“No, I would not give you false hope

“No, I would not give you false hope

On this strange and mournful day

But the mother and child reunion

Is only a motion away” – Paul Simon

There is hope!

Nike (NKE)’s 3% drop in Chinese Revenues was more than made up for by 19% gains in the rest of Asia and Latin America, 11% in Europe/Middle East/Africa and a whopping 30% gain in North America as kids got their shoe fixes back at the malls with 25% more footwear sales overall than last year.

And that is despite overseas numbers being dragged down 30% by currency conversions against the very strong Dollar. Gross Margins were also strong at 42.9%, despite inventory liquidations and higher logistics costs. NKE made $1.3Bn in Q3 AND built inventory up 43% over last year – ready for Christmas! They also bought back over $5Bn of their own stock while it was low.

Pre-market they are blasting up from $105 to $114 (8.5%) and that’s about $175Bn and they are running at about a $5Bn clip so 35x earnings is still overpriced in the end and what we’re interested to see is if they hold up. They did make $5.7Bn in 2021 on $44.5Bn in sales and now looking like $50Bn so let’s say they make $7Bn, that’s still 25x so $115 should be the top of a normal range, not the bottom.

FedEx (FDX) also had a very nice 10% beat but Revenues were off by 4% but it was still better enough to make for an 5% gain in the stock in pre-market trading. Lower Global volumes for express shipping was the major issue and the company is moving to cut costs but that’s because they are lowering outlook – so not that great.

Even pared back, FDX should make about $3.5Bn next year and $172 is $45Bn for the company, so call it 13x earnings and Fuel is their big wild-card. FDX made our Watch List but failed early on due to too much International Business (currency concerns), $13Bn in Debt and reliance on Oil.

It also takes them 345,000 people to make $3.5Bn and that’s only $10,144 per employee and let’s say those employees make just $35,000 each, that’s still $12Bn so giving them just a 10% raise would drop earnings by 12% – and that IS going to happen.

See how hard it is to make us happy? We’re just very critical right now but we’d welcome a change in sentiment if the market can get a proper lift based on these reports. We have over 100 stocks on our Watch List we’d love to buy if conditions turn around – but we’re still on pause into the new year.

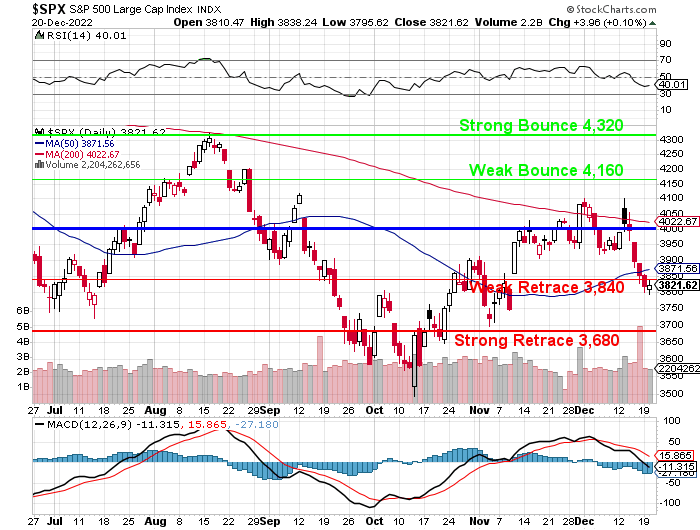

We’re at 3,880 this morning on the S&P 500 and that’s back over the 50 dma so all is well if we can hold onto it though the Nasdaq, of course, is still critically wounded at 11,242 but at least we’re holding 11,000, which I noted Friday in “TGIF – November’s Market Gains Are Gone, Now What?“, where I said:

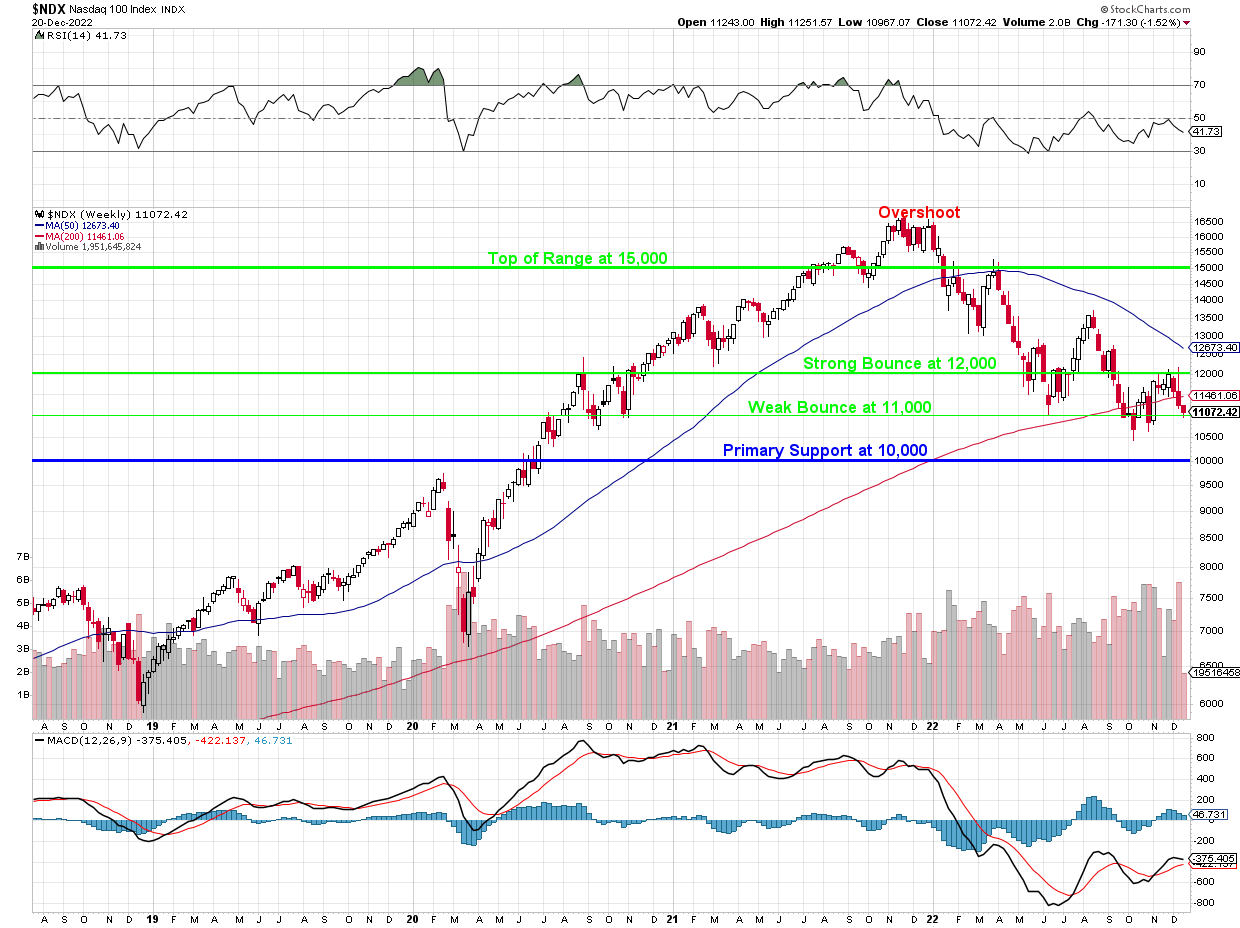

“Similarly, on the Nasdaq, after miserably failing the 12,000 line and now it’s 200-week moving average at 11,440 (which accelerates the decline of the 50 wma), there’s no proper support at all until the 11,000 line – 3% below our current position:“

See how easy it is to predict the future? Also note the broken “W” pattern – those are bad so we need to be back over 12,000 (where it broke) before there’s any safety at all and I’m not seeing that kind of catalysts so let’s not get excited about a little bounce on over-priced NKE or edge of disaster FDX.

On the other hand, our little long play on Natural Gas (/NG) yesterday has already paid us over $1,400 per contract so congratulation to all who played along at home. I think we can do much better but the sensible play here is to cash in one contract here for a $1,400 profit and put a stop on the other one at $800 ($5.44) so we lock in $2,200 in gains but we have room to run on the new contract. There’s an Oil Report at 10:30 that’s too much of a wild-card to risk our gains on…

On the other hand, our little long play on Natural Gas (/NG) yesterday has already paid us over $1,400 per contract so congratulation to all who played along at home. I think we can do much better but the sensible play here is to cash in one contract here for a $1,400 profit and put a stop on the other one at $800 ($5.44) so we lock in $2,200 in gains but we have room to run on the new contract. There’s an Oil Report at 10:30 that’s too much of a wild-card to risk our gains on…

We’ll see what other opportunities pop up during the day. Consumer Confidence and Existing Home Sales will be reported at 10 and the EIA Inventory Report is 10:30 and, later today, we have our Live Trading Webinar.