Welcome to 2023!

Welcome to 2023!

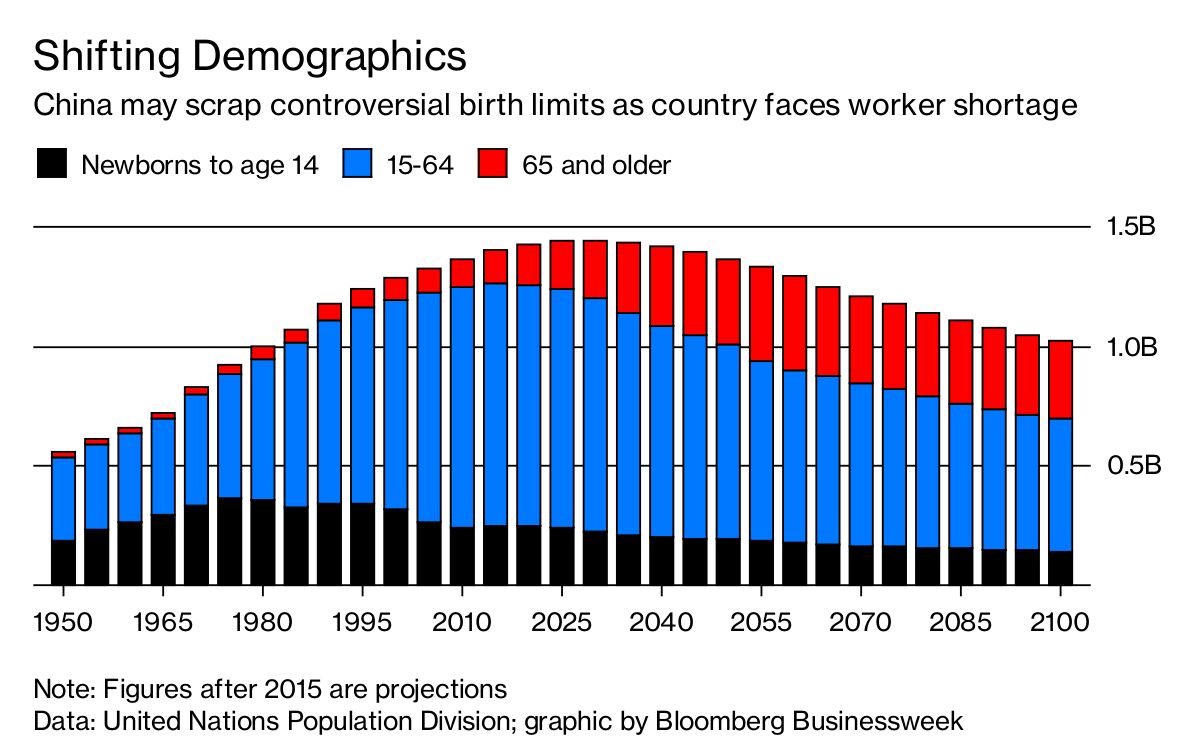

This will be my 60th trip around the planet so let’s all sit back and enjoy the ride… Speaking of aging, China is about to have a massive aging crisis as about 25% of their population is my age (which doesn’t seem bad, as I’m in Florida and skew young in my town) but, in 10 years, when 400M people are 65 or older – that’s a CRISIS!

The real problem in China is that the overall population is shrinking. Last year only 9.5M babies were born in China while 10.4M people died. Births were down from 10.6 million in 2021, the sixth straight year that the number had fallen, according to the National Bureau of Statistics. China’s overall population now stands at 1.4 Billion.

China has followed a trajectory familiar to many developing countries as their economies get richer: Fertility rates fall as incomes rise and education levels increase. As the quality of life improves, people live longer. Labor shortages that will accompany China’s rapidly aging population will also reduce tax revenue and contributions to a pension system that is already under enormous pressure.

Meanwhile, back at home, our Grand Old Party is looking to solve our retirement crisis by raising the age of retirement from 65 to 70 – ensuring that 100M (30%) more of us will literally work until we die – eliminating the need to pay us retirement benefits – problem solved!

Meanwhile, back at home, our Grand Old Party is looking to solve our retirement crisis by raising the age of retirement from 65 to 70 – ensuring that 100M (30%) more of us will literally work until we die – eliminating the need to pay us retirement benefits – problem solved!

Congressman Rick Allen of Georgia said people have been approaching him and saying they “actually want to work longer” and, at Georgia’s Minimum Wage of $7.25 an hour – who wouldn’t? Certainly not the Congressman’s 100+ completely unpaid campaign workers, who put in Millions of Dollars worth of time and effort so he could have a $174,000 job. Of course, he’s just an amateur compared to our beloved CEOs, who make an average of 235 TIMES what the average worker makes:

So it’s a combination of stressed-out economy, the continuation of the war, the continuation of Covid and wage increases that still haven’t kept up with inflation that are keeping me cautious into 2023 – at least until we hear what the companies are saying about 2022 and their outlook for 2023.

Banks have been pretty good so far and this week we’ll see what some other companies have to say. It’s a very slow data week without much Fed speak so we’ll be able to concentrate on Earnings as we look to match our Watch List with some early opportunities.

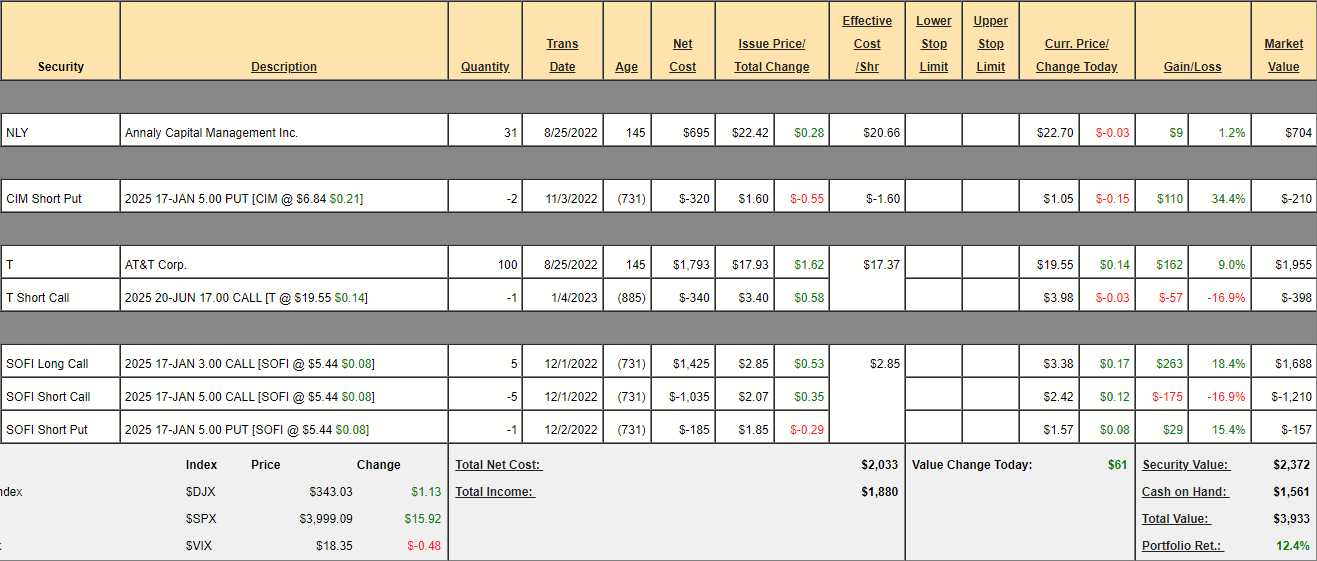

Now, on to our Portfolios. First up, we’ll take a quick look at the $700/Month Portfolio, which has just entered month 5 and we’re up 12.4% already and up 6.9% since our recent adjustments on Jan 4th. I’m not going to review it again – all is going as planned.

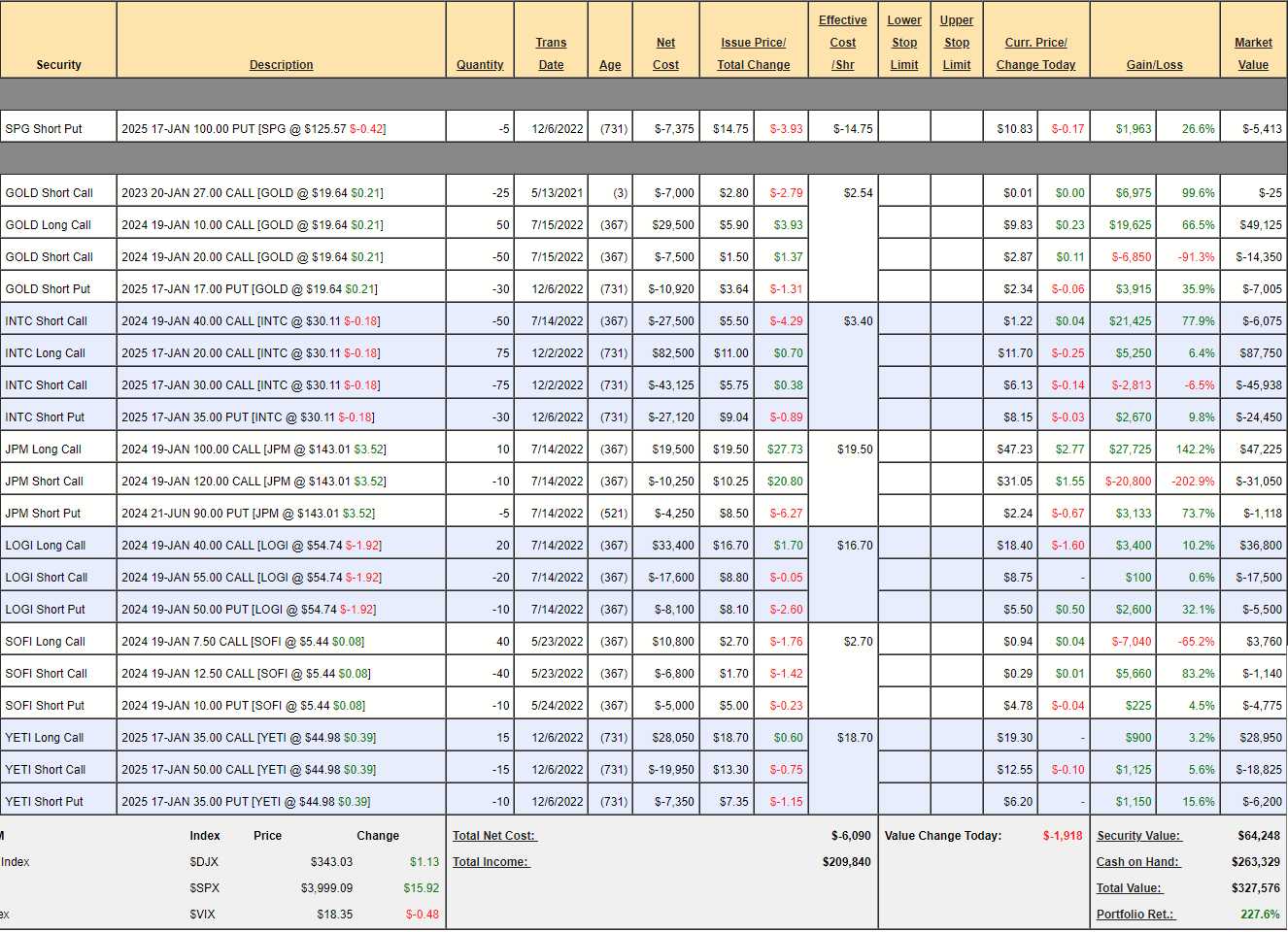

Money Talk Portfolio Review: That brings us to our other ultra low-touch portfolio, the Money Talk Portfolio, which we only adjust when we’re on the show, once each quarter. In our previous review, we were at $288,859 (up 188.9%) and swimming in CASH!!!, as we had cashed out half our positions in August – concerned about holiday uncertainties.

On the show, we added SPG and YETI and adjusted GOLD and INTC and, though we still have only 7 positions, we now have $327,576 (up 227.6%) – up $38,717 (13.4%) for the month – very nice! There’s a lot to be said for having a small portfolio with very strong positions – just ask Warren Buffett, who has about 40 stocks worth about $332Bn.

Warren does a good job following the portfolio management strategies we teach our Members at PSW and, in fact, we’ve been letting our Money Talk Portfolio run since Nov 13, 2019 to help demonstrate the power of letting your returns compound over time (we used to restart whenever we doubled up).

-

- SPG – One of our new ones. We started by just selling the puts and we’ll see how that goes. Selling the $100 puts for $14.75 gives us a net entry of $85.25, which we’d be fine with and, if we don’t get what would now be a 33% discount – we’ll just have to keep the $7,375 we collected for promising to buy SPG at a huge discount.

-

- GOLD – The Jan $27 calls will expire worthless and we get to keep the $7,000 we sold them for. I was more bullish on GOLD (and Gold) than I was in May, when we sold Jan calls and I was willing to risk being uncovered until the next show.

-

- INTC – My stock of the Year for 2024 if they stay this low – but I doubt it. We have those 2024 short calls because we rolled the long 2024s into the 2025 spread, so those are leftovers from our older position and we’ll see how earnings go now.

-

- JPM – Just had exactly the kind of bulletproof earnings we expected.

-

- LOGI – They guided down last week, so it’s a good time to pick them up. We don’t care because our target was $55 anyway and $67.50 was getting a bit crazy – especially with a year to go. Their issue is less people in the offices are killing Corporate Sales. That’s about 15% less then they expected but it’s exactly what we expected…

-

- SOFI – Lofty targets will have to be adjusted if we don’t make progress this Q, though the year is off to a good start.

-

- YETI – Our 2023 Trade of the Year was net $750 on the $22,500 spread and we’re already at net $3,925, which is up 423% so, officially, our Trade of the Year is already at goaaaaaallllllllllllll!!!!, as the idea is to pick the spread that has the most likely chance of making 300% for the year. Mission accomplished!

In our last review, we had $192,296 of upside potential and we realized $38,717 of it in the past month but we added $7,375 potential in SPG and $21,750 from YETI (parts of them realized) so let’s call it $182,704 (55.7%) upside potential remaining but we have tons of CASH!!! left to deploy and we’re sure to find more things to trade as the year moves along.

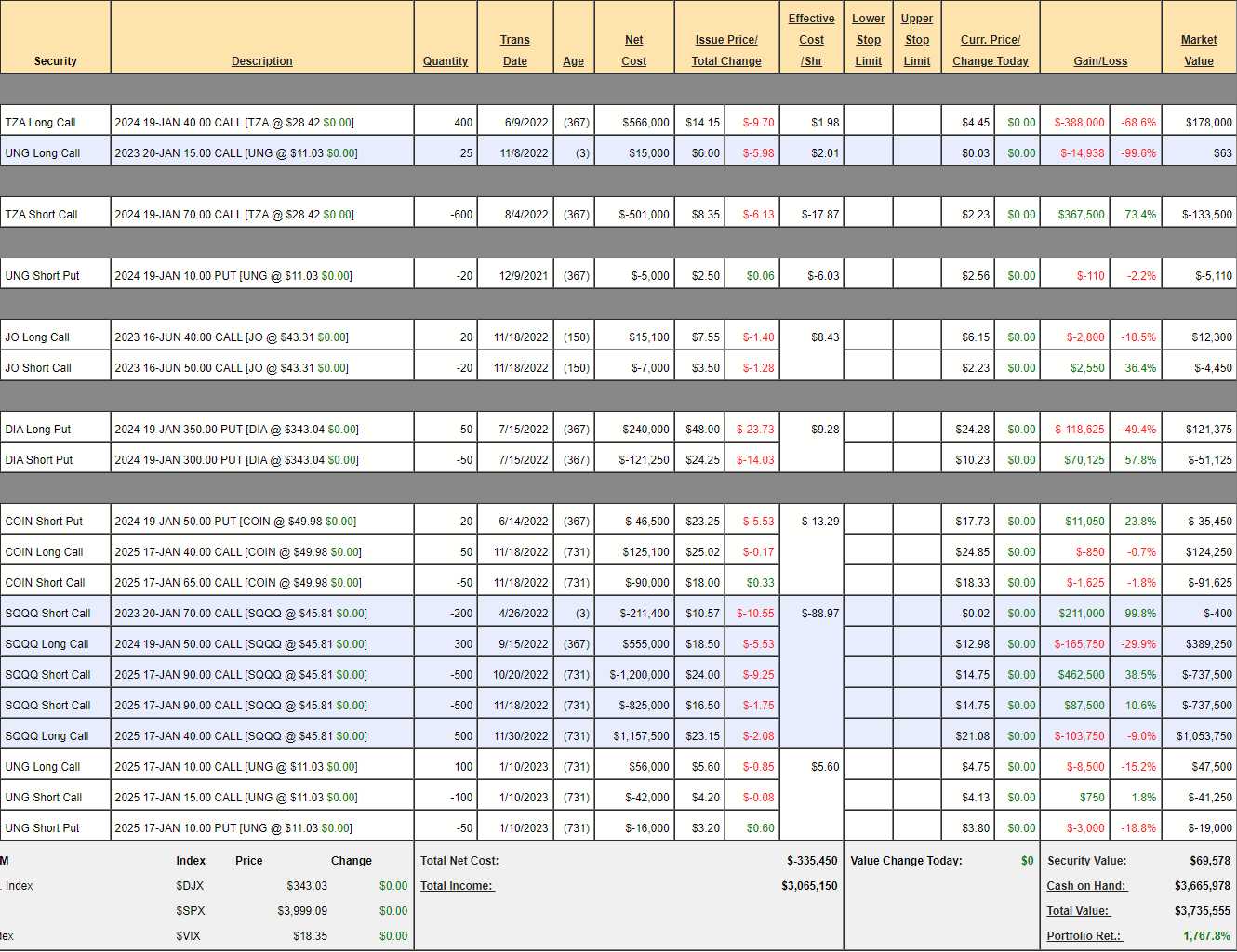

Short-Term Portfolio (STP) Review: Hedge first, then make your bets. It’s like buying life insurance BEFORE jumping out of a plane – makes more sense than doing it the other way. We have about $5M worth of protection in our STP and, at the moment, you can buy it for net $69,578 (plus margin, of course). That’s up $62,635 (1.7%) from last month as the portfolio went from $3,670,933 to $3,735,555 – and that’s without any adjustments (you’re welcome!).

Life would be easier for us if the market collapsed and we made a quick $5M (the longs would recover) but we’re not counting on that either – just trying to stay more or less balanced into earnings. $3,665,978 in CASH!!! is ready to deploy but our bullish portfolios have plenty of cash as well – so I’m not expecting to need it.

-

- TZA – Selling more premium than we buy is the key to making money in a flat market – they simply lose more than we do in the same time period. In this case, we have 400 long 2024 $40 calls and 600 short 2024 $70 calls so the spread will be at $1.2M before we start losing money to our short calls. Since $70 is over 100% higher than we are now and we don’t think the Russell will fall 33% (it’s a 3x ETF) we feel good about this play and, of course, it’s not static – we can adjust it at any time.

- The only thing I’m looking at at times like this is if there are any favorable adjustments to make like rolling to the 2025 $40 calls at $8.50. No, I don’t need to spend $4 ($160,000) to buy a year on a spread that was net $0(ish). If TZA begins popping up, I can spend $8.50 or even $12.50 ($500,000) to add 400 of the 2025 $40 calls and then we’d be over-covered and, of course, the 2024 $40s would be up significantly as well. Since there is no disadvantage to waiting – committing now would be foolish.

- Then I look at the 2024 $30s ($7.50) and $35s ($6.25) to see if they are a good deal to roll to but, again, if I’m going to spend $2, I’d rather go to 2025 and get another year of insurance so again, no disadvantage to waiting. The net of the spread is $45,000 so it’s about $1.15M in downside protection.

-

- UNG – In addition to hedges, we do small speculation in the STP and our first attempt at UNG failed, so we took a long-term spread instead. (see bottom). We’re going to likely lose $5,000 on the first spread and the new one is a net $2,000 credit on the $50,000 spread and it’s even cheaper than that now (net $12,750 credit).

-

- JO – More speculation, this time on Coffee. Pretty even so far.

-

- DIA – It’s a 1x ETF so it takes about a 10% drop for us to be $250,000 in the money and it’s a net $70,250 spread so let’s call this $179,750 of downside protection.

That’s a good point to make: What happens if the market goes up? Well we lose the $70,250 on the DIAs between now and Jan, 2024 and we lose the net $45,000 on the 2024 TZAs and whatever the SQQQs are. That’s then the COST of our insurance so, as long as our longs are going to outperform that in a bullish market – we’re going to be in good shape to the upside.

This is why you always need to be aware of what you expect to make or lose under various market conditions and then we verify each month (or after major moves) to see if your expectations are on or off track as we go along – making adjustments along the way.

-

- COIN – Nobody likes them but I do. I just see this as a last man standing sort of thing and it’s in the STP and not the LTP because I imagine we’ll make a lot of adjustments along the way. It’s a net $2,825 credit on the $125,000 spread so $127,825 (4,525%) upside potential against owning 2,000 shares for net $50 ($100,000) is worth the risk to me. If you just sell 10 calls it’s $17,725 more cash but still a great upside and you only risk owning 1,000 – but I have more confidence than that.

-

- SQQQ – The 200 short Jan $70s will go worthless, leaving us with 800 longs and 1,000 shorts and let’s call it $3.6M downside protection before we get into trouble and, like the Russell, I don’t see the Nasdaq falling 33.3%. The net of the spread is a $32,000 credit – it’s one of the best hedges I’ve ever seen!

- So, if they are paying us $32,000 to have $3.6M in protection, why not have 8,000 instead of 800? That’s because there is the risk that the Nasdaq does drop 40% and we’d have to adjust and then there’s margin issues, etc. This is perfect for our portfolio sizes and we are very well-protected for whatever Q1 may bring.

That is still just a bit under $5M of protection against up to a 33.33% drop in the Nasdaq. We certainly don’t have anywhere near that many longs and we’ve ditched most of our naked put obligations in our long portfolios – so I’m feeling very good about the overall mix.

“Though his mind is not for rent

Don’t put him down as arrogant

His reserve a quiet defense

Riding out the day’s events” – Rush

— Thursday —

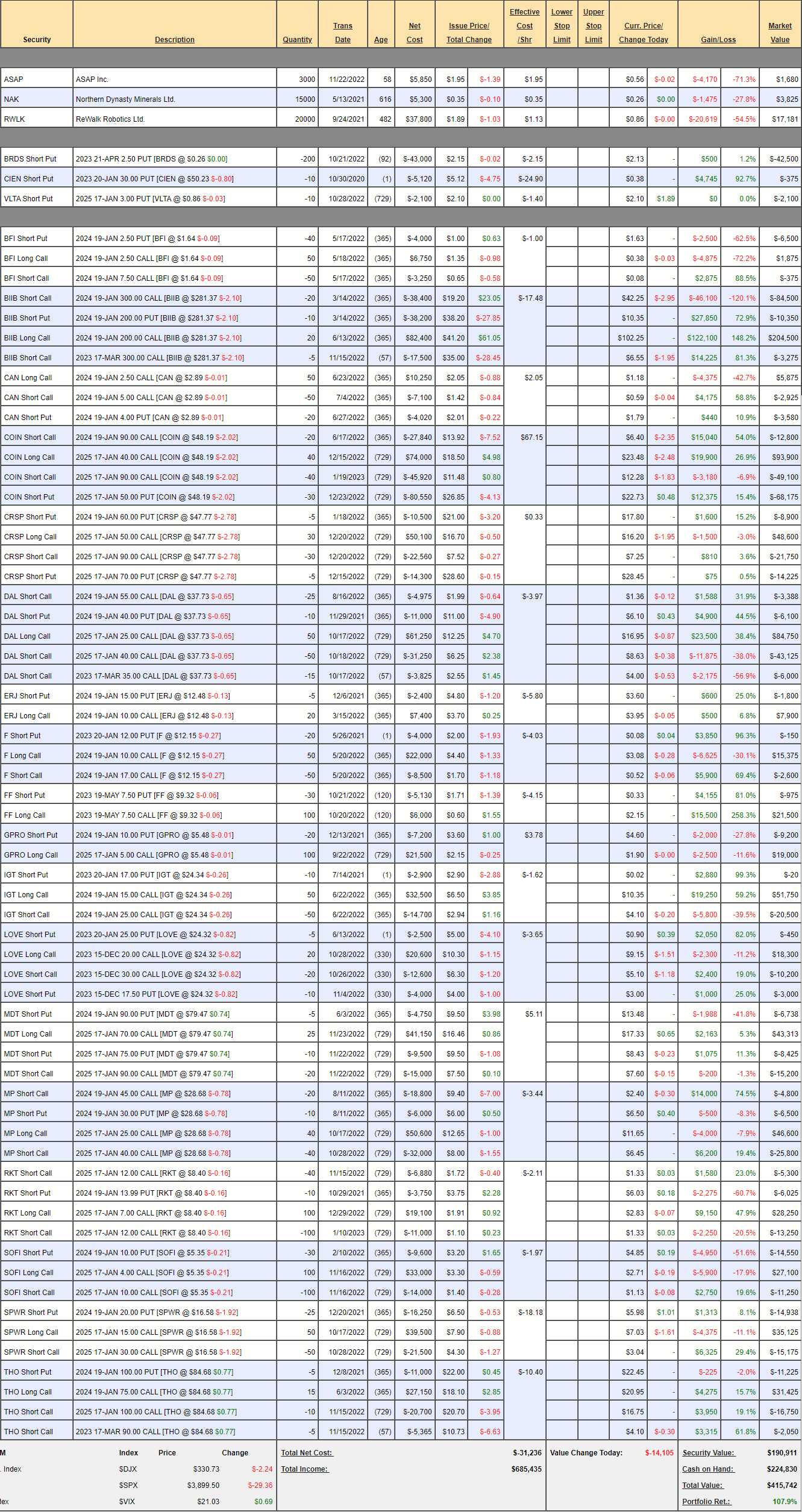

Future is Now Portfolio Review: $415,742 is up $49,448 since our last review in our most volatile portfolio. These are all speculative stocks I don’t like to play that invest in things that I expect to do well over the next decade – but who knows what they’ll do next year?

My Dad was a Futurist, who loved Science Fiction and this was started in his honor on his birthday on 12/12/19 – 20 years after he died (and now it’s 90 years since he was born) and we started with $200,000, so a double in the first 3 years is pretty good.

-

- ASAP – There was a burst of excitement last week and we popped to 0.75 but back to 0.56 now. They were a food delivery service but now more of an ordering solutions provider for restaurants as they saw a need.

- NAK – The most valuable unmined mine on Earth because mining in that part of Alaska has a great chance of wiping out the Salmon. In other words, we’ll have to wait for the next Republican administration.

- RWLK – Exo-legs that let people walk out of their wheelchairs is great stuff but expensive and we have to wait for various health-care providers to approve them. Could be years.

-

- BRDS – Scooter rentals coming back nicely but they expire in April so let’s just get out as I don’t see a catalyst between now and July ( the next longest options).

- CIEN – Will pay us in full at expiration. No longer cheap, so we’re done.

- VLTA – Shell (RDS.A) is buying us out and it’s net even for us so let’s close this and find something else.

-

- BFI – When 2025s come out we’ll roll and get more aggressive. There’s no point to the short 2024 $750 calls – so let’s buy them back and hope earnings pop us higher.

- BIIB – We’re right on track. I’m concerned they pop on earnings so let’s buy back the 5 short March $300 calls for $3,275 as we already made $14,225 so no sense in being greedy.

-

- CAN – We’ll see how earnings look.

- COIN – My theory is they are one of the few Crypto platform survivors. Just had a nice pop – right after we got more aggressive last month.

-

- CRSP – This one will change humanity – literally! We’re aiming for a double in two years.

- DAL – My 2nd favorite airline is right on time.

- ERJ – I like them because they are developing VTOL.

- F – On track and the logic is electric cars have better margins so, as Ford goes electric, margins should improve.

-

- FF – I love this company and finally they are coming back. Options only go to Aug or we’d have huge positions in these guys.

-

- GPRO – Another one of those cases where companies that spend on R&D get abandoned by impatient traders. Nice pop recently but miles to go before we’re happy.

- IGT – Already at our goal at net $30,000 on the $50,000 spread. Since we have 50 longs that will make $20,000 more (66%) if they simply hold $25 – let’s sell 15 (1/3) of the April $25 calls for $2 ($3,000) and 10 of the April $21 puts for $1 ($1,000). So we pick up $4,000 for 92 days out of 729 we have to sell, which is 13.33% of our $30,000. Those short Jan puts will expire worthless too, so let’s sell 10 of the 2025 $20 puts for $4 ($4,000) as well.

-

- LOVE – Great pop since last earnings but rejected at the top of a downtrending channel. They are Retail Sellers, so down with the sector and earnings are not until late March. We sold the Dec $17.50 puts and they went worthless and the Jan $25 puts are 0.90 at the moment, so let’s roll those to 10 of the Dec $20 puts at $4 ($4,000) and let’s sell 10 of the March $25 calls for $2.40 ($2,400) as well.

-

- MDT – I think consolidating to get over $80, earnings are 2/21 so I think we’ll wait and see.

- MP – US-based rare-Earth miner and it’s on track at net $9,500 on the $60,000 spread so still $50,500 (531%) upside potential. Last month it was net $6,900 with 769% upside potential. Like they say: “You snooze, you only make 531%!”

-

- RKT – Still getting no respect because they are in the mortgage sector but screw that, this is a great company. NET $3,675 on the $50,000 spread that’s $14,000 in the money. They are trying to GIVE you money here!!! In fact, let’s roll the 40 short 2025 $12 calls at $1.33 to 40 of the June $9 calls at 0.98. We’re giving up 0.35 ($1,400) but gaining a lot of time to collect more premiums. Hopefully we don’t get burned but I’m happy to DD on the long spread for another $15,000 to cover.

-

- SOFI – All the uncertainty about student loans has been holding them back but this is one of my favorite picks for the year. This spread is net $1,300 on the $60,000 spread that’s $13,500 in the money at the moment. More free money for those who like that sort of thing.

-

- SPWR – Our Stock of the Decade needs to be in this portfolio, of course. I don’t know why they are still so low but we can be patient and see how earnings go (2/15).

- THO – Supply chain issues are holding them back but that’s no reason not to invest in the future, is it? We sold the March $90 short calls so this is right on track for us.

We let go of all our short puts (reducing risks), bought back a couple of short calls (getting more aggressive into earnings) and we sold some short calls and puts for premium ($10,400) – that’s all we need to do to maintain it for another month.

— Friday —

Let’s keep in mind that the positions that are still in our portfolios have gone through several purges so what’s left are positions we REALLY want for 2023. As we think it’s going to be a pretty flat year – there shouldn’t be too much to do with them either.

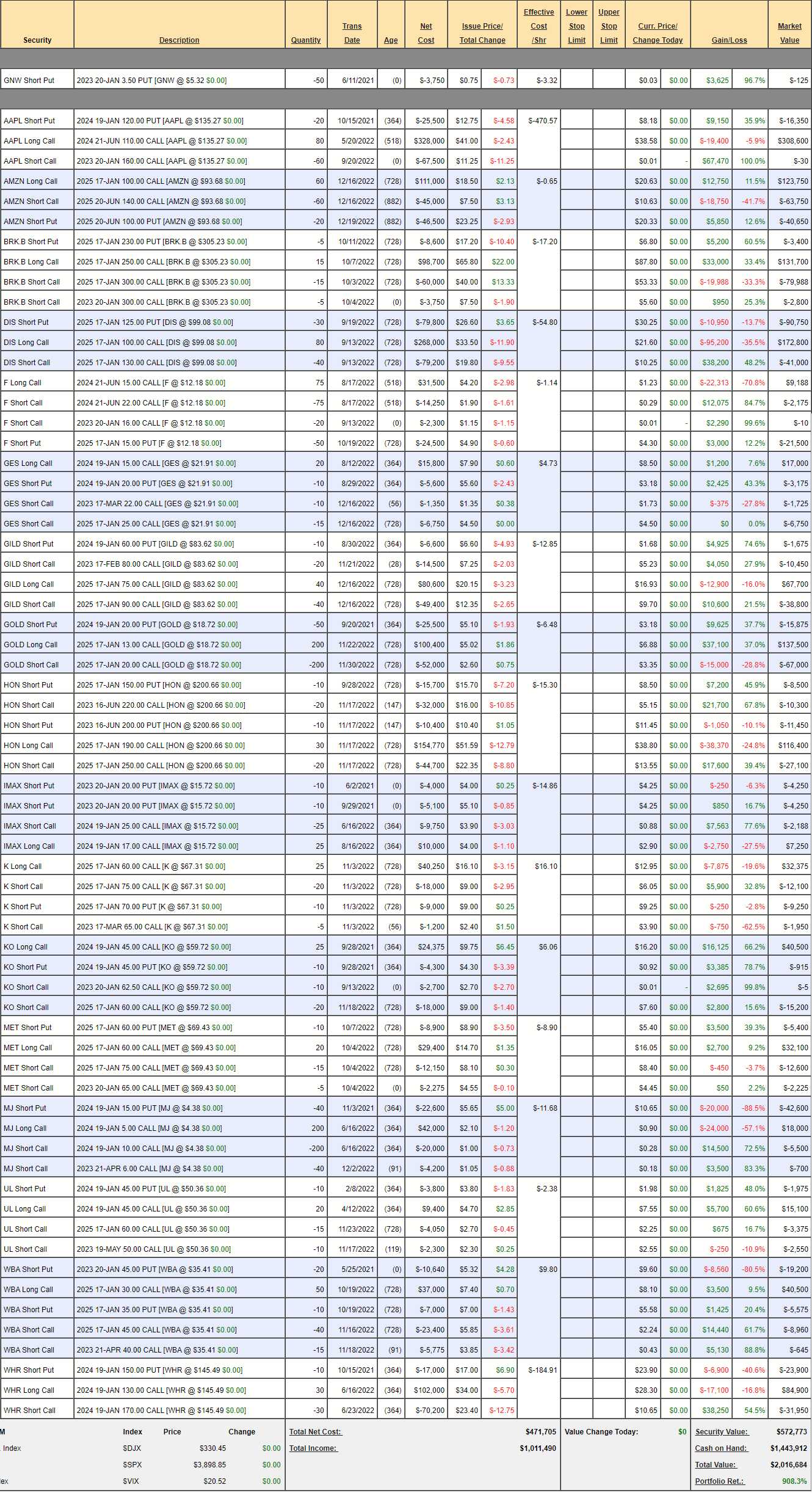

Butterfly Portfolio Review: $2,016,684 is down $41,705 (2%), mostly because AAPL had a bad month. We’re happy to wait for earnings on those but maybe a chance to get more aggressive too.

AAPL cost us $80,000(ish), so the rest of the portfolio is holding up great and we’re always thrilled for a chance to buy more AAPL – so all is well with what is usually our steadiest portfolio.

-

- GNW – These are going to expire worthless.

- AAPL – This position was massive and we cashed most of it out but happy to make it massive again down the road. The short $160 calls will expire worthless, leaving the June $110 calls as a $308,600 asset which we can roll to 150 of the 2025 $120 ($35)/160 ($17.50) bull call spreads at net $17.50 ($262,000). That’s now a $600,000 spread and the 80 $110s would have been worth just $400,000 at $160 – so we’ve got more upside AND more protection (from the short calls) while taking $46,600 off the table. We also can also sell up to 50 (1/3) short calls for income when/if AAPL does pop on earnings and, if it doesn’t, we’ll roll the $120s to the $110s ($42) or the $100s ($49) if they get cheaper (under $5 per $10).

- Also, since the 2025 $140 puts are $21, let’s buy back the 20 short 2024 $120 puts for $8 ($16,000) and sell 30 of the 2021 $140 puts for $21 ($63,000) to pocket another $47,000. The $120 puts were net $112 and the $140 puts are net $119 – so well worth it to collect the extra money…

-

- BRK.B – It’s kind of like a bet on the S&P 500 but we’re using this for income. The 2025 position is net $48,312 and we just made $1,000 on the Jan $300s and now we’ll sell 7 of the March $300 calls for $14.35 ($10,045), which is a very nice 20% return over 56 days. It’s like paying yourself a quarterly dividend!

- DIS – Still at the bottom of the barrel but now China is open and Marvel movies are coming out so Q1 and Q2 should be looking up. Let’s buy back the short 2025 $130 calls as we’re up almost 50% and let’s roll our 80 2025 $100 calls at $21.60 ($172,000) to 100 of the 2025 $90s at $27 ($270,000). Hopefully they don’t disappoint us but all that Avatar money just came in, didn’t it?

-

- F – The Jan calls will expire worthless and there’s no point in cashing in the 2024 June $15 calls at such a low price so let’s just buy 200 of the 2025 $10 ($3.60)/17 ($1.20) bull call spreads at $2.40 ($48,000) and see how that goes. F is at $12.15 now and the spread can pay $140,000 so it has $90,000 upside and we can sell 50 of the June $13s for 0.85 ($4,250) – but not yet, of course. That’s 10% back in 6 months so, even if F doesn’t pop back up – we’ll still be able to make enough to pay for the next roll.

- GES – Another income play (that’s kind of the point of this portfolio!) and the net of the long trade is $7,075 and we sold the March calls for $1,350 last month and, if they expire worthless, that’s 19% in 3 months. That’s why I love this portfolio!

-

- GILD – We sold the Feb $80s and that’s on track.

- GOLD – Outperforming now and it’s become a nice $140,000 spread, currently at net $54,625 (and that’s already up $31,725) despite being just $1.28 away from goal. The initial rejection at $20 (corresponding with $2,000 for Gold) was expected so no reason to cover yet.

-

- HON – The main spread is net $80,800 and we sold $42,400 worth of short June calls in November and we’re right on track to make 50% in 7 months.

- IMAX – Lot’s of good movies coming out and China is re-opening. Should be a good year so I’m not inclined to cover – especially with Avatar numbers coming in. In fact, the 2024 $13 calls are $5 so let’s spend $2.10 to pick up $4 more in position for the $17 calls.

-

- K – We’ll see how earnings go.

- KO – The Jan $62.50 calls will expire worthless so we gained $2,700 in the past 3 months on this net $24,385 spread but the short 2024 $45 puts are dead so let’s buy those back ($915) and sell 10 2025 $55 puts for $4.25 ($4,250) and let’s sell 10 of the June $60 calls for $3.10 ($3,100). So that’s net $6,435 collected (26%) in this period.

- MET – The short Jan $65 calls are even but that’s fine as it means our spread is on track. We will roll those 5 calls ($2,225) to 8 of the June $70 calls at $4 ($3,200).

-

- MJ – Let’s buy back the short April $6 calls for $700 as that’s a $3,500 profit in 6 weeks and we’ll see how earnings look before selling more.

- UL – On track

- WBA – We’ll have to roll the 20 short Jan $45 puts at $9.60 ($19,200) to 20 of the 2025 $40 puts at $8.50 ($17,000) and let’s roll the 10 2025 $35 puts up to the $40 puts as well, to keep things neat and make up that $2,200. Then we’ll see how earnings go.

-

- WHR – I think the data reports have been telegraphing a bad Q for durable goods but we’re on track and I’m not inclined to sell short calls this low so we’ll just see how earnings go and adjust afterwards.

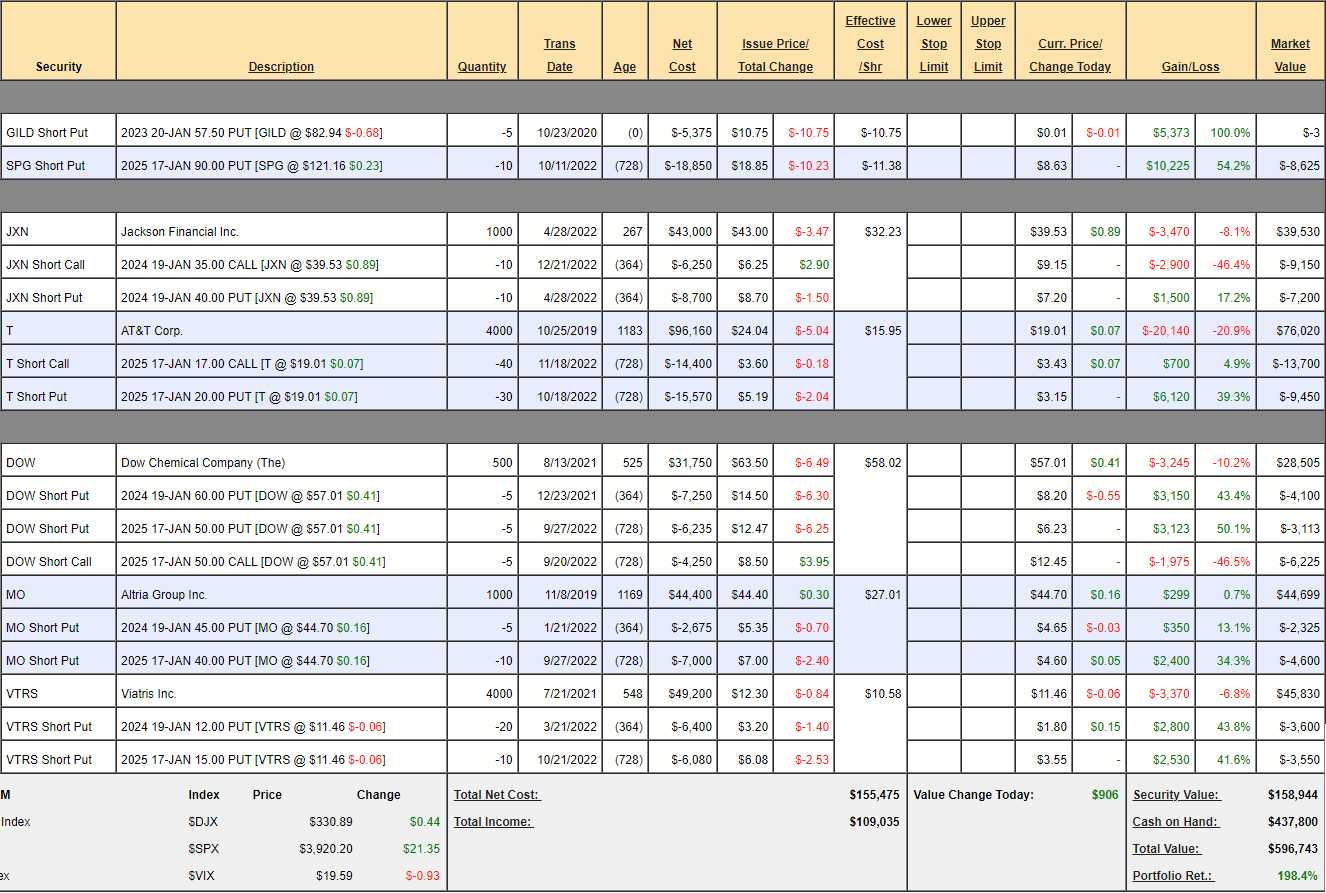

Dividend Portfolio Review: $596,743 is up $9,713 from last month’s review and almost half of that is from dividend payments! We only have net $158,944 in positions so we’re collecting at an almost 10% annual rate and the gains we make on the longs are simply a bonus. $437,800 (75%) CASH!!! on the side means we’ll be able to have fun adding more positions.

-

- GILD – Expiring worthless so we get paid $5,375 NOT to own 500 shares for 2 years. Our risk was $57.50 less the $10.75 we sold them for so $46.75 ($23,375) so the $5,375 is a 23% return but, of course, even at just 50% margin, it’s a 46% return on margin and how risky is it really to promise to buy GILD at net $46.50? It’s $82.94 now so the general consensus seems to be “not very”.

- SPG – Already up 54% in just 3 months. Same concept.

-

- JXN – We’re at target already.

- T – We sold the $17 calls so it’s not like we expected much out of them – and that’s what we’re getting.

- DOW – We’re well over target already.

- MO – At target.

- VTRS – We have aggressive puts and no short calls – I expect them to get back to $14 at least before we sell calls.

That was easy. Now we look for more discount dividend-payers.

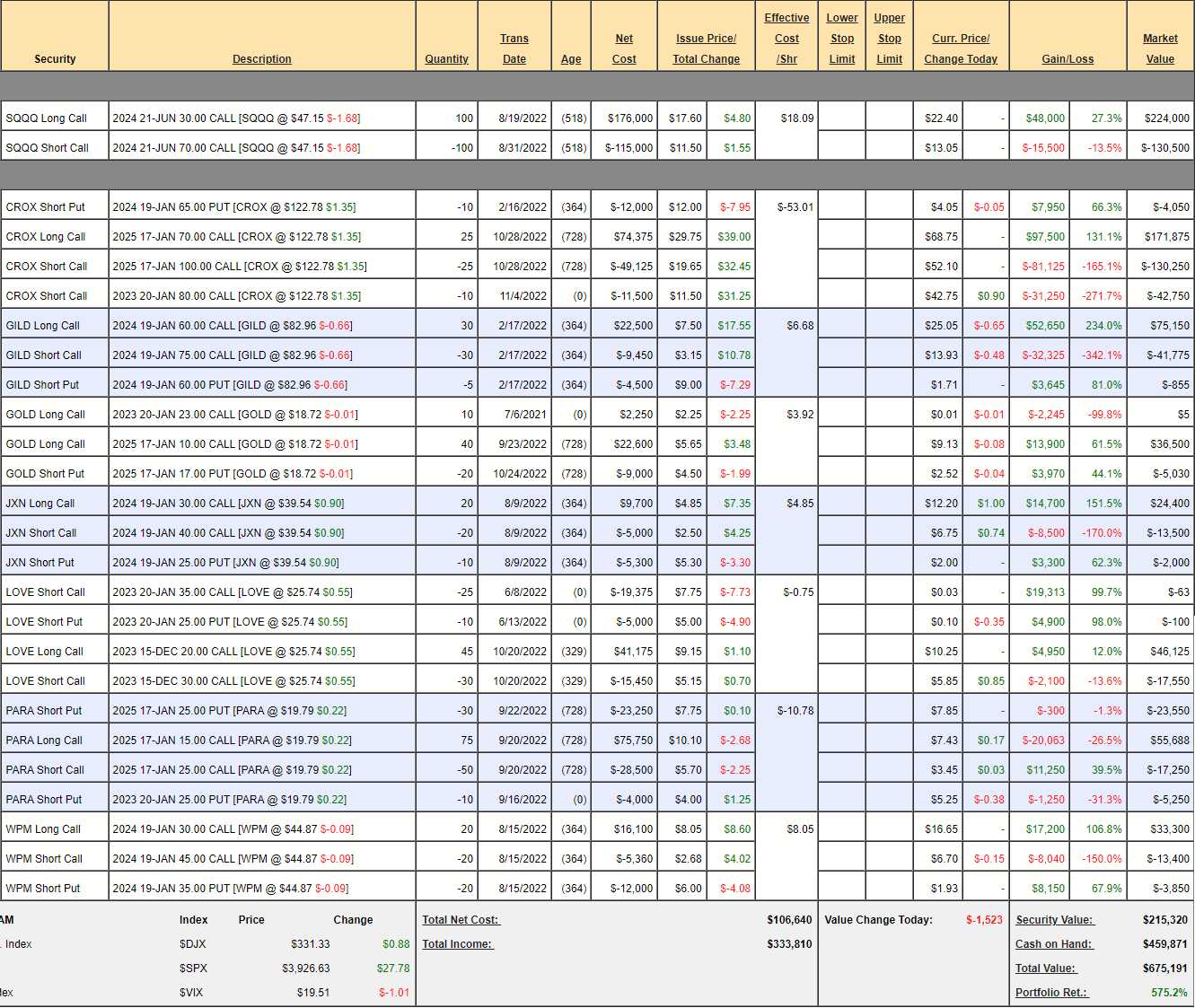

Earnings Portfolio Review: Here we look mainly for stocks that get oversold after earnings. $675,191 is up $32,818 (5.1%) from our last review but we’re also $459,871 (68%) in cash. Not one thing was changed last month or since as we were waiting on Q4 earnings to be reported, which means we’re up more like 20% on the net positions that are in play.

Unlike our other bullish portfolios, which rely on the STP to protect them, this one is self-hedging with its own SQQQ hedge.

-

- SQQQ – And here’s the hedge. It’s a modest $400,000 hedge that is currently net $93,500 so it’s offering us $306,500 in downside protection and it’s in the money, so it only loses if the Nasdaq goes higher – which would be good for our bullish positions.

The upside potential of the current positions was $266,315 in the last review, so more than we would lose on the hedge – but we’ll be looking to do much better than that, of course.

CROX – Those short Jan $80 calls are burning us and it’s only a $70/100 spread. If we closed it now, it would be net -$5,175 (we’d have to pay to shut it down). We only spent net $1,750 on the original position so it has to be worth it for us to adjust. Fortunately, the 2025 premiums are high so let’s cash this out (not the short puts) for a $3,000(ish) loss and let’s get back in with:

-

- Buy 30 CROX 2025 $100 calls for $52.50 ($157,500)

- Sell 30 CROX 2025 $130 calls for $39 ($117,000)

- Sell 10 CROX 2025 $90 puts for $17 ($17,000)

- Sell 10 CROX June $130 calls for $15.50 ($15,500)

That’s net $8,000 on our new $90,000 spread and the $3,000 loss we’re carrying – not a bad adjustment and great for a new play! One more good sale like the June $130s and this will be a credit spread.

-

- GILD – Deep in the money at net $32,520 on the $45,000 spread. The short puts aren’t doing anything so we may as well roll them to 10 of the 2025 $70 puts at $6.20 ($6,200) and we pick up $5,345 and lower our net on the spread to $27,175 and now it makes 100% for the year if GILD can hold onto $75.

- GOLD – You can tell my favorites as they are in every portfolio. Just waiting for the break over $20.

- JXN – Already at target.

-

- LOVE – The short Jan calls are going worthless, so we make $19,375 after 6 months and the short puts are also going worthless for another $5,000 profit so that’s $24,375 made in 6 months against what is now a net $28,575 bull call spread. Meanwhile, the spread itself will be $30,000 at $30 and it’s only 2/3 covered so more if we go higher. I think I want to see earnings before making any more sale decisions.

-

- PARA – The short Jan puts are in the money at $5,250 so let’s roll them to 10 more (40 total) short 2025 $25 puts at $7.85 ($7,850) and my theory is they get bought this year for about $30, so let’s see what they say in the earnings report before doing anything else.

- WPM – Blasted up to our target so not much to do but wait for our net $16,050 spread to hit $30,000. Isn’t it dull to make 100% in a year?

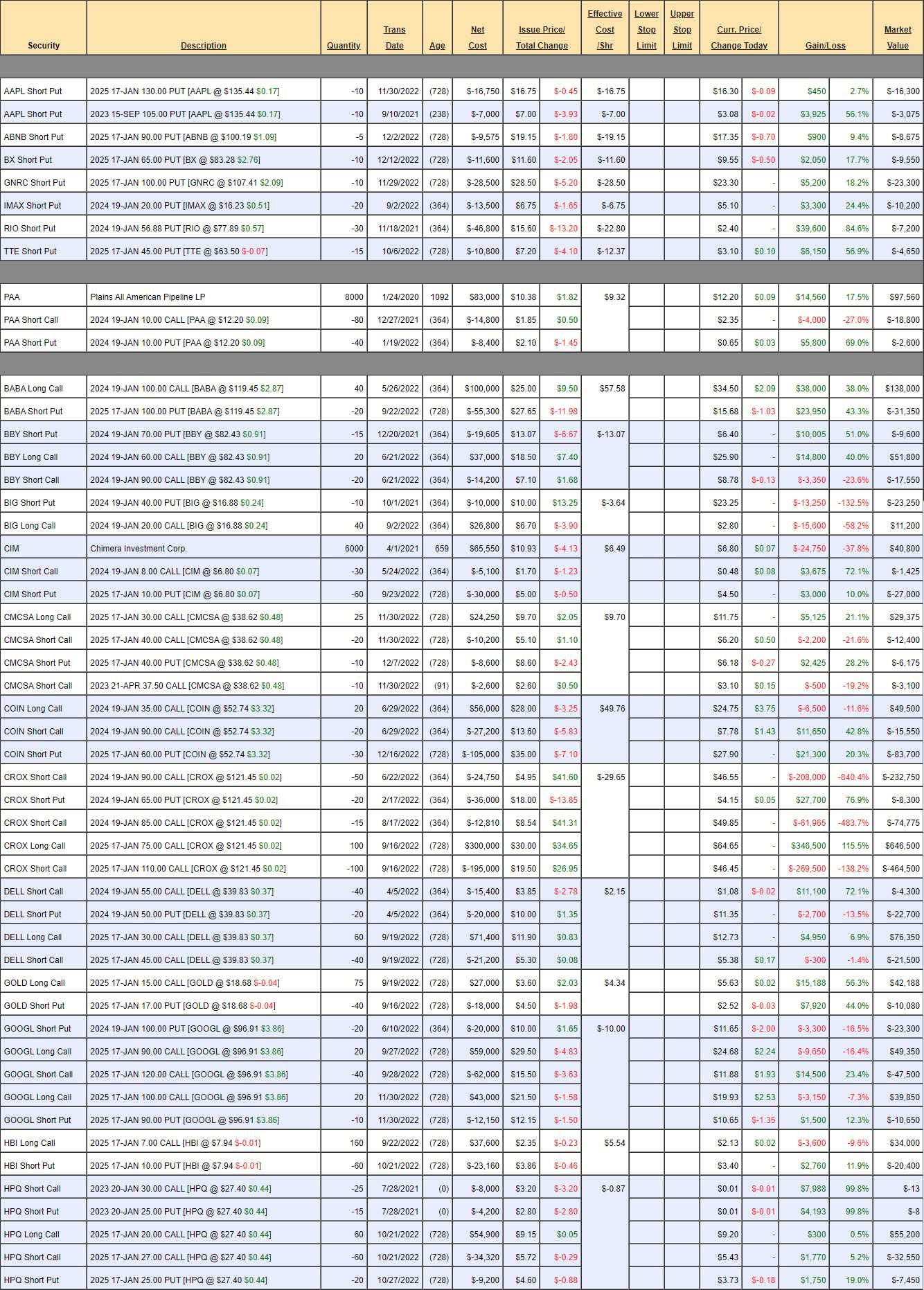

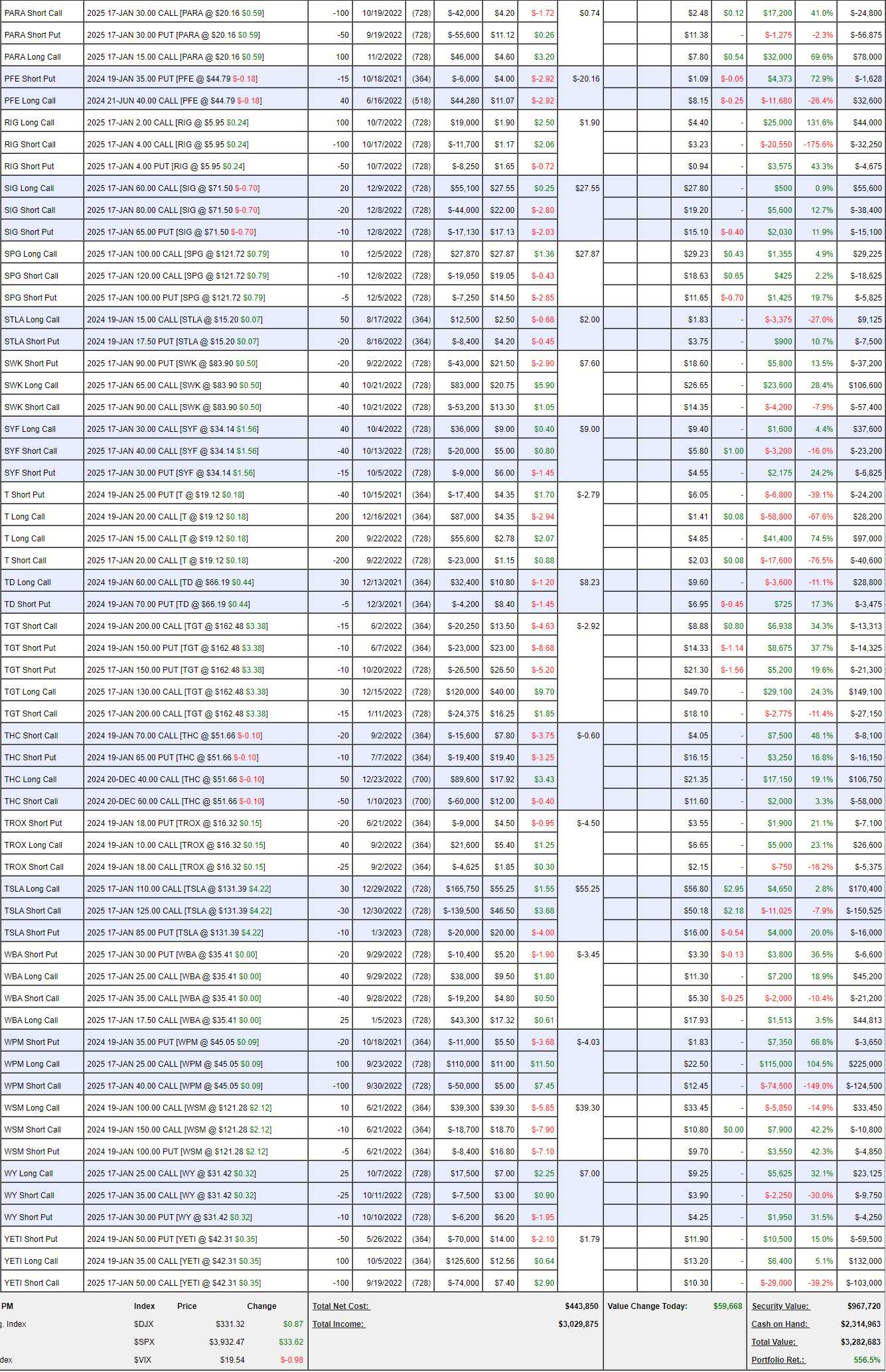

Long-Term Portfolio (LTP) Review: $3,282,683 is up $226,282 from our Dec Review and we barely touched them last time. The declining VIX helped a bit – as well as not having AAPL in this portfolio (just the short puts). The only thing we added in the past month was TSLA – and they popped much higher.

-

- AAPL – One new, one old. Let’s take the new one ($130 put) and add 30 2025 $120 ($36.40)/160 ($17) bull call spreads at net $18.60 ($55,800) for the $120,000 potential spread. We already collected $16,750 on the puts so our net net is $39,050 and the upside potential is $80,950 (207%) but, of course, I’m sure we’ll buy more when there are opportunities.

- ABNB – Another one I don’t want to miss so let’s add 25 2025 $80 calls at $40 ($100,000) and sell 20 2025 $120 calls at $23 ($46,000) for net $54,000 on the $100,000 spread (but we already collected $9,575 on the puts).

-

- BX – On track

- GNRC – On track

- IMAX – On track

- RIO – Almost done already but we don’t need the money or margin so no reason to buy them back.

- TTE – Way ahead of schedule.

-

- PAA – They have a nice, 0.218 ($1,744) dividend and it’s over our target. Lovely…

- BABA – This is a big gainer since last month when it was -$18,000, now +$61,000. Glad we stayed aggressive. I’m only going to cover if there’s a good reason to – this is our hedge against a rally we didn’t expect.

-

- BBY – On track.

- BIG – Waiting on earnings.

- CIM – Just paid an 0.23 ($1,380) dividend I did not log yet. Love these guys.

- CMCSA – On track.

- COIN – Rumors they are getting bought. That would be a shame.

CROX – We are burned on the short calls so we’ll have to adjust. Here’s a really cool trick:

-

- We have 100 short 2025 $110 calls ($464,400) and 50 short 2024 $90 calls ($232,750) and 15 short 2024 $85 calls ($74,775) – that’s $771,925.

- We have 100 2025 $75 calls ($646,500) – so we’re at a net loss (ignoring short puts, which will go worthless) of $125,425.

- The spread was originally a net $31,440 credit.

2025 $120s are $42.50 so we need to roll all the short calls to 120 of those ($637,000). We will also sell 40 of the June $120 calls at $20 ($40,000) and 20 of the June $100 puts at $7.70 ($7,700). That roll will cost us net $87,225 but we sold $47,700 in premium in this 6-month block so, if we do that a couple of more times – we’ll be caught up and in the $75/120 spread where we collect $450,000 before we owe anything back (still on our $31,440 net credit).

-

- DELL – On track.

- GOLD – Not ready to cover yet.

- GOOGL – Off to a slow start.

- HBI – Waiting on earnings.

-

- HPQ – Bullseye! The short puts and short calls are both expiring worthless (we’re dead center, in fact). For my next trick – I will wait for earnings rather than guess which way they go!

-

- INTC – Almost at goal already.

- JD – At goal.

- JPM 1 – I forgot to log a sale of 25 2025 $150 calls at $16 from last month. That brings this down to net $69,500 on the $150,000 spread (assuming we’ll roll the short $135 calls higher).

- JPM 2 – This one is a $100,000 spread at net $30,812 so a healthy amount left to gain and we’ll sell more puts at some point.

- JXN – On track.

- LEVI – We’re aggressive into earnings.

-

- LMT – Super-deep in the money.

- LOW – At goal.

- MDT – On track.

- MET – We sold the Jan calls, then they popped and we thought it was over-done, so we sold the March calls too – expecting a pullback. It was not our intent to have 10 short so we’re just closing out the short Jan calls and then we’re back to normal.

-

- META – When they went down to $100, I simply said “What if they’re right?” Now it’s on track and we’re going to make a fortune here. We came in with a net $4,200 credit (very aggressive put sales) on the $210,000 spread! Still only net $51,825.

- MO – Disappointing so far.

- MRNA – On track.

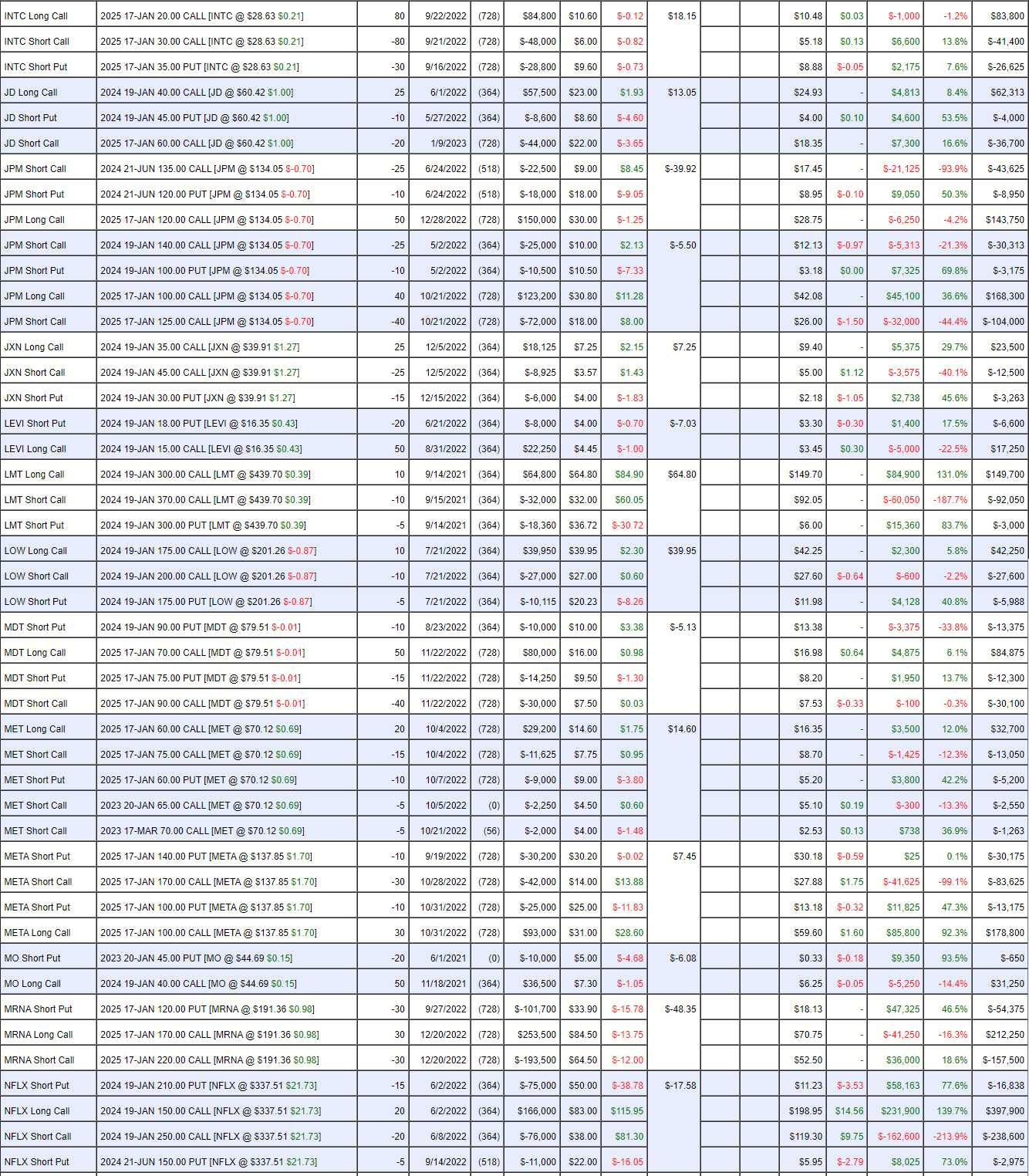

- NFLX – Up 7% today and we only needed $250. Net $139,487 out of $200,000 so worth keeping as we’re $90 over target. Free money anyone?

-

- PARA – On track.

- PFE – If they go lower, we’ll buy more.

- RIG – Way over our target at net $7,075 on the $20,000 spread. Aren’t options fun?

- SIG – On track.

-

- SPG – On track.

- STLA – Disappointing start but only net $4,100 and it pays $25,000 at $20!

- SWK – On track.

- SYF – On track.

- T – We added the $15/20 spread in September, when the 2024 $20s seemed hopeless but we’re back to $20 again so this could turn out very well.

-

- TD – Expecting much better.

- TGT – We don’t mind buying more if they go lower. Essentially it’s on track.

-

- THC – On track.

- TROX – On track.

- TSLA – The only trade we added all month. Already over target at net $3,875 on the $75,000 spread. Not free money because TSLA is risky but I think that’s a pretty reasonable risk.

-

- WBA – Over goal already.

- WPM – Over goal and $125,000 out of $150,000. We could spend about $4 ($40,000) to roll the short $45s to the $55s and add $100,000 upside potential but there’s no hurry.

-

- WSM – On track.

- WY – On track

- YETI – We’re only hurt because the short calls have a crazy premium. That won’t matter to us if they stay at $42 and our $35 calls are worth $70,000 and the short $50s expire worthless, right? At $50, this is a $150,000 spread and currently (due to very aggressive short puts) it’s at a net $30,500 credit. Now THAT is free money!

See how many trades we have that will make $100,000, $200,000+? That’s why this portfolio makes such ridiculous gains in a FLAT OR UP market.

And keep in mind we are monstrously over-hedged with $5M worth of protection in the STP and only net $1M in positions here.