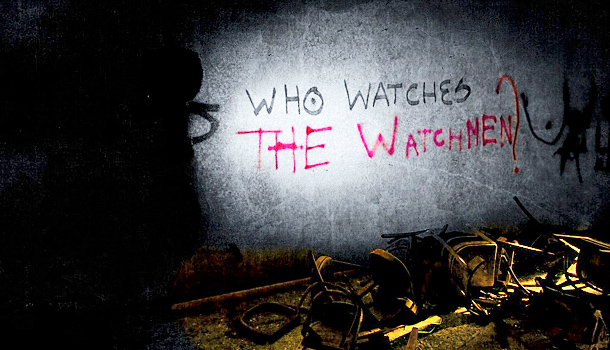

Who watches the watch list?

Who watches the watch list?

Back on Thanksgiving we made our Trade of the Year selection and, to get to our final selection (YETI), we had to eliminate the other 6,000+ publicly traded stocks. Most of them were easy - as they were too expensive or had too much debt or no clear path to growth but the last few hundred were all worthy stocks and we ended up with 60 finalists.

On top of that, we purged another 50 stocks from our Member Portfolios, not because there was anything wrong with them, but because we had already made nice profits and didn't want to risk the positions into a downturn (which we're in at the moment).

Still, we are very happy to add most of those stocks back in if they get cheaper so let's do a quick review so we have a ready list to refer to, whenever we're in the mood to add a stock to one of our Portfolios going forward. Generally, we're going to focus on whoever is on sale at any given time. Some are already up quite a bit from November but we're not buying now - just making a list we can check twice later:

AKAM - $83.50 is $13Bn and 15x earnings and cloud services is a growing space.

ALL - $136 is $36Bn and 15x and topping in a range they will likely break over. Higher rates are good for insurance companies, who are forced to park their reserves in "safe" assets.

APD - $312 is $69Bn and 26x so not cheap but explosive growth in a very niche specialty gases company so we'd love a shot at another dip.

APO - $63.40 is $36Bn and not even 10x earnings. Nice little Wealth Management firm that should grow nicely as Investors seek help in a troubled market.