Get clicking!

Get clicking!

Retail needs a win – especially with Oil (/CL) and Gasoline (RB) prices crashing (Gasoline is a big part of Retail sales), now due to anti-lockdown protests in China that are likely to lead to more lockdowns, quelling demand for oil into Q1.

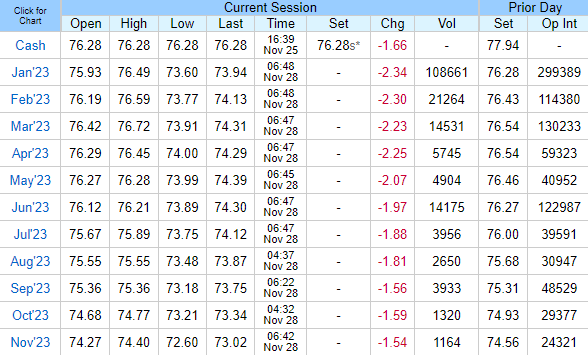

As you can see in the NYMEX Futures, oil is expected to continue to track lower over the course of the next year but we’re nowhere near capitulation yet as there are a ridiculous 300M barrels of oil (1,000 barrels per contract) still open for January to Cushing, OK – a facility that can handle 50M barrels at most but nowhere near that as they are full at the moment.

Those orders are mostly fake, Fake, FAKE!!! and are there just to manipulate the prices and create a false sense of demand as traders push them back and forth each day when only 570M total barrels of oil actually end up being delivered across the entire US – and most of that is via pipelines or ports – not through Cushing, OK.

Those orders are mostly fake, Fake, FAKE!!! and are there just to manipulate the prices and create a false sense of demand as traders push them back and forth each day when only 570M total barrels of oil actually end up being delivered across the entire US – and most of that is via pipelines or ports – not through Cushing, OK.

Having “Open Interest” for 550M barrels to be delivered over the next 3 months is a problem for oil traders, who don’t actually want any oil at all (95%) and are hoping to sell their contracts to a greater fool for a profit. The theory is there’s always a spike due to one report or another and you’ll eventually get a good price for your oil but two years ago we had such a sharp drop that it caused panic selling and prices on the NYMEX actually went NEGATIVE – with people PAYING you to take the oil contracts off their hands.

That’s because these “traders” represent no buyers and have no ability to receive, store or deliver oil – they are just churning contracts – often at the behest of oil producers who want to maintain a facade of demand for their product to keep the prices up. But they are hired guns, they don’t work “for” the oil producers, so a lot of them have no fallback plans if things go south.

If that happens again, don’t buy the current month or you’ll be stuck with deliveries and even 1,000 barrels of oil are a pain in the ass to move around. What you want to do is wait for the selling to subside and then look at the 2nd and 3rd forward months (March if it happened today) and pick up those contracts in the panic as it’s not at all likely that they will keep paying traders to take oil for 90 straight days.

Now, back to shopping! Sales figures are coming in about 3% of last year in terms of traffic but discounts are averaging 30% so actual sales figures may still disappoint. Margins are almost certain to be disappointing with higher wages and higher discounts.

So far, we haven’t had much participation in our 2022 Holiday Shopping Survey – we’re just looking for comments on your personal shopping observations, when you have a chance. I don’t know if people haven’t done much shopping yet or what – but please, it’s very helpful to hear from our Members about their personal experiences.

I’m in Toronto where I’ll be speaking at the TD Wealth Conference tomorrow. The town did not seem particularly busy this weekend but I was reminded this morning that a bacon, egg and cheese wrap from Starbucks comes with Canadian bacon – they should put a warning label on the menu! I don’t know who invented Canadian bacon but he’s been responsible for many of my life’s most disappointing breakfasts…

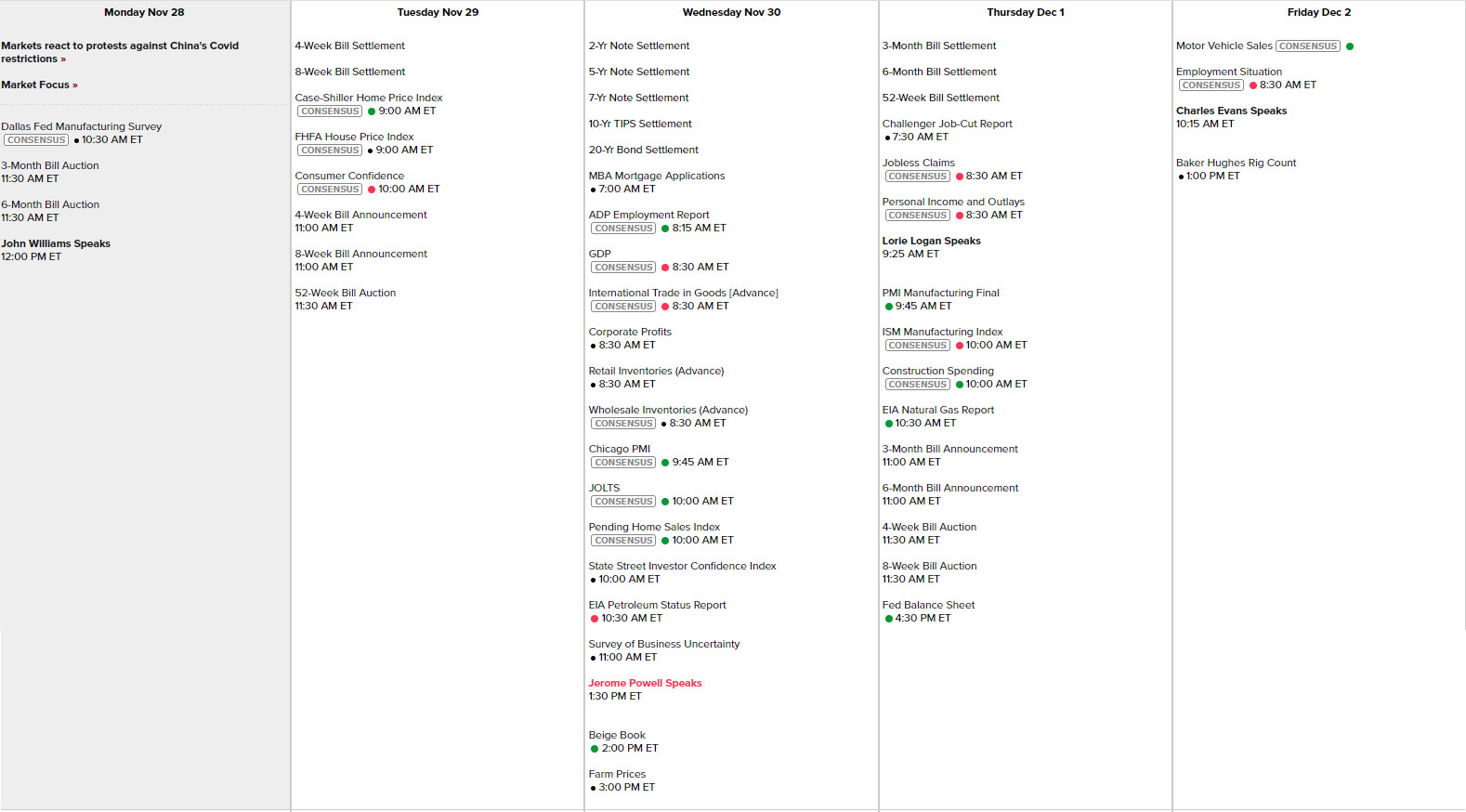

Will this week be disappointing? It is so far with a down 0.6% Futures Market and oil is off another 2.5% this morning, with even Natural Gas (/NG) falling 5%. We’ve got the Dallas Fed today and they have oil so should be better than others. Tomorrow is Case-Shiller, which should be dreary and Consumer Confidence can’t get worse (can it?). Wednesday we have the 2nd revision to Q3 GDP (2.7%) but watch ADP for signs of a weakening Job Market and Corporate Profits will give some insight along with Retail Sales, Chicago PMI, JOLTS, Pending Home Sales (dreadful) and Investor Confidence.

Wednesday is such an awful data day that they’ve scheduled Powell to speak at 1:30 – ahead of the Beige Book – which will probably also be disappointing. Thursday is Personal Income & Outlays, PMI Manufacturing, ISM and Construction Spending and Friday is Non-Farm Payrolls AND Motor Vehicle Sales. I am so glad we cashed out last week!

And there is still no shortage of Earnings Reports and not all of them are small caps. 5 Below and The Dollar Store bear watching but our attention will be focused on the Final Four in our Stock of the Year tournament, which we’ll be finishing up in our Live Member Chat Room today and tomorrow with the official Trade of the Year pick made Wednesday morning.

Be careful out there,

- Phil