It’s been a rough few days.

It’s been a rough few days.

The market is behaving just as we expected it to which is why, in our Nov 15th Portfolio Review, we cashed about half of our positions as I said:

“Since then (10/17) we’ve blasted back to our mid-point at 4,000 and this is where we predicted the S&P would finish 2022 and, as you can see, the 200-day moving average is still declining and, catalyst-wise, I don’t see any reason we should be breaking higher unless the War ends or the Fed decides to pause – neither of which are likely until Q2 – so SHOULD we keep our money in the market when we KNOW this is the top of the range?

“Well, we can never KNOW for sure but, valuation-wise, we’re fairly sure of where things should be and that’s why we were buying 4 weeks ago and that’s why we are selling now. If you are not going to sell when you make profits – when will you be selling?

“So, with that in mind, we’ll take a close look at every position and we’re going to need very strong reasons NOT to cash them out here. If we’re going to stick with something, we should be ready, willing AND able to put more money into the position if the market drops 20%, which is pretty much what it did from our September to October reviews. “

We just completed our December Portfolio Review and we have been able to re-deploy some of that cash at the bottom but we’re certainly not on a buying spree as we’d rather wait a month and see how Q4 Earnings Reports look. As I said a month ago (and we reviewed in this week’s Webinar) – there’s not much in the way of positive catalysts between now and then either.

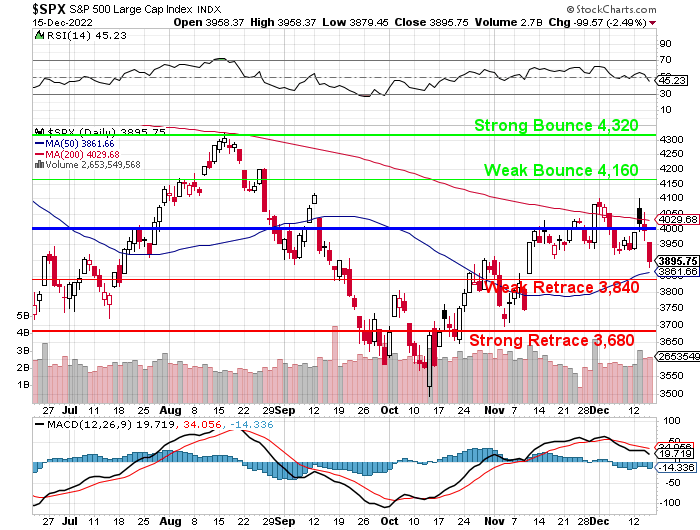

Yesterday I said we were likely to test the 50-day moving average on the S&P at 3,860ish but I didn’t mean THAT DAY! We had a Hell of a fall – all the way down to 3,871 and we’ll see today if there’s any bounce into the weekend. In this situation, we’ll call the fall from the 200 dma at 4,030 to the 50 dma at 3,860 and that’s 170 points so we’ll look for 35-point bounces to 3,895 (weak) and 3,930 (strong) today and anything less than a weak bounce today indicates follow-through to the downside next week.

We are extremely well-hedged after being bearish for a month, so we’re not worried and, in fact, we’d love a chance to get back into some of our positions more cheaply but that would (unfortunately for the bulls) be more like 3,680 – another 5% drop from here – Merry Christmas indeed!

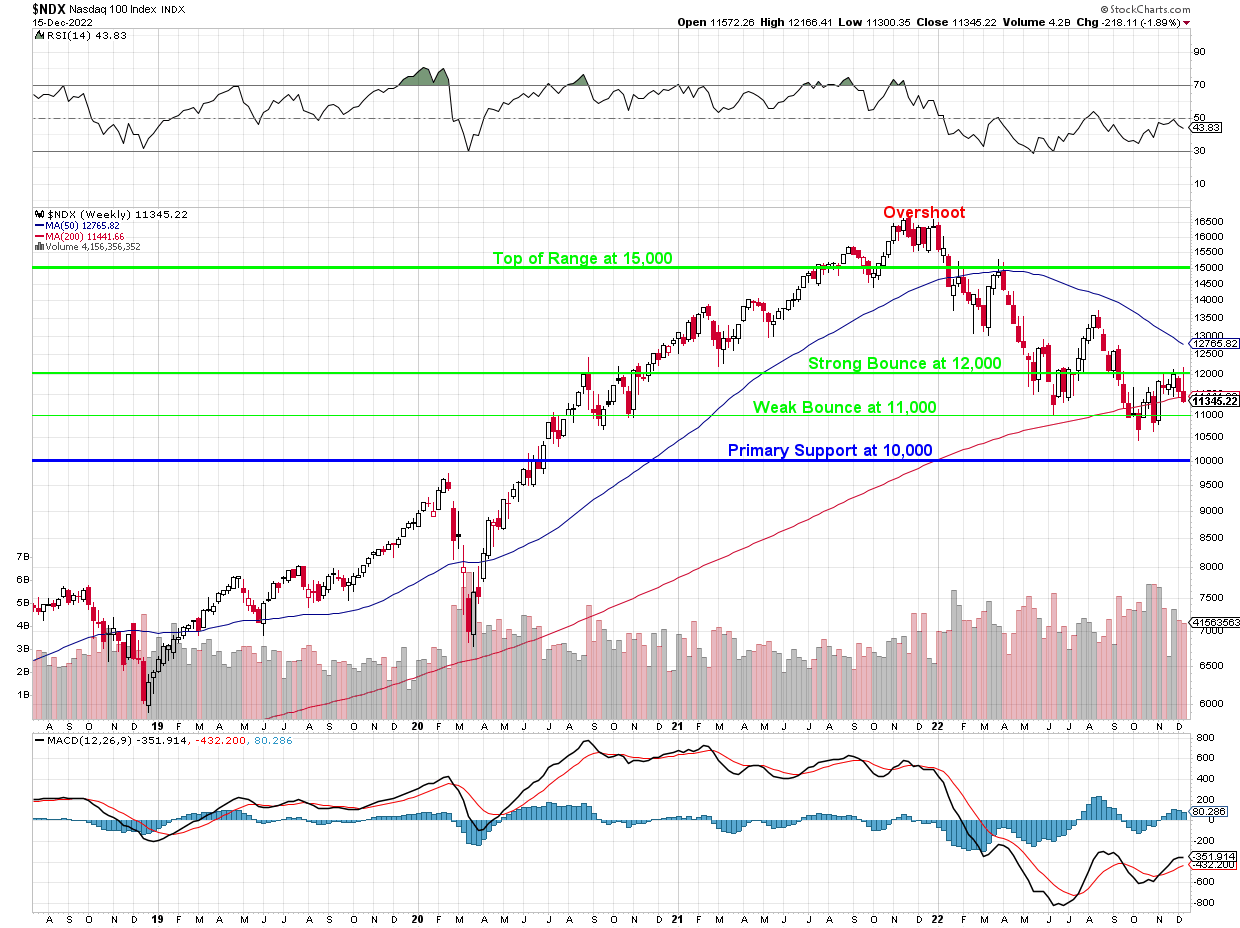

Similarly, on the Nasdaq, after miserably failing the 12,000 line and now it’s 200-week moving average at 11,440 (which accelerates the decline of the 50 wma), there’s no proper support at all until the 11,000 line – 3% below our current position:

Now you can see why I had no confidence in November’s low-volume rally. See how quickly it reversed? That was my concern when I called for a cash-out – that we’d have a rapid sell-off (like the last 3 days) and we’d be unable to get good prices for our bullish option positions.

My biggest concern remains China, which is in a massive Bond and Builder Crisis (they are fruits of the same dying tree) and, on top of that, they’ve now released their population from captivity to play with Covid and that, unsurprisingly, is not going well at all.

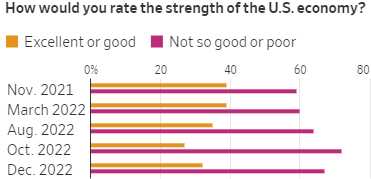

We also have to be concerned about US Consumer Sentiment, which is still terrible with 60% of the people surveyed saying it’s “Not so good or poor“ and 52% say they think it will be worse next year – which is only two weeks away now!

We also have to be concerned about US Consumer Sentiment, which is still terrible with 60% of the people surveyed saying it’s “Not so good or poor“ and 52% say they think it will be worse next year – which is only two weeks away now!

As investors, we tend to be in the Top 10% of the economy so of course we think things are going well. But it’s the Bottom 80% that drive the day-to-day economy because – even if you buy your daughter 3 American Dolls – there’s still 8 of them in the bottom 80% that can’t afford one.

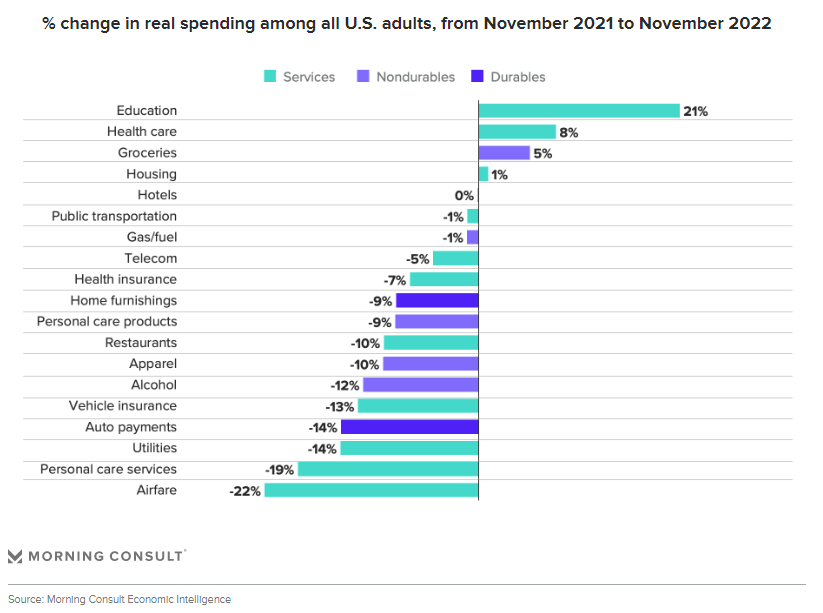

As we discussed in our Live Member Chat Room yesterday, Consumers are being forced to cut back on discretionary spending as necessities like the cost of education is up 21% in the past 12 months and Health Care has gone up 8% and Groceries are up 5% and that is AFTER people have moved to lower-cost alternatives.

As inflation continues, if wages don’t keep up, then more and more the sectors on the bottom of that list (which is most of them) are cut back more and more and even Health Care, which is struggling is getting their profits squeezed by not raising prices enough. As I noted yesterday morning, the UK Health Secretary, told striking hospital workers that their demand is “not affordable.”

This is because the Fed, insanely, has decided to handle Inflation NOT by helping working families have more money to boost the Economy but by DESTROYING demand for Labor and the Economy along with it. THAT is their “plan” to fight Inflation – have fun with that!

This is because the Fed, insanely, has decided to handle Inflation NOT by helping working families have more money to boost the Economy but by DESTROYING demand for Labor and the Economy along with it. THAT is their “plan” to fight Inflation – have fun with that!

There’s no point in complaining, of course, it’s all rigged. Yesterday I managed to shame the NY Times into covering the Hospital Strike in the UK but you still won’t find a word of it in the shameless Wall Street Journal – or almost any other US news source.

And don’t even get me started on Twitter, who just suspended the accounts of 6 journalists and I don’t mean Matt Drudge but Ryan Mac of The New York Times; Drew Harwell of The Washington Post; Aaron Rupar, an independent journalist; Donie O’Sullivan of CNN; Matt Binder of Mashable; Tony Webster, an independent journalist; Micah Lee of The Intercept; and the political journalist Keith Olbermann. All were suspended for “Violating the Twitter rules” with no explanation of what they are.

Even as I write this, I wonder if I’ll be next? That’s what it’s like to live under an authoritarian regime that censors free speech. Also, I haven’t paid my blue check-mark fee yet…

“After his suspension from Twitter, Jack Sweeney (the plane tracking guy) turned to Mastodon, an alternative social network. After Mastodon used Twitter to promote Mr. Sweeney’s new account on Thursday, Twitter suspended Mastodon’s account. As some journalists shared the news of Mastodon’s suspension, their own accounts were suspended.“

Are you freakin’ kidding me??? This is cartoon villain kind of evil we’re dealing with at this point! What Elon Musk does not understand it’s it’s people like us who build Twitter as we send our followers there to generate more and more traffic. If we can’t count on our accounts being open – why put in the time investment to generate his traffic? An environment of fear and paranoia will destroy Twitter a lot faster than Mastodon or criticisms of Musk will.

Happy Hanukkah (Sunday),

-

- Phil