originally spent net $5,800 plus a new $45,175 so we’re in for $50,975 on what is now a $180,000 spread that’s $75,000 in the money and hopefully some good income on the short calls.

This is how those innocent little Butterfly Plays explode into larger holdings. Of course we only do this when we see a good money-maker in the works. AAPL has been cut 2/3 down from what it grew to, for example.

-

- IMAX – Black Adam and Black Panther were huge for IMAX. Still not high enough to sell short calls though.

-

- K – Another new one! We grabbed them on the drop and now we’ll see what happens.

- KO – We were aggressively long and it paid off. No need to be greedy, we can sell 20 of the 2025 $60 calls for $8.60 ($17,200), which is now more than we paid for the spread off the table and we’re not even fully covered. When the short Jan calls expire, we’ll sell more short calls.

-

- MET – Doing better than we thought but no damage. We’ll roll when we have to.

- MJ – We kept this position because we expected good opportunities to sell calls. Wouldn’t be smart not to sell them. Let’s sell 40 of the April $6 calls for $1 ($6,000). For each $1 we would have to give them back, we would be $20,000 further in the money. On the whole, it’s a net $0 position for us and we’re collecting $6,000 for 157 days, which is 1/3 of our time.

-

- UL – Blasting higher, which is what we expected for earnings. Now it’s time to cover so let’s sell 15 of the 2025 $60 calls for $2.60 ($3,900) and 10 of the May $50 calls for $2.10 ($2,100). Again, collecting more than we paid for the spread for a nice little money-maker.

- WBA – Yodi’s favorite stock! Up 33% since early October is good and we’re aggressively long. The 2025 $45 calls are $5.60, so let’s sell 40 of those for $22,400 and we can then sell 15 of the April $40s for $4 ($6,000) to lock in the gains and I’m sure we can easily roll out of trouble on those. So we had a net $49,625 and we’re taking $28,400 off the table and we still have a $75,000 spread remaining.

-

- WHR – They missed by 20% but made $4.49/150 share so call it $18/yr and that’s fine with me! That means they are still to low to cover so we wait some more. No big deal as our spread is on track for $120,000 and currently net $30,850 so only of interest to people who don’t mind 300% profits over 14 months.

If they are making $18 per share, then $170 is still not even 10x earnings!

You can see why this portfolio does so well. We have a relentless focus on drawing profits out of our position – we don’t just leave positions open with our fingers crossed. We take risks when they are prudent but mostly we treat our positions like investment apartments – they don’t do us any good unless we’re renting out the space!

Continuing on 11/16:

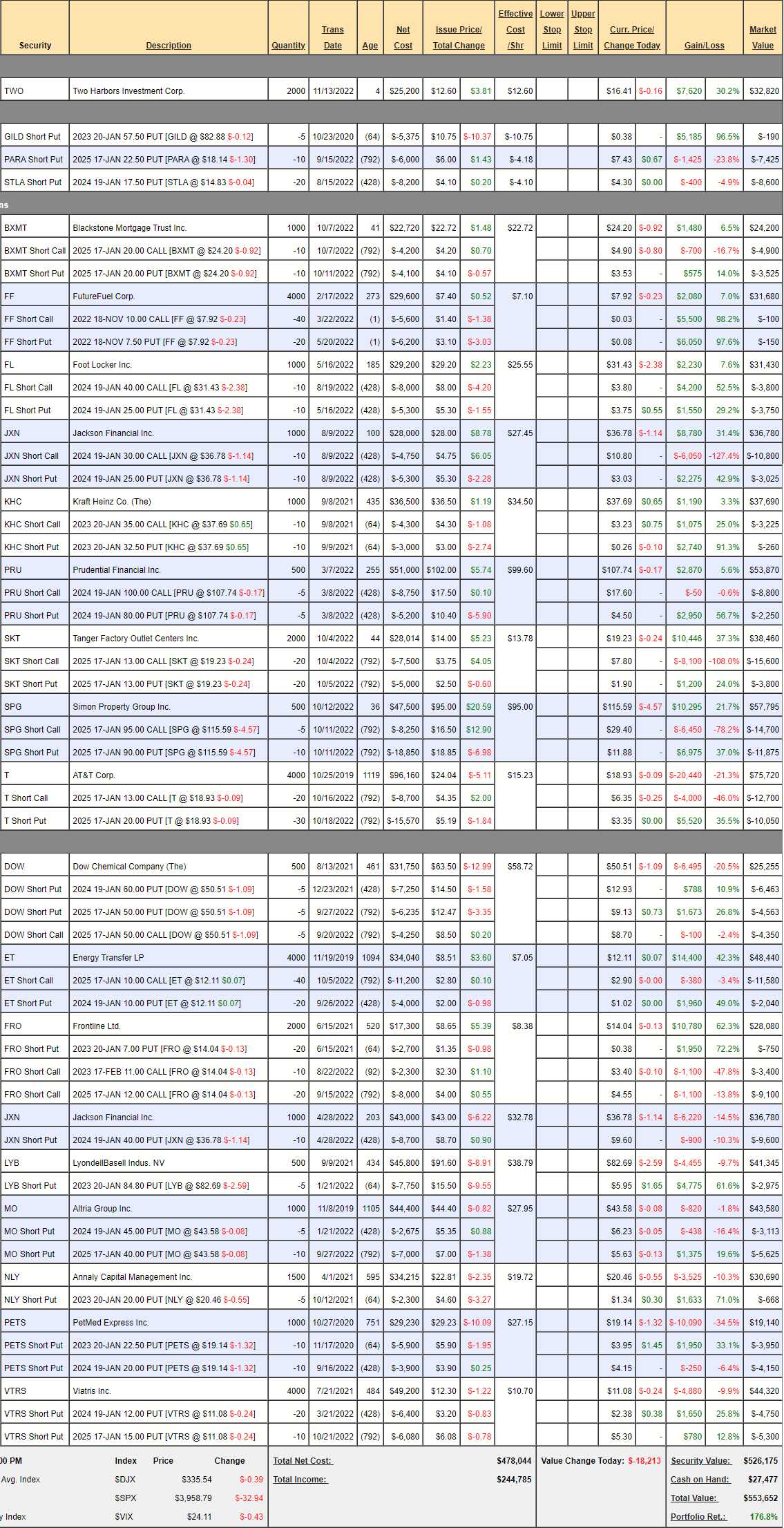

Dividend Portfolio Review: $553,652 is quite an improvement over last month’s $422,532 and that was only down $6,937 from 9/13. We lucked out as dividend stocks came back into fashion after the last sell-off. We didn’t even make many changes – so it’s a nice batch of positions.

We began this portfolio on 10/25/19 and we got hit so hard in the March 2020 crash that we added another $100,000 from the STP to the $100,000 we started with. THAT was good timing and now we’re up 176.8% but, if we didn’t have those hedges – I doubt we’d be up more than 50% now.

With that in mind, let’s see if we want to stay invested or quit while we’re ahead. This portfolio, in normal circumstances, makes about 30% a year so there’s really not much sense in risking a pullback as it would take a year just to catch up – so I’m very inclined to kill it.

-

- TWO – They did a reverse split and the stock took off and now we’re ahead so let’s cash out.

- GILD – Will expire worthless.

- PARA – I don’t want to build a full position so let’s exit.

- STLA – Same, let’s exit.

- BXMT – Housing too iffy – let’s exit.

- FF – Good profit, let’s exit.

-

- FL – Good profit, let’s exit.

- JXN – This one I could almost keep, but let’s not.

- KHZ – Good profit, let’s exit.

- PRU – Done with these.

- SKT – I love these guys but let’s exit.

- SPG – This is super-hard as I really love them and we played it right with the half-cover but let’s be happy we did and get out BUT we can leave the short puts as I’d love to get in again at net $71.15.

-

- T – Let’s roll our 20 short 2025 $13 calls at $6.35 ($12,700) to 40 of the short 2025 $17 calls at $3.60 ($14,400) and that is net $1,700 in our pockets so another 0.40/share, which brings us to a $17.75 per share average which is more than the $17 we’ll get called away at but we’ll roll to 2026 whatevers by then. Meanwhile, we keep collecting that fat dividend!

-

- DOW – We can leave this one.

- ET – Great profits, let’s cash out.

- FRO – Great profits, let’s cash out.

- JXN – This one we can leave on. It’s aggressive and I expect them to break back to $45.

-

- LYB – We kept Dow so we don’t need LYB.

- MO – I think they are still way undervalued.

- NLY – We just tripled down on them and they came back from a big loss. I don’t see a reason to deal with the drama so let’s just be happy and get out.

-

- PETS – Going nowhere so let’s give up.

- VRTS – Too undervalued to dump.

That’s much better. Just a few left to worry about.

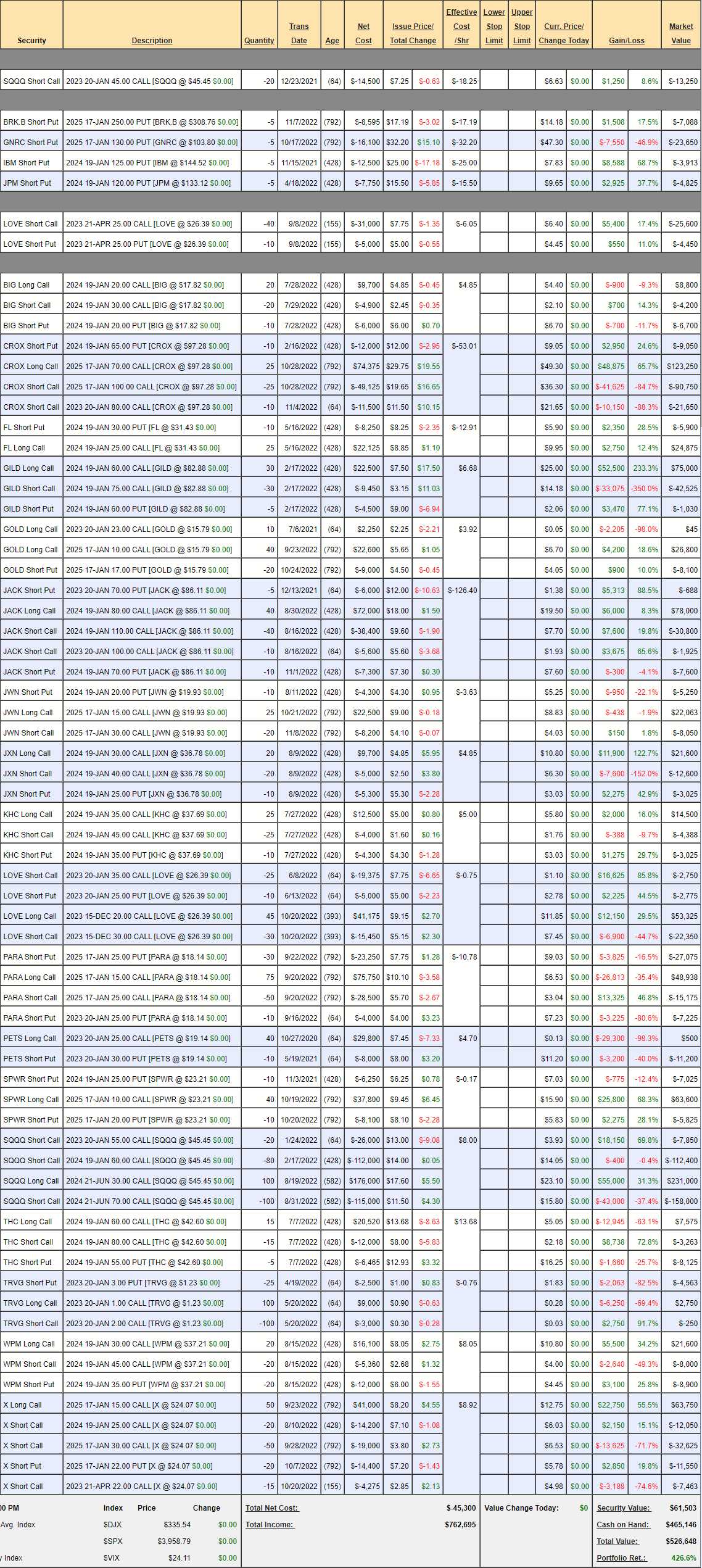

Earnings Portfolio Review: $526,648 is up 30% from $403,231 in the last review and up 426.6% overall since our 10/21/19 start. Generally in the Earnings Portfolio, we look for stocks that we think were oversold on earnings reports so, starting just before the crash of 2020 was great timing for this portfolio.

This is also the only portfolio we have that has it’s own hedge – but I don’t know if that’s a good enough reason to take a risk with a 426% gain.

-

- SQQQ – We’re looking at all of them (there’s the main batch below). The main spread is 100 June 2024 $30/70 bull call spreads that are $15 in the money ($150,000) out of a potential $400,000. We sold 80 2024 $60 calls, 20 Jan $55 calls and 20 Jan $45 calls that were down $13,650 last month – so nice escape there. With 120 short calls – it’s not much of a hedge. I’m going to come back to this later (though it won’t seem like that to you – after I see how many positions we want to keep).

- OK, I’m done with the positions and now I’ve traveled back in time to adjust the hedges. We are keeping (spoilers!) CROX, GILD, GOLD, JXN, LOVE, PARA and WPM – shouldn’t lose more than $100,000 in a downturn (before we do something about it). As noted above, the spread has $250,000 upside at $70 and SQQQ is at $45 so a 20% drop in the Nas would get us there. BUT, we have too many short calls so let’s buy back the 20 short Jan $45s (very top) and the 20 short Jan $55s and the 80 2024 $60s and that leaves us with just the 100 June 2024 $30/70 spreads at $73,000 with $327,000 upside potential.

That means we’re very well-protected and we’ll start selling short calls again to make our $73,000 back once we feel the Nasdaq can actually hold 12,000. By the way, all that happens when we buy back the short calls is the money goes out of cash to close the position – it doesn’t change our balance at all. It will use about $125,000 out of $465,000 we have laying around but then we have all these other cash-outs coming in.

-

- Short Puts – Kill them all. It’s post earnings and, if we don’t like a position enough to make it full – why keep it at all. BRK.B is brand new but up 17.5%, we could keep it but clean slate.

- LOVE – The broke lose as we closed bits of a full trade and we have more on the bottom. They are up so let’s kill these two.

- BIG – Tired of waiting – close them. Not just being capricious – look at the hits random retailers are taking – we have no way to be sure this is a good bet.

-

- CROX – This party is just getting started and the short Jans give us some cover so we’ll keep them. It’s a $75,000 spread at net $1,800 – I’d rather make the $73,200 than not…

-

- FL – We have enough shoes so let’s kill it.

- GILD – BLASTED higher. Now net $31,445 out of $45,000 and the next $13,555 (43%) seems like a lock and that’s only 14 months away. Since we are keeping a couple of positions, I can’t say I have something better to do with the cash than make 3.5% per month so I guess we’ll keep it for now.

-

- GOLD – In the running for Trade of the Year for 2023 so I guess we can keep this one.

- JACK – Messy trade but it worked out. I’m not confident enough to keep it.

- JWN – $30 target is up 50% from here – I’m not that confident.

- JXN – Net $6,000 on a $20,000 spread is too hard to close.

- KHC – It’s a target I don’t feel 80%+ sure about at the moment so we’ll kill it.

-

- LOVE – Very nice gains and still really cheap and I have faith in the target so we’ll keep it going.

- PARA – I’m not willing to close this with a loss. I think they are way undervalued.

- PETS – These I give up on.

-

- SPWR – Stock of the Decade so not inclined to close it in 2022. Net $50,750 out of $70,000 potential at $30 so I guess we will close it after all.

-

- THC – TERRIBLE so far. They missed Revenue and reduced guidance but earnings were $1.44 per $42.60 share for the Q – I still think they are worth $60 but our target was $80 so we have a net $2,055 (originally) position that is down $5,867 and the Dec 2024 $40s are $15 – so $10 ($20,000) to roll would put us in for $25,867 and we’d HOPE to get to $40,000 back at $60. Seems like too much bother to keep…

- TRVG – Not working and I don’t want to put more in so let’s just get out.

- WPM – We already have GOLD but they are both good inflation hedges (against CASH!!!) and I don’t think the target is too aggressive – so we can keep this one.

-

- X – So, when I look at the position and I’m surprised we have a profit – I guess we should cash it out!

Another one (mostly) bites the dust!

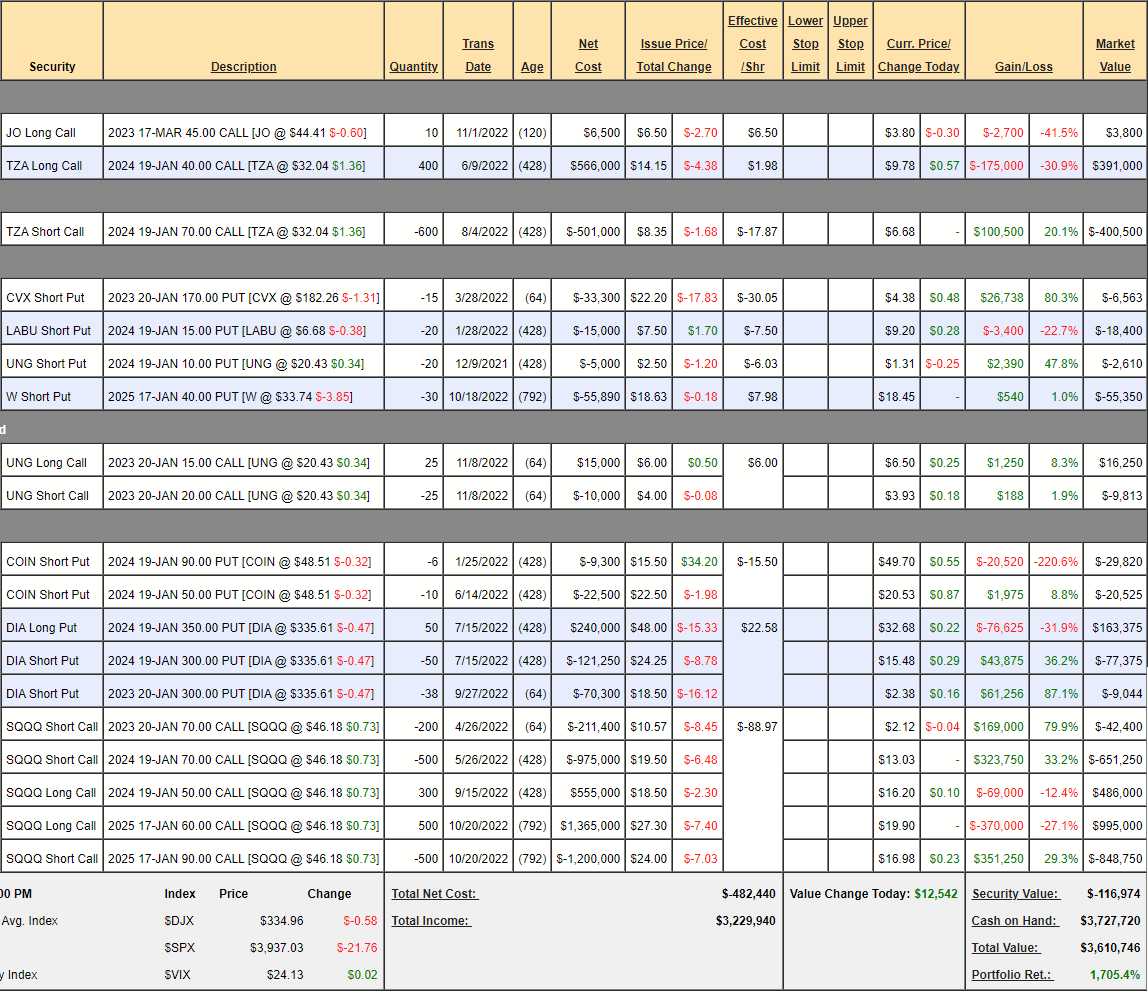

Short-Term Portfolio Review (STP): We just did an interim review on the 1st and those were great adjustments as we flipped more bearish and caught the dip. Though we’ve given some back, we’re still up substantially at $3,610,746 – and that is up over $1M from October 17th, when we had gone very bullish.

I know it is tempting to say that we called the last two turns perfectly so let’s call another but the key to control in our STP is that we KNOW we have long positions that will cover our losses if we get aggressive and miss. Now that we’re paring down our longs – we don’t have that safety net, which means it’s not smart to keep making major bets on direction – especially if we don’t have a lot of confidence.

Very simply, we’re now in the middle of the trading range and we could up or down 10-20% from here very quickly and we don’t know which – so the best move is NOT TO BET! We already have more cash ($3,727,720) than the net of our positions, we just have to determine what risks we are willing to take.

-

- JO – We made a long bet on Coffee and it went the other way. I think it will bounce here ($150 on /KC Futures), which is about $44 on JO. We’re down $2,700 and it was a small bet because we thought it would fall further and we’d double down – we just didn’t want to miss out if it didn’t fall… The June $40 calls are $7.80 – so we’ll pay $4 to roll down $5 in position with 81 more days to make money. We can offset that by selling the June $50 calls for $3.60 to cover so it will only cost us net 0.40 to roll from the March $45 calls to the June $40/50 spread. We originally spent $6.50 for 10 so now $6.90 and if we double down (20 total spreads), we spend net $4,200 ($4.20) and we’ll be in for net $10,700 and our break-even is now $45.35 – much better than where we started.

This is one of the most powerful things about options. If you stay on top of your trades and manage them well, a 10% drop (which we had here) is simply an opportunity to improve your position.

-

- TZA – We cashed most of it out and now we’re left with the $1,200,000 spread that can hurt us if TZA goes over $70 but that’s up over 100% from here and implies a 35% drop in the Russell – I don’t think that’s very likely and, even then, that’s just $70 and we’d be $1,200,000 in the money before having to pay the short $70 callers back $60,000 for each Dollar over. It’s currently a net $9,500 credit so there’s $1,209,500 upside potential and I have faith we can adjust if TZA goes higher and, if it doesn’t – we still make $9,500 if the whole thing goes worthless. Aren’t options fun?

So we’re keeping this as it’s a $1.2M insurance policy that has almost no way to hurt us. Not the sort of thing you throw out.

-

- CVX – I hate to give them money but I’d hate it even more if CVX took a dive and we lost our $26,738 gain so let’s cash this one in.

- LABU – This ETF is so annoying! I’m giving up – let’s kill it.

- UNG – We’re a mile over target so why pay $2,610 to get out?

- W – Not confident enough in the economy to stick with them – kill it.

- UNG – New legs to the above trade. Already at goal so a keeper at net $6,437 with $6,063 (94%) left to gain if UNG holds $20 for 64 days.

-

- COIN – Can they have any more bad luck? Their top competitor goes bankrupt and people dump COIN? Seems like they will benefit in the long run. All we have are short puts and I don’t think $90 is an unrealistic target but we can consolidate all 15 short puts ($50,000) into 20 of the 2025 $50 puts at $24 ($48,000) and we can buy 50 of the 2025 $40 ($27)/65 ($20) bull call spreads at $7 ($35,000) so we’re spending about $37,000 to move into a $125,000 spread that’s $40,000 in the money. Keep in mind that’s coming off a net $31,800 credit so we’re net into the spread for just $5,200 now. And that’s AFTER being down $20,520 (220%) on our original bet – that COIN would be over $90 in 2024. Now it just has to be over $45 and we’re in great shape!

-

- DIA – We’re up too much to risk the short Jan $300 puts so let’s take them off the table and wait for the next dip to sell more. That leaves us with the $350/300 spread that’s net $86,000 out of a potential $250,000 – so there’s another $164,000 worth of protection.

-

- SQQQ – Yikes! We have 800 longs, $50s and $60s and 1,200 shorts, $70s and $90s. The $50/70 spreads are not very useful, are they? The Deltas are too close so they won’t give us good gains on the way down. We wanted this on the way up (no losses) but not anymore. So what’s the best way to get more bearish?

- The short Jan $70 calls will expire worthless – it’s not even close enough that I’m willing to spend money buying it back. That will leave us with 800 long and 1,000 short – much better. I still don’t like the short 2024 $70s and we get paid net $3.95 ($197,500) to roll them to 500 short 2025 $90s – so let’s do that. The 2025 $50s are $22 so it would be $5.80 to roll our 300 2024 $50s there or $2.10 to roll our 2025 $60s there. That’s a no-brainer as we spend less money to pick up $500,000 in position so we’ll certainly roll the 500 2025 $60s to 500 2025 $50s but the 2025 $40s are only $24 ($205,000) – so now we should do that instead!

All in all, we’ve spent net $7,500 and now we have 500 2025 $40s and 300 2024 $50s and 1,000 short 2024 $90 calls. It would take a 2008-type catastrophe for SQQQ to double to $90 and, before that happens, we’d have $2.5M from the 2024 $40s and $1.2M from the 2024 $50s before we start having to pay back $100,000 per $1 over $90 to the short callers. Again, we’ll adjust long before that happens.

The current net of the spread is $61,000 – so that’s the cost of our insurance if the market goes higher and they all expire worthless. If that happens, our longs will make far, far more than enough to cover it.

So the upside potential of SQQQ is $3.64M and there’s $164,000 in DIA and $1.2M in TZA with little danger to the downside (upside for the market) in our hedges. $5M of protection means we ought to have something to protect – but we’ll still pick our longs very carefully.

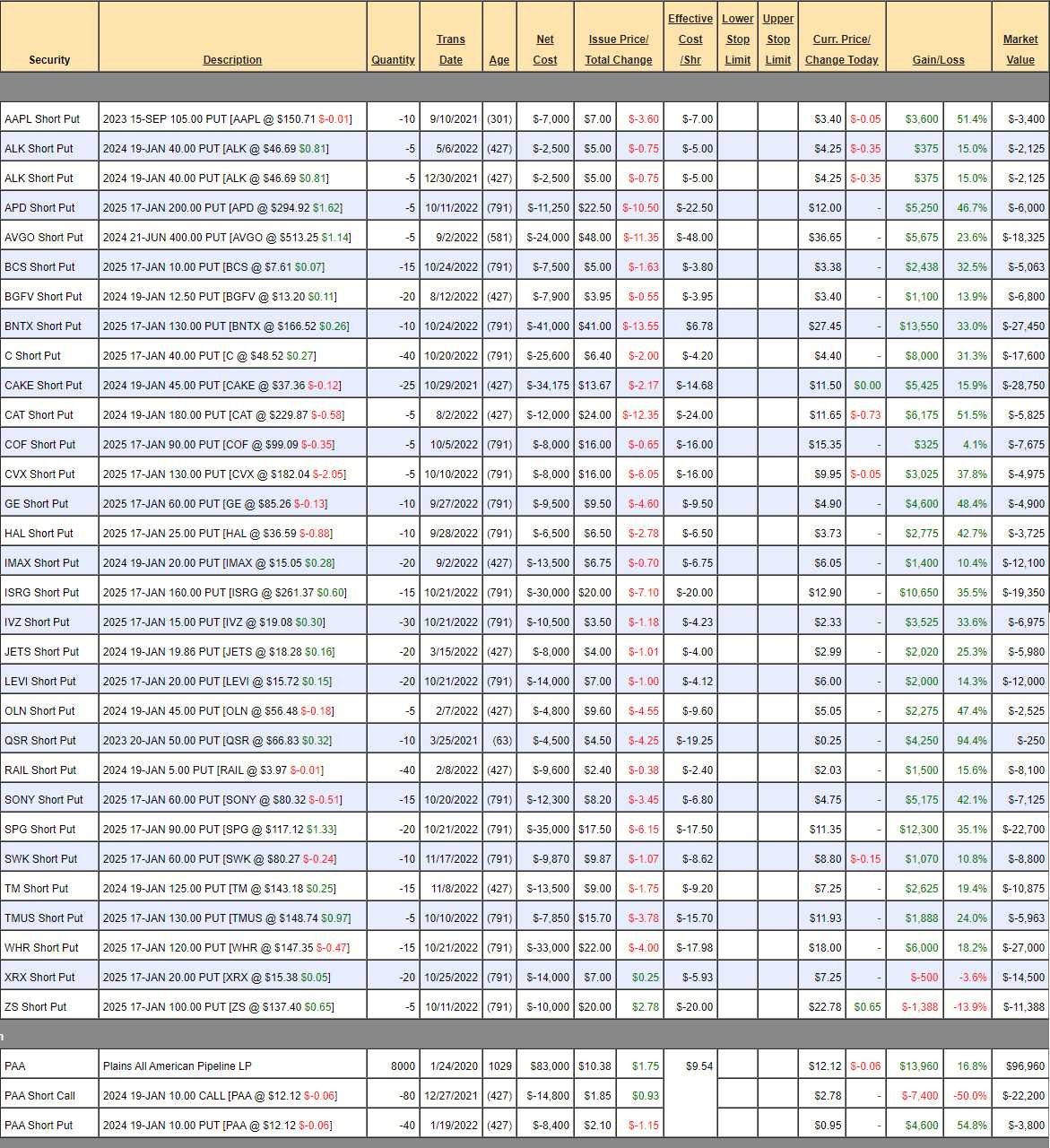

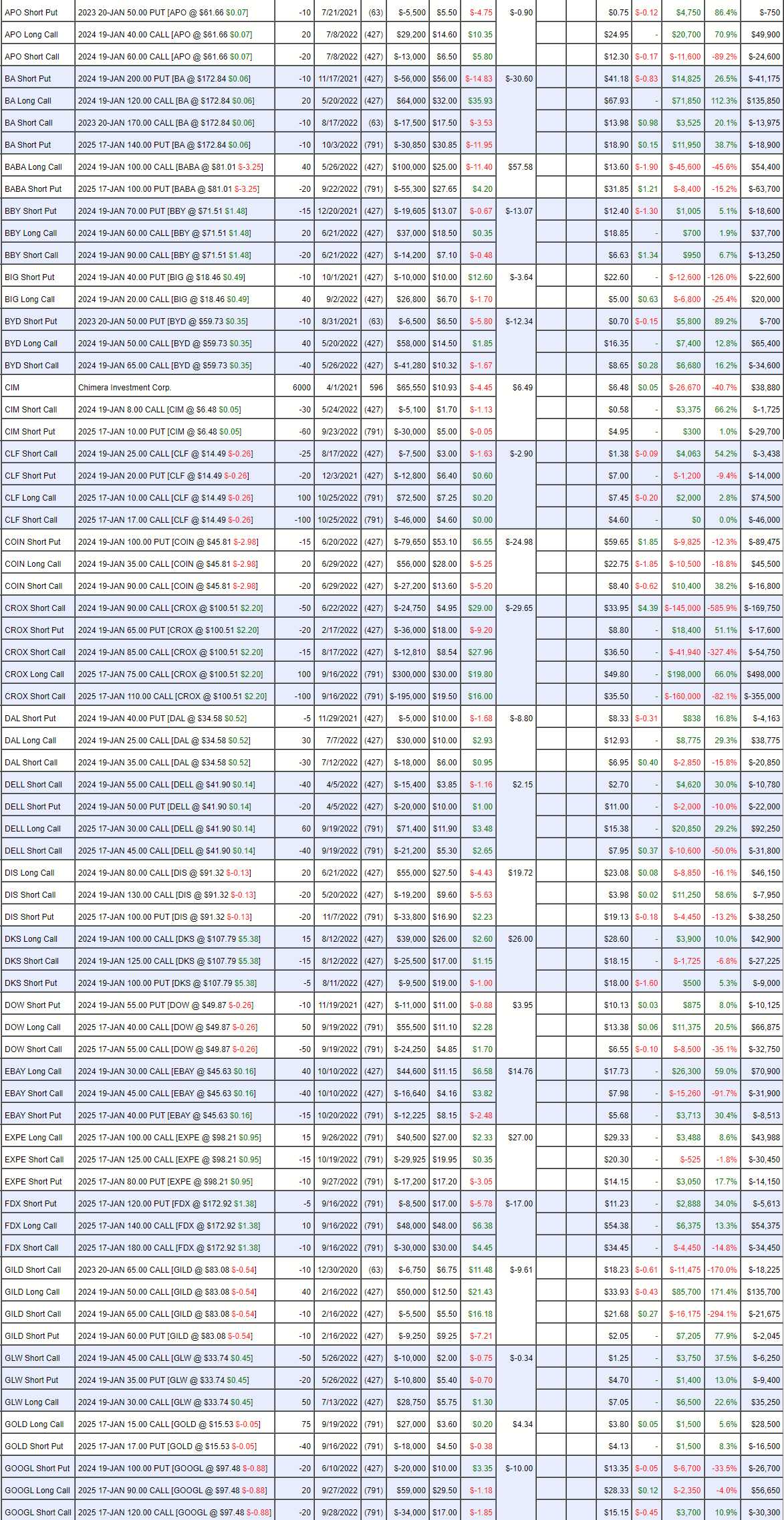

Long-Term Portfolio (LTP) Review: $2,625,722 is up 425.1% from where we started and our paired LTP/STP combo is now over $6M – $1M past our goal! – and I was going to cash out at $4M in August!!! Last month we were down $320,419 and we got very, very aggressive with our longs with the S&P down around 3,600 – now it’s up 10% and our positions have exploded but we have to recognize how unusual this is and it’s far more likely that we drop back $500,000 than gain another $500,000 over the next few months so why take the risk?

As noted in the STP Review above, we are massively over-covered with $5M in hedges against a 30% drop in the indexes – and that would only cost us about half the LTP’s value ($1.3M) – so we’d actually be way ahead if we have a sell-off.

Still, they aren’t profits if you don’t take them off the table so we’re going to be very wary of taking risks BUT, as I said last month, this portfolio has been through 3 major purges and the positions that are left are like the 1927 Yankees – every single one of them is a Hall of Fame player!

With the short puts – we have to be Ready, Willing AND Able to buy these positions if the market drops 30% or more or we shouldn’t have them. On the one hand, the STP will be up a couple of Million Dollars – so we’ll have lots of cash – but we also need money to fix our existing positions. And what about new opportunities? We don’t want to miss out on those, do we?

-

- AAPL – Short-term and yes, we’d love to own 1,000 shares for $105.

- ALK, APD, AVGO (too expensive), BCS, BGFV, BNTX, C, CAKE, CAT, COF, CVX, GE, HAL – all close.

- IMAX – Like them too much.

- ISRG, IVZ, JETS, LEVI, OLN, QSR, RAIL, SONY, SPG, SWK, TM, TMUS, WHR, XRX, ZS – all close.

-

- PAA – Safely on track and pays a nice dividend.

-

-

- APO – Done

- BA – Done

- BABA – This we can take a chance on and see how far they go now that relations are thawing.

-

-

- BBY – We’ll see how Christmas goes.

- BIG – I’d like to see earnings before deciding.

- BYD – Hate to but kill it. We’re miles ahead of target.

-

- CIM – Paying 0.23 on Dec 29th. I’d rather DD than get out but waiting and seeing.

- CLF – If there’s a Recession, I don’t want to sit on this so we’ll kill it.

- COIN – I think they’ll be a survivor but rough ride ahead.

- CROX – We’re playing this like a Butterfly and there’s an insane amount of premium in the short 2024 $90 calls so it would be silly to close it and pay that.

- DAL – I hate to close it but we should.

- DELL – I think they are just breaking up and I like the spread so keeper.

-

- DIS – Too much risk, kill it.

- DKS – Kill it.

- DOW – Kill it.

- EBAY – Sadly letting it go.

-

- EXPE – Kill it.

- FDX – Disappointing anyway, kill it.

- GILD – We’re taking $90,000 off the table so shouldn’t be sad.

- GLW – Kill it.

- GOLD – You know I love them too much. Possible Trade of the Year.

GOOGL – Still cheap and I’d love to own them in 10 years so keeper.

-

- HBI – Big winner for us last time we stuck it out so keeper.

- HPQ – Too good to drop (income producer).

- IBM – $50,000 out of $75,000 we’ll take it and run.

- IBM 2 – $45,000 out of $75,000, sadly we’ll kill it too.

- INTC – We’re in for the long haul.

- JD – Like BABA, I think they are coming around.

- JPM – We liked it enough to buy it twice, so we’ll stick with them. If you have to own just one bank stock in a Recession – it should be JPM.

- KHC – Kill it.

- LABU – Too much work – kill it.

- LEVI – I want to see how this plays out.

- LMT – Our stock of the Century and it’s only 2022! $50,000 out of $70,000 but so far in the money there’s no point in cashing it in with a year to make 40% more.

-

- LOGI – I’m happy with the quick gains, kill it.

- LVS – Great gains, let’s take them and run.

- MDT – Too cheap to sell.

- MET – No sense in taking a loss, we can roll these along.

- META – We just rolled these to aggressive longs.

-

- MGM – Kill it.

- MO – I have faith for the long run.

- MRNA – I’m certainly not going to pay $69,975 NOT to own the stock at $120 so we can leave the puts and cash in the bull call spread at about 1/2 of the potential.

- MT – Kill it.

- MU – Kill it.

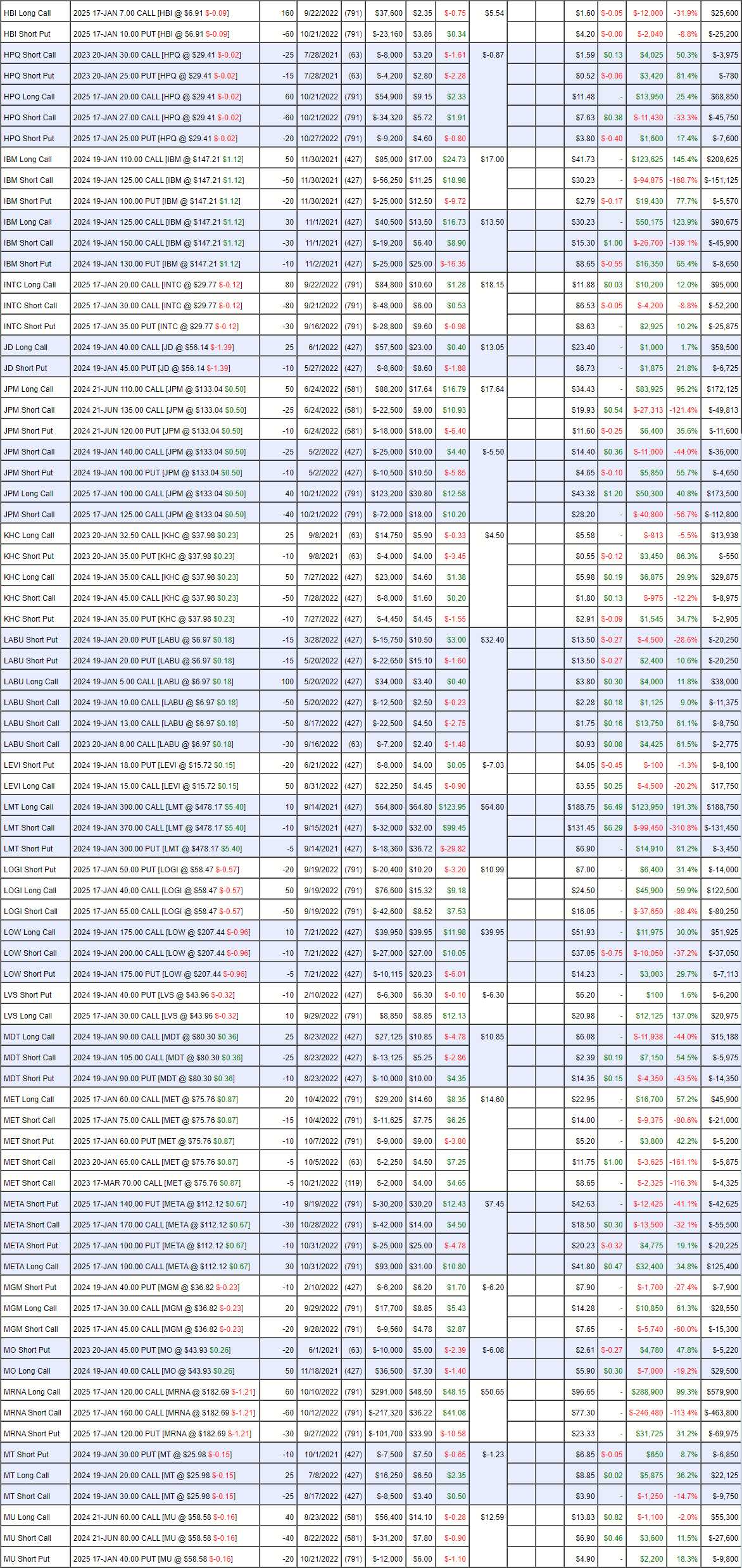

-

- NFLX – Way over target with a lot to gain so keeper.

- NRG – Tough one but kill it.

- PACW – Kill it.

- PARA – I would be so mad if I missed the rally so keeper. Net $20,000 credit on the $150,000 spread that’s $35,000 in the money – I like the odds!

-

- PFE – Who throws away a free ATM?

- PHM – Good earnings. Not enough confidence they can ignore a Recession so kill it.

- RH – Great profits so Kill it.

- RIG – This is our hedge against oil prices rising.

- RIO – Let’s cash the bull call spread and leave the short puts.

-

- SBUX – Labor issues, I’m out.

- SKT – Love them so much but we’ll cash out now and buy on the next dip.

- SPG – Made nice, quick money but let’s take it and run.

- SPWR – Stock of the Decade and the decade is young but this spread is about $100,000 out of $150,000 (at $25) so let’s call it a day.

STLA – I think they are consolidating for a break-out.

SWK – $100,000 spread at net $0 and I don’t want the net $0 so… keeper.

SYF – New and on track.

T – Finally starting to gain ground.

-

- TD – Just starting to come around.

- TGT – Big disappointment but we’re still ahead. Let’s give them time.

- THC – Huge disappointment but too cheap to let go.

- TROX – Value is too good to dump.

- TTE – Let’s cash the bull call spread with a nice profit and leave the short puts.

-

- TUP – Big disappointment. Kill it.

- VALE – Let’s take the nice profits and run.

- WBA – Net $20,000 on the $40,000 spread. Can’t sell Yodi’s favorite stock.

- WPM – Net $60,000 on the $150,000 spread. I’d rather buy more than kill this.

-

- WSM – Disappointing. Kill it.

- WY – Only net $7,000 on the $25,000 spread so let’s hang on.

- X – Not enough fait – kill it.

- YETI – Told you so! It’s still a net $46,000 credit on the $150,000 spread (because we sold super-aggressive puts) so we make $196,000 at $50 in 16 months. This could be our whole portfolio! Maybe Trade of the Year…

So, aside from the puts, we’ve cut 34 positions – roughly half of them. I feel much better going forward as YETI alone would make up for the STP losses if things go well in the markets (and YETI doesn’t particularly screw up) and, if we do have a massive drop – it will be raining CASH!!! from the STP and I’d be thrilled to double down on the remaining positions.

Now we can relax into the holidays!