We are finishing a weak week weakly.

It’s only been 4 days but we’ve done a lot of damage in the first 3 of them and today does not look like it will improve things. In earnings last night, CNXC, NFLX and SVB all missed while OZK and FFIN were in-line and PPG had a small beat. ERIC already missed this morning with RF and SLB posting small beats.

NFLX wasn’t as bad as feared so not too much damage from them (we’re long) but the first week of earnings has, on the whole, sucked. Next week, about 20% of the S&P 500 will report and we’ll have a much better idea of what’s happening under the hood of Corporate America but we’re going into the weekend “Cashy and Cautious” and very well-hedged.

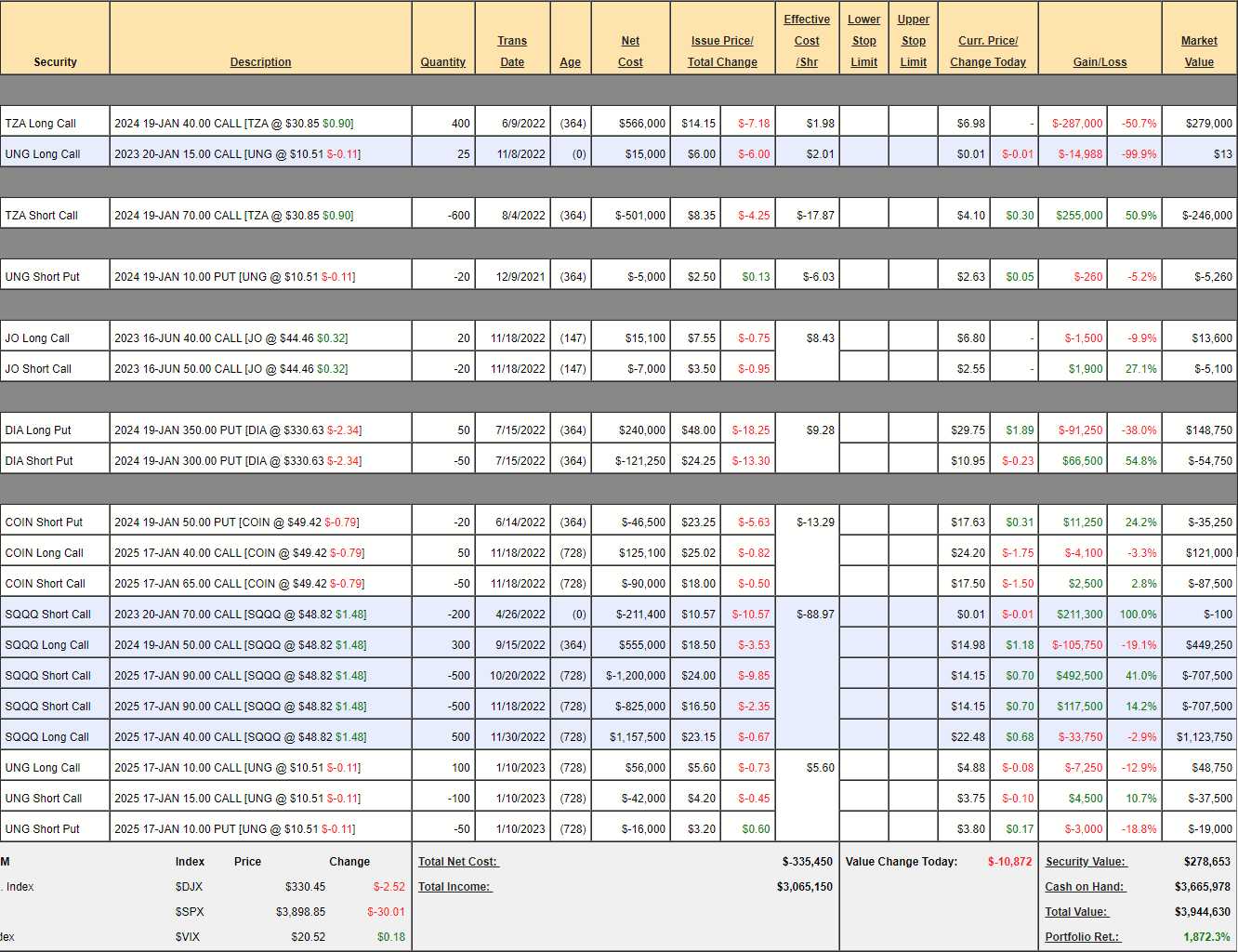

In fact, our Short-Term Portfolio (STP), which hedges the longs in our other portfolios, finished the day yesterday at $3,944,630 (up 1,872% since 10/28/20) and that is up $209,175 (5.6%) from Tuesday’s review – where we made no changes.

Of course we have $3,665,978 (93%) in CASH!!! (winnings from previous cycles) so the real story is our net $69,578 in active hedges from Tuesday are now net $278,653 and that’s up $209,075 (300%) in two days on a 2.5% drop in the market. Since the upside potential of our STP is roughly $5M on a 30% sell-off, we’re right on track and this week has been an excellent test of our hedging portfolio.

As I said in Wednesday’s Webinar, now we have to find things to go long on so we can hedge our hedges but our bias at the moment is to the downside and we’ll make a lot more on a 20% drop than we would on a 20% pop. That means, if earnings don’t stay bad and economic data doesn’t stay bad – we’d better find some more longs to buy!

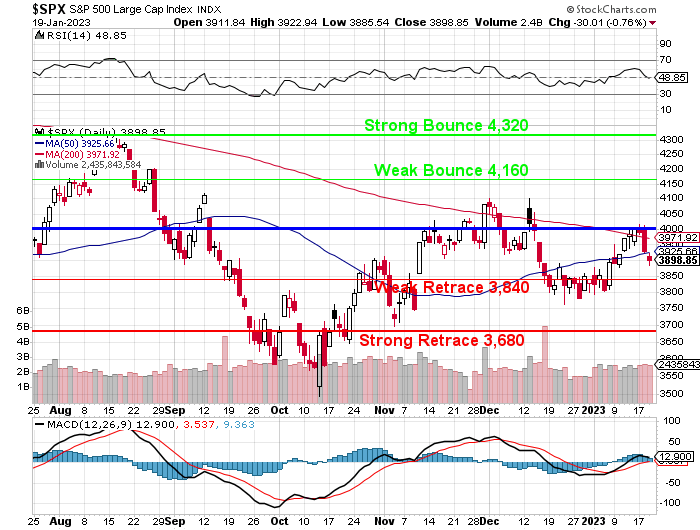

Last month, in our Portfolio Reviews, we made very few adjustments as we decided to wait for earnings to get better information. The S&P 500 was at 4,000 then and it’s at 3,925 now – so no harm in waiting and, as noted above, we’re very well-hedged.

We have a Watch List of 100 stocks we’d love to buy if they get cheaper and, if they don’t, we will pick up the laggards on the way up but we also have over 100 positions in our Member Portfolios and our first priority is to adjust them to take advantage of any dips because – if they are in the portfolio – we MUST like them even better than our Watch List Positions, right?

We got more aggressive with UNG in the Short-Term Portfolio because we believe, over time, that Natural Gas prices will settle around $4.50 (now $3.20) but JO, on the other hand, is the Coffee ETF and Brazil, where 40% of the World’s coffee is grown, just had huge rain like California – and they are projecting 16% better crops this year – so the data has changed since our investment and we’re going to be less bullish going forward.

We got more aggressive with UNG in the Short-Term Portfolio because we believe, over time, that Natural Gas prices will settle around $4.50 (now $3.20) but JO, on the other hand, is the Coffee ETF and Brazil, where 40% of the World’s coffee is grown, just had huge rain like California – and they are projecting 16% better crops this year – so the data has changed since our investment and we’re going to be less bullish going forward.

It never makes sense to use up your buying power on new positions if you haven’t optimized the positions you already have, does it?

So that’s our plan for today and next week we’ll see how earnings look and we’ll also get Leading Economic Indicators on Monday, Durable Goods and GDP on Thursday along with New Home Sales and Friday it’s Non-Farm Payroll ahead of the Feb 1st Fed Meeting – fun, Fun, FUN!!!

Have a great weekend,

-

- Phil