We have no Congress.

We have no Congress.

It would be a great time to attack America as the President needs Congress to declare war and we haven’t had a Congress since Tuesday. Until they elect a speaker, Congress can’t swear in new Members or begin a session and Congress only works 26 weeks a year so 4% of 2023 is already in the toilet – or the swamp.

Fortunately, Congress doesn’t accomplish much when they are in session so it’s business as usual in the US for the most part. It’s just kind of funny to watch the man who had already moved his things into the Speaker’s office lose the 11th vote in 3 days for the position. There is no viable alternative, so by vote 15 he may finally win but this is just a preview of the next debt ceiling fight – keep that in mind.

Speaking of losing, the Markets have blown 2% of their chances to make progress for the year as this week joins Kevin McCarthy in the loser column, down about 25 points this morning from our 3,853 official open on Tuesday.

The big data point this morning is the 8:30 Non-Farm Payroll Report and the expectations are for 210,000 new jobs, down from 263,000 in November but ADP was expected to be 160,000 – UP from 127,000 – and that report came in at 235,000 yesterday. If NFP confirms ADP – then the Fed has a lot more work to do to cool the Labor Market.

Average Hourly Earnings are also expected to cool off from 0.6% to 0.4% and that is not too likely either so could be a downside surprise on Jobs and then Factory Orders also may disappoint at 10 so I don’t think we will pull off a positive for the week.

Monday is already the 9th and next Friday is the 13th and we get earnings from BAC, BLK, BK, C, DAL, FRC, JPM, UNH and WFC on Friday morning – so next week will finish off with a bang as well…

Monday is already the 9th and next Friday is the 13th and we get earnings from BAC, BLK, BK, C, DAL, FRC, JPM, UNH and WFC on Friday morning – so next week will finish off with a bang as well…

The big Economic Data next week will be Consumer Credit on Monday, CPI on Thursday and Consumer Sentiment on Friday but it’s not a big data week – things heat up on the 16th with earnings and data coming in daily two weeks before the next Fed meeting – Fun!

8:30 Update: 223,000 jobs were created in December and, while a bit over expectations, it’s down enough from 263,000 in November to be a win for the bulls – a real Goldilocks number as it’s down enough to calm the Fed and up enough to signal we’re not in any sort of Recession yet.

Average Hourly Earnings also came in better (lower) than expected at 0.3% but Unemployment Dropped to 3.5% from 3.7% expected and the Fed wants more people out of work than that. Still, this could be enough to end the week on a positive note!

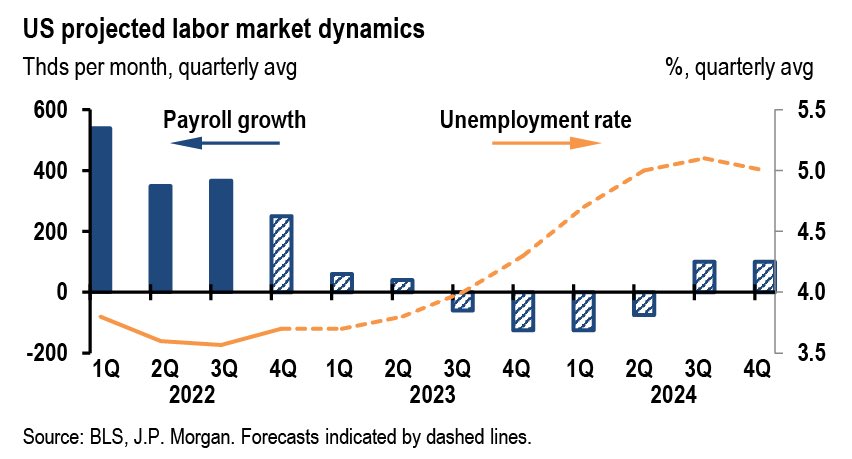

According to this forecast by JPM and the BLS, the Fed PLANS for no new jobs until 2025 and WANTS Unemployment to get back to 5% so our Corporate Masters can continue to mistreat the workers without fear of repercussions. Then the Fed will have done their job by keeping their boot firmly on the throat of the Working American.

By the way, I was going to include a one-hour clip of Edward Griffin explaining the horror of the Fed but that clip has been redacted from the internet so now you need to read “The Creature from Jekyll Island” to get the full story and, since nobody reads anymore, the Fed is safe. Here he is giving a 2012 speech live on a similar topic.

This video is still here though:

Have a great weekend,

– Phil