Welcome back!

Welcome back!

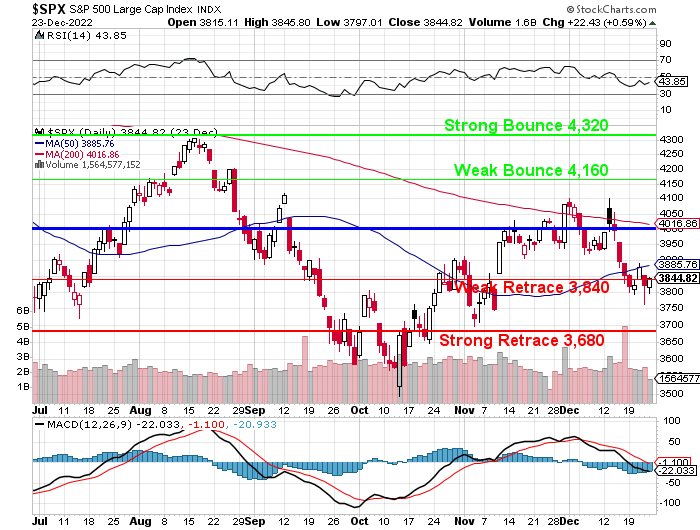

It’s a nice, short week and we get another day off next Monday so all is well and the volumes are low, so it’s a good time to push the market a bit higher but we’ll have to see what sticks next week. Today we’ll see if “THEY” can even get the S&P back over the 50-day moving average at 3,886 – it’s trending up, so it shouldn’t be too much resistance.

Will anything be enough to get us to our predicted 4,000 line for the last day of 2022? It really doesn’t matter – it’s not like we needed 4,000 on the button to make our bones for the year – we already cashed out and the market is right where we expected it to be – so on we go to 2023.

As we expected, Covid has become a huge issue in China but they stopped reporting numbers and rumors are anywhere from 50M to 350M people have been infected in the past month. At the moment, US numbers are holding steady at 66,000 infections per day (24M/year) and “only” 426 deaths per day (155,490/year), which is only as many Americans as died during the entire Vietnam war every 6 months – so why worry about that?

One effect we are seeing here is Tesla’s (TSLA) stock is dropping today because their Shanghai plant is extending production cuts into next year due to the Covid emergency. At the moment, the plant is completely shut down. Shanghai makes about 1/3 of all Teslas (3s and Ys) in the World.

$117 pre-market is down to $368Bn from $1,300,000,000,000 last Christmas – so it’s been a bad year for Elon and company. The real problem is they never should have been at $1.3Tn and, even at $368Bn, the company “only” made $13Bn in 2022 so it’s STILL trading at 28x earnings but they projected $19Bn for next year, which would be a forgivable 19 times earnings but producing ZERO cars in Shanghai for a month will cost them $1Bn.

On the other hand, TSLA has $17.5Bn net of debt in the bank – that’s a huge plus, so they are getting into the zone where they may be playable. This morning you should be able to sell the 2025 $50 puts for $10 and that would net you into the stock for net $40 and even Elon Musk shouldn’t be able to screw things up that badly – right?

Let’s say we sold 10 short TSLA 2025 $50 puts (obligating us to own 1,000 shares at $50) for $10,000 and bought 20 of the 2025 $50 ($80)/80 ($63) bull call spreads for net $17 ($34,000). That would be net $24,000 on the $60,000 spread that is 150% in the money to start. If TSLA stays over $80, you make $36,000 (150%).

That is the first bullish play I’ve picked for TSLA since they were about $50! Although I just filled up my tank this weekend at $2.85/gallon, Gasoline (/RB) priced shot back up to $2.40 over the weekend though with all the snow and grounded flights, I think it should pull back again. Oil (/CL) is $80 this morning and also a fun short with very tight stops above that line.

That is the first bullish play I’ve picked for TSLA since they were about $50! Although I just filled up my tank this weekend at $2.85/gallon, Gasoline (/RB) priced shot back up to $2.40 over the weekend though with all the snow and grounded flights, I think it should pull back again. Oil (/CL) is $80 this morning and also a fun short with very tight stops above that line.

We’re still long on Natural Gas (/NG), which is hanging around $5.15 this morning. The cold snap has mainly gone away but the intensity of the cold is likely to lead to a major draw-down in this week’s report.

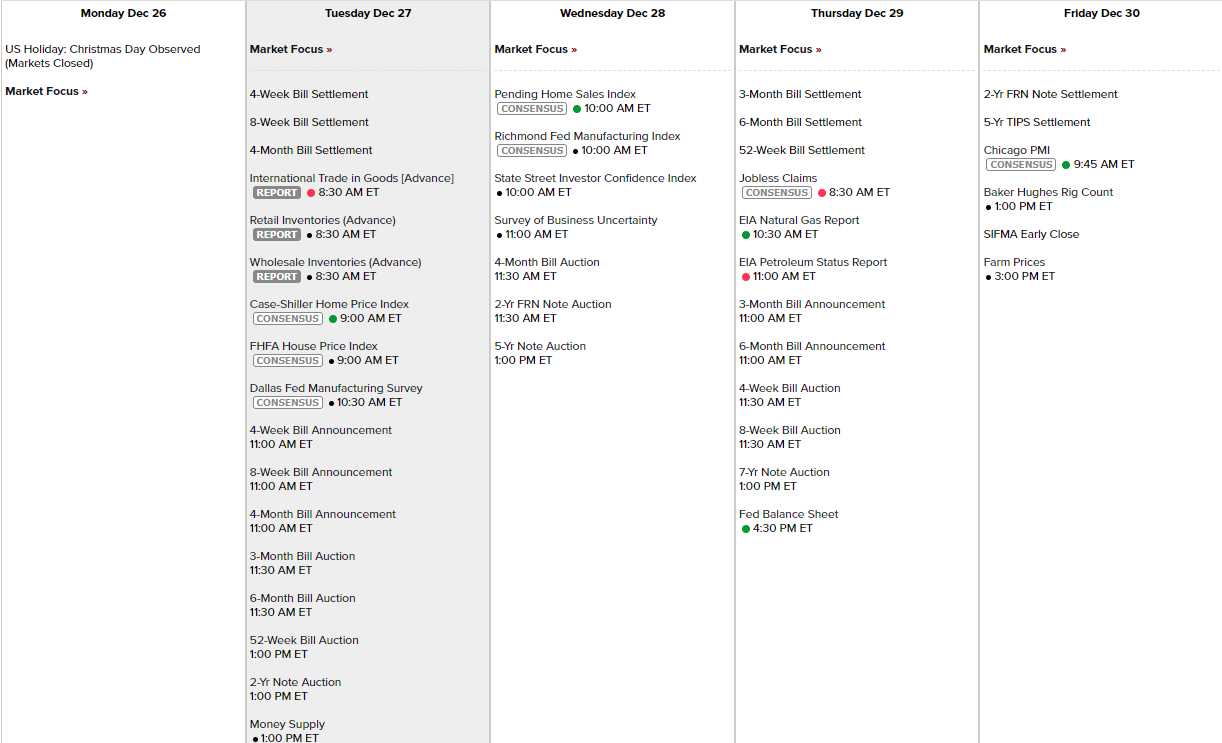

Speaking of reports, it’s a pretty dull data week with NO Fed speeches scheduled:

And there are no significant Earnings Reports this week either. We really should be on vacation and I was going to be but I dithered about taking a cruise this week as I was worried about Covid and I waited too long and missed my chance. Now I’m sorry I missed it as, historically, it is such a slow week.

Market moves this week are not to be taken seriously.