China “eased” their Covid policy.

China “eased” their Covid policy.

That’s the narrative we’re hearing this morning but is it true? Not at all. China has eased RESTRICTIONS in two cities that were locked down – but that’s what they’ve been doing for 3 years: Cases spike, they lock down the area, cases ease off and they unlock it. That IS their policy – it’s not a change. China’s capricious moves are just another lever “THEY” use not to send Retail Investors scurrying in and out of stocks – pair them up with unsubstantiated AAPL rumors and we can get some serious manipulation going almost any day we like!

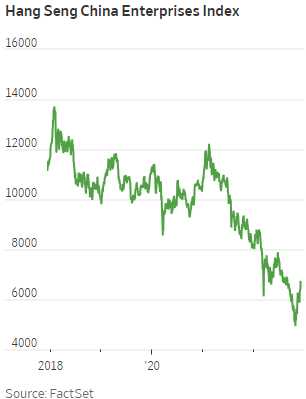

More contagious Covid variants have made maintaining China’s low tolerance approach to infections nearly impossible without devastating the country’s already-weak economy. The expense of near-continuous mass testing has also seriously strained the finances of local governments. Chinese stocks are still underperforming other major markets this year. The MSCI China’s value is only around half what it was in early 2021.

A full re-opening of China – if it goes smoothly, would take months to roll out – so Q1 is shot already. China is only just now starting a program to vaccinate their high-risk elders but, being China, that’s 173M people! That is only step one towards re-opening.

A full re-opening of China – if it goes smoothly, would take months to roll out – so Q1 is shot already. China is only just now starting a program to vaccinate their high-risk elders but, being China, that’s 173M people! That is only step one towards re-opening.

The propaganda needs to shift as well: A party-run newspaper in Beijing, for example, published interviews with recovered Covid patients who said their symptoms were mild and they had no long-term effects, a shift from previous media coverage highlighting the dangers of the virus. Yes there are protests, but they are scattered and small with blank papers – since they are not allowed to say anything against Government Policy (which is kind of clever).

In other totalitarian news: OPEC has kept their oil production levels unchanged but oil is up 2.5% this morning despite the fact that it had been rallying on BS rumors of OPEC production cuts. The excuse to manipulate Oil higher has now shifted to China’s re-opening (which is more BS) and the EU tightening sanctions against Russia – effectively banning seaborne Russian Oil unless it is sold for less than $60 – kind of a reverse-tariff.

Russian Crude currently trades at $50 and Putin has threatened to unilaterally cut production if the caps are enforced but first Brent Crude, now $87.50, would have to be back over $100 and that’s not very likely so it’s all a lot of hot air and is no reason for WTIC (/CL) to be at $82.50 this morning. Still, it’s a dangerous short (last week was obvious) and I’d be very careful playing it – with very tight stops above $82.50.

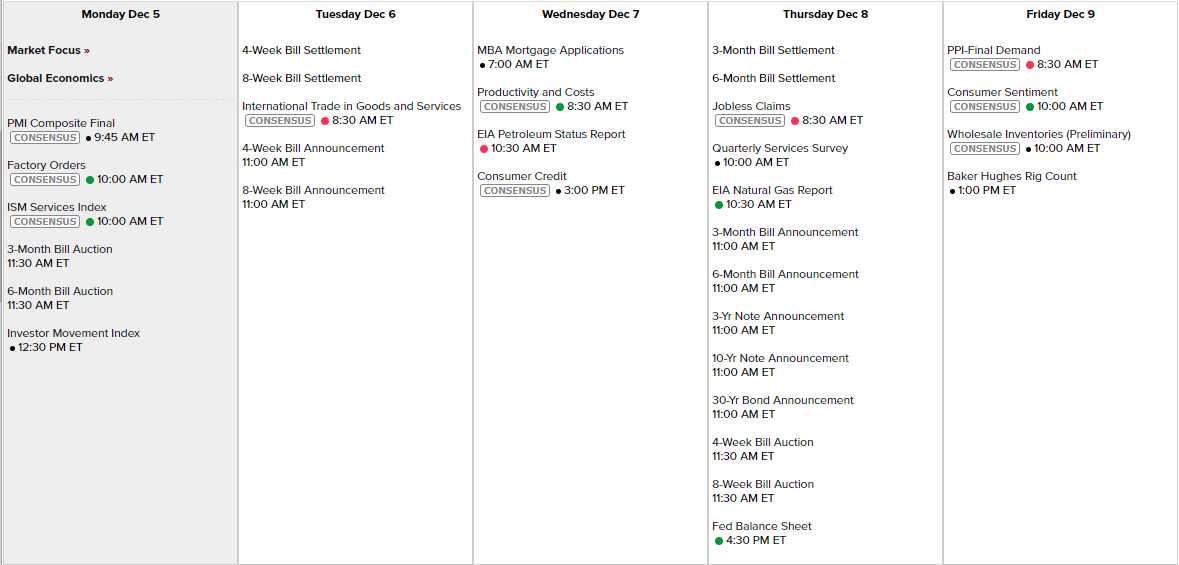

It’s a pretty boring week on the data front. We have PMI, Factory Orders and ISM Services this morning, Productivity Wednesday along with Consumer Credit, the Services Survey on Thursday and PPI and Consumer Sentiment Friday with NO Fed Speakers as they have to be quiet ahead of next Wednesday’s Policy Meeting (shhhhh!).

And there are still WAY more earnings reports than you would think still to come:

We love LoveSac (LOVE), so we’ll see how they are doing. GME is the proverbial meme and COST gives us a clue as to what Consumers are up to and HOV, RH, SIG, TOL, PLAY, MTN, THO, LULU, DOCU and AVGO are all stocks we like to watch.

Hello Group (MOMO) reports on Thursday and that’s a fun Chinese stock to play. Sales were over $2Bn pre-pandemic and profits were $285M and now they are down to 1.5Bn and $200M but you can buy the whole company for $1.1Bn at $5.75 and they have about $1Bn in the bank – so free company!

MOMO is a Chinese Social-Media company for Social Networking which works a lot like Tinder but more of a friends thing. They have 115M users on live streaming and another 27M on their dating app (Tantan).

They beat earnings and expectations in Q2 (Sept 1 report) and gave great guidance for Q3 but the CEO resigned for health reasons on Oct 28th but the stock has already recovered quite a bit.

They should do well if China does ease their Covid policies. It does seem Biden and China are working out the accounting issues to keep Chinese companies on the US exchanges. A nice way to play is with the 2024 $3 ($2.80)/5 ($1.80) bull call spread at net $1, which pays $2 (100% gain in 13 months) if MOMO simply stays above $5. So, if you have $1,000 now and you want to have $2,000 to start off 2024, then buying 10 of those spreads would do the trick if all goes well.

If not, the net Delta of the two is just 0.16, so MOMO would have to drop $1.50 for you to lose $250 – which makes it a good stop if the $5 line fails. Risk $250 to make $1,000 on an undervalued stock with almost it’s entire market cap in the bank? Sounds good to me!