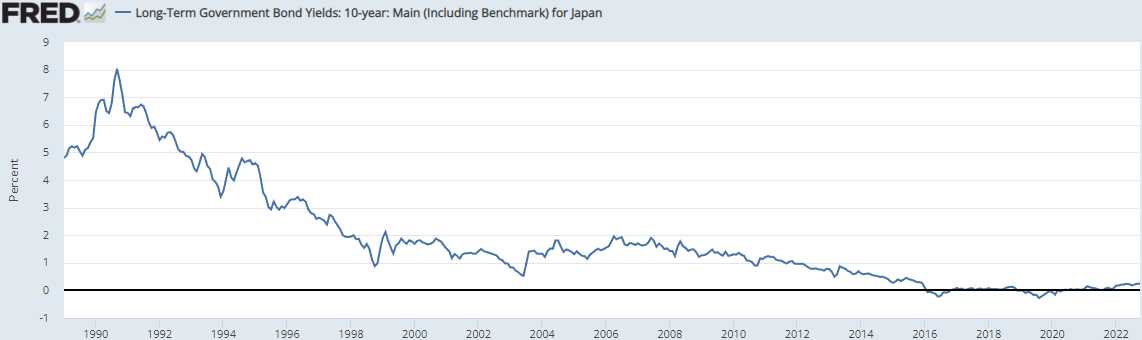

The Bank of Japan raised rates!

In a surprise, overnight move, the BOJ raised their benchmark 10-year rate from 0.25% to 0.5% – the highest level since July of 2014 in an effort more to create demand for their debt than to curb Inflation in the country.

This surprising move sent the Yen up 3% in overnight trading and sent the Dollar down 0.5% to 104, which provided a small boost for equities and a very large boost for Silver (/SI), which popped 3% – back to test $24.

This surprising move sent the Yen up 3% in overnight trading and sent the Dollar down 0.5% to 104, which provided a small boost for equities and a very large boost for Silver (/SI), which popped 3% – back to test $24.

US Equity Indexes, however, remain very weak (see yesterday’s notes) and we don’t keep lowering our expectations just because they are underperforming – we need to see some proper progress before risking more capital into this uncertainty.

Speaking of uncertainty, 587,000 people in the World got Covid yesterday and 150,748 were in Japan, where infections are up 41% in the past two weeks. Hong Kong’s infection rate has jumped 66% in two weeks, but that’s only 15,511 per day. China is doing well – but that’s only because they stopped counting. Here in the US, “only” 65,995 people caught Covid yesterday but, like China, we don’t report most of the cases as vaccinated people tend not to need medical care for mild cases.

Deaths in the US are still “only” 413 people per day and that’s up 59% in two weeks but, at that rate, it takes a whole week to equal the amount of people who died on 9/11 (2,996) and almost 5 months to equal the number of Americans who died in the 10-year Vietnam War. And, on top of this, it’s a very bad flu season with another 150 people per day dying of that – but that’s out of 342,000 people per day getting sick.

Our early Christmas Gift of the Day is Natural Gas (/NG), now back to $5.35 and I think $5.50 is too low though we could see $5 so best to play it when it crosses back over $5.50 and keep tight stops below (say $5.45), bearing in mind that /NG contracts pay (or take!) $100 per penny, per contract.

We caught the up move two weeks ago and did very well so I’m willing to play with conviction at $5.30, which means 2 contract at that price and 2 more at $5 but tight stops if $5 fails. If we go up at all, we get out of 1 (1/2) as soon as momentum stops because, even if we add just a dime, that drops our net on the remaining contract to $5.20 and so on – until we can get a basis below $5, which we can let ride with a lossless stop.

Natural Gas died in the past few days as a previously very cold outlook for the next two weeks was completely reversed and now it looks like Christmas may well be wet but not white in most of the country. Still – it is Winter and it will get cold and Natural Gas is now a global commodity, not a US commodity – this is what traders are forgetting.