2023 Predictions

Courtesy of Scott Galloway, No Mercy/No Malice, @profgalloway

Every year we make predictions. The purpose is to inspire a conversation. We also try to hold ourselves accountable. Here are some of our predictions for 2023.

2023: Patagonia Vest Recession

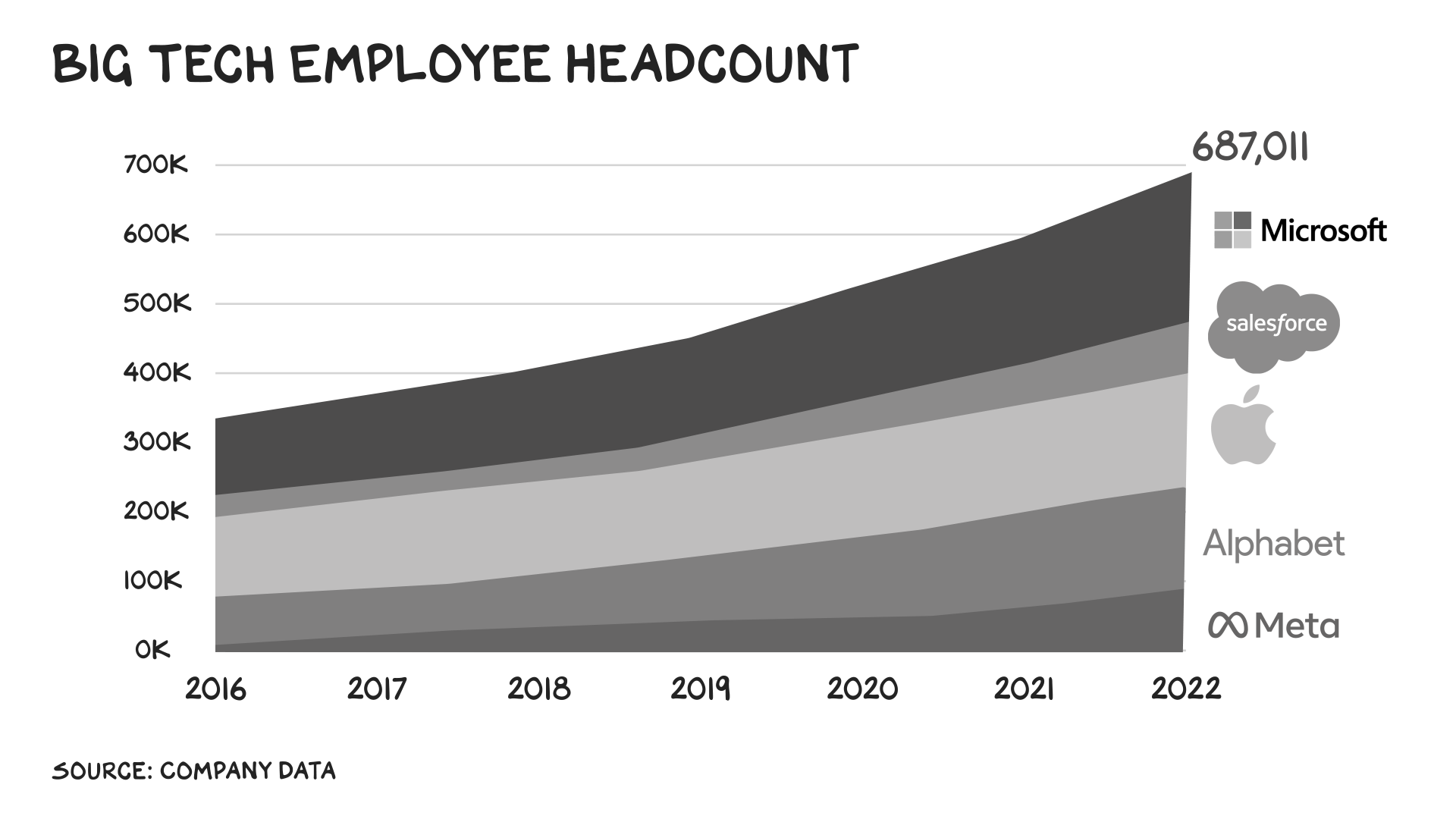

The business story of 2022 was inflation. In 2023 it will be recession, and we’ll realize there are worse things than people with assets becoming less wealthy. In addition, a generation of tech workers (and tech journalists) who believe Pet Bereavement Leave is normal will discover a new normal. Goldman Sachs, Airtable, Adobe, Plaid, Morgan Stanley, Buzzfeed, Pepsi, Gannet, CNN, DoorDash, AMC Networks, Carvana, Nuro, Roku, Cisco, Amazon, and Asana have all announced layoffs in the past month. More than 90,000 workers in the U.S. tech sector have been let go so far in 2022 and over 150,000 globally — more than in 2021 and 2020 combined. Relative to the 5 million total U.S. jobs created in 2022, it’s a drop in the bucket, but the drop will swell in 2023. Big Tech exploded headcount during the 14-year-long sonic economic boom.

The clouds forming over Meta’s rooftop Kombucha bar: The fastest interest rate hikes in history; tech valuations reuniting with fundamentals; and Musk proving that a business can maintain a minimally viable product with a third of its employee base. Twitter’s revenue has collapsed, from $5 billion to $1 billion, but that’s more a self-inflicted wound than the result of Musk’s mass firings. Overheard in every tech boardroom: “We can have the same great taste (massive reduction in headcount/costs) with fewer calories (revenue loss).” The most consequential business strategy of 2023 won’t be AI or supply chain diversification, but being tough without being an asshole.

The average U.S. tech worker is 35, meaning they were in 8th grade in 2001 and in college in 2008. The longest expansion in America’s history is “normal” to them — it’s the only market they know. The layoffs will make for dramatic headlines as journalists, most of whom have likewise only reported during high tide, broadcast history’s largest symphony of tiny violins. The upside(s) of the reckoning (aka, capitalism) will be substantial. Specifically …

Amazon, Alphabet, and Meta Register Historic Profits

Layoffs are bad for company morale and worse for those who get fired, but they’re often good for business. The average tech worker cost their employer at least $100,000 in salary plus benefits and dilution in 2022. Call it $150,000. Fewer humans means substantially more profit per share. Google and Meta, with 30% operating margins, can either fire 25,000 people each or increase their top-line revenue by $12.5 billion and register the same operating income. They, and hundreds of other tech firms, will choose a version of the former.

Activist shareholders, and management whose lifestyles are linked to the share price, realize this. TCI, a hedge fund with $6 billion of Alphabet shares, sent a letter to CEO Sundar Pichai last month saying the company has too many employees. Alphabet and others will heed TCI’s call. Despite the headwinds facing the ad giants, including Apple’s privacy measures, the rise of TikTok, and a slowing economy, “efficiencies” will deliver Alphabet, Amazon, and Meta’s most profitable quarters ever.

As a founder/entrepreneur I’ve had several decent/good exits. The skills responsible for my (modest) success, other than being ridiculously fucking lucky: communication, attracting talent, and firing (non)talent. Put another way, if you enjoy the Hallmark Channel more than the History Channel … don’t start a business. If this sounds callous, keep in mind that 99% of the world would kill to be a recently laid-off U.S. tech professional; it means you are educated, highly skilled, and live in a democracy. And this downsizing cloud comes with a thick silver lining — a recession is the best time to start a company, because people and equipment are less expensive and consumers/clients are open to new products/services.

ByteDance Breaches $1 Trillion in Value

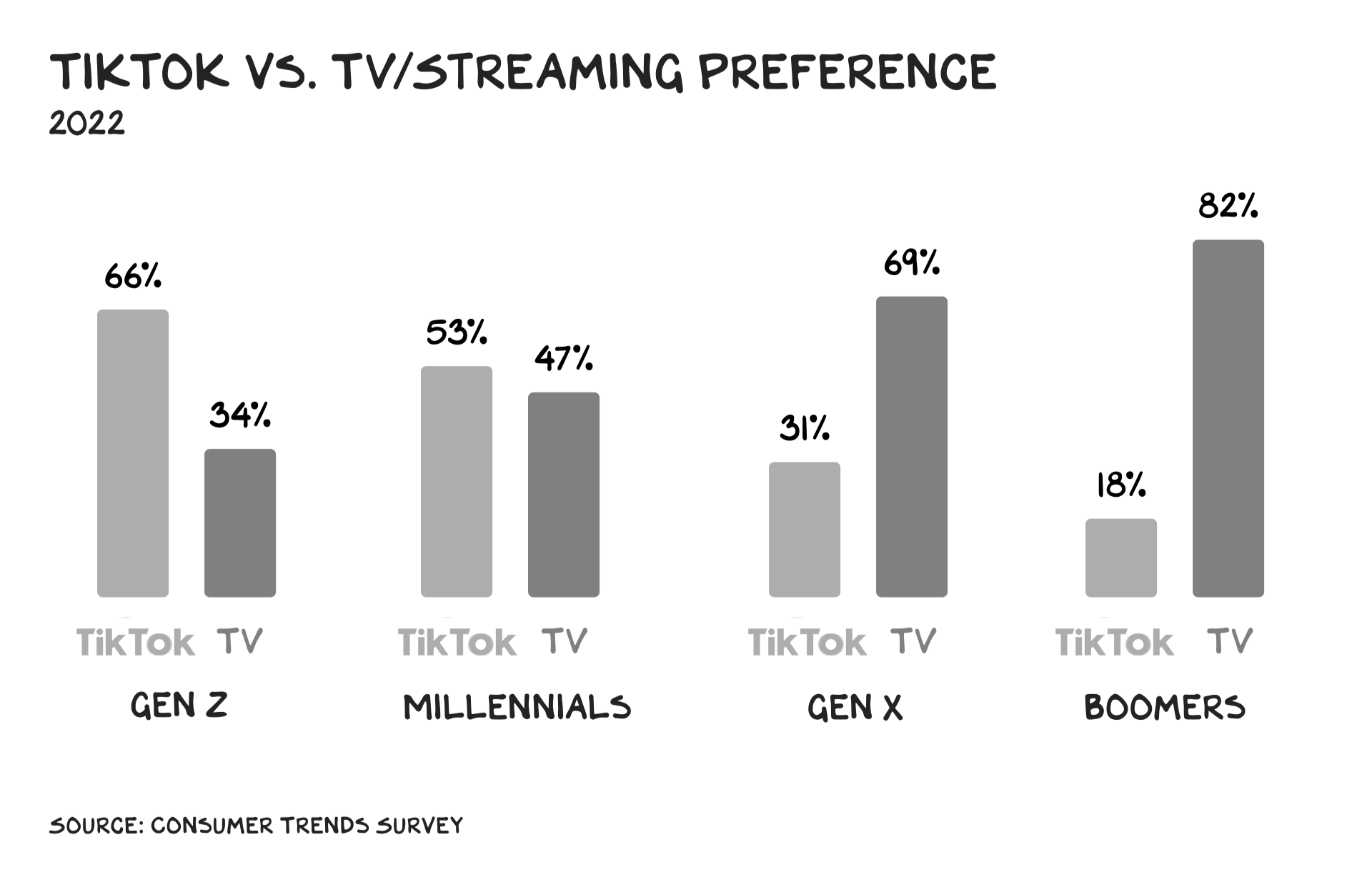

A couple months ago we wrote about the two forces sucking the oxygen from the advertising ecosystem: Apple and TikTok. Apple is already a multi-trillion-dollar firm, and TikTok will cut the ribbon on its four-comma valuation this year. At its current $300 billion valuation, TikTok’s parent, ByteDance, is worth more than Disney, Snap, Pinterest, Twitter, IPG, WPP, and the Omnicom Group combined.

The Chinese company took just five years to reach a billion users — three years less than Instagram and four years less than Facebook — and those users spend 100 minutes/day on the platform. When young people are asked to choose between TikTok and all of TV/streaming … they choose TikTok. Think about the last sentence. ByteDance’s network should be banned or spun to U.S. interests, but that’s another post. The parties involved will find an accommodation, as there’s just too much money at stake.

Peak Idolatry of Innovators

Nearly 7 billion of the 8 billion people on Earth identify with a religion. As a species, we can’t choose if we worship, but can choose who we worship. As search engines and iPhones replace mythical and spiritual beings as our sources of truth, our worship shifts to the gods responsible — the wealthiest person in tech has a 1 in 3 chance of being Time’s Person of the Year. Our new gods: Bill Gates, Steve Jobs, Larry and Sergey, Elon Musk, Elizabeth Holmes, Sam Bankman-Fried …

Our gross, nonsensical adoration of tech innovators may have peaked. It’s been a tough couple of months for the Church of Technology: Elizabeth Holmes was sentenced to 11 years, and her colleague to 13 years; Nikola founder Trevor Milton was convicted of fraud; Celsius Network went bankrupt and faces federal investigations; and SBF’s Oops I Did it Again apology tour was cut short due to an outbreak of law.

I hope a fresh round of bankruptcies, margin calls, and orange jumpsuits dethrones our modern-day gods and sobers up the media, the public, and elected leaders who worship them. I’m optimistic these abusers will not just be reassigned to different parishes, but their close-up will illuminate the importance of regulation, trust, and independent boards. We may even realize the people responsible for prosecuting fraudulent actors, maintaining backstops on savings accounts, and writing laws are the people who are really on y(our) side.

I also believe we’ll see a return to 20th century admiration for government agencies and people who have re-created the sun and are transporting us to the beginning of time. They have achieved these things without stealing from others, accusing ex-employees of sex crimes, or spreading homophobic conspiracy theories.

While we’re here …

Tesla: Record Revenue … and the Stock Halves (again)

Scott Fitzgerald defined intelligence as the ability to hold two opposite ideas in the mind at the same time. Tesla will post record revenue and deliveries next year, and the stock will still get cut in half. I’ve been a Tesla bear for a long time, which means I’ve been (very) wrong for a long time. The lesson was to “never bet against a company with a great product.” And that’s still true. The problem for Tesla is that greatness is relative, and the industry is catching up. In London every other car is an EV, and most of them aren’t Teslas. At the World Cup in Qatar there was a barrage of advertisements for the Ioniq 5, Car and Driver’s 2022 EV of the Year.

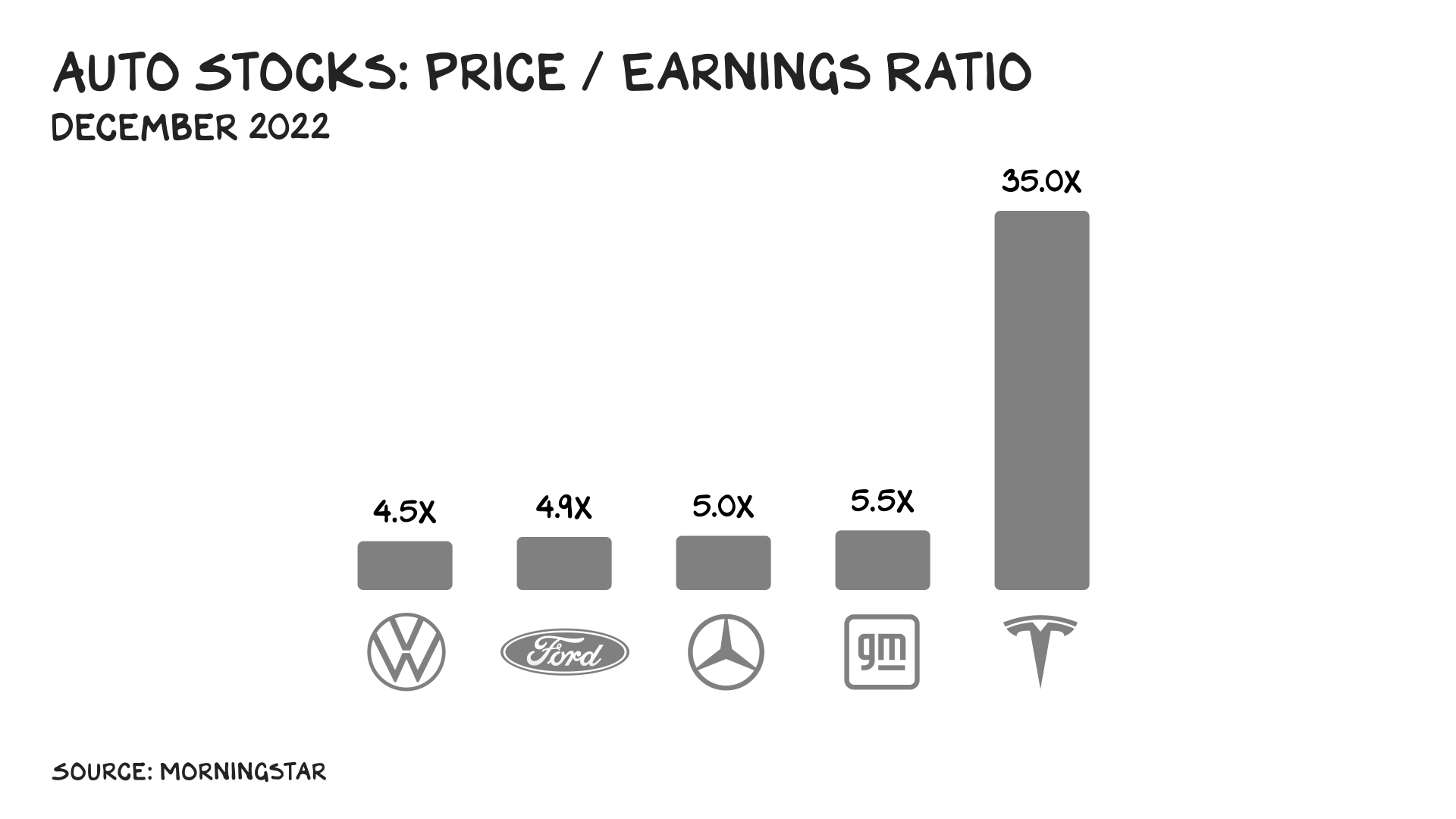

Tesla pulled the future forward with EVs that bested internal combustion cars. But the future is finally here, and TSLA is catching up to our prediction. Last year we said (again) that Tesla would be cut in half in 2021, and it was. The slide will continue. Why? Tesla still trades at 35 times earnings, while the competition (something Tesla didn’t have before) trades at 5 times earnings.

Best-Performing Tech Stocks: Airbnb, Meta, Chinese Internet Firms

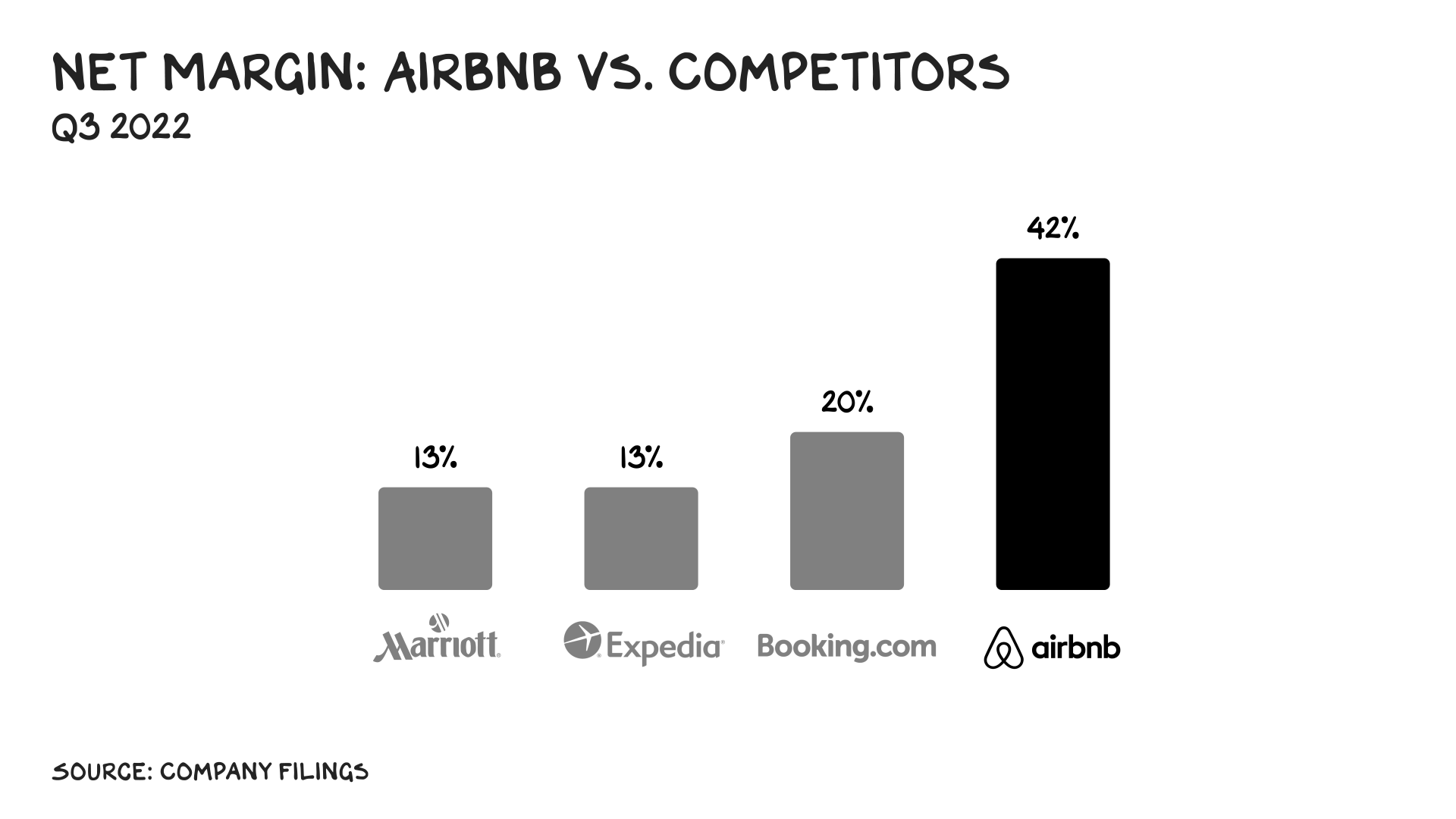

I believe the best-performing large tech stocks of 2023 will be Airbnb and Meta. For different reasons. Airbnb stock is pricier, but we believe it will grow into its valuation. Seventy percent of the company’s site traffic comes from direct, organic visits — that’s compared to 40% for Marriott and Expedia. This brand strength results in a net margin twice those of its hospitality peers. Airbnb also generates half a million in revenue per employee, more than most tech companies — and ten times greater than hotel chains. The company can reinvest at a rate that will further increase the delta between the business and its peers. I believe, already, that ABNB is the strongest hospitality brand in modern history. “I got a Hilton in Los Angeles,” said nobody, ever.

I hate Meta and … its equity will outperform the market. The Zuck’s growth plan (the metaverse) is something his most formidable enemy could not have dreamt. We said this before it was cool, and the market concurred this year and took the stock down 75%. In one year, Meta lost its gains from the previous five. Sure, the metaverse is dumb/stupid/ridiculous, but Meta is still a $120 billion business and a cash volcano with (despite Zuck roofieing his colleagues with a Big Gulp Grande Venti ayahuasca trip to the metaverse) exceptional operating margins. Facebook and IG are no longer the hot new thing, but the population of the Southern Hemisphere and India still use them.

Other strong performers will be Chinese tech stocks such as Meituan, Pinduoduo, Tencent, Alibaba, and JD.com. The thesis is simple: On an enterprise-value-to-revenue basis, these stocks are selling for 50% off their U.S. peers due to political uncertainty, not the performance of the underlying businesses. There’s likely more short-term turbulence as China reels from its abandonment of “zero-Covid,” but China’s economic heft and Xi’s need to continue bringing his countrymen into the middle class will augur a reprieve for the tech sector.

Longshot: Disney Acquires Roblox

Roblox is a metaverse that works. The gaming platform has roughly 60 million daily active users, half of them 13 years old or younger. At the beginning of the year the stock was $120; it’s now below $40. At Disney, Bob 1 is back, and he may be the best buyer in history. During his first stint he acquired Pixar, Marvel, Lucasfilm, Bamtech, and 21st Century Fox. (We’ll ignore the last one.) Acquiring Roblox would be expensive, but Disney has the capital, and strategically it makes sense. Just as Bob brought Woody and Anakin Skywalker to the parks, he has the opportunity to now bring the parks (and their characters) to Roblox. A Disneyverse, if you will.

Consolidation of Subscale

Bear markets morph large firms into firms that are not large enough. These are prime acquisition fodder. I believe we’ll see the consolidation of many subscale companies, including Lyft, AMC, Peloton, Carvana, and Robinhood. In terms of market cap, Uber is now 15 times more valuable than Lyft, as are Ford and GM, who are hungry for autonomous driving experience and IP. Expect many acquisition attempts this year, accompanied by headlines that the FTC is “reviewing it.”

2023 Tech of the Year: AI

Like Web3 last year, artificial intelligence is on track to be the most hyped technology of 2023. Unlike Web3, however, AI will (mostly) live up to the hype. We’ve already witnessed the immense capabilities of image- and text-generating AI programs, including Midjourney, Stable Diffusion, and ChatGPT. I wrote a post a few weeks ago showcasing the expansion of AI capabilities. An influx of capital and attention in 2023 will accelerate the category’s growth.

Streaming Consolidates

The past decade in streaming has been a nonstop champagne-and-cocaine party where the numerical direction of content budgets, deal sizes, and stock prices was up and to the right. Until this year. Since December 2021, Netflix’s stock price is off 60%, bringing the rest of the streaming market down with it. For consumers, there are too many choices — both in terms of platforms (the average U.S. household now uses five streaming services) and programming (the average Netflix user spends 18 minutes searching for something new to watch). The space has gotten too crowded, and it will tighten.

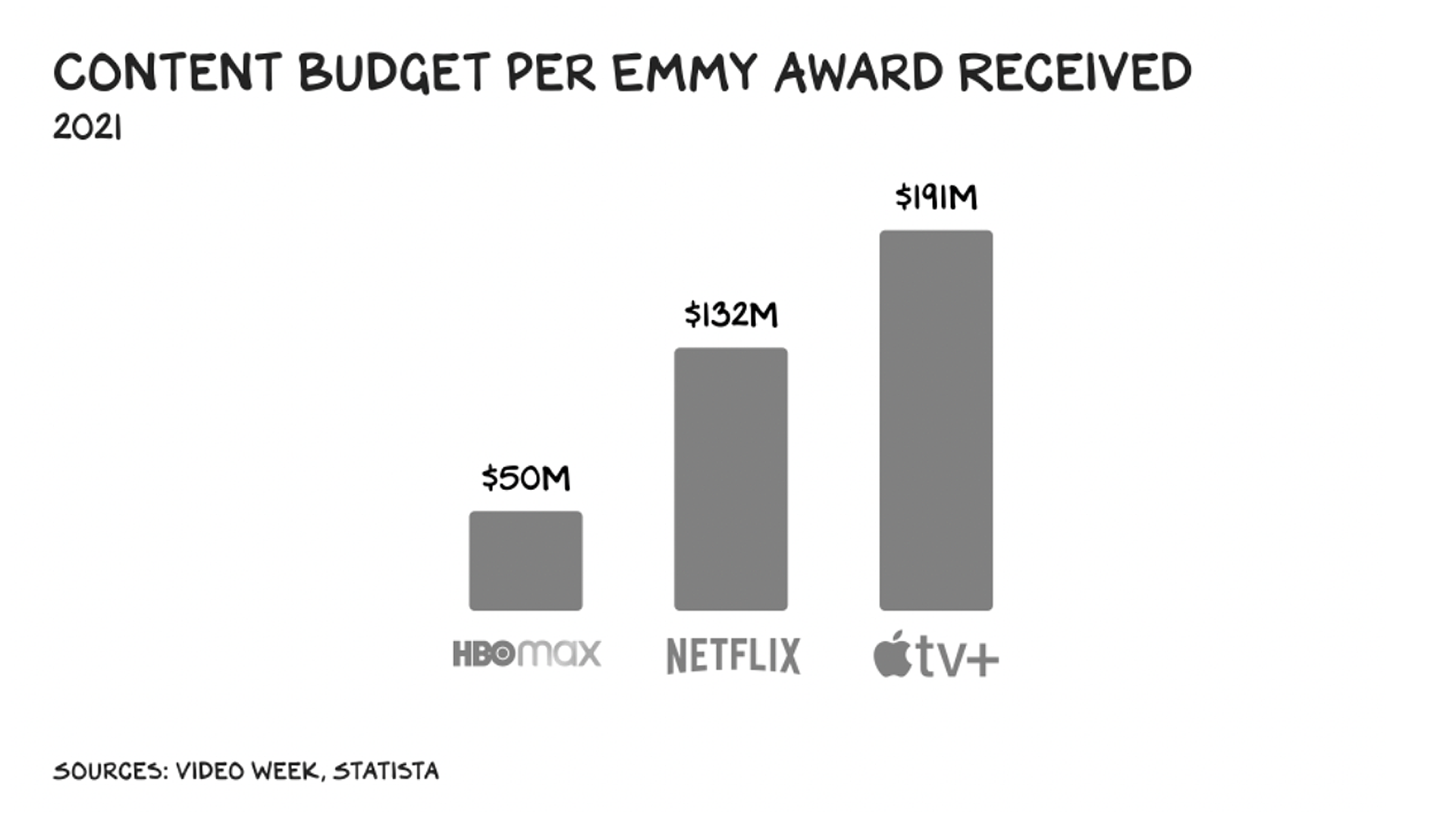

As in tech, activist investors will rattle media cages. I’d bet Warner Brothers Discovery is put in play by the end of the year. HBO remains the premier artisanal content creator — garnering nearly three times the Emmys per dollar spent than Netflix, and four times as many as newcomer Apple. It’s a crown jewel in search of a suitable crown.

U.S. Reasserts Dominance

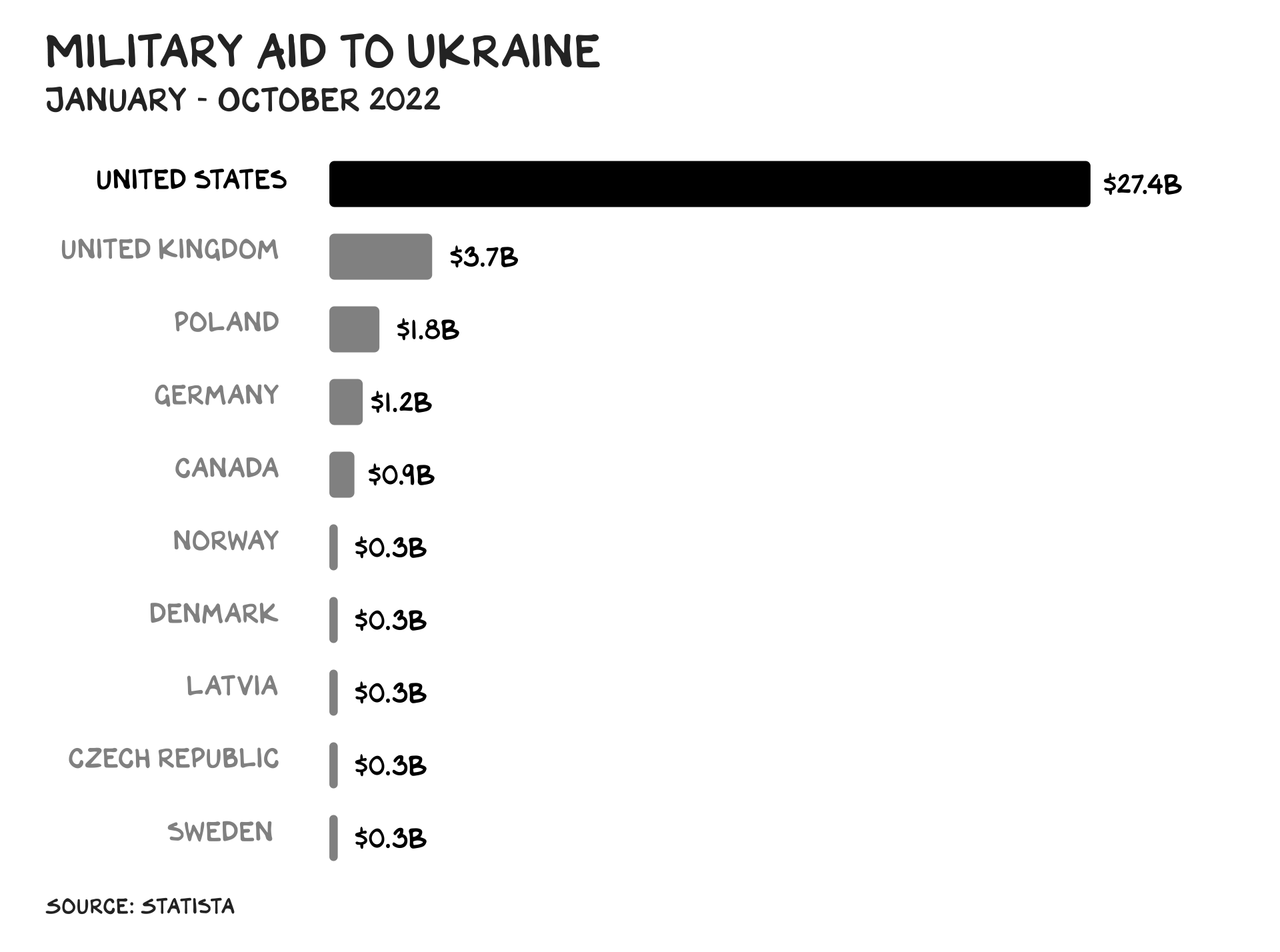

The Situation Room and Tucker Carlson are incentivized to tell us “America is awful, news at 11.” Their apocalyptic vision is misguided, bordering on delusional, as we are in a position of strength relative to our global peers: Over the past two years our stock market has outperformed China’s by 30%. Our inflation rate, while high, is nowhere near those of European nations including Germany (10%+), the U.K. (11%+), and Italy (12%+). We are energy and food independent and have again demonstrated our mastery of the world’s master: technology (see above: re-creating the sun). Nobody is lining up for Chinese or Russian vaccines. The U.S. has pledged $47 billion in military aid to Ukraine, greater than the combined contribution of every other country.

Aid to Ukraine will be the best trade of 2023. For only 6% of our defense budget we continue to repel an enemy and signal to the world the United States of America is (again) an ally without equal. As Elton John reminds us on his seventh “Farewell” tour: The bitch is back.

2023

I hope 2023 brings you health, prosperity, time with loved ones, and the presence to appreciate all three.

Life is so rich,

![]()

P.S. I’m teaching the Business Strategy Sprint again in January. If you want a taste before becoming a member, you can watch the first lesson here.