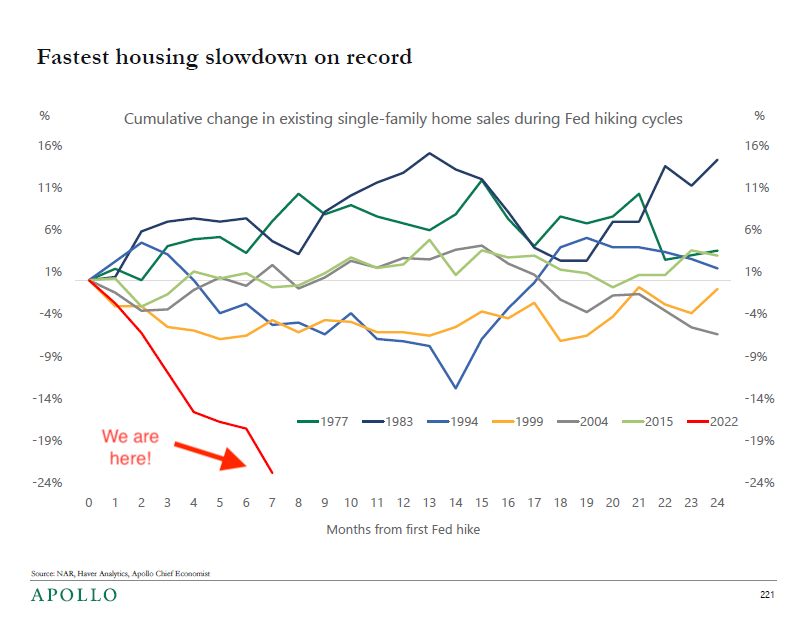

It’s possible that today’s Non-Farm Payroll number may be down a lot from last month. Certainly we’ve been hearing a lot more about cut-backs and layoffs from Corporations recently and imagine all the Construction Workers and Mortgage Brokers and Movers and Cable Installers who aren’t needed with Home Sales down 24% and Pending Home Sales down 36.7% from last year as rates relentlessly rise.

Inflation isn’t dead – we just got that data – but Housing is certainly on its last legs and Housing is 16.5% of our entire GDP. Let’s do that math: If 16.5% of your GDP is off by 36.7%, then your ENTIRE GDP is down 6% – that is NOT GOOD!

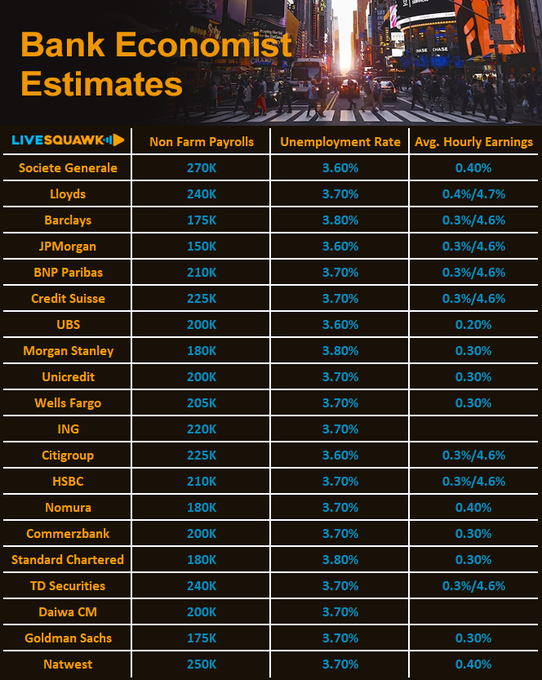

Expectations are for 200,000 Jobs created in November vs 261,000 in October but ADP came in just 7% below last month, so it may be that jobs are still running too hot for the Fed’s tastes. We shall see. Either way, compared to the 2.9M net jobs LOST during Trump’s 4 years – we’re in the Renaissance. Wages are up 5.7% this year vs 8.7% total in Trump’s 4 years but Corporate Profits were up 67.8% under Trump as the combination of not taxing them and giving them Trillions of Dollars seemed to do the trick…

You can see why Corporations are willing to funnel Billions of Dollars into Dark Money Super-Pacs to insure the GOP stays in power – they get Trillions back on the bargain.

And if Biden takes away the tax breaks from the Ultra-Wealthy and the even-wealthier Corporate Citizens, then he’ll be the bad guy – just like your parents are the bad guys when they tell you every day can’t be Halloween or Christmas and you are too young to grasp the reality of the situation.

We can’t keep running the economy without collecting taxes – that causes deficits and we’re already $32Tn in debt and the last 3-Year Note Auction went off at 4.5% on 11/15. 2-Year Notes were also 4.5% on 11/30 and we are currently paying $483.5 BILLION in interest on what is officially $31.3Tn in debt at the moment (but we have a $1Tn deficit too) but even $483.5Bn is ONLY a 1.5% interest rate. That means, in 3 years or less, we’ll be paying 4.5% on what is likely to be $35Tn in debt or $1.575 TRILLION in debt service alone.

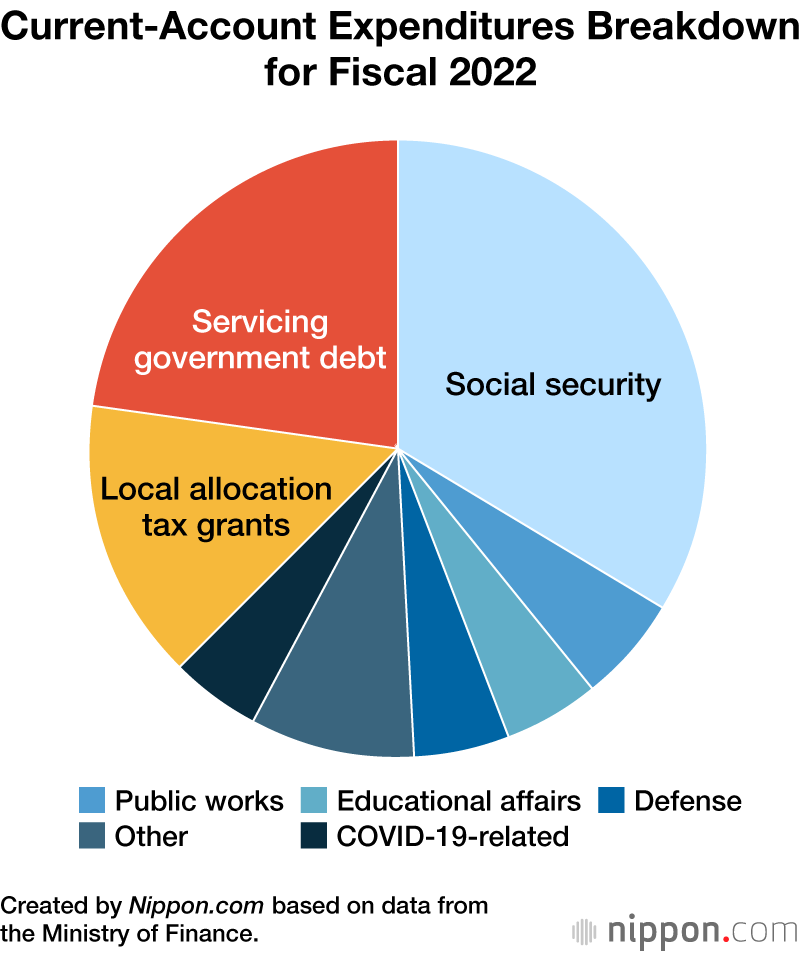

That’s $1.1Tn more than in our current budget, which would then add to the deficit and, before you know it, we’re Japan, who are 266% of their GDP in debt (we are at 133%) at $10.7Tn, which is 1.25 QUADRILLION Yen! Japan, however, only spends $194Bn for debt service, which is 1.8%, at 4.5% it would be $481Bn – 10% of their GDP added to debt each year!

That’s $1.1Tn more than in our current budget, which would then add to the deficit and, before you know it, we’re Japan, who are 266% of their GDP in debt (we are at 133%) at $10.7Tn, which is 1.25 QUADRILLION Yen! Japan, however, only spends $194Bn for debt service, which is 1.8%, at 4.5% it would be $481Bn – 10% of their GDP added to debt each year!

You can see on the chart that Debt Service in Japan is over 20% of the Government’s budget, another $287Bn per year (4.5%) will bring debt service to 49.6% of the Government’s budget so Japan, over the next 36 months, has to raise taxes by 30% or cut services by 37.5% and neither one bodes well for the country or its people.

We’re not far behind them but we’ll be seeing a preview of what will happen to us when it starts to happen to them, much like the great Japanese bust of 1991 was a preview of our own Dot Com Crash of 2000. Of course we’re all a lot more interconnected now – so it won’t take 9 years for the collapse of the Japanese Economy to affect us – 9 months would be a stretch these days…

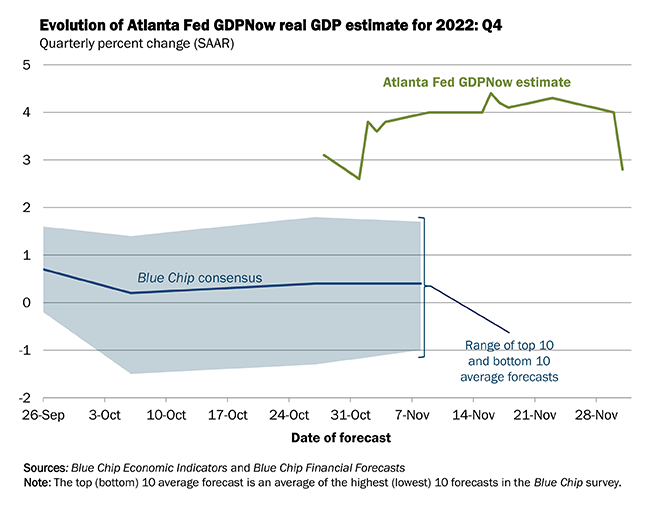

8:30 Update: Speaking of economic disasters – Oh nooooooooooo!!!! Non-Farm Payrolls came in way hot at 263,000 jobs and last month’s jobs were revised up to 284,000 – you just can’t kill this economy! That means the Fed is much less likely to take their foot off the brakes any time soon. Look how wrong the Banksters were – no one was even close on wages:

In bad news for our Corporate Masters, Average Hourly Earnings blasted up 0.6% (7.2% pace), which was DOUBLE the 0.3% expected by our Leading Economorons AND last month was revised up from 0.4% to 0.5% – all very bad news for people who want more free money…

If the Banksters are this wrong about this very critical report, how does that then affect every other thing they are trying to predict for their clients and their own investing? I smell a rotten Q4 for GS, who were badly wrong along with MS, JPM and BCS – all of whom were drinking the same under 200,000/0.3% punch.

We at PSW, on the other hand, are positively THRILLED with the $5M hedge we have in our Short-Term Portfolio (STP) and all the CASH!!! we have on the sidelines from our recent Members’ Portfolio Reviews, where I said:

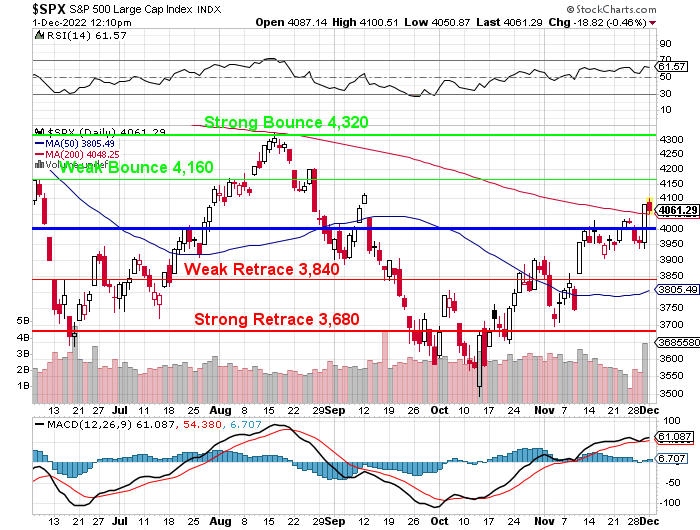

“…Since then we’ve blasted back to our mid-point at 4,000 and this is where we predicted the S&P would finish 2022 and, as you can see, the 200-day moving average is still declining and, catalyst-wise, I don’t see any reason we should be breaking higher unless the War ends or the Fed decides to pause – neither of which are likely until Q2 – so SHOULD we keep our money in the market when we KNOW this is the top of the range?

Well, we can never KNOW for sure but, valuation-wise, we’re fairly sure of where things should be and that’s why we were buying 4 weeks ago and that’s why we are selling now. If you are not going to sell when you make profits – when will you be selling?

So, with that in mind, we’ll take a close look at every position and we’re going to need very strong reasons NOT to cash them out here. If we’re going to stick with something, we should be ready, willing AND able to put more money into the position if the market drops 20%, which is pretty much what it did from our September to October reviews.

There are many positions we did put more money into but, if we’re not going to take that money off the table when it makes a big, quick profit – what on Earth was the point of adding the money in the first place?“

Whether 4,000 holds or not, it’s a hell of a lot more relaxing going into the weekend with lots of CASH!!! and lots of hedges. That doesn’t stop us from making money, of course. Our first trade idea in yesterday’s Live Member Chat Room was:

“As noted above, markets got a bit over-excited and now Oil (/CL) is touching $83 and that’s a good spot to short with tight stops above. The Dollar is likely to bounce off 105 and that alone will send /CL back to $82.50 or lower.”

As you can see, that worked out very nicely for our Members, who made $1,500 PER CONTRACT in just the one session and you are all very welcome!

Next week we can look forward to Factory Orders, ISM Services, Productivity (which has been awful), Consumer Credit (scary), PPI and Michigan Sentiment and we’ll have earnings from SIG, PLAY, TOL, CPB, THO, GME, MANU, AVGO, COST, DOCU, LULU, RH, MNTN and ORCL – so not too slouchy either.

Have a great weekend,

– Phil