Let the layoffs begin!

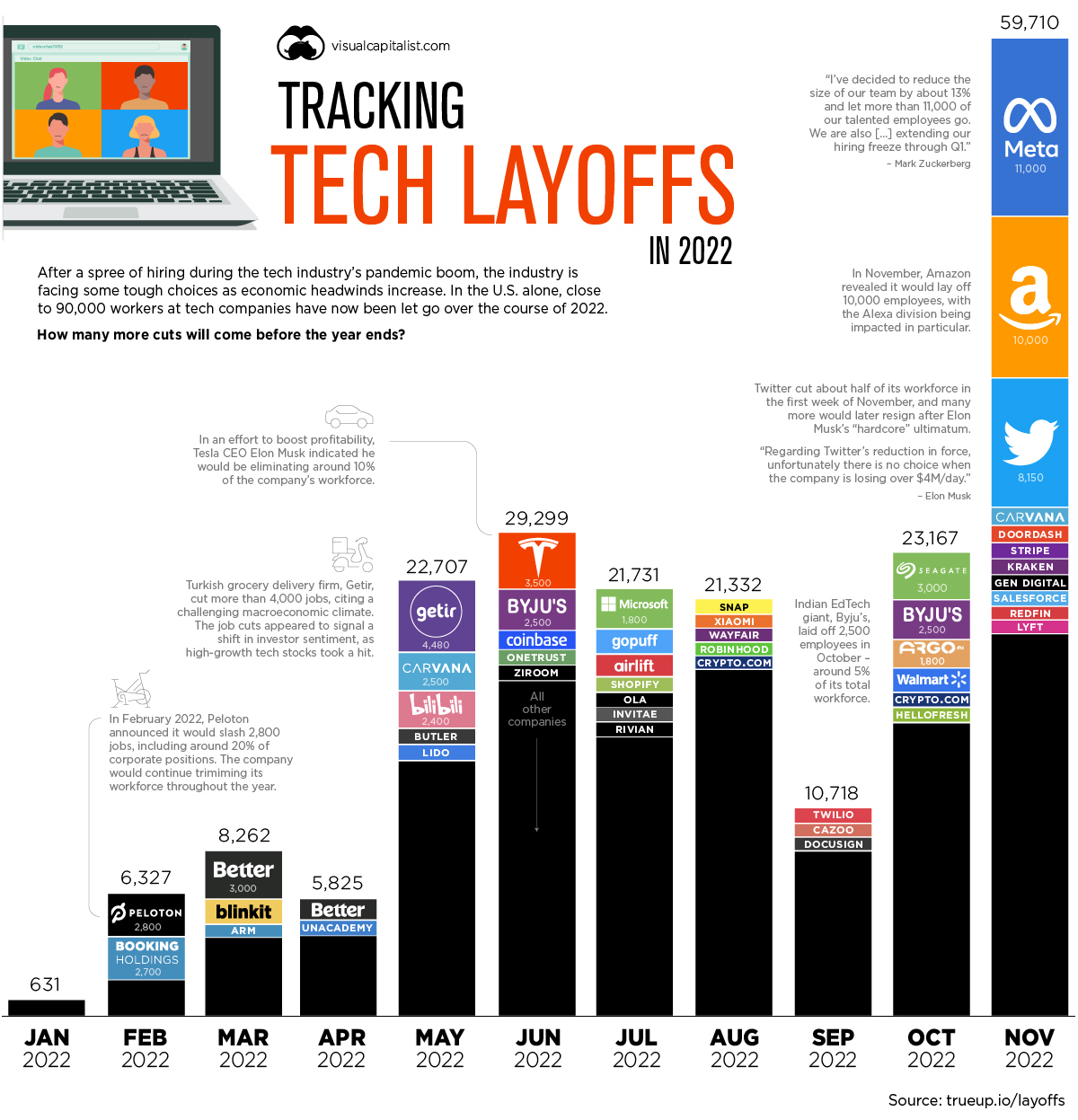

Tuesday we heard that Salesforce (CRM) was laying off 10% of it’s staff and now Amazon (AMZN) has announced they will be laying off 5% or their workforce, 80% more than was expected by our leading Economorons. So, if we assume Amazon know what they are doing and Econmorons do not – then we’re facing 80% worse conditions going forward than are currently being projected.

Tesla (TSLA) announced deliveries in China for December that were 20% below last year and 50% below November deliveries as the now unreported Covid surge is ransacking the country. Meanwhile, insanely, Walgreens (WBA) announced a 1.5% drop in sales due to far less people getting their Covid vaccines, priming the US up to suffer from the next wave.

The top-line results came as the company swung to a loss of $3.72 billion due to a $6.5 billion charge tied to a settlement to resolve opioid-crisis lawsuits brought by states, cities and other governments. However, adjusted for the settlement and other one-time items, Walgreens posted per-share earnings ahead of Wall Street expectations.

The stock is back to $35 this morning and it’s a good time to get in or adjust as this is a silly sell-off based on things we already knew about and have already taken the company down to where it is. Writing off the entire Opioid Settlement in one quarter puts it in the rear-view mirror and, next year, the company can make it’s typical $4Bn without the impairments – yet you can buy the whole thing for $32Bn at $35 per share.

We’re not too concerned as $35 was our target price for WBA from our September entry in the Long-Term Portfolio (LTP), where we sold 20 of the 2025 $30 puts for $5.20 ($10,400) and bought 40 of the 2025 $25 ($9.50)/35 ($4.80) bull call spreads for net $4.70 ($18,800), which is net $8,400 overall on the $40,000 spread. As long as $35 holds up in Jan 2025, we’ll make $31,600 (376%).

You don’t have to take big risks to make big money – remember that!

Should WBA fall back to $30, we don’t mind owning $2,000 shares at $30 and the 2025 $17.50 calls are currently $20 and our $25 calls are $13.50 so it would cost us $4 to roll down $7.50 and if that gets to $3.50 or less, we’ll take advantage of it in our LTP.

That would put us into a $70,000 ($17.50/35) spread for net $14,000 more or $22,400 total and our upside potential shifts from $31,600 to $47,600 (212%) but now, at $25, we’d have $30,000 back, so better than break even below where the original trade started (we would roll the short puts).

We often start out with trades that COULD make 300-500% if all goes perfectly so that, when it does not, we can fall back to trades that are much more likely to make 150-200%. Giving ourselves space to pull back and regroup in adverse markets is the key to a successful long-term strategy and that begins with having the discipline not to overcommit to our initial entries.

It’s still a tricky market and we are mostly just improving our existing positions, rather than adding new ones. This morning the market is heading lower as the ADP employment report came in at 235,000 vas 160,000 expected and more than double last month’s 127,000 – so the Fed is not slowing down job growth fast enough to stop raising rates.

Backing that up are Jobless Claims at just 204,000 this morning vs 230,000 this morning, despite AMZN pitching in with 18,000 cuts. We get Markit PMI at 9:45 and Natural Gas at 10:30, which will hopefully turn it back up from $3.85, and EIA Oil Inventories at 11.

Bostic speaks at 9:20, Bullard speaks at 1:20 and Bostic again tomorrow at 11:15 and 3:30 with Barkin at 12:15 but, clearly, whatever message Bostic is delivering is one the Fed wants to make sure you take into the weekend.

- Corporate Insiders Aren’t Betting on a Market Rebound

- Most businesses expect 2023 recession: JPMorgan survey

- Futures muted as Fed minutes confirm more tightening ahead

- Ex-Fed Chair Alan Greenspan sees a US recession as the ‘most likely outcome

- Sterling weakens after business activity data points to recession

- BOE Says Outlook for Inflation and Wages Worsens for Businesses

- Chinese Builder Defaults on Bonds Despite State Help for Sector

- Debt Payments Consume 80% of Nigeria’s Revenue Collection

- Saudi Arabia Cuts Oil Prices for Main Market as Demand Slows

- Canada posts C$41 mln Nov trade deficit on lower energy exports

- Bed Bath & Beyond warns it may go out of business, stock tanks