Courtesy of ZeroHedge

Flexport founder and co-CEO Ryan Petersen warned a global shipping downturn is underway. He said the container shipping industry is in “recession” as a glut in capacity plagues major shipping lines. This comes right after Baltic Exchange’s dry bulk sea freight index crashed on Tuesday, an ominous sign the global economy could be headed for turmoil.

Petersen told Bloomberg’s Odd Lots podcast on Wednesday about the boom and bust of the container shipping industry. After a record-breaking boom for ocean carriers during the virus pandemic, a glut in capacity and slowing demand for freight has caused what Petersen said is a “great recession” for shipping.

This is the result of the “shortage of everything” bullwhip effect. Demand for goods soared during the pandemic as government stimulus checks unleashed massive consumer demand for overseas products from Asia. Carriers expanded lines to meet new demand. Companies only found out last summer (explained here) they over-ordered as consumer demand dropped, only to be left holding an abundance of inventory. That sparked the terminal phase of the bullwhip effect that led companies to reduce shipments of overseas products.

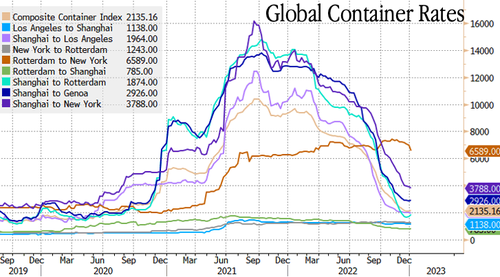

The boom and bust in shipping demand can be seen in the rollercoaster ride of container shipping rates.

Petersen noted in the podcast that the average container shipped is about 70% full. He also explained:

The length and depth of a shipping recession now depend on various factors, including the health of the US consumer and the direction of the Chinese economy.

Adding:

All these ships are going to start slow steaming.

So our economists estimate this is going to be a 4% to 6% reduction in capacity. That’ll start in January. So that may rein-in some of it as well.

And his outlook for the industry:

On the counter side though, during this boom and in years prior, these ocean carriers ordered a lot of ships. So over the next three years you’re going to see a 25% increase in container capacity as new ships come online.

None of this should be a surprise, as we’ve been documenting plunging container rates over the last two quarters and a looming global recession.