Courtesy of ZeroHedge

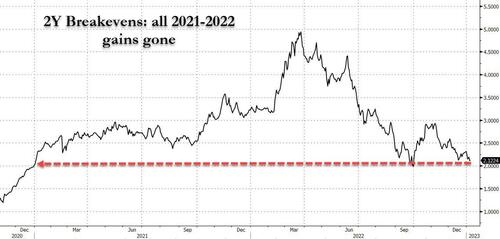

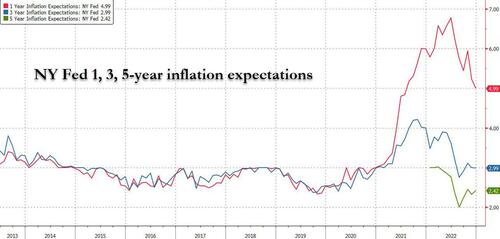

With long-term inflation expectations (those 3-Years ahead or more) peaking more than a year ago, and even shorter inflation expectations – at least according to the NY Fed Survey of consumers – now sliding after hitting a record high 6.8% in June and dropping alongside 2Y breakevens which recently hit the lowest level in 2 years, wiping out two years of gains…

… it is hardly a surprise that the latest just released NY Fed survey showed a continued drop in inflation expectations, as median one-, three-year-ahead inflation expectations decreased to 4.99% from 5.23% – one month after plunging more than 0.7% from October’s 5.94% print – the lowest since July 2021, while 3-Years dipped to 2.99% from 3.00%; 5-year inflation expectations, which the NY Fed tracks only periodically, posted a modest increase from 2.32% to 2.42%. In August, this ad hoc series hit its lowest level yet, dropping to just 2.0%.

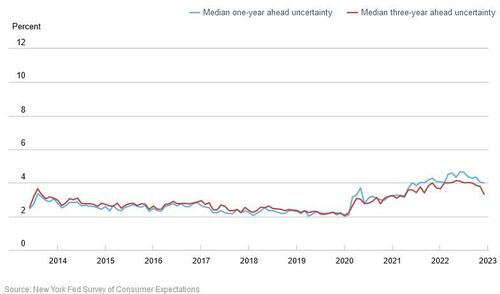

Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—was unchanged at the short-term horizon and decreased at the medium-term horizon to the lowest level since April 2021.

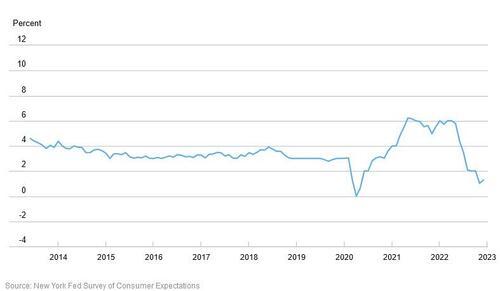

Separately, the median home price growth expectation increased fractionally to 1.3% after dropping to 1.0% from 2.0%, the lowest reading since May 2020 a decrease which was “driven by those in the South census region.” Despite this increase, home price growth expectations remain subdued relative to their pre-pandemic levels. Also, a 1% increase which is laughable when 30Y mortgages are about 5-6%…

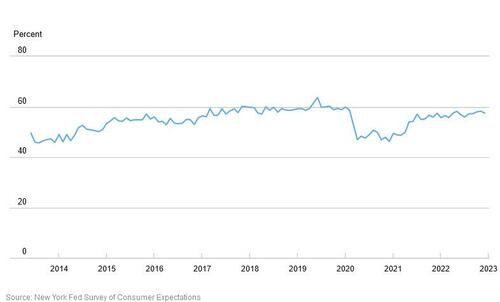

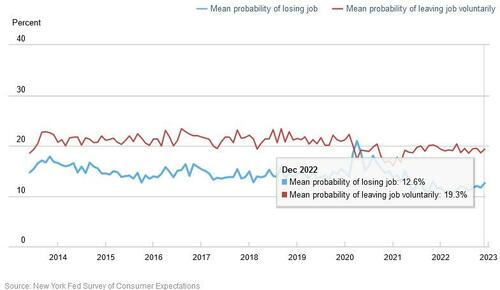

… while labor market expectations paradoxically remaining very strong (apparently no tech workers were surveyed)…

… although a sliver of concern about the labor market could be found in the survey’s job separation expectations, which rose to 12.6%, the highest since Nov 2021, even as the probability of voluntarily leaving one’s job was unchanged.

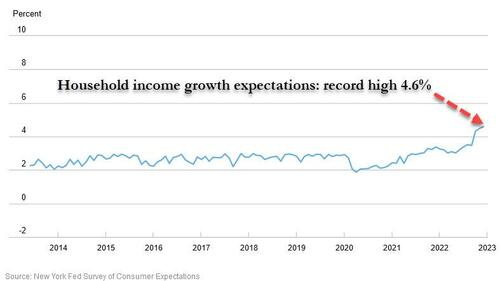

Yet nowhere was the self-delusion more evident than in household income growth expectations, which jumped to a new record high of 4.6% from 4.5%. Not surprisingly, the increase was driven exclusively by respondents with no more than a high school education.

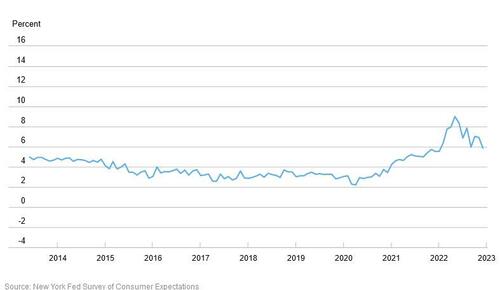

On the other hand, while households expect a spike in income, there are less sanguine about spending, and median household spending growth expectations fell sharply to 5.9% from 6.9% in November: “The decline was broad based across age and income groups .”

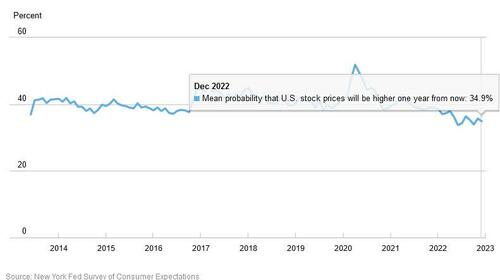

Remarkably, despite the worst bear market in a generation, 34.9% of respondents, modestly lower from 35.7% last month, expect stocks to rise in the next 12 months. Then again, 38.9% expected higher stock prices one year ago: that didn’t work out too well.

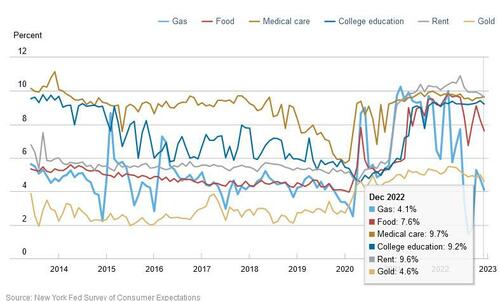

Looking at various prices, over the next year consumers expect gasoline prices to rise 4.1% from 4.7%; food prices to rise 7.6% (from 8.3)%; medical costs to rise 9.7% (up from 9.6%); the price of a college education to rise 9.2% (down from 9.4)%; rent prices to rise 9.6% (down modestly from 9.8%).

Here are some more findings from the report:

Inflation

- Median home price growth expectations increased by 0.3 percentage point to 1.3%. The increase was driven by those in the South census region. Despite this increase, home price growth expectations remain subdued relative to their pre-pandemic levels.

- Expectations about year-ahead price changes declined by 0.7 percentage point for both gas (to 4.1%) and food (to 7.6%), and 0.2 percentage point for both college education (to 9.2%) and rent (to 9.6%). The median expected change in the cost of medical care, on the other hand, rose by 0.1 percentage point (to 9.7%).

Labor Market

- Median one-year-ahead expected earnings growth rose by 0.2 percentage point to 3.0% in December. The increase was most pronounced for respondents over the age of 60 and those with a high-school education or less.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 1.4 percentage points to 40.8%.

- The mean perceived probability of losing one’s job in the next 12 months increased by 0.9 percentage point to 12.6%, its highest reading since November 2021. Similarly, the mean probability of leaving one’s job voluntarily in the next 12 months increased by 0.7 percentage point to 19.3%. Both increases were most pronounced for respondents over the age of 60.

- The mean perceived probability of finding a job (if one’s current job was lost) decreased to 57.5% from 58.2% in November.

Household Finance

- The median expected growth in household income rose by 0.1 percentage point to 4.6% in December, a new series high.

- Median household spending growth expectations fell sharply to 5.9% from 6.9% in November. The decline was broad based across age and income groups.

- Perceptions of credit access compared to a year ago improved slightly in December, but the share of households reporting it is harder to obtain credit than one year ago remains near its series high. Similarly, expectations for future credit availability improved in December, with the share of respondents expecting it will be harder to obtain credit in the year ahead falling.

- The average perceived probability of missing a minimum debt payment over the next three months fell by 0.4 percentage point to 11.4%.

- The median expectation regarding a year-ahead change in taxes (at current income level) declined by 0.5 percentage point to 4.1%.

- Median year-ahead expected growth in government debt was unchanged at 10.1%, its lowest reading since March 2020.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.5 percentage point to 31.9%. The decrease was more pronounced for those with a college degree or higher.

- Perceptions about households’ current financial situations compared to a year ago improved in December, with the share of households reporting a worse situation compared to a year ago declining. Similarly, year-ahead expectations about households’ financial situations also improved in December.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 0.8 percentage point to 34.9%.

More in the full NY Fed survey which can be found here.