Yesterday was crazy!

Yesterday was crazy!

Even crazier as the market started moving higher 60 seconds BEFORE the CPI data came out to the point where the White House had to issue a statement that they did not leak the data. As noted by Bloomberg:

“Stock futures suddenly spiked more than 1%. Trading in Treasury futures surged, pushing benchmark yields lower by about 4 basis points. Those are major moves in such a short period of time — bigger than full-session swings on some days. And they should get scrutinized by regulators, long-time market observers say, even if a leak is only one of several possible explanations for why traders suddenly started buying right before the report was published.”

Over a 60-second span before the data went out, over 13,000 March 10-year futures traded hands (during a period when activity is usually nonexistent) as the contract was bid up. Stocks and bonds rallied further immediately after publication of the data, as investors speculated that cooling inflation meant the Federal Reserve would pause its tightening cycle early next year.

Whatever the case, fortunately we just ignored the nonsense and reviewed our portfolios in our Live Member Chat Room, which turned out to be well-balanced enough to pass yesterday’s test with flying colors. The last time we had a Fed day was November 2nd, and again the market was looking for a 0.5% hike and got 0.75% and Powell’s press conference didn’t help at all and the S&P did this:

That’s down close to 200 points on /ES in the session, which is more than it fake rose yesterday before selling back off (now 4,050 pre-market). 3,900 is where we got to in anticipation of the Fed slowing to 0.5% at the last meeting and 0.5% or less at this meeting and that’s 1% total. Once that didn’t work, the market flew lower. So, using MATH – not TA – I’d say anything more than a 0.25% hike (not going to happen) will not be supportive of 4,000 this afternoon, which makes shorting the S&P 500 ETF (SPY) at 401 or /ES at 4,050 this morning practically a sure thing. Just keep tight stops above that line if you are playing the Futures.

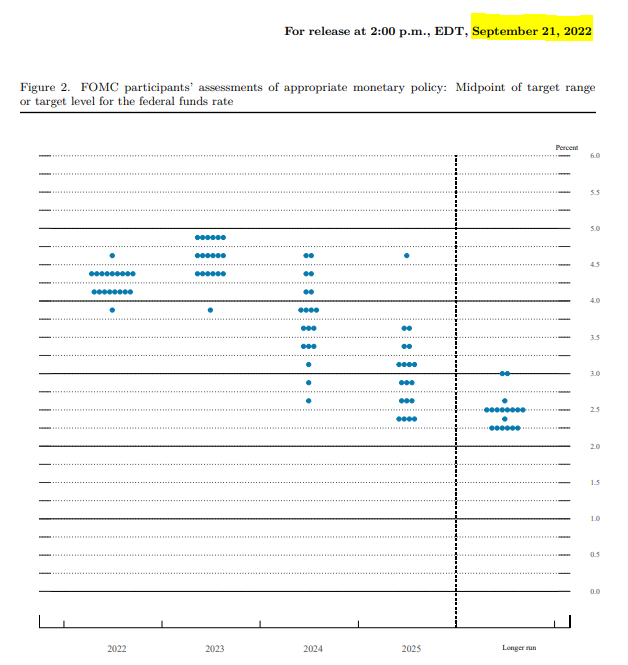

4.5% was the upper limit of the Fed’s “Dot Plot” last month. That is the expected target range for the Fed Funds rate over time. At the last meeting, the Fed raised the rate to 3.75-4% so a 0.75% raise today will take them over the max expectations and REALLY disappoint traders.

As you can see, no one is predicting over 5% while my expectations for June of next year remain at 6% before the Fed finally stops raising rates but they also are not going to collapse back to 2.5% again without a crisis – that’s just silly! While yesterday’s CPI data was much cooler than expected, wages are still rising and oil is still $75 and there are still over 10M unfilled jobs. This is NOT a cooling environment for Inflation yet.

Also, you need to consider that Powell doesn’t WANT to pause. He doesn’t WANT the market to do well because – if you are buying stocks – you are not buying bonds and the Fed most desperately needs you to buy bonds. We had TERRIBLE Bond Auctions this week, with very low demand and low demand means higher rates have to be offered for the bonds and the US has $32Tn worth of debt to service so higher rates are a DISASTER for the US budget.

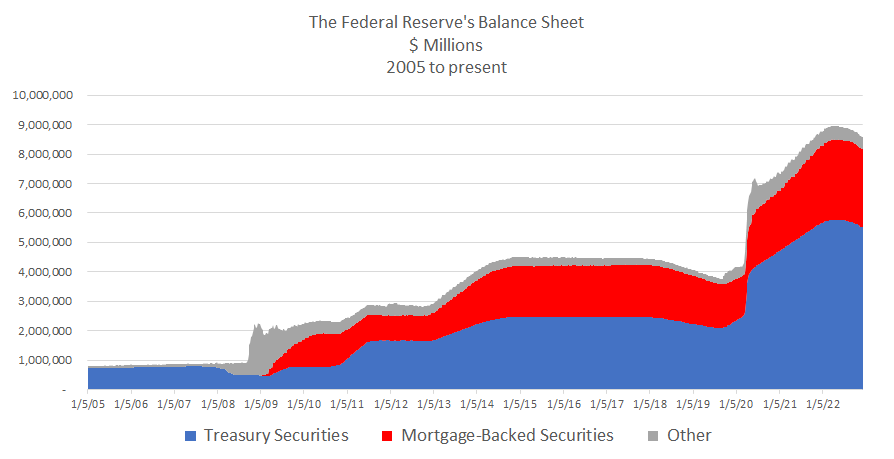

The Fed is still in the process of winding down their own purchases of Treasury Securities and Mortgage-Backed Securities but it will take the rest of this decade for them to reduce their balance sheet, which itself is around $9Tn (but, for some reason, not considered Government Debt).

The Fed is still in the process of winding down their own purchases of Treasury Securities and Mortgage-Backed Securities but it will take the rest of this decade for them to reduce their balance sheet, which itself is around $9Tn (but, for some reason, not considered Government Debt).

How do you get people to buy Bonds? Well the anticipated risky return of the Stock Market (and Housing) has to be less then the lower-risk return of Bonds but Bonds have been anything but risk-free as the Fed’s Rate Increases have drastically devalued existing low-rate bonds. See, this is all complicated stuff!

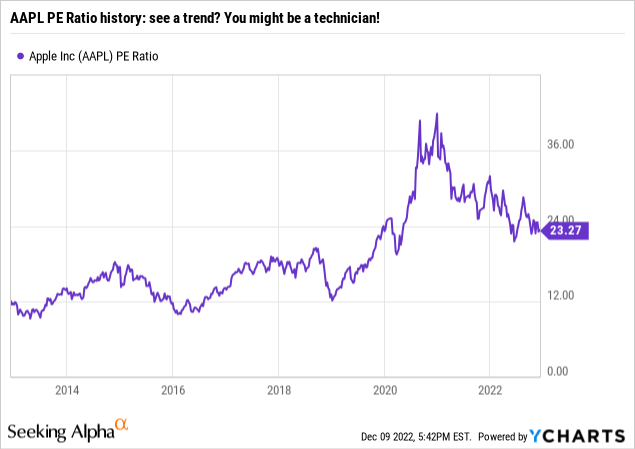

Meanwhile, stocks are too expensive. I noticed that when I was going through our Trade of the Year candidates and, while we did find over 100 stocks to put on our Watch List, we also found 5,900 stocks that did not go on it – because we don’t feel they are a good value yet. Take my favorite stock, Apple (AAPL) – they didn’t make the list because they are at higher than usual valuations at the moment. 23.27x earnings is very high compared to their historical average of less than 15%, in fact, it’s 30% too high!

Meanwhile, stocks are too expensive. I noticed that when I was going through our Trade of the Year candidates and, while we did find over 100 stocks to put on our Watch List, we also found 5,900 stocks that did not go on it – because we don’t feel they are a good value yet. Take my favorite stock, Apple (AAPL) – they didn’t make the list because they are at higher than usual valuations at the moment. 23.27x earnings is very high compared to their historical average of less than 15%, in fact, it’s 30% too high!

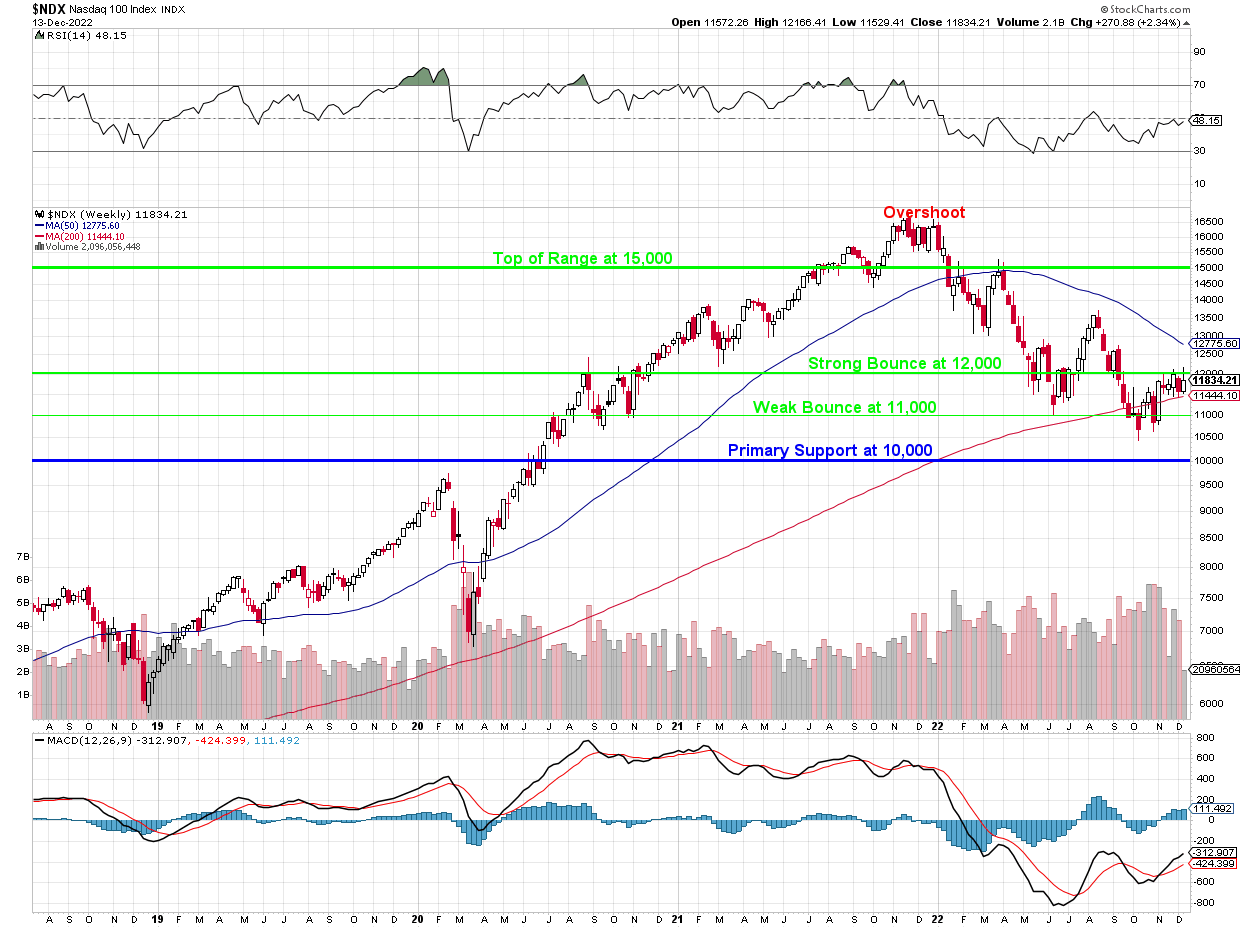

If AAPL drops 20%, the Nasdaq drops 20% (to 9,550) but we think 10,000 should hold on the Nasdaq, as you can see on our weekly chart:

So far, the 200-week moving average has been holding up (as it should) but the longer the Nasdaq fails to take back 12,000, the more the 50-week moving average (now 12,775) will fall and, once it crosses the 12,000 line (in 17 weeks) – the 200-week moving average will weaken considerably and may no longer be support we can count on.

That’s why we want to wait for Q1 Earnings before jumping back into the market. If we don’t see some positive catalysts forming (and I don’t think they are likely), then we need to be well-prepared for that 20% drop back to 10,000.

Do you know who else thinks stocks are too expensive? S&P 500 companies, who bought back 25% less stock ($200Bn) in Q3 than they did in the last two years average, which peaked at $270Bn in last Q4 and Q1. Hmmmmmmm, 20% less buybacks and the S&P is down 16%? Coincidence?

In-line with that statistic, Deloitte just surveyed S&P CFOs about their optimism and that came in at a very pessimistic -21 points, down 3 from Q3 and 10 from Q2. Net optimism, as measured by the difference between the share of CFOs respectively expressing higher and lower levels of optimism, hasn’t been at such a low level since 2020’s second quarter, when it was -54, the survey found.

In-line with that statistic, Deloitte just surveyed S&P CFOs about their optimism and that came in at a very pessimistic -21 points, down 3 from Q3 and 10 from Q2. Net optimism, as measured by the difference between the share of CFOs respectively expressing higher and lower levels of optimism, hasn’t been at such a low level since 2020’s second quarter, when it was -54, the survey found.

During the latest quarter, 41% of CFOs surveyed suggested they were “more pessimistic” about their companies’ prospects than they were a few months earlier, compared to 20% who said they were “more optimistic.” The consulting firm reported Geopolitics and Stability was the top cited external risk at 54%, followed by Inflation (41%) and Policies and Regulations (29%). More than a quarter, 27%, said the possibility of a Recession caused them the most anxiety.

Good news on China is they are reporting less cases of Covid. Unfortunately, that’s because they’ve stopped collecting the data as, apparently, their strategy to end Covid is going to be ignoring it to death. Meanwhile, the Chinese Commercial Real Estate Market continues it’s slow-motion collapse – read this scary article.