What a year it has been!

What a year it has been!

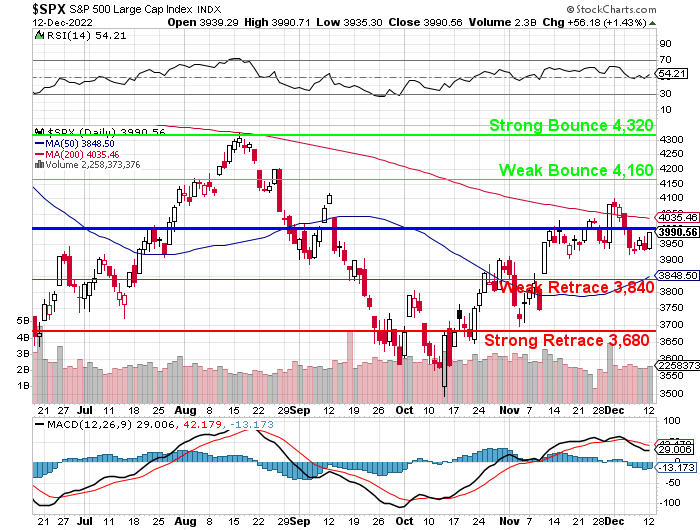

4,000 was our target for the year for the S&P 500 and that’s exactly where we are on Dec 13th so no complaints. We’re in almost the exact same place as we were for last month’s review, when we became cautious and cashed out about half our positions but, if we chose correctly, hopefully they were the better half that we kept and we still should be doing well because time is on our side with our “Be the House – NOT the Gambler” approach to investing.

We are, at the heart, FUNDAMENTAL Investors and we use options, not to gamble, but to hedge and to leverage our positions to get the most out of them with the least amount of risk. We sell premium so, in truth, a 15% down year like the one we’re having on the S&P 500 can work just as well as a 15% up year does for us.

Take MMMB from yesterday’s post. I know it’s only been a day but it was an earnings play and earnings were GOOD and the stock is up 50% this morning (you’re welcome!). Revenues were up 136.9% over last year – even better than we expected and, suprisingly, there were PROFITS! – a full year ahead of schedule. All it took was 3 new large clients to move the needle on such a small company and that’s exactly why I liked them!

It’s not hard to find value – it’s getting the timing right that’s difficult. We have to look ahead and see if there’s a near-term catalyst that will get our fellow investors to realize what a bargain we are holding, so they can begin bidding to buy it back from us. In the case of MMMB – it was simply on my watch list and they had this upcoming earnings report – so we pulled the buy trigger ahead of it.

It’s also a lot easier if you know how to hedge and, at PhilStockWorld, we use our Short-Term Portfolio (STP) to balance out our longs although, at the moment, with less longs and more hedges, we are balanced a bit bearish into the holidays although, as we calculated in last Monday’s STP review(we look at it more often than the others), we feel we’ve sold enough premium that a slow rise shouldn’t kill us and, so far, it hasn’t as we’re down only $26,000 since last week.

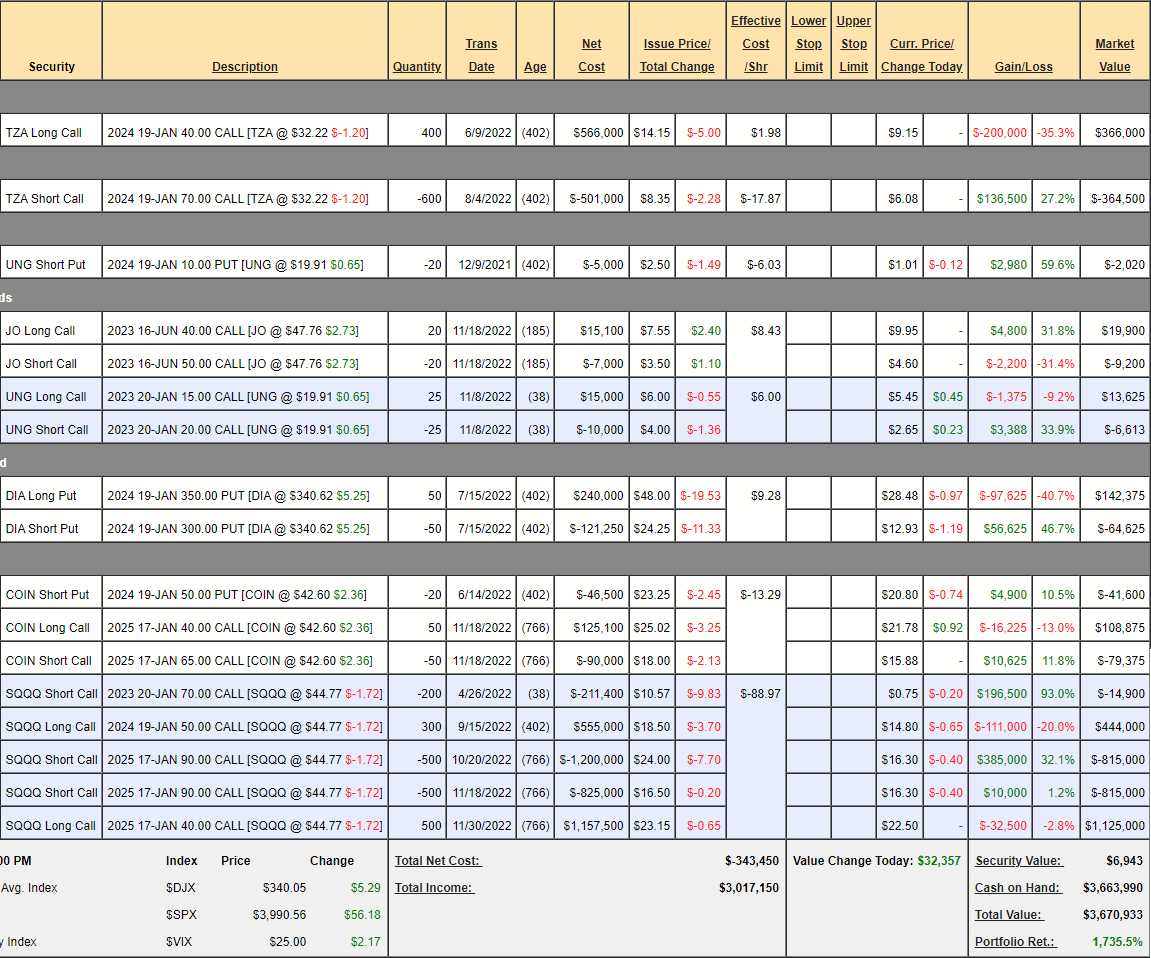

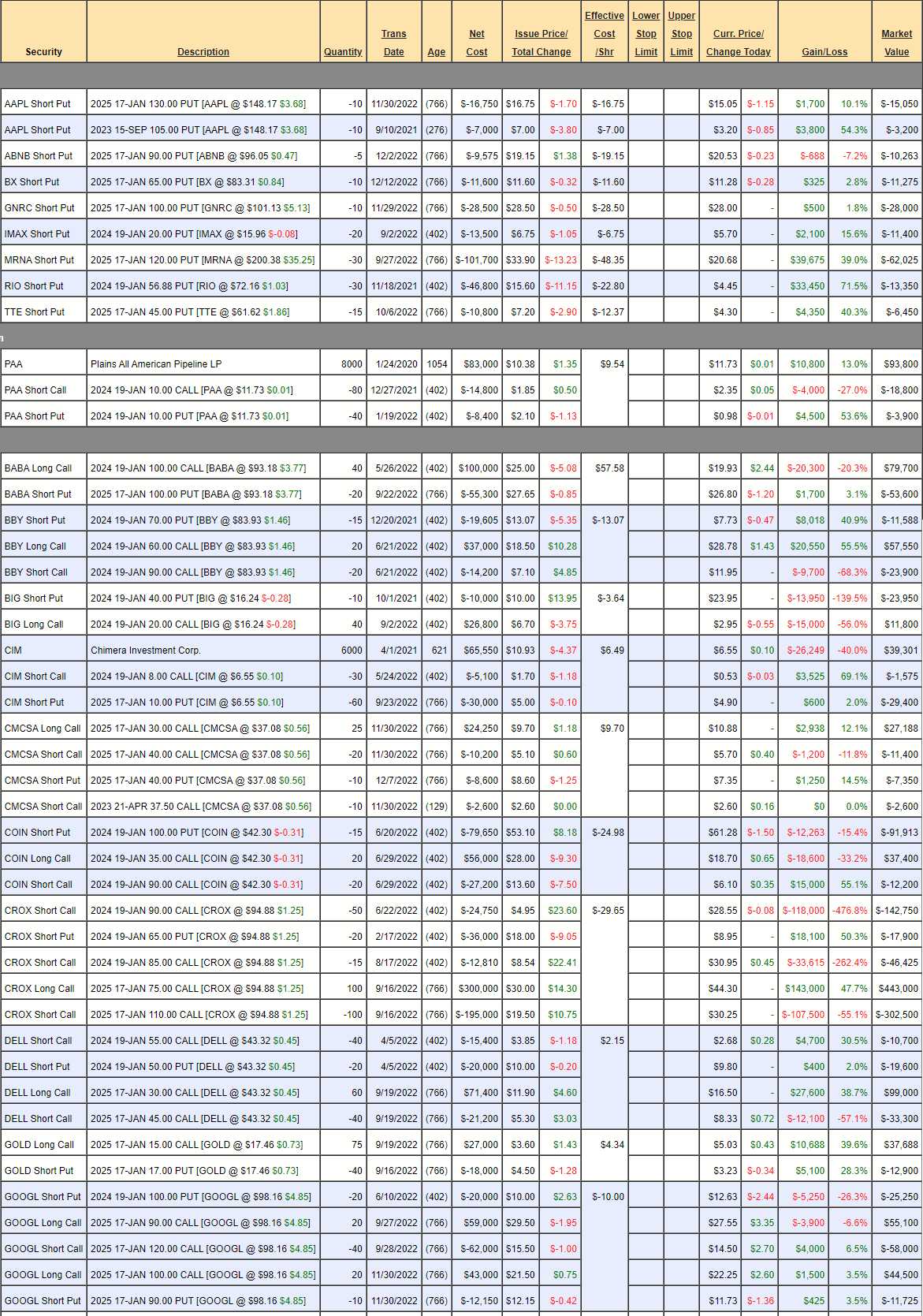

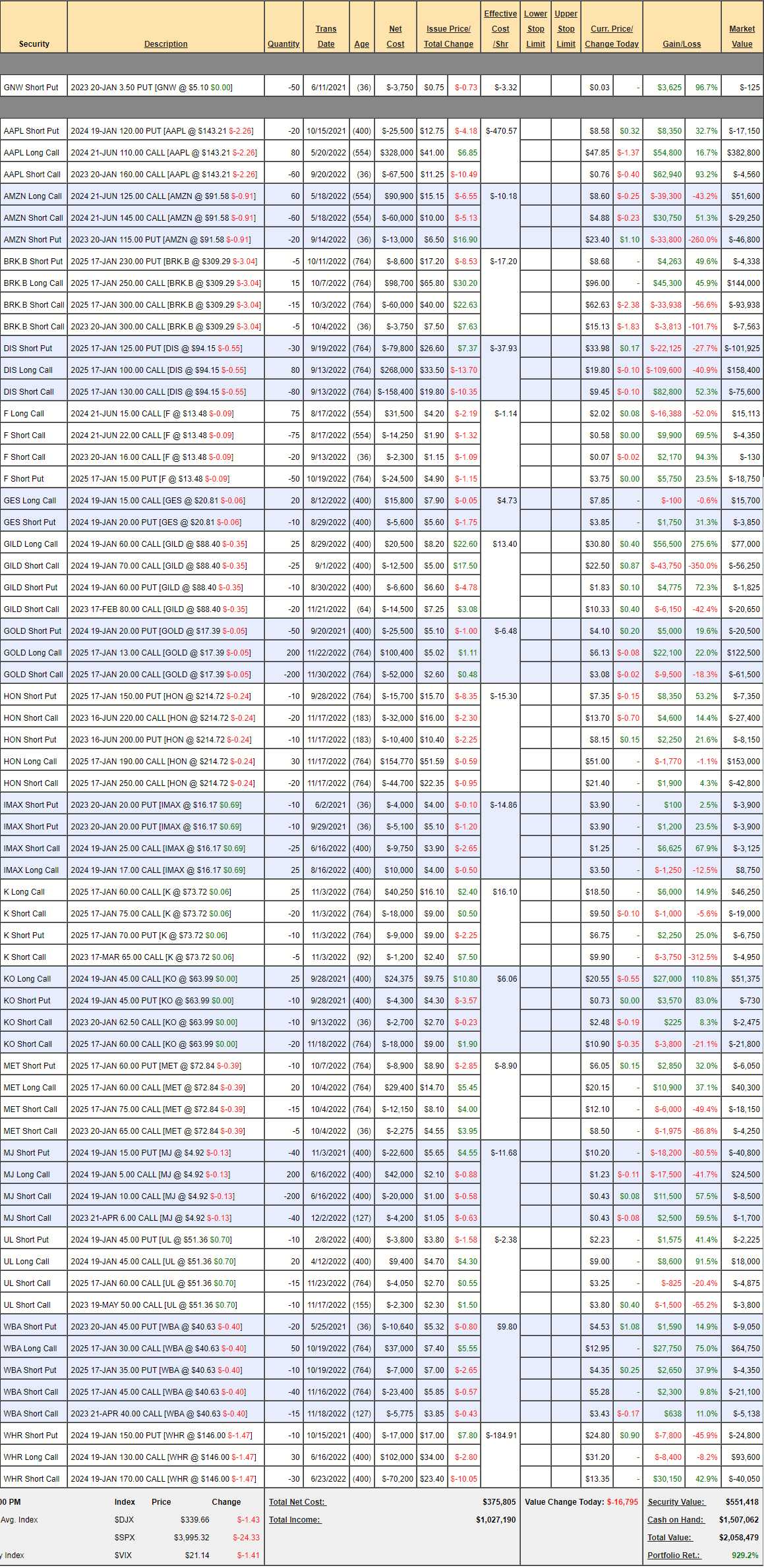

Short-Term Portfolio (STP) Review: $3,670,933 is up 1,735.5% overall as we’ve played our hedges REALLY well in the past two years. As noted above, we’re down a bit for the week, as the market has popped back up but, since our Nov 15th review, we’re up $60,187 despite the market not going anywhere.

How do we do that? By SELLING MORE PREMIUM than we buy! For some reason that surprises people every time it works. The only sure thing in the market is that ALL Premium expires worthless (options are left with only their intrinsic value, no premium) and that means it’s FREE MONEY!!! every time we sell it.

In the case of our hedges, we use several tricks to sell a lot of premium, including the seemingly risky selling more time on the shorts than we have on the longs and that is risky – if you don’t manage it correctly (but we do). That’s why we tend to review the STP more often – though there were no changes made last week – just making sure all was well:

-

- TZA – Here we sold 600 2024 $70 calls for $501,000 and we bought 400 2024 $40 calls for $566,000 so we spent net $65,000 on the hedge but the premium decay is MUCH worse for the $70s than the $40s and the key to this hedge is we REALLY don’t believe TZA will get to $70 (again, a valuation call) as it would require a 35% drop in the Russell to 1,200 – a level last seen in 2016. Meanwhile, at $70, the $40s would be $1.2M in the money while the net of the spread is currently $1,500 so that’s $1.2M of downside protection ($1,198,500) from this spread but we decided to call it just $600,000 of realistic protection because, again, we’re not expecting 1,200 by any stretch.

- UNG – We put our short-term gambles in the STP (makes sense, right?) and here we’re simply playing for Natural Gas (/NG) to be over $3.50 in Jan 2024 and the short put should expire worthless and we make the full $5,000. That trade was from last December and we’re just waiting now for our remaining $2,020 (which is still free money as a new bet).

- JO – We’re playing Coffee (/KC) to be around $200 next spring. Weather patterns indicate a poor crop ahead so we’ll see. It’s a $20,000 spread we paid $4,900 for and we’re already up $2,600 (53%) in the month since we entered the trade and there is still $9,300 (87%) left to gain.

-

- UNG – We added this spread as a new play last month, when /NG had a dip, at net $5,000 on the $25,000 spread and we’re already up $2,072 (41%) but there’s another $17,928 (253%) left to gain and we’re already at the money! Aren’t options fun?

- DIA – This one is another hedge. If the Dow is below $300, the net of the spread will be $250,000 and currently it’s net $77,750 so we have $172,250 of downside protection if the Dow fails to hold $30,000 (less than 15% drop). We’ve also been using this spread to generate an income by selling short-term puts on DIA but, at the moment, it makes us more bearish simply by not selling puts this quarter.

- COIN – I am all alone liking these guys and perhaps I misunderstand this market (cryto) but it seems to me that the FTX scandal which is dragging down COIN’s competitors is ultimately good for US-regulated COIN – unless all of Crypto collapses and they lose their trading business. What’s hurt them the most was actually the big investment they made in NFT, which flamed out hard and fast but, as a platform, revenues are over $3.2Bn and they made $322M when revenues were $1.3Bn in 2020 and $3.6Bn (on $7.8Bn) last year before things fell apart and you can buy the whole thing for $9.6Bn with $1.6Bn net of debt in the bank – so a fun chance to take! It’s a $75,000 spread that’s at the money and currently netting a $12,100 credit so $87,100 upside potential.

-

- SQQQ – Our primary hedge is the 3x Ultra-Short on the Nasdaq (QQQ) and it’s currently a net $75,900 credit and the short Jan $70s will go worthless (or the World will be ending) in a month and that leaves us with 800 longs and 1,000 short but very wide spreads. The 500 2025 $40s are in the money at $44.77 and a 20% Nas drop will pop SQQQ 60% to $70 (.832) and they’d be $1.5M in the money. The 300 2024 $50s would be $600,000 in the money so $2.1M on a 20% drop and another $1.6M if we get to $90 (about 10% lower on the Nas) before we run into our shorts. So call it, overall, $2.67M of protection against a 20% drop and another $1.8M at about a 30% drop for a total of $4.67M in protection.

What’s key here is the net of our spreads is essentially $0 so, if the market goes higher and the spreads expire worthless, we don’t even lose any money (we even make money on our side bets). However, if the market does drop, we are massively over-covered against our long portfolios likely losses – which we’ll review next.

THAT is how you hedge!

8:30 Update: Well so much for 4,000 as Markets are blasting higher on a surprisingly weak CPI Report (weak is good) showing just 0.1% inflation for the month vs 0.4% expected by Leading Economorons. Even better, the core CPI is 0.2% vs 0.3% expected. Overall, that brings our annual inflation rate down to 7.1% and, of course, a huge amount of that is the massive drop in fuel for the month – but let’s enjoy it while we can!

The indexes are blasting 2.5% higher on the news as it indicates the Fed has reason to pause – not tomorrow but early next year if this CPI print stays low in another month.

This is a good time to see how our long portfolios are doing:

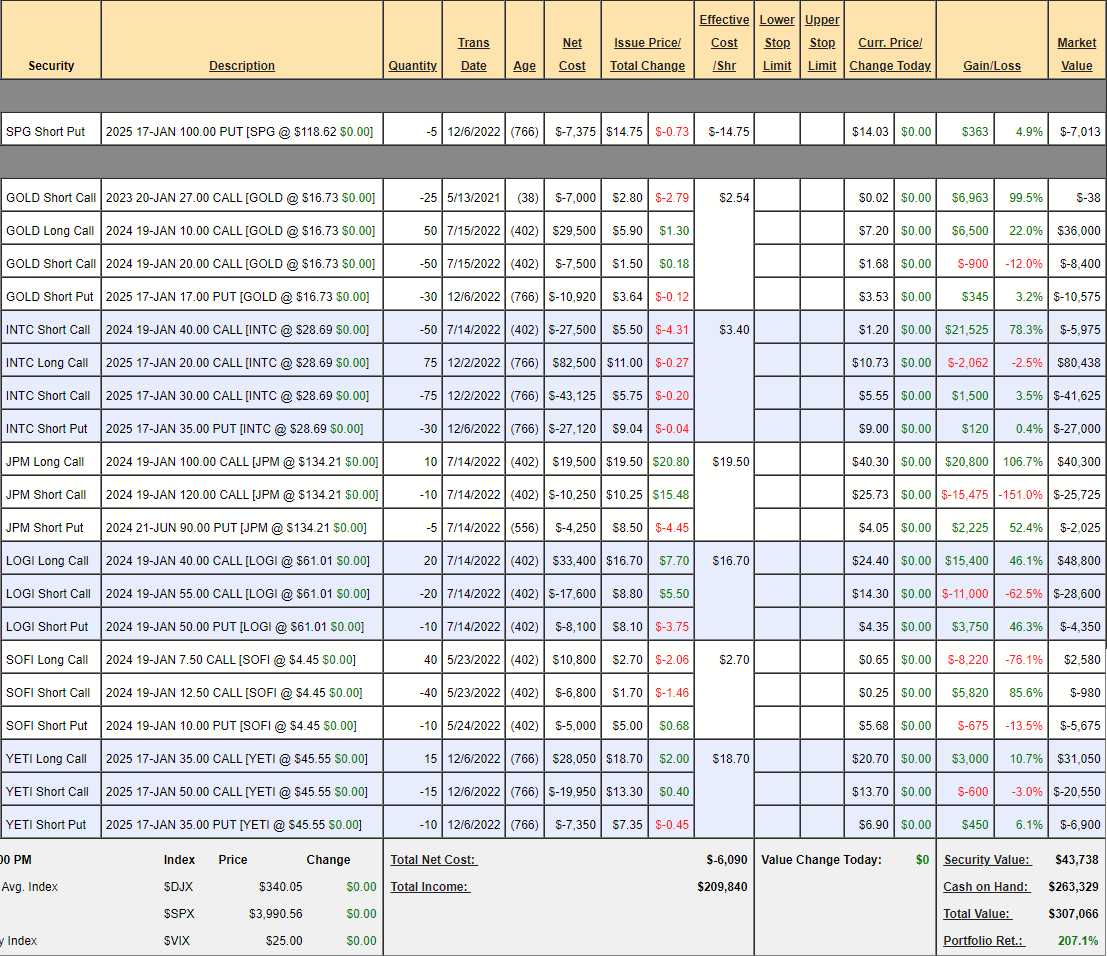

Money Talk Portfolio Review: This is a tricky portfolio as we can only make adjustments when I am on the Money Talk Show, about once each quarter. I was just on the show on Nov 30th and we posted the review and changes that morning. It’s still pre-market but even without today’s pop, the Money Talk Portfolio is at $307,066, which is up 207.1% and up $18,207 in just two weeks – very nice!

These are all very strong positions that we don’t fear trading with our hands tied between quarters. It’s worked out very well so far and these are all the positions that survived a 50% portfolio purge in August (when we thought the market was toppy).

-

- SPG – This is one of our new ones and we’re simply betting it will be above $100 in two years and we just keep the $7,375 we sold the puts for. $7,013 upside potential.

- GOLD – A great inflation hedge and popping this morning with the Dollar drop (in anticipation of Fed easing due to the CPI print). The short $27 calls will go worthless and that leaves us with a $50,000 spread that’s currently on track at net $15,987 so there’s $34,013 (212%) of upside potential at $20. This is great for a new trade!

-

- INTC – They are always in the running for Trade of the Year but they are in a heavy investing cycle that holds them back (for now). Still a great long-term hold and this is a $75,000 spread that’s almost all in the money already at net $5,838 so there’s $69,162 (1,185%) of upside potential but this is a dangerous trade if I’m wrong about the timeing and INTC flies higher into our short calls.

-

- JPM – Another TotY finalist and this was a very conservative $20,000 spread we bought for net $5,000 and it’s already at $12,500 (up 251% in 5 months) with another $7,500 (60%) left to gain if JPM simply stays above $120 for the year.

-

- LOGI – Also in the money at net $15,850 on the $30,000 spread so we have $14,150 (89%) left to gain if LOGI hangs on to $55.

- SOFI – Cheaper than our entry with a net $4,075 credit on the $10,000 spread which means there’s $14,075 of upside potential but, as this trade is disappointing so far, I’m not going to count on it (no highlights).

-

- YETI – Our 2023 Trade of the Year is already up nicely at net $3,600 on the $22,500 spread so we have $18,900 (525%) left to gain at $50 or above. Still great for a new trade at $45.55 with 2 years to left to gain.

Despite the Money Talk Portfolio being cautiously 85.7% in cash, the 7 positions we do have give us $150,738 of upside potential, which is almost 50% of the portfolio’s entire balance! Of course we’ll add more trades if we get more confident next Q but we’re in great shape for continued gains with the positions we already have.

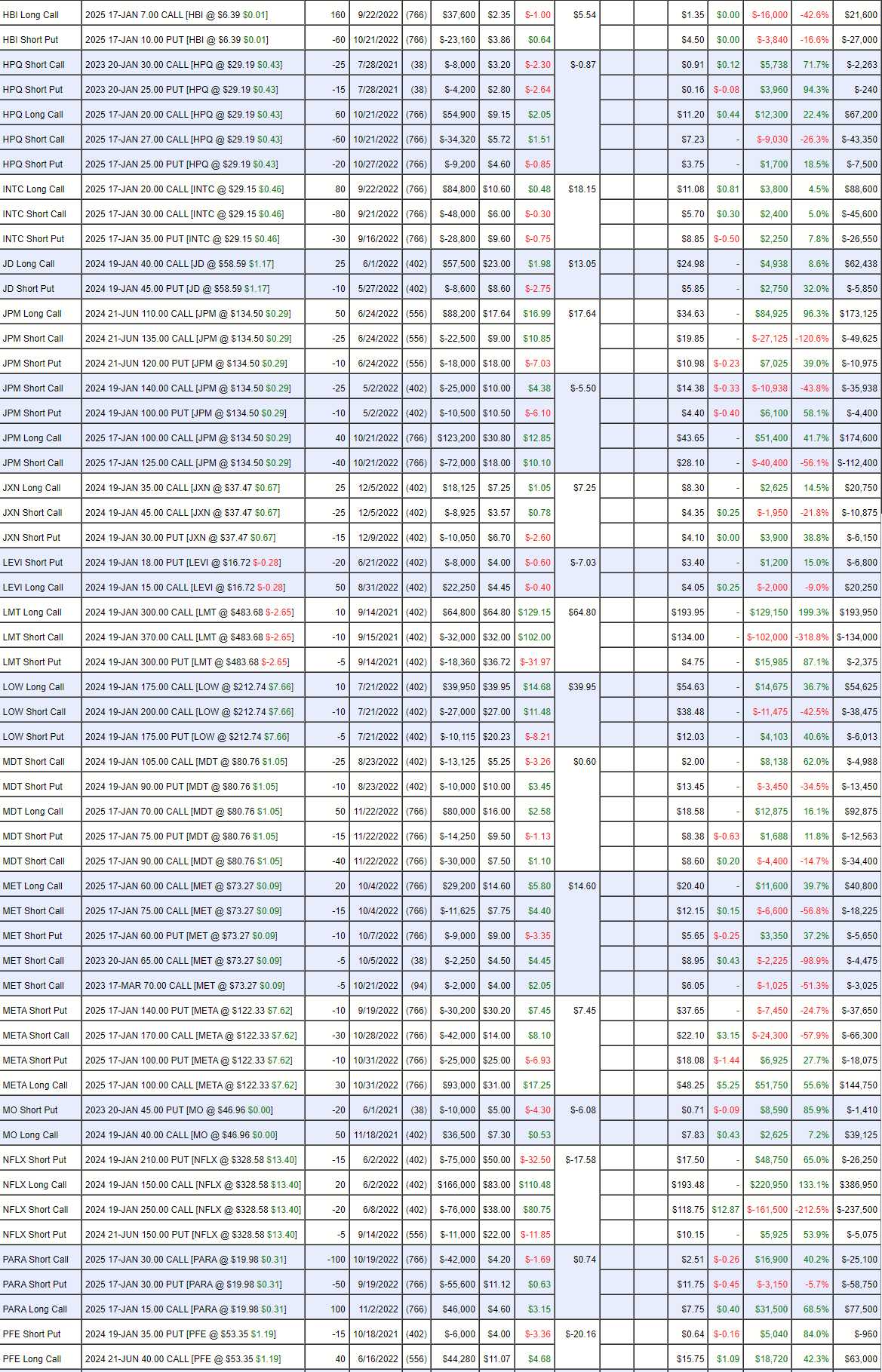

Long-Term Portfolio (LTP) Review: $3,056,397 is up $430,675 since our Nov 15th review but that’s going to set a ridiculous bar for next month as we’re benefiting from this huge pop today that’s not likely to last. Overall, we’re up 511.3% from our $500,000 start back on Nov 1st, 2019 so it’s a 3-year total – a very good 3 years!

We cut about half our positions and almost all of our puts and CASH!!! is now $2,403,769 but we did spend a lot of it adding new positions in the past 30 days as a lot of our Trade of the Year runner-ups were too cheap to pass up on. Heck, that’s why we go to CASH!!! – so we can buy more stuff that’s on sale…

- AAPL – One new, one old.

- ABNB – New

- BX – New

- GNRC – New

- IMAX – Left from a spread we closed part of.

- MRNA – Left from a spread we closed part of. Let’s get back in with 30 of the 2025 $170 ($90)/$220 ($70) bull call spreads at $20 ($60,000) for the $150,000 spread.

- RIO – Left from a spread we closed part of.

- TTE – Newish

Our 5 new short puts put $77,225 in our pocket this quarter in exchange for simply promising to deploy some of our cash if we can get AAPL for net $113.25, ABNB for net $70.85, BX for net $53.40, GNRC for net $71.50 and TTE for net $37.80 – all better than 20% below the current prices. Do that once per quarter and your portfolio picks up $300,000 in premiums for the year – just for reminding yourself to buy things if they go on sale!

-

- PAA – They just paid us a $1,744 dividend on 10/28 and the spread itself is nicely on track. We netted into these shares for $7.48 so the 0.872 annual dividend is 11.6% and, if we’re called away at $10 – that’s another 33% gain. A very nice dividend play!

- BABA – We’re already aggressive and I’m not so sure things are better in China that I want to put more in but I do want to stay with it as a speculative play. Just back to $150 would make us $200,000.

-

- BBY – I was determined to hold on for Christmas and they have exploded back from $65 to $85 and now it’s net $22,125 on the $60,000 spread so the reward potential seems worth the risk to stay in.

- BIG – We’ve already gotten aggressive and I want to see how earnings go next Q. They have supply chain and inventory issues they need to work through – as do many retailers.

- CIM – Quite a disappointment so far but our short puts are net $5 and the stock is at $6.53 so who cares? They paid us a $1,380 dividend in September and another is on the way. I love these guys long-term so I consider this a great entry for a new trade.

-

- CMCSA – One of our new ones as it was a finalist for Trade of the Year. It’s an income-producing spread to take advantage of the lack of near-term catalyst while we wait.

- COIN – As mentioned above, I think they are being treated unfairly. This is a wide spread that’s $14,000 in the money (ignoring the short puts) at net $25,000 out of a potential $110,000. Here is would be foolish not to take advantage of the low price so let’s roll the 15 short 2024 $100 puts at $61.20 ($91,800) to 30 of the 2025 $60 puts at $32.50 ($97,500). We sold them for $53.10 ($79,650) and that obligated us to own 1,500 shares at $46.90 ($70,350) and now we’re obligated to own 3,000 shares x $60 ($180,000) less $79,650 less $5,700 from the roll is $94,650 or $31.55/share – still less than the stock is at now.

Notice if you look at that spread in the portfolio, you see it’s down $15,650 but, after seeing those adjustments – you can see that it’s not even a bit of bother and, in fact, it’s kind of an exciting trade with a net credit of $72,200 on the $110,000 spread that’s $14,000 in the money. All COIN has to do is stay at $40 and the longs close at $7,500 and the short puts end up at $20 ($30,000) and we still have a $34,700 credit to cash in!

Options are tricky in that way and you have to learn to ignore the premiums and focus on the true value of the positions to determine whether or not you want to stick with a trade.

-

- CROX – We’re also treading this like an income trade and, if the short calls get away from us, we’ll just buy more longs because we love this stock – so not too worried.

- DELL – Another one where the short calls are a bit of a worry but another one we’re happy to buy more of if the market is more bullish than we expect.

- GOLD – Very aggressive and right on time. Still too early to cover.

-

- GOOGL – Two sets of short puts, as we are so ridiculously low and then a fully covered spread with 2 different longs. $100,000 potential on the spread and currently net $5,250. No wonder this was a trade of the year finalist and still should be in everyone’s portfolio (though you don’t have to be so messy).

That’s how we make so much money in the LTP. You can see how it works. We start out with trades like GOOGL that can make 2,000% if all goes well. Since we’re generally picking great value stocks, it does often go well and we make huge returns on small outlays. When it doesn’t go well, we adjust and, if we’ve done our value models correctly, we often make more money on our adjustments than we do on the plays that simply go well from day one.

That’s because we scale in. I know you say “Well if $5,250 on GOOGL can pay me $100,000 then why not put in $50,000 and make $1M?” That’s because it’s difficult to adjust such a large trade when it doesn’t go well and you’re missing the chance to be diversified in dozens of good value positions – that’s the strength of the LTP.

-

- HBI – Down and down they go but we’re waiting on Q1 earnings. The beat last Q but gave disappointing guidance.

- HPQ – Yet another one we turned into an income-producer. We’re right on target so we’ll see how things stand next month.

- INTC – We love them and this is a conservative trade already in the money at net $17,150 on the $80,000 spread so more than 300% upside potential at $35 – which would expire the short puts worthless. Even at $30, the short puts just cost us $15,000 of our $80,000 though. Again, this is a trade where they are just throwing money at you.

-

- JD – Another China play we’re just keeping an eye on. In this case, however, we can sell 20 of the 2025 $60 calls for $18.50 ($39,000) and that’s taking a lot of our cash off the table and we’ll see how things go from there. The short calls have a year advantage but we have 25 longs and the 2024 $60 calls are $13.50 while our calls will maintain their intrinsic value (currently $17.50) so it should even out.

- JPM 1 – We’re only half-covered on these and now we’re all in the money. Let’s sell 25 of the 2025 $150 calls for $16 ($40,000) and roll our 50 June 2024 $110 calls at $33.50 ($167,500) to 50 of the 2025 $120 calls at $30 ($150,000). So we had net $112,787 on the table and we just took net $57,500 (about half) off the table and we still have 25 $120/150 spreads with $75,000 of potential and 25 $120/135 spreads with a $37,500 potential but a time advantage, so I’d call it $50,000. The potential is about the same but we cut the risk in half and put money back in the bank.

- JPM 2 – We might have sold too many short puts but we can always buy more longs so no change at the moment.

- JXN – Another new one.

- LEVI – Recovering a bit and we’re very aggressive.

-

- LMT – Our Stock of the Century. Already blew past our targets. An example of a small, initial trade set-up that took off so fast we’ll just have to be happy with getting $70,000 back on our initial net $17,440 investment.

- LOW – Over our target already.

- MDT – Let’s buy back the short 2024 $105 calls as I think MDT is done going down.

-

- MET – We’ll have to roll the short calls along but no hurry.

- META – Still a good trade at net $22,850 on the $210,000 spread. Another 10x opportunity if it works out.

-

- MO – Maybe I’m being greedy but I want to wait a bit before covering this.

- NFLX – Funny how much cheaper big tech has gotten. This is a $200,000 spread at net $116,337 but we’re deep in the money so may as well wait a year to collect our other $83,663 (76%).

- PARA – This is my white whale stock of the past year but I do love them long-term. It’s a $150,000 spread at net about $0.

- PFE – Shooting back up again as they just announced $15Bn in Covid vaccine orders for 2023. It ain’t over until the fat lady develops natural antibodies… I’d cover but PFE is still stupidly undervalued at $293Bn ($53.25) with $30Bn in profits. Even if you say $10Bn is Covid and it goes away – still a respectable 15x.

-

- RIG – I was thinking deep-water drilling will come back and we’re in the money at net $1,875 on the $20,000 potential spread so the risk/reward is still there for sure. I guess it’s kind of a hedge against rising oil prices so we’ll just wait and see.

- SIG – New one.

- SPG – The runner-up for Trade of the Year and a brand new spread.

- STLA – We just got more aggressive on them so we’ll see.

-

- SWK – New and already getting close to goal

- SYF – And another one.

- T – So undervalued. I’m happy with the spread we have. Eventually we’ll cash in the 2024s but hopefully more like $3.

- TD – Great bank and I want to give them a chance to move higher than this before covering again.

-

- TGT – This is a net $12,025 credit on the $90,000 spread so there’s $112,025 upside potential at $200 but is $200 realistic in 13 months? I think we can roll 15 2024 $140 calls at $31 ($46,500) to 30 of the 2025 $130s at $42.75 ($128,250) and we can sell 15 of the 2025 $200 calls at $16 ($32,000) so we’re spending net $49,750 to move from a $90,000 spread to a $210,000 spread that has a year longer to play and is $30,000 more in the money. That’s worth it!

-

- THC – I’m very surprised they are not doing better. I suppose we should take advantage and roll our 20 2024 $50 calls at $8.70 ($17,400) to 50 of the Dec 2024 $40 ($17)/$60 ($10) bull call spreads at $7 ($35,000) and we’ll see how that plays out. We’re leaving the short 2024 $70 calls as they don’t seem too likely and our longs would be $100,000 in the money before they come into play. The spread was a net credit so we’re still not putting much at risk.

- TROX – Fairly new and a bit aggressive, as it should be.

- WBA – Now they are over our target for a change. Still only net $22,640 on the $40,000 spread.

-

- WPM – In the money already at net $79,200 on the $150,000 spread so it’s another one that makes almost 100% if it simply holds the line.

- WSM – On track.

- WY – On track.

- YETI – Our Trade of the Year is still about where we started so still good for a new trade with a $24,250 credit on the $150,000 spread (this is more aggressive than our official TotY in the Money Talk Portfolio).

That was nice and easy and not many changes since these are all such fantastic positions (after 3 purges in 3 years, they certainly should be!).

— Wednesday —

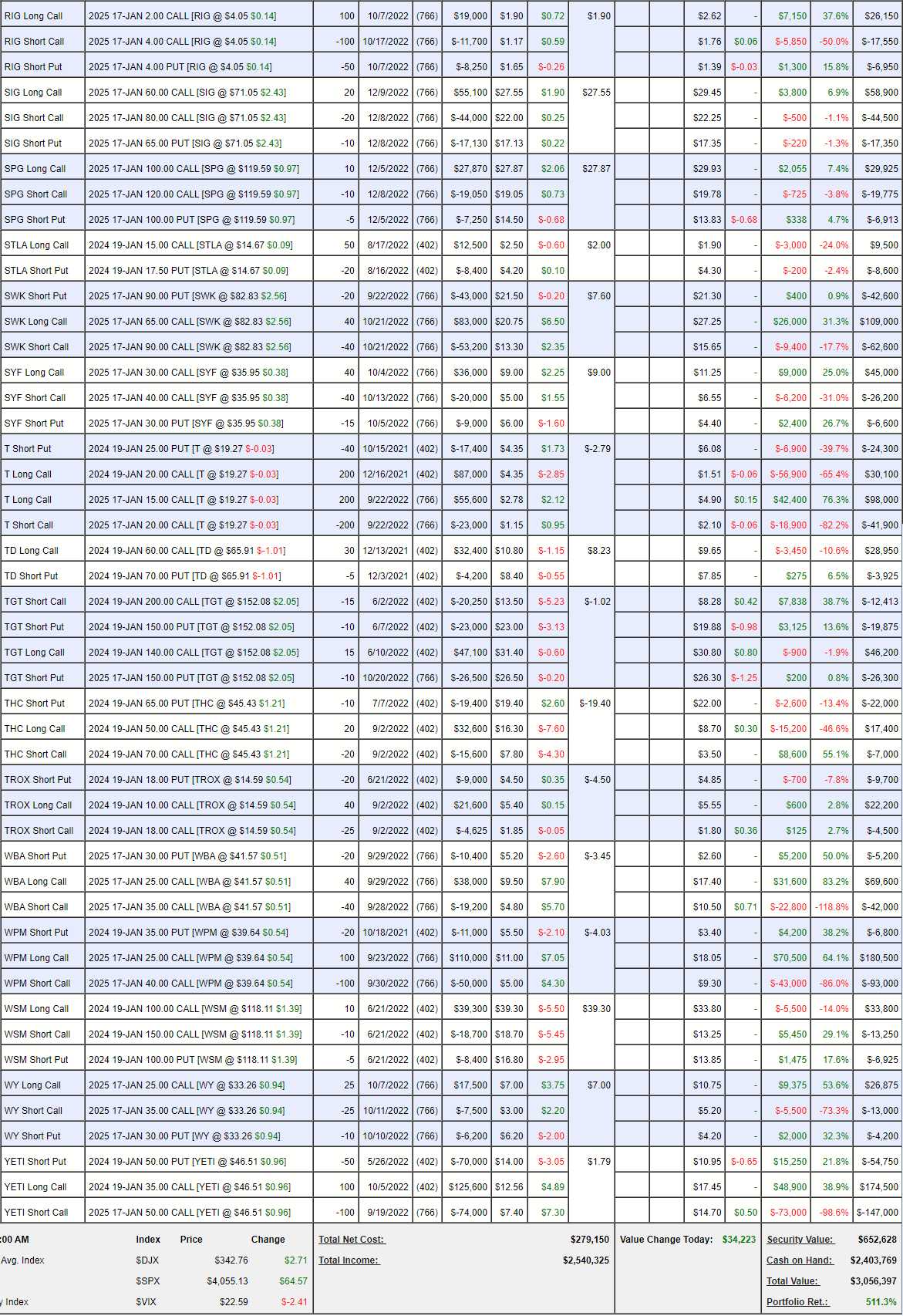

Future is Now Portfolio Review: $366,294 is up a lovely $8,069 from our Nov 15th review. This has been a poor-performing portfolio as we started on 12/12/19 so it’s been 3 years and speculative stocks have taken a big beating this year but, after 2 purges, these are the ones we decided to stick with. Per the portfolio’s title, these are stocks for the future – not the now. They are companies we expect to make 5x on in 10 years or less so it’s still early stages after 3 years.

-

- ASAP – Well, stuck with is more like it. This was WTRH and they reverse split and then dropped another 50% and we’re down about 100% but that means we have little to lose by spending 10x to buy 2,750 more shares for $1,347.50 and then we’ll have 3,000 shares for net $1.95, which still sucks but I see these guys signing deals and it’s just a fun play at this point.

- NAK – This is speculation that the need for Copper and Molybdenum (I can spell it but I can’t say it!) will outweigh the concerns over the Salmon – eventually.

- RWLK – I love what they are doing. Now we need to see if they can do it properly. They won a huge case in Germany (that should work in the EU) that their ExoSkeletons should be covered by health insurance along with wheelchairs. That’s the whole ballgame if that logic spreads.

-

- BRDS – Fairly new. Scooter company.

- CIEN – These will expire worthless.

- VLTA – Car charging. They are burning too much cash and they’ll have do dilute but we’ll take the assignment and build a position down the road.

-

- BFI – This is a burger chain I like. $1.73 is $41M and they made $6M in 2020 and they are now spending money on expansion and revenues are up 5x since 2020 but they are still spending money. I have long-term faith but there are no 2025 options yet. I don’t see a need to roll for the sake of it – we’ll wait for 2025 to come out but we may as well spend $250 to buy back the short 2024 $7.50 calls.

- BIIB – We’re selling the March calls for income against our in the money long spread. All good so far.

-

- CAN – Mainly make Bitcoin mining equipment so doing well considering.

- COIN – Another crypto play and not doing as well but up 5% this morning. Let’s roll our 20 2024 $35 calls at $18 ($36,000) to 40 2025 $40 ($20.50)/90 ($11) bull call spreads at $9.50 ($38,000) and we can roll the 20 short 2024 $75 puts at $40.50 ($81,000) to 30 of the 2025 $50 puts at $25.25 ($75,750). Our obligation was to own 2,000 shares at net $81,600 ($40.80) on the puts, which is where the stock is now. By spending $5,250 on the roll, we’re now obligated to own 3,000 shares at $50 ($150,000) less the $68,400 we sold the puts for plus the $5,250 is $86,850 – so barely any more money to own them but now it’s 3,000 shares at $28.95. That’s called the RAWHIDE Strategy!

- CRSP – This is such amazing tech! Also out of favor and we already got aggressive but let’s roll the 15 2024 $60 calls at $11.50 ($17,250) to 30 of the 2025 $50 calls at $20 ($60,000) and sell 20 of the 2025 $90 calls at $10 ($20,000) and sell 5 of the 2025 $70 puts for $28.50 ($14,250) and we’re spending net $8,250 to move into a still-aggressive $120,000 spread that’s at the money. The whole company is $4Bn at $51.50 and they still have $1.9Bn in the bank, which should last them until there are profits in 2025.

-

- DAL – My 2nd favorite airline (ALK) and it’s right on track as an income-producer.

- ERJ – I like them because they are developing VTOL and they are otherwise solid.

- F – On track and the logic is electric cars have better margins so, as Ford goes electric, margins should improve. $13.75 is $54.5Bn for a company making $7.5Bn a year NOW – so it’s idiotic anyway.

-

- FF – I love this company and finally they are coming back. Options only go to May or we’d have huge positions in these guys.

-

- GPRO – Another one of those cases where companies that spend on R&D get abandoned by impatient traders.

- IGT – Already at our goal at net $26,400 on the $50,000 spread. If they dip, we’ll sell more puts and, if they don’t, we’ll make $23,600 (89%) in 13 months.

- LOVE – They had good earnings and then they died. Nothing to change. It’s a $20,000 spread at the money at a net $875 credit so $20,875 (2,385%) profit from here if they make it to $30 in 12 months.

-

- MDT – I’m glad we’re aggressive on these.

- MP – US-based rare-Earth miner. Doing well so far but the spread is still only net $6,900 on the $60,000 spread so $53,100 (769%) upside potential at $40 and we’re $30,000 in the money already. I feel like Rare Earths are a pretty good bet.

-

- RKT – Getting killed with the Mortgage Sector, unfortunately. I have faith so let’s take advantage and roll our 40 2024 $5 calls at $3.75 ($15,000) to 100 of the 2025 $7 ($2.80)/$12 ($1.30) bull call spreads at $1.50 ($15,000).

- SOFI – Another on-line Financial but this is more like a bank. Held down by Student Loan concerns I think are unfounded but no need to change the spread.

- SPWR – Our Stock of the Decade still seems obvious to me and now we’re well ahead and still just net $25,000(ish) on the $75,000 spread.

-

- THO – Sentiment is all over the place on this one but it’s working for us. This is just net $1,225 on the $37,500 spread and, if Q1 earnings are good – I’ll go for a much bigger position.

That’s nice and relaxing, only 4 adjustments.

— Thursday —

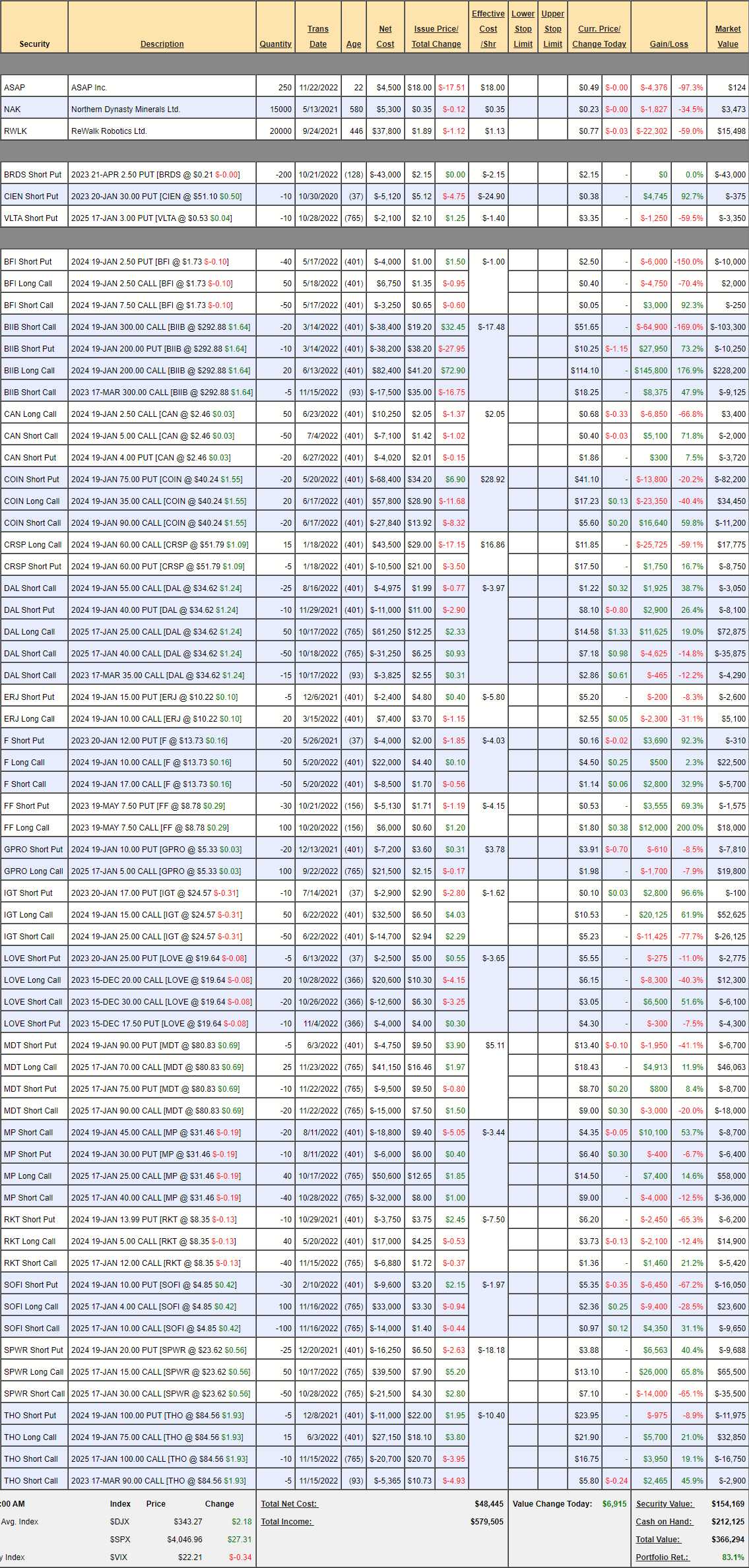

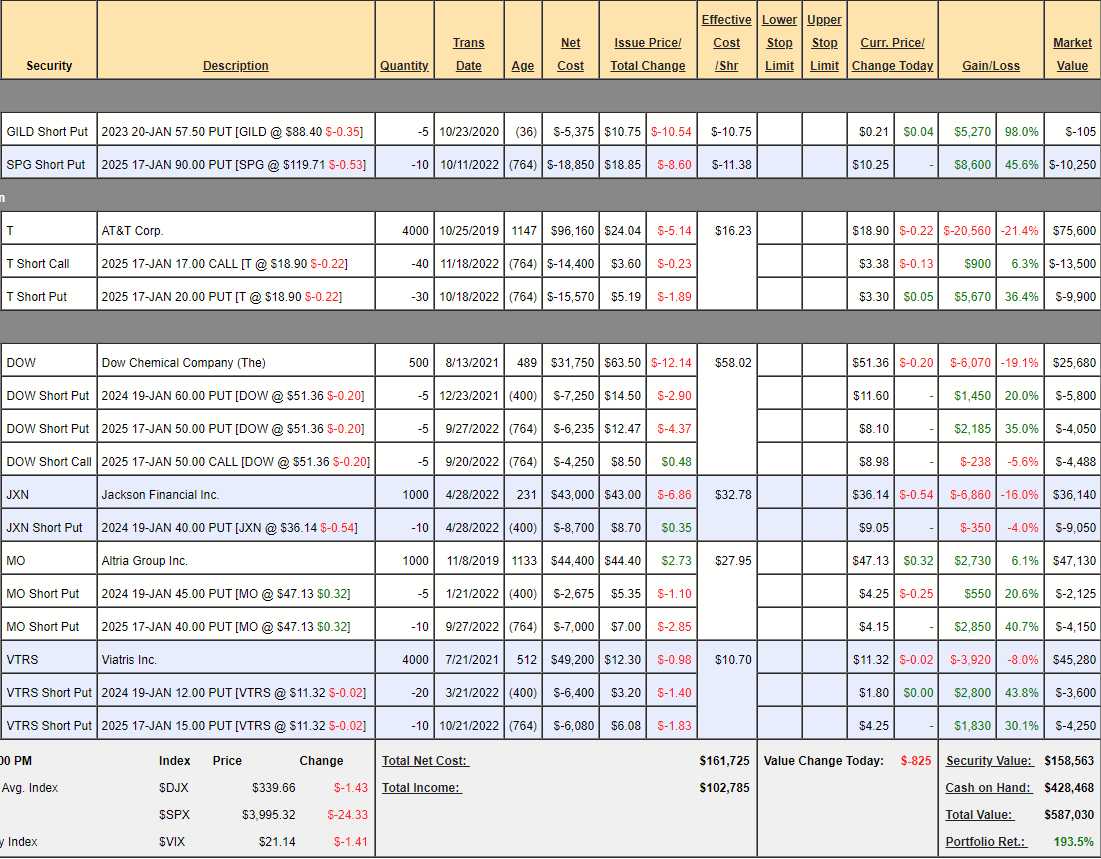

Butterfly Portfolio Review: $2,058,479 has barely budged from our last review but that’s fine as neither has the S&P. This is our oldest portfolio – from Jan 2nd, 2018, and it’s up 929.2% and it’s our steadiest portfolio year after year following our core “Be the House – NOT the Gambler” strategy of simply selling as much premium as possible. Generally, it’s a low-touch portfolio.

We’re 75% in CASH!! and, unlike our other portfolios, the positions in the Butterfly Portfolio are mainly backstops against which we sell shorter-term puts and calls and, because of that, the portfolio is mainly self-hedging. That also means we didn’t have much reason to cut positions – as we don’t really care if the market goes up or down – as long as we collect our premiums…

-

- GNW – Will expire worthless in Jan.

- AAPL – Took a nice hit today. Hasn’t been high enough to motivate us to sell short calls but we might sell more puts if this dip keeps up.

-

- AMZN – I don’t see how we can pass up the chance to buy back the short calls. Let’s buy back the 60 June 2024 $145 calls at $4.40 ($26,400) and let’s roll our 60 June 2024 $125 calls at $7.85 ($47,100) to 60 of the 2025 $100 ($18.70)/140 ($7.70) bull call spreads at $11 ($66,000). Let’s also roll the 20 Jan $115 puts at $25.75 ($51,500) to 20 of the 2025 $100 puts at $22 ($44,000). So we’re spending $30,800 to re-position but we can sell 20 March $100 calls (not yet) for $4 and that’s $8,000 back right there.

- BRK.B – This is a fairly new one and right on track.

- DIS – Let’s buy back half the 2025 $130 calls for $8.70 ($34,800) ahead of the Avatar open. If it goes well, combined with Iger being back – DIS should pop. If it does poorly, they can blame the other guy.

-

- F – We’re in the zone for our Jan target.

- GES – They popped as expected on earnings but now to cover. Let’s sell 15 of the 2025 $25 calls for $4.50 ($6,750) and let’s sell 10 of the March $22 calls for $1.35 ($1,350). We’re taking $8,100 off the table and it’s very unlikely the March calls can burn us.

- GILD – We sold short Feb $80s but now they are protection against our $25,000 long spread that’s in the money. We can roll our 25 2024 $60 calls at $29 ($72,500) to 40 2025 $75 calls at $20 ($80,000) and we can roll the 25 short 2024 $70 calls at $21.25 ($53,125) to 40 of the 2025 $90 calls at $12.50 ($50,000). That’s spending net $10,625 but we move from a $25,000 spread to a $60,000 spread and now we have another year to sell short calls.

Remember – it’s not about “winning” the 2025 spread – it’s about covering the short calls. We sold 20 for $14,500 last month, using about 90 days. We’ll have 7 more chances to roll those and sell more premium so we can generate a lot more than $60,000 playing the short game and any long-term gains are just a bonus.

-

- GOLD – GOLD was our Trade of the Year for 2020 and it was around $16.50 when we picked it on Nov 13th, 2019 and I predicted Gold (/YG) would hit $2,000 ($1,450 at the time) and we hit it in Aug of 2020 and again in March of this year. GOLD topped out at $30 in 2020 and we cashed in early. That’s why we have such a huge position here and no inclination to sell short calls just yet. This is net $37,075 on a $140,000 spread that’s $80,000 in the money – they are just giving it away!

-

- HON – A little complicated but completely on track.

- IMAX – Also benefits from Avatar. We’ll see what the box office says.

- K – We picked a terrible time to sell short calls. We can roll the 5 short March $65s at $9.20 ($4,600) to 10 short June $72.50s at $5 ($5,000) so I’m not worried enough to take action here, with the stock at $72.66. You have to get the mindset that now the short calls are locking in the gains on our much bigger (5x) 2025 $60/75 spread.

-

- KO – On track.

- MET – Busted a little high on us but also the same protection logic.

- MJ – This has been disappointing for us but it’s a net $23,600 credit spread and we sold $4,200 (20%) worth of April calls using 150 of 790 days we had at the time. So 4 more sales like that pay for the whole thing and a bonus if anything happens.

- UL – On track.

- WBA – On track.

- WHR – As I said last month, this boring trade is only of interest to people who want to make 300% in the next 13 months as it pays $120,000 at $150 and is currently net $25,650 despite being $39,000 in the money.

Dividend Portfolio Review: $587,030 is up $33,378 from our last review and up 193.5% since we began on 10/25/19. MUCH more importantly, we are now 80% in CASH!!!, having cut the majority of our positions as we made that mistake last time there was a correction and this portfolio lost half its value.

The problem with dividend stocks is that rumors start that they will cut dividends and people start bailing on them – which is a great opportunity to buy – but not if you don’t have the cash, which we did not ($27,477 last month). Now we are well-positioned to take advantage of a sell off and, if there isn’t one – more of the ones we have!

-

- GILD – The short puts are left over from our spread and will expire worthless.

- SPG – Also left over from a spread we cashed out and well on track.

- T – We’ll be happy to DD if they make us. $18.38 is $135Bn and they made $19.5Bn this year and will make $19Bn next year. There’s $128Bn in debt and 5% of that is $6Bn but that would still leave $13Bn and be 10x. Companies that have $13Bn to spend in a Recession tend to win – especially companies like T who can certainly borrow another $130Bn with a snap of their fingers to make an acquisition (which is how they got so massive in the first place).

-

- DOW – We sold the 2024 $60 puts for $14.50 so we’ll end up with 500 more at net $45.50 to average $54.50 and then we’ll sell 5 more calls for $8 ($4,000), which will take our net down to $50.50 with a call-away in 2025 at $50 but of course we’ll roll the short calls and simply keep playing this game and collecting the dividends. That’s why they survived – it’s early stages and we don’t mind accumulating.

- JXN – We bought them for $43 so if we sell 10 2025 $35 calls for $6.25 ($6,250), that drops our net to $36.75 and we already made money on the short calls we bought back – so let’s do that. If we get assigned the next 1,000, it will be at net $31.30 – so we’re good either way (and then we sell 10 more short calls for another $6,000).

-

- MO – I think these guys are way undervalued and we’re playing them conservatively so no worries.

- VRTS – Super under-valued. That’s why no short calls. People haven’t caught on to these guys yet.

There’s a nice options spread on VTRS:

-

- Sell 20 2025 $10 puts for $1.60 ($3,200)

- Buy 50 2025 $7 calls for $4.50 ($22,500)

- Sell 50 2025 $10 calls for $3 ($15,000)

That’s net $4,300 on the $15,000 spread that’s 100% in the money to start and all VTRS has to do is hold $10 and you make $10,700 (248%) and, even at $8.50, you get $7,500 for the $7s and pay $3,000 for the short puts – so that’s your break-even – 24% below the current price.

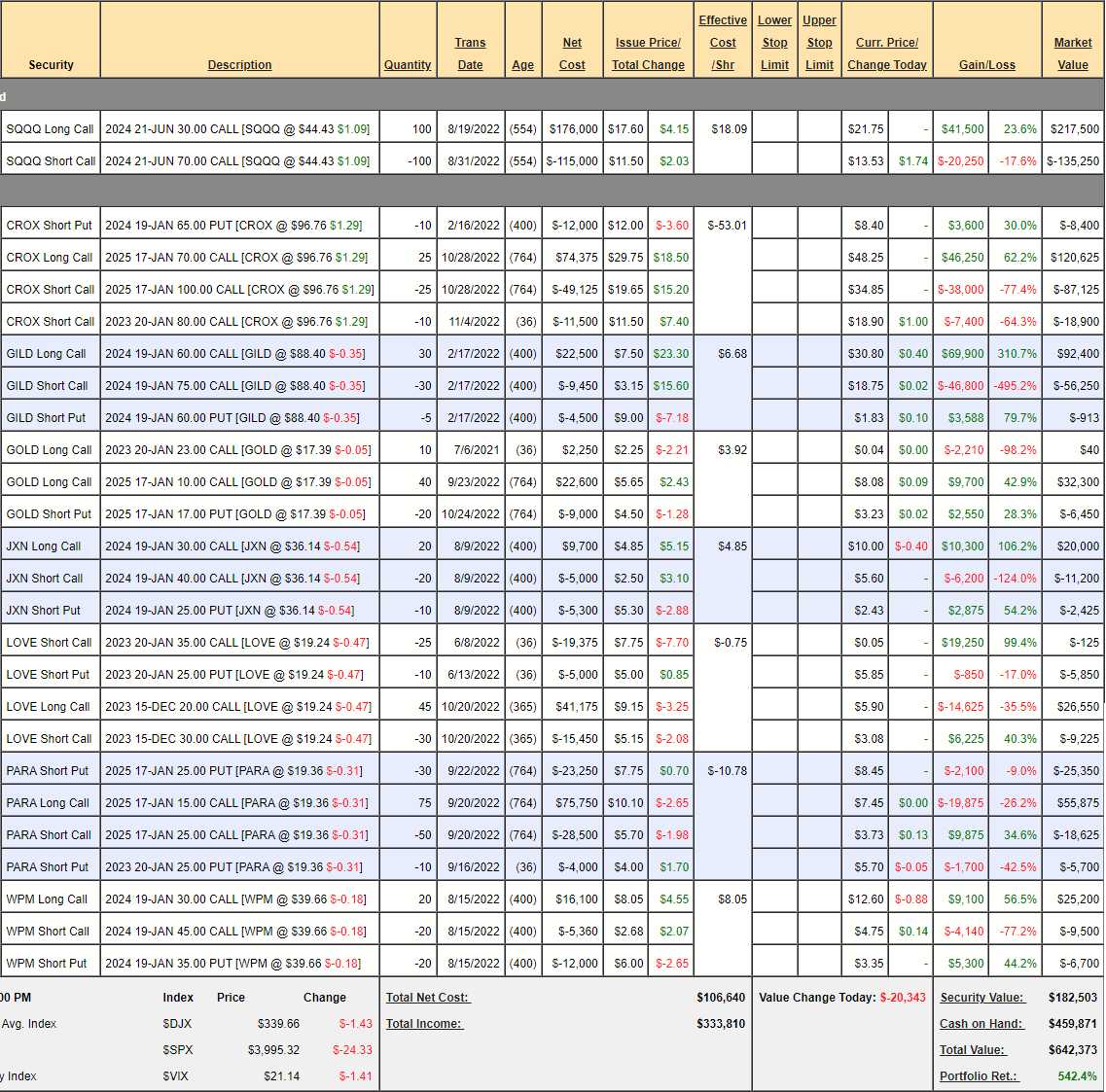

Earnings Portfolio Review: This is another portfolio we mostly cashed in and now we’re at 71.5% CASH!!! and up 542% overall from our 10/21/2019 start. The strategy for the Earnings Portfolio is to find stocks that we feel have been overly sold off after earnings reports and we jump in and buy them at the (hopefully) lows. It’s been working well those some earnings seasons it’s slim pickings trying to find good bargains.

The Earnings Portfolio is also self-hedging, with its own SQQQ position. This was simply as a teaching tool for people who didn’t want to follow the paired LTP/STP strategy.

-

- SQQQ – Very simply it’s net $82,250 on a $300,000 spread and $70 is a realistic target so the potential protection here is $217,750 – more than the current positions are worth, which means we’re very well-hedged with just 7 long positions remaining (as was our intention).

- CROX – Net $6,200 on the $75,000 spread means we have $68,800 (1,109%) upside potential if CROX can gain $3.24 in the next 25 months. Remember, I can only tell you where the money is being given away – I can’t give it to you myself! We’re essentially entirely in the money and we’ll roll the short calls along over time, so I’m not worried about them and they are protection for now.

-

- GILD – This one has exploded higher and, fortunately, we didn’t have any extra short calls. Now net $34,022 on the $45,000 spread that’s way in the money so we’re just waiting to collect the other $10,978 (32%) as we don’t really have anything better to do with the cash at the moment.

- GOLD – You know I love them and we’re hardly covered. Let’s say we hit $25 and that would be $60,000 and currently net $23,250 (I’m not counting the $35, just there in case we get lucky in the next 36 days) so $36,750 (158%) upside potential although if we end up selling the $25 calls (now $1.70) for $10,000+ then that’s more money we’ll be making (and less we’ll be risking). You’re just watching us construct a spread in very slow motion!

- JXN – Funny how they keep popping up. Also boring, just a $20,000 spread at net $5,575 so we have $14,425 (258%) upside potential.

- LOVE – The short calls are essentially worthless and we picked up $19,375 on those for 6 month’s work and we have a year left on the spread. It was only net $1,350 originally and now it’s net $9,100 and it’s a $45,000 spread (assuming we fully cover) and $30 seems very realistic with $35,900 being given away if all goes well – time for another “Buy Me” song! We’ll wait for a bounce to sell more short-term calls (and make even more money!).

-

- PARA – Boulevard of broken dreams in this portfolio. I’m fairly convinced they’ll get bought next year, that’s why we’re conservative with our sales. Still a net $2,162 credit on the $75,000 spread if they can manage to claw back to $25 in 25 months. In 2023 they have a 2-part Mission Impossible and a Transformers movie (and other stuff of course) and I think Paramount + will do well too. That’s $77,162 upside potential at $25.

-

- WPM – They go in and out of favor and we buy them when they are out of favor. Been working for us for many years (2017 Trade of the Year). We picked this up in August and they have already perked up nicely. We started with a $1,260 credit and now we’re net $7,700 after 4 months but it’s a $30,000 spread so no reason not to stick with it. In fact, it’s $17,000 in the money so another one that’s great as a new trade with $22,300 (289%) upside potential.

So that’s $266,315 of upside potential to offset the potential loss of our $82,250 hedge, which pays us $300,000 if the market goes down. So we do better on a sell-off than a rally at the moment – Perfect!