NEW: Watch Phil’s segments on the Live Money Talk Program on Dec. 1, 2022 here. Phil discusses the investing risks ahead and his top trade ideas, including the new Trade of the Year for 2023:

Weighing recession risk in 2022 and beyond

Phil Davis’ MoneyTalk portfolio

Phil Davis’ Trade of the Year

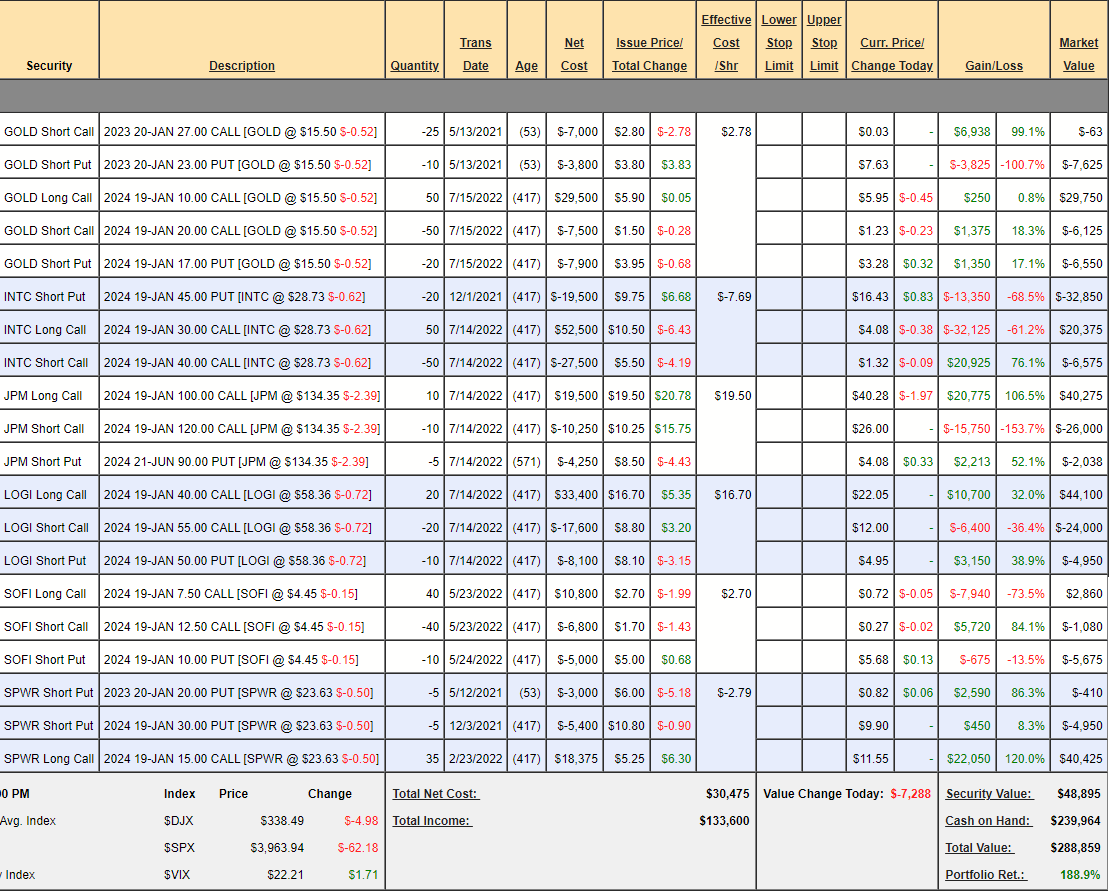

Money Talk Portfolio Review from November 29, 2022:

Our Money Talk Portfolio is up 188.9% ($288,859).

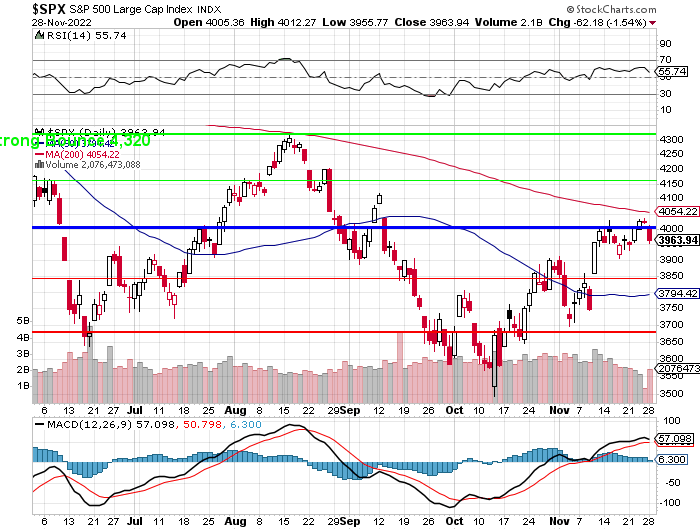

That’s over 3 years, from our November 13th, 2019 start with $100,000. We only adjust the portfolio once per quarter, live for the show and my last appearance was August 24th, when we cashed out half our positions ahead of the crash. We were at $269,804 at the time so we’ve gained about $19,000 (7%) since then but now we have $239,964 in CASH!!! – up from $78,974 so we are much more flexible here and we sat on the sidelines while the S&P fell from 4,200 to 3,500 (16.66%) before bouncing back to 3,900.

We KNEW the market was going to fall – we did not KNOW it would bounce back, so CASH!!! was a safer way to go into the turmoil ahead. Now we have plenty of money sitting on the sidelines to make our adjustments so let’s consider each position and then we will discuss our finalists for the 2023 Trade of the Year, which is very tricky as we’re contemplating a Recession – so we’re looking for stocks that can weather the storm:

-

- GOLD – We like gold as an inflation hedge and GOLD is our favorite miner. In this case, we’re making short-term money selling Jan puts and calls while we wait – though more so on the call side in this round. Nonetheless, we collected $10,800 and we’ll roll the 10 short Jan $23 puts at $7.63 ($7,630) to 30 2025 $17 puts at $4 ($12,000) and we’ll buy back the 20 short 2024 $17 puts with a small profit for $3.28 ($6,550). So we’re spending net $1,630 to clean up our puts. The remaining $50,000 spread is $25,000 in the money and currently showing net $9,387, so there’s $40,613 (432%) upside potential at $20.

-

- INTC – 2023 is yet another building year for INTC but 2024 is possibly their turn as Stock of the Year. They are spending 10s of Billions of Dollars building new foundries for the next generation of chips that will ensure their dominance for the rest of the Decade. For now, we will roll the 50 2024 $30 calls at $4.08 ($20,375) to 75 2025 $20 ($11)/30 ($5.60) bull call spreads at net $5.40 ($40,500). We will also roll the 20 2024 $45 puts at $16.43 ($32,850) to 30 of the 2025 $35 puts at $9 ($27,000). So, essentially, we’re doubling down on the longs while leaving the short calls as a hedge and spending $5,850 to improve our short puts. It’s a $75,000 spread and our spread was net -$19,050 and now it’s -$45,025. To be clear, that’s a huge loss and we’re sticking with it. A turnaround to $35 would net us $75,000 and erase the loss for a potential $120,025 gain.

-

- JPM – Way over target already at net $12,237 on the $20,000 spread so we have $7,763 (63.4%) left to gain if JPM can hold $120 into Jan, 2024.

-

- LOGI – Another one ahead of schedule at net $15,150 out of a potential $30,000 so $14,850 (98%) left to gain.

-

- SOFI – I love these guys but underperforming so far with a net $3,895 credit on the $20,000 spread, so that’s $23,895 upside potential at $7.50 – but it’s a long way away.

-

- SPWR – We were very aggressive on our Stock of the Decade and we are going to cash it out at net $35,065 from our $10,000 start.

Our 5 remaining positions have $192,296 of upside potential, still with most of our cash at the sidelines and now we can take a close look at our finalists for the 2023 Trade of the Year – I’m sure more than one can be added to the Money Talk Portfolio.

These are notes from our Live Member Chat Room, where we discussed about 60 finalists for Stock of the Year and we whittled them down to these final few. We were looking for stocks with low debt, high p/e, high Earnings/Employee ratios (who would be less affected by wage increases). Not too many supply chain concerns, not too much overseas business (where the strong Dollar is a disadvantage):

-

- QCOM – 11.4x earnings, $9Bn in debt takes $450M off $11.5Bn in sales – we can live with that. Growth around 10%, even with all the issues. QCOM is big on chips for AR and VR. Q4 was 37% revenue growth over last year. 5G also a catalyst for them – Strong Contender but only making $225,000 per employee is a bit worrying.

-

- CMCSA – There’s something to be said simply because they make $15.7Bn a year. Slow (5%), steady growth but $91Bn in debt x 5% wipes out 1/3 of the profits so call it $12Bn and it’s STILL a good buy at $148Bn ($35). This is NBC/Telemundo, Universal/Dreamworks, Xfinity (who are VZ partners and the 3rd largest US cell provider), Theme Parks, Peacock, Sky TV. They also own the Philadelphia Flyers. Since they reach about 50% of the US households already – their add-on costs for new customers are lower than anyone else’s and that should make them competitive but only $89,000 per employee in profits is worrying (lots of customer service people and retail locations kill them).

-

- ET – Pipelines always work. Despite nice gains still just 8.5x and that x is growing so this is stupidly cheap but they pay it out as a $1.06 (8.5%) dividend and that means we don’t get great money on the options. Still, that’s about the only thing I don’t love so let’s see: How about 50 2025 $10 ($3)/12 ($2.05) bull call spreads at 0.95 ($4,750) with 20 short 2025 $12 puts for $2.60 ($5,200). That’s a net credit of $450 on the $10,000 spread so $10,450 (2,322%) upside potential is definitely Stock of the Year performance if they just hold $12. It only takes 12,500 ET employees to make $3.2Bn, that’s $336,000 per employee!

-

- GOOGL – We just added them to the LTP aggressively with 20 2025 $90/120 spreads and 20 short $120 puts an the current net is $1,300 on the $60,000 spread out of the money at $98 but I think GOOGL is stupidly cheap making $62Bn against a $1.2Tn market cap, which is 19x but they made $76Bn in 2021 and will be at $80Bn in 2025 where even 15x would be a 25% pop from here ($1.6Tn). With META and TWTR screwing up, should be good for ad revenues and still no real challengers to search – you KNOW that is true when AAPL’s default search is Google.

Oh, debt is NEGATIVE $100Bn as well and he who has the most money in a Recession tends to win. So we have value, no debt, one of the best employee to profit ratios in the world ($331,550 per employee but AAPL is $1M per employee and MSFT is $322,334 – no one else is in AAPL’s league).

- GOOGL – We just added them to the LTP aggressively with 20 2025 $90/120 spreads and 20 short $120 puts an the current net is $1,300 on the $60,000 spread out of the money at $98 but I think GOOGL is stupidly cheap making $62Bn against a $1.2Tn market cap, which is 19x but they made $76Bn in 2021 and will be at $80Bn in 2025 where even 15x would be a 25% pop from here ($1.6Tn). With META and TWTR screwing up, should be good for ad revenues and still no real challengers to search – you KNOW that is true when AAPL’s default search is Google.

-

- Sell 10 GOOGL 2025 $90 puts for $12 ($12,000)

- Buy 20 GOOGL 2025 $100 calls for $22 ($44,000)

- Sell 20 GOOGL 2025 $120 calls for $14 ($28,000)

That’s net $4,000 on the $40,000 spread and it’s going to be very hard to knock that trade off the pedestal.

So I look a trade like that and I can’t think of too many ways it can go wrong. A deep recession, perhaps but will it last a year without stimulus? Maybe with a Republican Congress – even though they approved stimulus bills for Trump every other month. GOOGL did great during Covid so that’s not a worry and the war hasn’t hurt them and inflation hasn’t bothered them… Looking good!

-

- JXN – You’ve got to love that they only need 2,800 guys to make $1.4Bn – that’s $500,000 per guy! They are miles up from where we started with them at $25, now $38 but that’s still only $3Bn, which is silly but they did lose $1.6Bn in 2020 so they could tank in a Recession. Otherwise – they’d be in the final 4 because everything else about them is great, including $2.7Bn in CASH!!! so really you are paying net $300M for the company and they can afford to lose $1.6Bn but TotY needs timing – for the LTP though, they are perfect. Oops, options only out to 2024, unfortunately – another reason they are a dangerous pick. Still, for the LTP:

-

- Sell 15 JXN 2024 $30 puts for $4 ($6,000)

- Buy 25 JXN 2024 $35 calls for $9 ($22,500)

- Sell 25 JXN 2024 $45 calls for $5 ($12,500)

That’s net $4,000 on the $25,000 spread and we are going to be very happy to make a larger commitment if they go lower as this is a very under-recognized Financial. They also pay a $2.20 dividend (5.7%) so being assigned is doing us a favor.

-

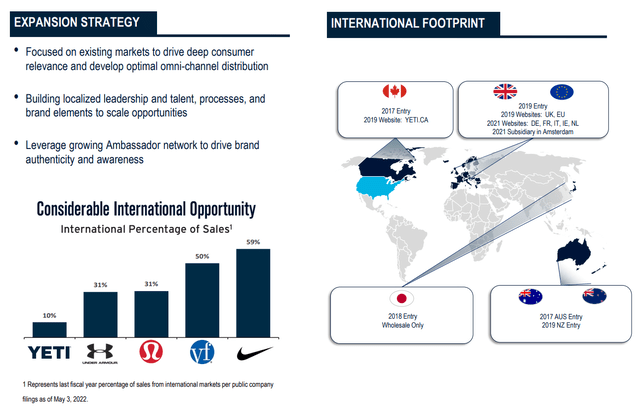

- YETI – Another table-banger this year. They just popped but not too much, from $30 to $40.85 and that’s $3.5Bn with $1.6Bn in sales and $200M in profits so call it 17x but those profits are up 300% from 2019 and a good 20% more ($245M) expected next year is all good going forward. Only $24M in debt but they had $192M in CASH!!! last year so I guess they spent it on expanding the business and the question is will it stick in a Recession? YETI is a high-end product so I don’t think their customers are likely to cut back very much. YETI is also controlling their own destiny with DTC (Direct to Consumer) sales now 56% of their Revenues, up from 15% in 2015 – that’s where the investment money is going.

Nonetheless, Wholesale Revenues are up 14% (DTC up 23%) so both ends are growing nicely. International is only 10% and that’s another area they have room to push. When I look at YETI and I want to consider their growth, I look at other brands like North Face (VF), which is another better-quality but much more expensive thing people buy. North Face had 40% growth in Emerging Markets last year and 33% overall global vs 29% in the US and we can argue the US is pretty saturated but YETI is still so small that driving International to just 30% of their sales would add another $50M to profits and then we’re at $300M for a $3.5Bn market cap and still growing.

Are they going to be Recession-proof? That’s very hard to say and may ultimately cost them their spot in the Final Four. I would rather see how they perform over Christmas but I think Q1 will be Better than Expected as they make great gifts since they are the kind of thing someone might not buy for themselves but are not that expensive and great to own.

- YETI – Another table-banger this year. They just popped but not too much, from $30 to $40.85 and that’s $3.5Bn with $1.6Bn in sales and $200M in profits so call it 17x but those profits are up 300% from 2019 and a good 20% more ($245M) expected next year is all good going forward. Only $24M in debt but they had $192M in CASH!!! last year so I guess they spent it on expanding the business and the question is will it stick in a Recession? YETI is a high-end product so I don’t think their customers are likely to cut back very much. YETI is also controlling their own destiny with DTC (Direct to Consumer) sales now 56% of their Revenues, up from 15% in 2015 – that’s where the investment money is going.

We have a big YETI position in the LTP (100 2024/2025 $35/50 bull call spreads with 50 short 2024 $50 puts) that’s very aggressive but, as a new trade, we could try this:

- Sell 10 YETI 2025 $35 puts for $8 ($8,000)

- Buy 20 YETI 2025 $35 calls for $16.50 ($33,000)

- Sell 20 YETI 2025 $50 calls for $11 ($22,000)

That’s net $3,000 on the $30,000 spread that’s $12,000 in the money to start so all YETI has to do is not go down and the 2024 $35/50 spread is $13/6.80 ($12,400) and the 2024 $35 puts are $5.50 ($5,500) so that would be net $6,900 for a $3,900 (130%) profit so we can assume that’s what would happen if YETI stays flat for a year BUT, if the VIX calms down, the advantage would strongly go to us as we’re in the money by $12,000. We certainly don’t mind owning 1,000 shares of YETI at $35 – happy to DD if they drop 40% ($24.50) or we would take the $10,000 loss if we don’t like the outlook but if that’s our unlikely risk and our reward is the very realistic $27,000 – that makes is a very good trade.

Is it still a good trade with 15 longs? That cuts the net to a $250 credit with $22,750 upside potential (9,100%) and now we’re almost guaranteed to hit our mark as we’re starting out $12,000 in the money and YETI has to drop 14% just to get to $35 so now our worst case is owning 1,000 shares at a 14% discount and flat at $6,900 would be up 2,860%… This may be our winner!

And what happened to SPG? I thought that was in?

Ah, they got cut because I killed the short puts in the LTP but I do love them so let’s review:

Yeah, so it was the huge move from $90 to $120 that killed them in the end but it could be saved by huge premiums:

- Sell 5 SPG 2025 $100 puts for $15 ($7,500)

- Buy 10 SPG 2025 $100 calls for $28 ($28,000)

- Sell 10 SPG 2025 $120 calls for $19 ($19,000)

That’s net $1,500 on the $20,000 spread that’s $17,000 in the money to start. The upside potential is $18,500 (1,233%) and all we have to do is stay over $110 and this should be an easy $6,000 for a 300% gain for the year. With the ability to sell another $40 worth of puts and calls if assigned, we would knock a net $115 entry down to net $75 on 2x so worst case going out would be owning 1,000 shares for net $75 on a very nice stock.

So those are our finalists and we’ll pick an official winner tomorrow morning but, out of hundreds of stocks that have run the gauntlet to get to this point – all of them make fine additions to long-term investment portfolios.