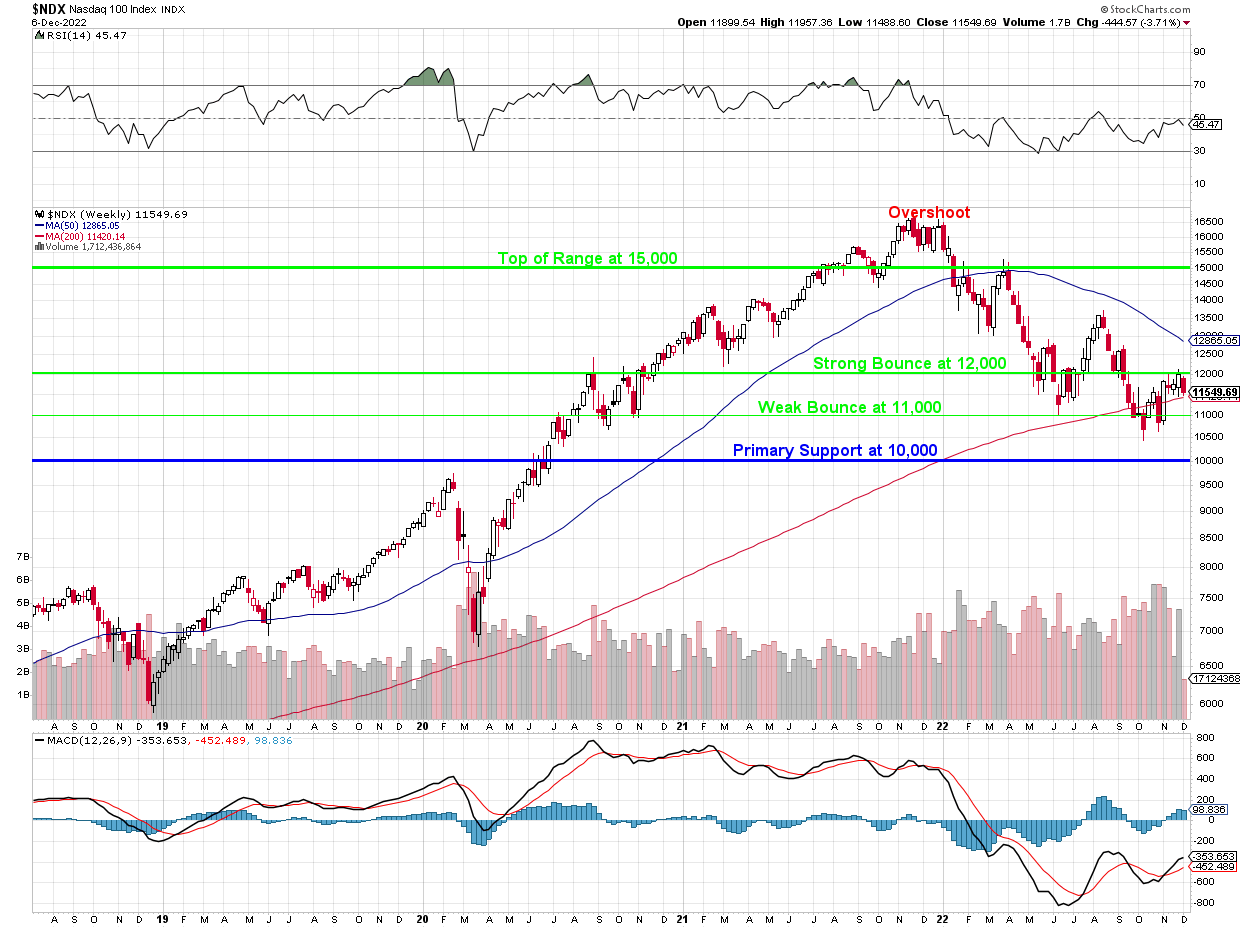

Why 11,420 on the Nasdaq 100?

That’s the 200 WEEK moving average – a very significant technical line and we’ve already failed our Strong Bounce Line at 12,000 and, below this, support is way down at 10,000 – a 20% drop from here.

Today is Pearl Harbor Day – a day that may live in infamy for more than one reason if the Nasdaq fails to hold again. It has failed before in the past few months but now we’re past earnings and there’s not much to save it if it takes another dive.

We reviewed our Short-Term Portfolio (STP) hedges on what I called: “Mixed Signal Monday” in expectations of weakness and we’ve already cut half the long positions from our Long-Term Portfolio (LTP) in our last review, way back on November 15th, also in anticipation of a sell-off so we almost hope it will happen – though not for the sake of the average investor – who is ill-prepared for these events.

We had more fun playing with Natural Gas (/NG) Futures yesterday but, as I told the Members on the first run to $5.60 – you have to take those gains off the table quickly or they tend to evaporate (this does not affect the UNG spread).

$5.50 is our bullish line and we play it when /NG is crossing OVER from below – so it has momentum heading up. As you can see, that worked for our morning call to the tune of $1,000 per contract, then failed on the next cross for a $500 loss, then a $500 gain on the next cross and then, overnight, another cross for big money at $1,000 and now $2,000 for those who held on (we prefer to take 1/2 off quickly and stop the rest out if $5.50 fails).

The Dollar tested 106 overnight but came back down when China finally announced some actual easing of their Covid policies. That then strengthened the Yuan and pushed the Dollar back down but that’s why I’m now VERY CONCERNED that it isn’t cheering up our indexes – as that’s two strong positives. The Hang Seng actually fell 2.5% as now investors are worried about soaring infection rates as the Chinese are allowed to go out and about. You can’t win…

- The Covid Policy Changes do not dismantle the policy, but they represent a loosening of measures that have dragged down the economy by disrupting daily life for hundreds of millions of people, forcing many small businesses to close and sending youth unemployment to a record high.

- Mass testing will no longer be conducted in areas that are not considered “high risk,” a designation for regions that have positive cases. The high-risk category is now limited to buildings, units, floors or households, rather than encompassing neighborhoods.

- Those who are infected with mild symptoms are now free to isolate at home. Close contacts are also allowed to quarantine at home, and will be released with a negative test on the fifth day.

- The measures circumscribe the power of local officials to impose lockdowns and ensure they are lifted quickly. Local authorities may still lock down buildings in the event that a positive case is detected, but they cannot restrict movement and suspend business operations in regions outside a specified “high risk” designation. For “high-risk” areas, the guidelines mandate lockdowns to be lifted if no new positive cases are detected for five consecutive days.

- The government reiterated its pledge to do more to increase the vaccination rate of older people. But the new rules left unanswered questions about how officials will try to contain the inevitable wave of infections.

So, as you can see, this is not going to “Fix” China’s economy – there are still major restrictions and it’s inevitable that there will be some massive outbreaks – especially as China’s non-MRNA vaccines are nowhere near as effective as the ones used in US and Europe.

China’s economy is still a catastrophe waiting to happen with property companies unable to repay Trillions in debt and housing speculators (EVERYONE!) are in BIG TROUBLE and the Chinese Government itself has gone from Zero debt in the 2008 crisis to $3.65Tn in debt as of last year – probably about $4Tn now.

That’s nothing compared to the US’s $32Tn, of course but China has this funny idea that debt is real and they should be concerned about it, which means they are less likely to be in the mood to hand Trillions to their Banksters – like the US likes to do whenever there’s a chill in the air.

Some good news this morning as Productivity finally stopped falling – up 0.8% for Q3 vs 0.6% expected and -4.1% in Q2. Of course that means we’re still down 3.3% from Q1 – so let’s not spend too much money on Champagne. Unit Labor Costs are still far ahead of Productivity Improvements, which is still bad for the S&P 500 – they were up 10.2% in Q2 – so at least they are calming down but this is not the chart of a healthy economy by any stretch:

Be careful out there!