It’s that time of year again.

It’s that time of year again.

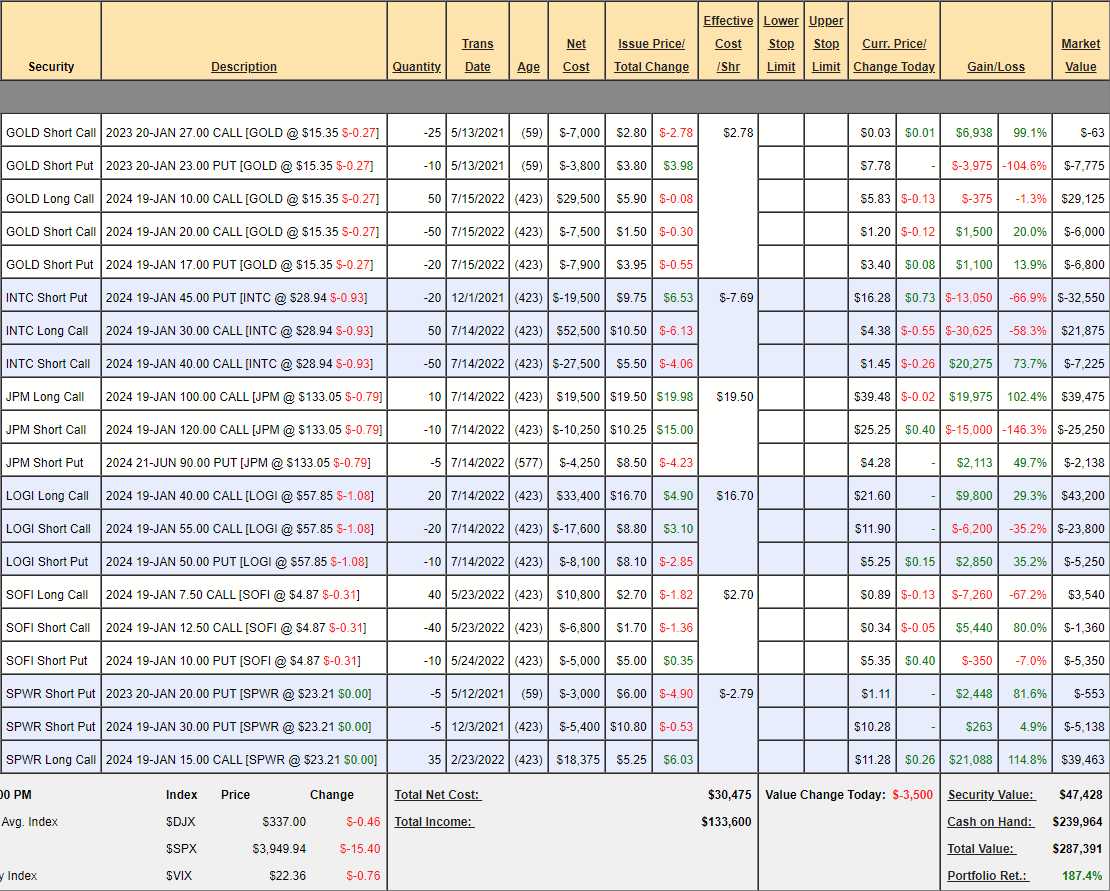

We usually pick our Trade of the Year around Thanksgiving and, this year, it will be next Tuesday, when I’m scheduled to be on Money Talk in the evening (airs Wednesday) live at the TD Wealth Conference in Toronto. The Money Talk Portfolio, which we only adjust live for the show about once per quarter, is mainly in CASH!!! with a $287,391 total value (up 187.4%) and $239,564 (83.3%) in CASH!!!

The image above, by the way, is what happened when I asked DALL-E to make me a graphic for “Trade of the Year 2023”. I think Graphic Designers will be secure in their jobs for a bit longer…

As you can see in the Money Talk Portfolio, we’ve cut down to 6 positions and we’re in the same place we were last year where I love INTC but it’s still a year to early for it to be our Trade of the Year. Intel is spending $20Bn building foundries for their next generation of chips and traders hate it when companies build infrastructure for the future – they only care about the next quarter.

That gives long-term investors like us an advantage. Despite all the spending, INTC still drops $8Bn to the bottom line and $28.94 is just a $119Bn market cap – only 15x current earnings but they made $20Bn a year before this investment cycle and will again by 2025 so NEXT year, if INTC is down this low – it would be a certain winner for Trade of the Year and we look forward to investing more in the position we have now ($23,400 loss currently on the $50,000 spread).

GOLD we have plenty of faith in and we’ve been playing it for income, selling $10,800 of January puts and calls for a small ($3,025) profit so far but the rest of the spread was net $14,100 so that’s a nice 21.4% return on the spread since May while we wait for GOLD to recover.

GOLD we have plenty of faith in and we’ve been playing it for income, selling $10,800 of January puts and calls for a small ($3,025) profit so far but the rest of the spread was net $14,100 so that’s a nice 21.4% return on the spread since May while we wait for GOLD to recover.

JPM already popped from $110 in July to $133 though the spread we have is only net $12,087 out of a potential $20,000 so $7,913 (65%) more to gain in the next year is not bad when we’re already $10 in the money. LOGI also popped over our target already – net $14,150 on the $30,000 spread has over 100% left to gain next year.

SOFI is a favorite of mine and cheaper than our entry at a net $3,170 credit on the $20,000 spread, so there’s $23,170 of upside potential at $12.50 – but we’re a long way from that target. SPWR is already our Stock of the Decade with a $4Bn market cap at $23.21 but they have gotten a bit ahead of themselves now and we will be cashing this one out with a $23,939 (240%) profit in less than a year.

Just because we love a stock, doesn’t mean we don’t sell it when it gets over-valued. SPWR will be lucky to make $100M next year, so 40x earnings is ahead of itself – our target was $22 and I’d rather have the cash than cover it for now.

All strong candidates, but it takes more than a good value to make a Trade of the Year – we also need to have a clear catalyst that will move the stock higher in the next 12 months. Unfortunately, the coming Recession makes this very tricky so the stocks we’ve been looking at are ones with very low p/e ratios, high levels of earnings per employee (so as to be less likely to be affected by rising wages) and low levels of debt (so as not to be buried with debt service as the Fed raises rates).

We began assembling our watch list on Sept 22nd in our Live Member Chat Room, when the Fed had just raised rates by 0.75% and Chairman Powell promised us PAIN!!! In the morning post that day, we jumped on AT&T (T) at $16.25 and it would have been our Trade of the Year for 2023 but now it’s $18.84 – so we have to think about whether it’s worth chasing.

We also put up a trade on RH, which blasted from $240 to our goal at $303 but is now back to $263. That trade idea was:

-

-

- Sell 5 RH 2025 $140 puts for $20 ($10,000)

- Buy 10 RH 2025 $200 calls for $120 ($120,000)

- Sell 10 RH 2025 $300 calls for $80 ($80,000)

-

That’s net $30,000 on the $100,000 spread and all RH has to do is get back over $300 and we make $70,000 (233%). The risk is being assigned 500 shares of RH at $140 ($70,000) and, if you lose all $30,000 on the spread, the net is $200 ($100,000) – still 20% off the current price as our worst case. Since we can then turn around and SELL 2027 $200 calls for $120 and knock our net down to $80 – I really don’t see how owning this stock would upset me.

The $140 puts are now $21 and the $200 ($125)/300 ($83) which makes it net $31,500 – about where we started so still good for a new trade on that one but Recessionary pressures make it hard to call it a Trade of the Year. More to the point was my caution to our Members at the time:

“Again, with any stock you buy in this environment, make sure you are HAPPY to double down on it if the market drops 20% and, if you are not, make sure you stop out of the position with a 20% loss (net $24,000 in the above case) so you don’t get caught in a long-term stock market crisis. If the market does drop 20% – there will be lots of fun things to buy with our remaining 80%.“

That led us, later that morning, to come up with a list of stocks that we think have potential for 2023, we pared it down, but here are the contenders:

Stocks to check on: MMM, GE, DOW, BA, HON, NFLX, ZS (security), IEP, GNRC, PARA, META, DIS, GOOGL, MGM, YETI, BKNG, TGT, WMT, HAL, SLB, MET, COF, SYF, ALL, THC, OMI, TNDM, UHS, DAL, MIDD, VMC, WY, NRG, TMUS, TTE, APD, T, V, ET, CMCSA, PM, F, STLA, TROX, DOW, LYB, GILD, RIO, LEVI, JXN, AVGO, BLK, IP, PACW, GOOGL, PBR, MRNA, AKAM, EXPE, NKE, BRK-B, CIM, WBA, TGT, WMT, HAL, PARA, SPG, APD, BXMT, RIG, SLB, TTE, MET, ERJ, FF, LOVE, SWK, SYF, VALE.

That’s our base list and we have to eliminate 69 out of 70 contenders to get to our Trade of the Year between now and next Tuesday. We’ll be discussing it on our Live Member Chat Room (and, Members, please remind me if there are any good ones I missed).