Here we go again.

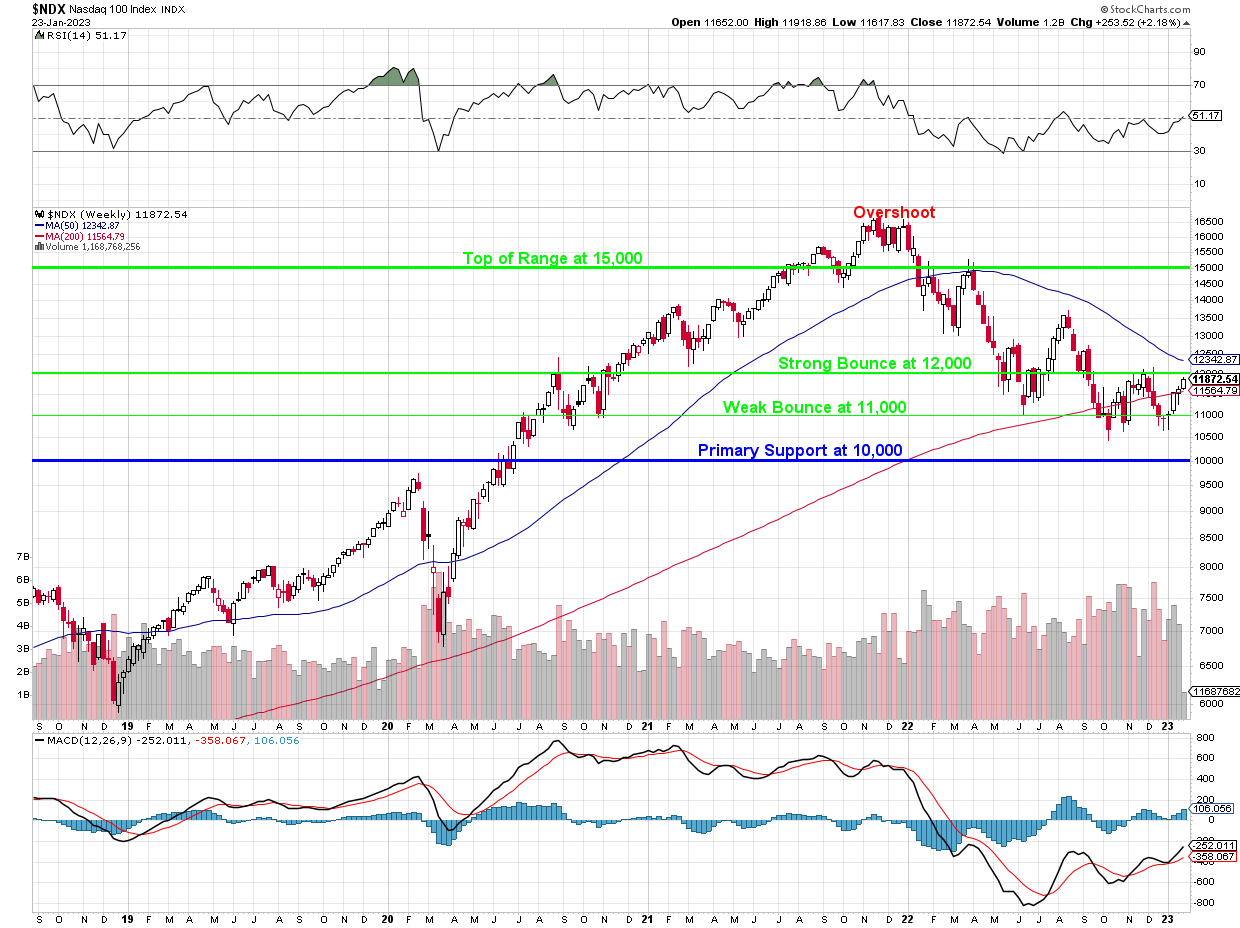

We topped out at 11,983 yesterday on the Nasdaq 100 as tech stocks came roaring back but, this morning, we’re back to 11,882 in the Futures and now it’s going to be up to the actual earnings – to see if they are strong enough to support the 1,000 points (9%) we’ve added on since the start of the year.

The last earnings were in October/November – and that caused us to drop 10%. Will we be that much improved since or is the market being as irrationally optimistic as it was when we ran up ahead of last quarter’s earnings?

3M (MMM) missed so badly this morning that they are cutting 2,500 jobs. GE was in-line but guided down. LOGI missed last night along with 3 others, keeping it 50/50 between hits and misses in companies that have reported so far.

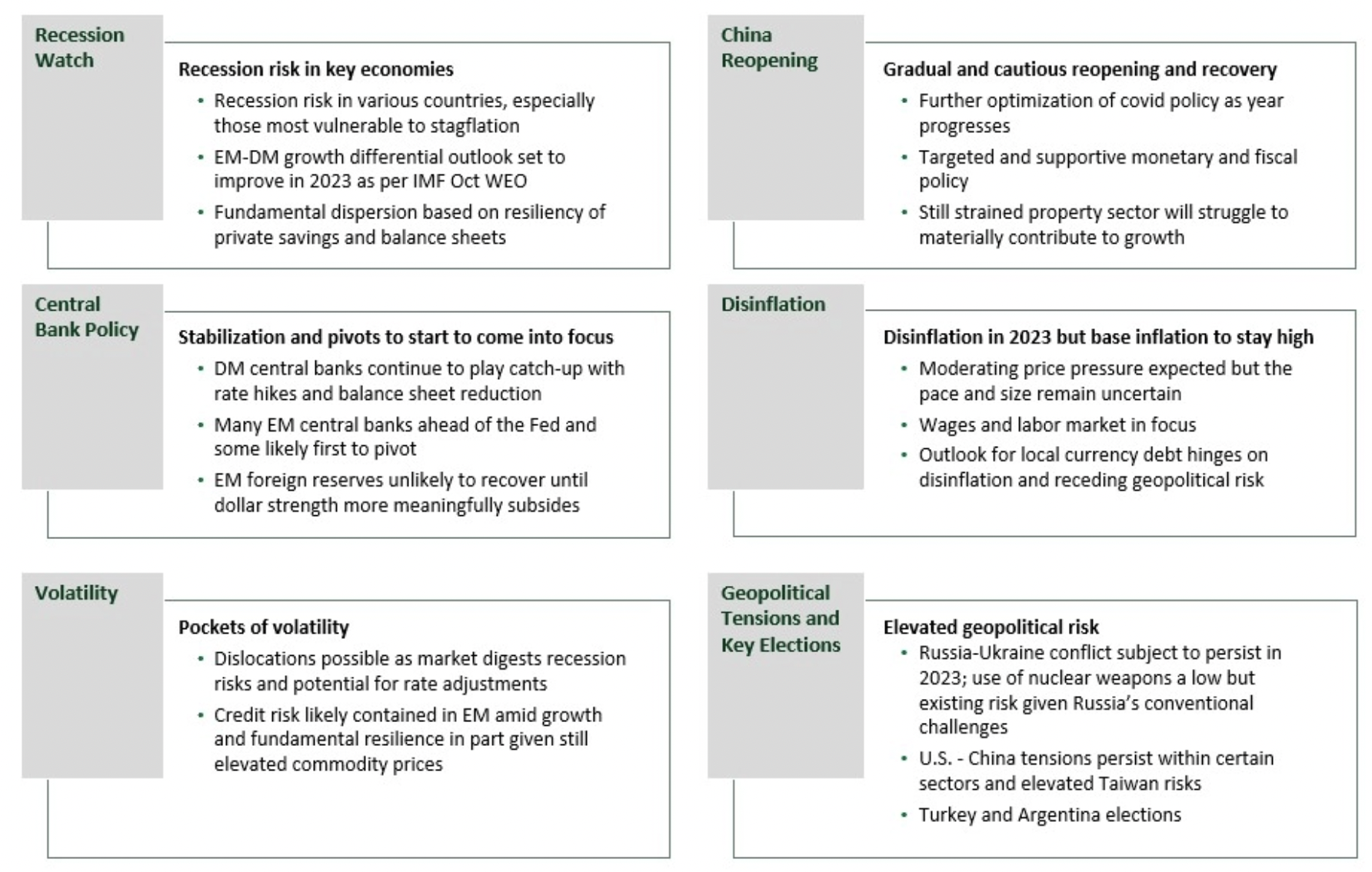

Along with the micros of earnings, here are the macros we’re paying attention to this quarter:

Homebuilder KBH reported that 68% of their Q4 contracts were cancelled, compared to 13% the year before (which is more typical). Of course rapidly rising rates played a part in that but how many other purchase decisions were cancelled in Q4? That’s why we need to be patient and see what the companies actually say about Q4 and the year ahead in the coming reports.

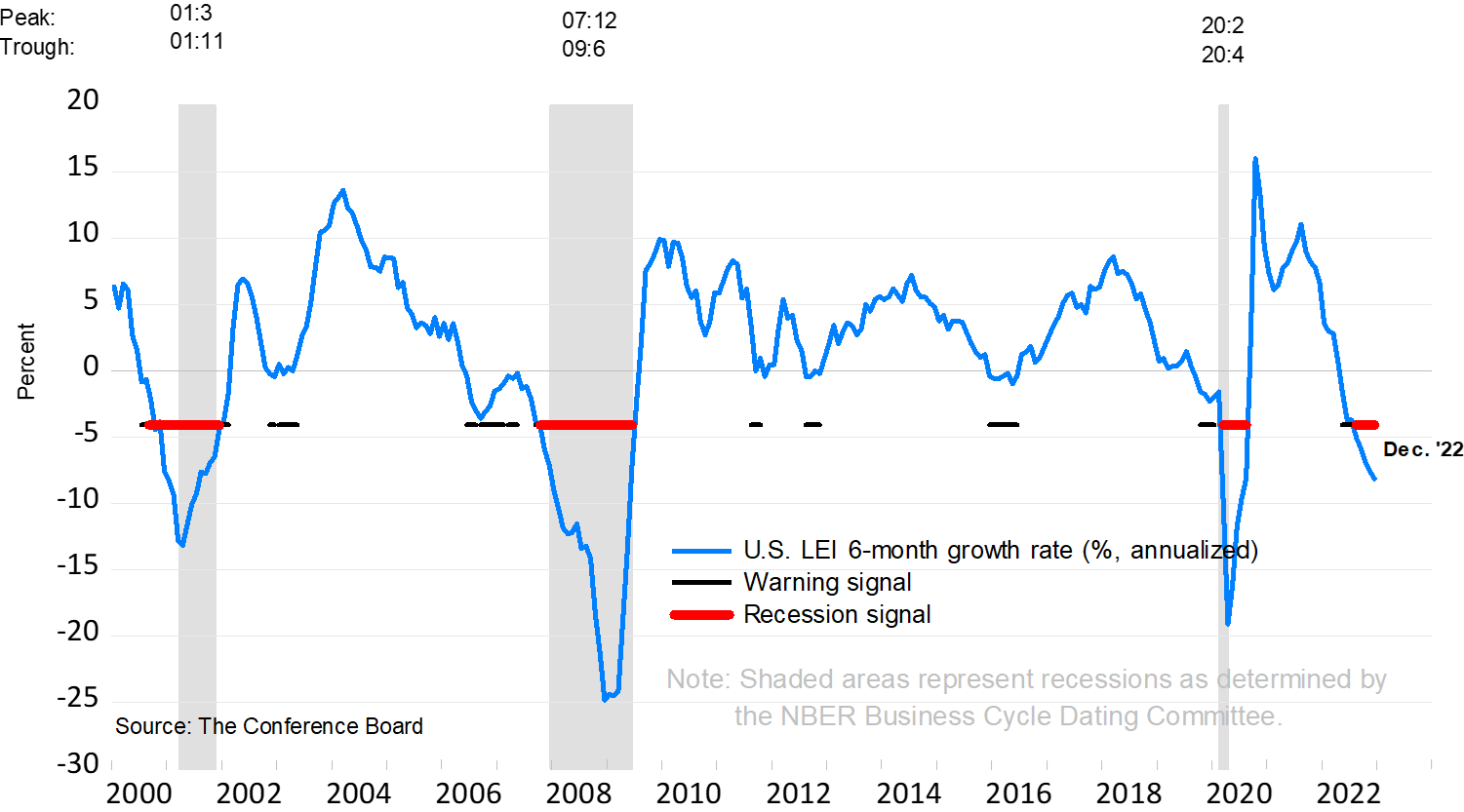

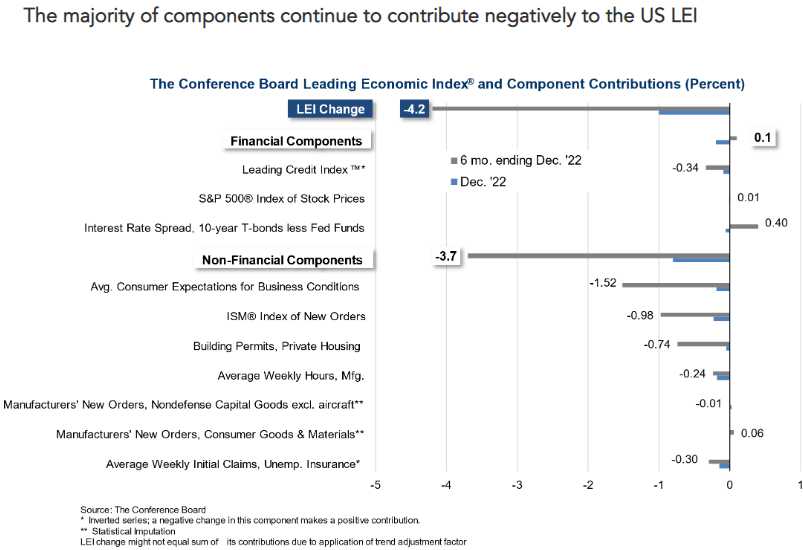

Another report we’re concerned about what yesterday’s Leading Economic Indicators, which are still trending down and, usually, when the indicators are this low, we’re about to collapse into Recession:

November was down 1.1% and December was down 1% and people tend to think 1% is not much but that’s because you are thinking it’s out of 100% but you need to be aware of the RANGE we usually move in, which is 10% up or down so 1% is actually a very significant move for a single month and 1.1% is accelerating to the downside – in a month that was make or break for retailers.

It’s not so much that we’re at -1.1, it’s that there are NO positives. Well, interest is positive and that’s supposed to be an indication of a healthy economy but we know it’s only and indication of artificial Fed moves, not the natural supply and demand for Dollars.

What may save us this quarter is our very low expectations. Estimates for the S&P 500 are for -4.9% earnings growth and that is down from + 4.8% that was expected in September so a lot of the Recession is already baked in but still, that does not excuse us from making sure the companies we invest in are above the curve in handling what the economy is throwing at them, not below it.

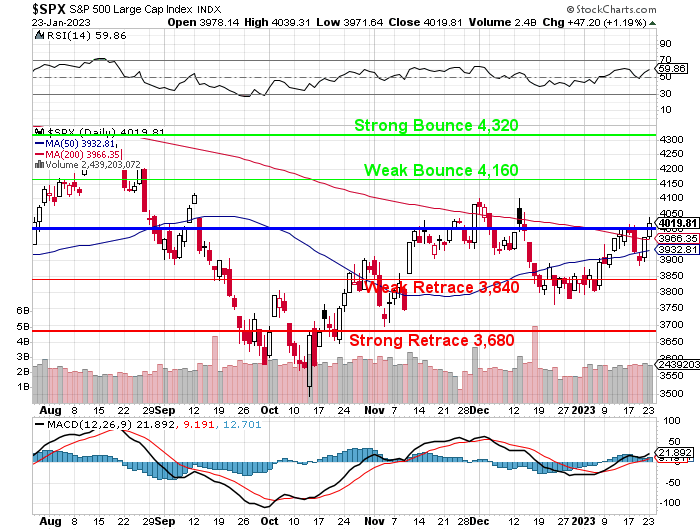

The S&P 500 was at 4,325 in August (4,800 in January) and now we are just getting back above 4,000 so let’s say earnings are down 5% from 2021 and 2021 averaged around 4,300 so 5% less than that is 4,100 – which is where we are. That’s where our range is too:

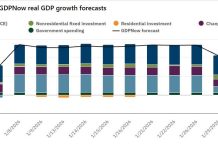

Earnings are going to make or break us and Thursday we get the first estimate of Q4 GDP on Thursday morning and that’s likely to be lower than the 3.2% expectations – how much lower is the question. Then, next week, we get the Fed Rate Decision and Non-Farm Payrolls and, after that, we can get back to watching earnings – still from the sidelines for now.

Good interview:

‘The Fed-fueled fantasy bubble has popped.’ Stock investors are about to get a big dose of reality.