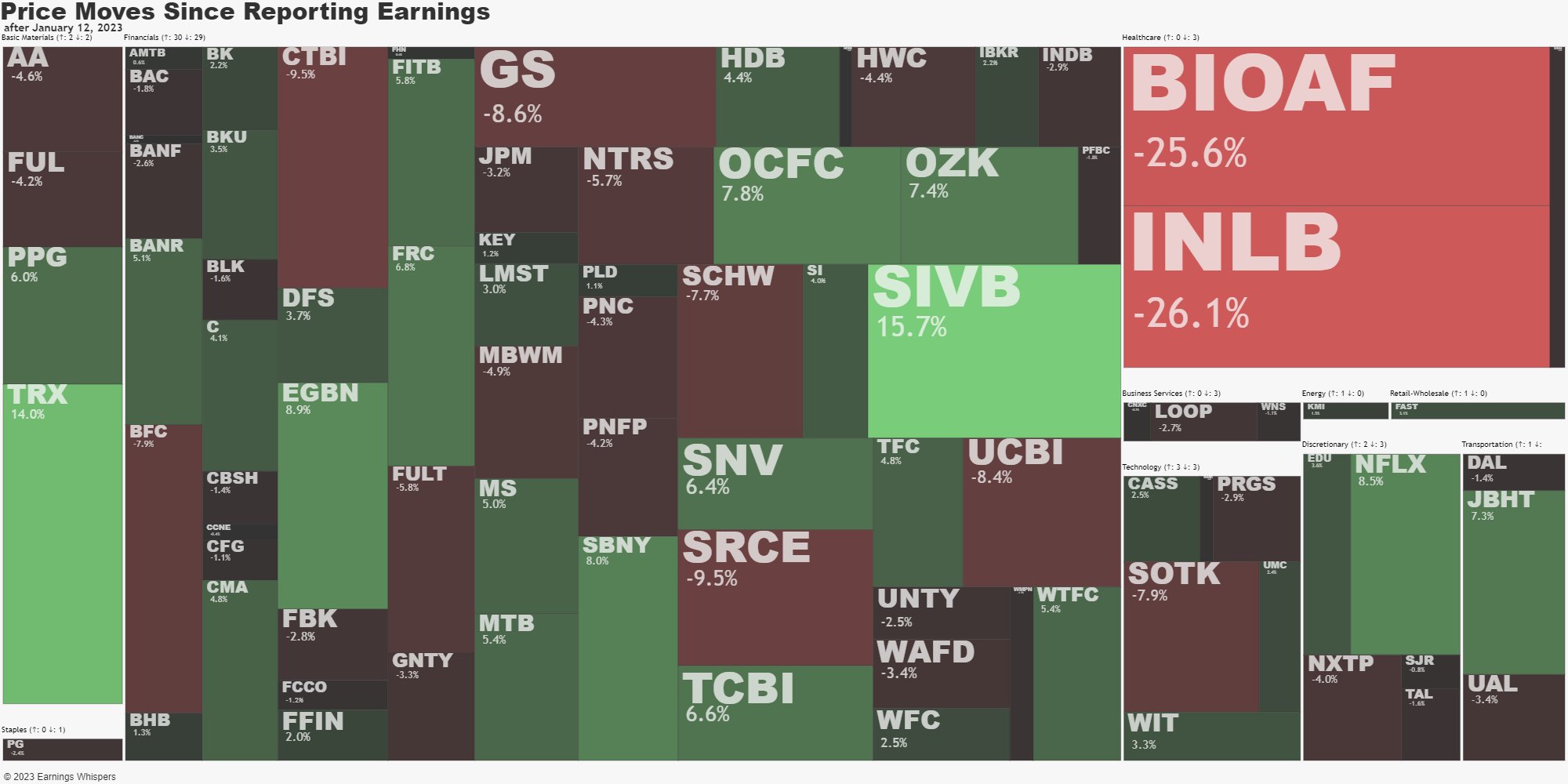

That’s right, it’s Earnings Season and the dance card is full:

Finally we get to see what’s what in Corporate America though, unfortunately, we’re off to a pretty bad start with the early reporters with 39 (52%) out of 74 reporting companies trading down for the week. Incongruously, the market burst higher on Friday in anticipation of the Fed saying they are done raising rates at the next meeting (a week from Wednesday).

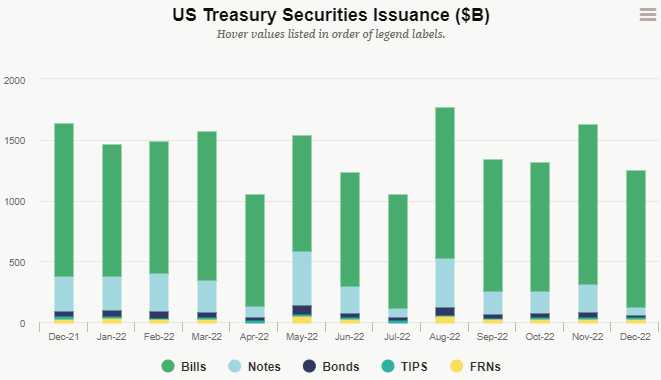

But are they done? There’s still plenty of inflation and, more importantly, the Government is still running a $1.4Tn deficit so it has to borrow over $100Bn a month to keep the lights on – in addition to rolling over $1.5 TRILLION per month of the old debt as it comes due (because we don’t have the money to actually pay it back).

In order to keep this charade going, the Fed can’t allow bonds to be unattractive compared to stocks and, with the Fed getting out of the TBill-buying game (they have been buying most of them for past decade), they need to raise the rates in order to entice outside buyers

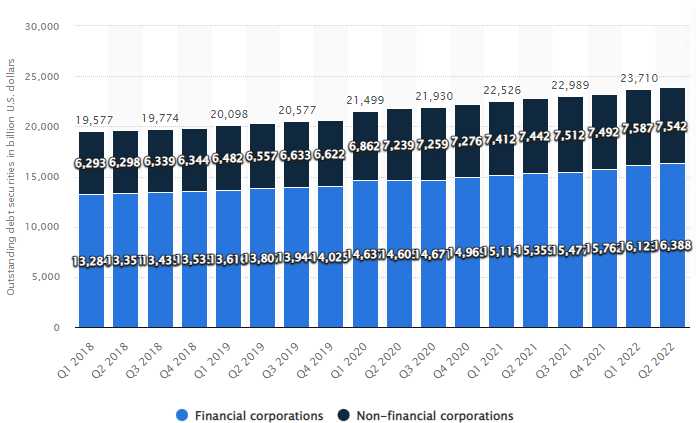

Do you know who else has debt they can’t possibly pay back so they just have to roll it over at much higher rates? Companies! That’s right, our beloved Corporate Masters have gone over $24Tn into debt in 2022 and that’s essentially out entire GDP. No nation on Earth comes anywhere close to this and it’s hard to imagine how they are ever going to get out of this either.

Let’s not forget that they used a large portion of this debt to buy back their own stocks – so their earnings per share would look better as they divided it by fewer shares. Very few companies are making more actual money than they were in 2018. Corporate buybacks in 2022 alone were close to $1Tn on the S&P 500, roughly 3% of it’s $32Tn total market cap!

See that dip in late 2020? That’s because companies accepting Covid bailouts were FORBIDDEN to buy back their own stocks. Many companies turned down the money on that basis and the ones that did pause, came back with a vengeance once the restrictions were lifted.

And look how all that buying drove the S&P 500 to new highs. Of course that means that, between Aug 2021 and March of 2022, companies spent about $700Bn paying ridiculously inflated prices and a rational person would say it’s loss when their stock prices subsequently drop 20% from the top – but not Corporate Accounts…

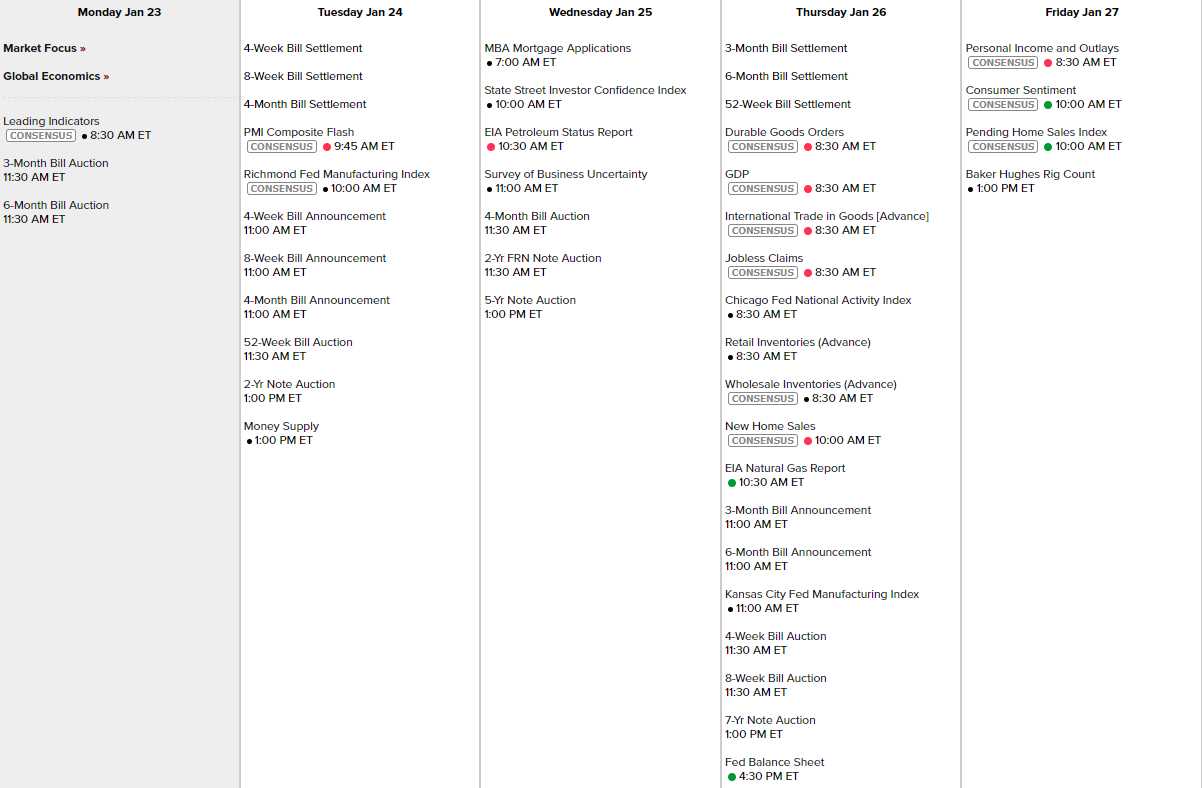

The Fed will be quiet this week ahead of next Wednesday’s meeting and this morning we have Leading Economic Indicators at 10 (it’s wrong on the calendar) with PMI and the Richmond Fed tomorrow, Investor Confidence and Business Uncertainty on Wednesday, Durable Goods, GDP, Retail Inventories, New Home Sales and the Chicago and KC Fed on a busy Thursday (7-year note auction too!) and in Friday, we have Personal Income, Consumer Sentiment and Pending Home Sales – plenty to chew on.

We’ve been “Cashy and Cautious” since Thanksgiving, and that’s been kind of dull but now we get a chance to see what’s actually happening in US companies. Hopefully that picture gets a little brighter, as we’re off to a poor start so far.