Is the the last hurrah for US shoppers?

Is the the last hurrah for US shoppers?

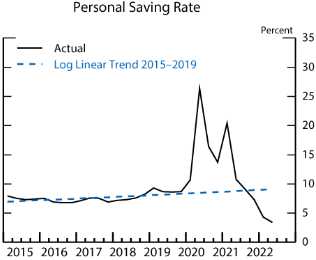

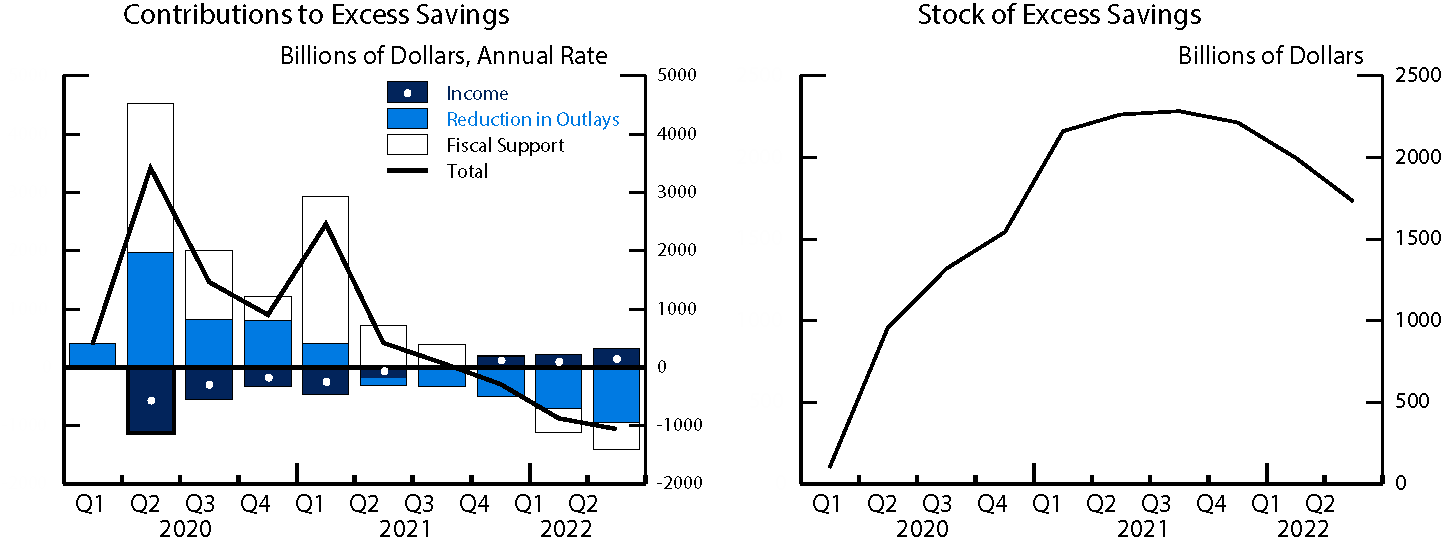

It won’t be for the Top Half of earners, who are still sitting on $1.35Tn (80%) of the excess savings put away during the pandemic but the bottom 50% are down to their last $350Bn (20%) at a time of year when $1.5Tn will be spent putting gifts under the tree and preparing holiday feasts for the family (and perhaps even putting snow tires on the car).

I live in Florida and we’ve heard of these things calls “coats” and “jackets” and “sweaters” and “boots” – but we have absolutely no idea where you can buy such a thing. Actually, we do have ONE (1) North Face store – in the Sawgrass Mall, between Miami and Fort Lauderdale.

Exotic items aside, prices are officially up 7.7% since last year, which turns $1.5Tn in spending into $1.62Tn just to keep up with last year. That’s $120Bn more Dollars drained from those savings accounts in order to have a happy holiday.

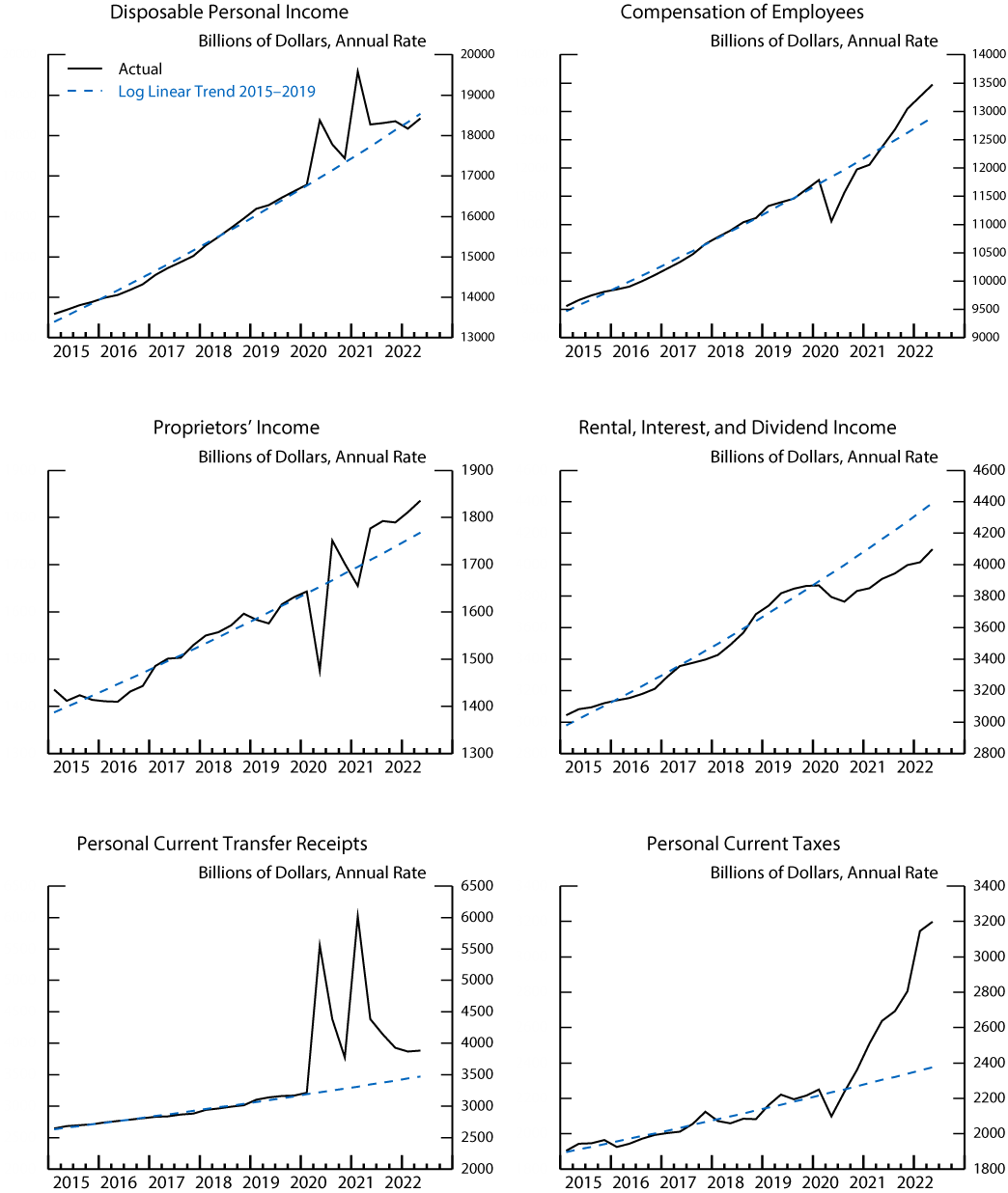

Notice that Disposable Income has turned negative as well due to the near elimination of Transfer Receipts (stimulus) vs the past two years, though there was still $844Bn worth of Stimulus delivered in the first half of the year – one HALF of the total savings consumers still have. Rents, unfortunately, went up $844Bn and taxes went up $745Bn – but that was mostly because the ultra-rich made some outrageous amounts of money on rents and such…

And, speaking of the rich, for all their whining about having to increase compensation to employees, wages only rose $77Bn in the first half of the year, not even 10% of what the employers had to pay in taxes on their excess profits so, if $745Bn was 40% in tax (as if they pay 40%), then profits were up $1.862Bn for the Top 10% and their companies.

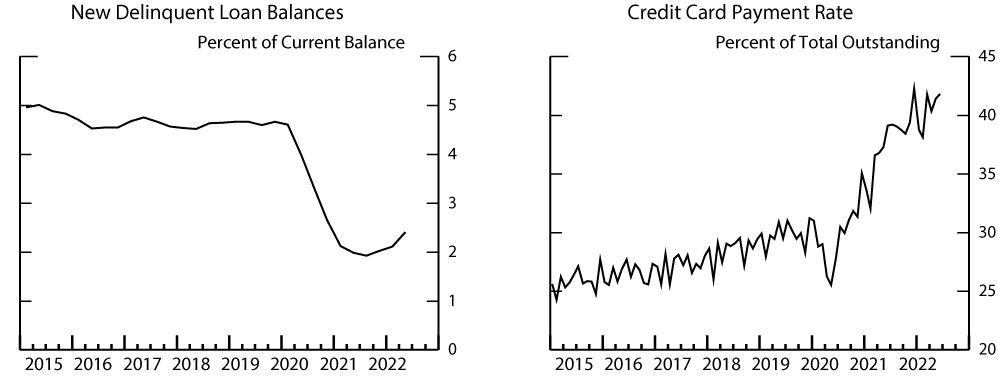

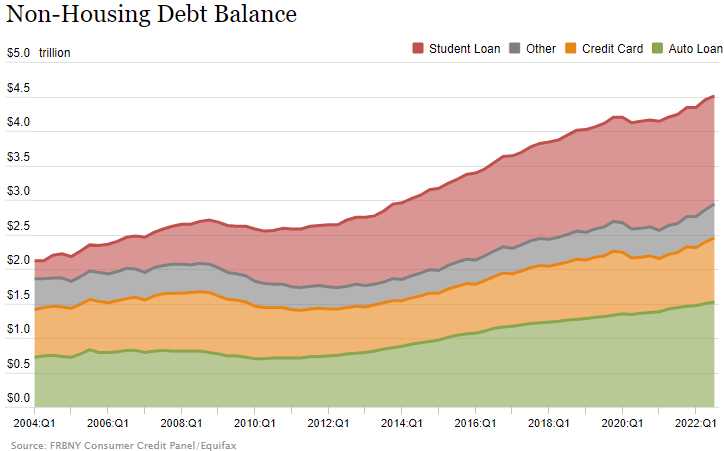

So far, the poor have been trying to keep up by charging more on their credit cards with non-mortgage debt now over $4.5Tn – more than double the $2.7Tn we had in 2008 and, at the same time, interest on that debt is already 4% higher than it was last year – with more rate hikes ahead. That’s causing a sharp uptick in credit card debt and Christmas hasn’t even started yet!

If it can get past being blocked in the courts, Biden’s Student Loan Forgiveness program is expected to knock $400Bn off that total, but that’s over 10 years so it will have essentially no impact if they spread it out over that time or little impact if they knock off the $400Bn up front. Either way $4.1Tn is still up a lot (52%) from $2.7Tn.

As it stands now, a whopping 25% of US households SKIPPED Thanksgiving this year to save money – figure HALF of the bottom 50%. 33% planned to have smaller dinners and 88% (all but the Top 12%) planned on have less dishes than last year. I don’t need to tell you that even the smallest cutback in consumption can have this country overrun by Turkeys as early as March!

As it stands now, a whopping 25% of US households SKIPPED Thanksgiving this year to save money – figure HALF of the bottom 50%. 33% planned to have smaller dinners and 88% (all but the Top 12%) planned on have less dishes than last year. I don’t need to tell you that even the smallest cutback in consumption can have this country overrun by Turkeys as early as March!

Overall, 45 percent of the country say they feel financially stressed by Thanksgiving 2022. Gen X Americans have the least amount of stress (33%) while Gen Z is feeling it the most (54%). In terms of dollars and cents, one in five Americans doubt they have enough money to afford a traditional Thanksgiving meal this year. Although 52 percent say they’re spending the same on their holiday groceries, 33 percent are slashing the budget.

All this does not bode well for Christmas – especially in states where Santa has to wear long pants (not us!). Actually, we should be very concerned about the deteriorating Consumer Situation and we’ll be looking closely at Black Friday and Cyber Monday data next week. A lot of Retailers have been hanging on for this Holiday Season but it may be the final straw if things don’t end up going well.

Retail is one of the worst-performing S&P 500 sectors year-to-date, down more than 30% compared with the overall benchmark’s decline of about 17%. Some of that stems from the sell-off in mega-tech: Amazon.com is approximately 45% of the gauge and responsible for about 75% of retail’s decline in terms of market cap but even the equal-weight index is down 30%.

Inflation, while slowing, remains firmly entrenched above pre-pandemic levels, meaning people are spending more on essentials like food and gas. Lower gasoline prices may help. But consumer sentiment is fragile amid rising borrowing costs. Some spending has also shifted from goods to experiences such as travel. Amazon is concerned, projecting the slowest holiday-quarter growth in its history. Retailers may have to discount deeply to attract shoppers, threatening profitability at a peak period.

On other fronts, as we discussed in the Webinar, 37 percent of U.S. Real Estate Agents could not pay office rent in October as higher borrowing costs triggered a sharp drop in mortgage applications and home sales in the back half of the year. Deal flow is drying up for many Real Estate Agents and Mortgage Brokers, resulting in financial duress that may worsen into early 2023.

They say a picture is worth 1,000 words and I certainly hope so as I don’t have 1,000 more words to stress how careful we have to be at this juncture. Homebuyer Confidence was 120 during the last collapse, 14 years ago and now it’s 40 (FOURTY!!!). Not the Builder Confidence is a lagging indicator so, if we see that starting to catch up – look out below!

The time to sell (or at least cover/hedge) your stocks is when the market is rallying – not AFTER you see it begin to collapse. That’s when it becomes a lot harder to find buyers and mistakes like that. Not only have we sold about half the long positions in our Member Portfolios but we have so much coverage that, at this point – we’d actually prefer it if the market crashed.

The markets close at 1pm today, so be careful out there when shopping and PLEASE, take notes – we’re going to do a PSW Holiday Shopping survey starting tomorrow and I want to see as many reports as possible from our Members’ experiences.

Have a great weekend,

– Phil